Lenders rely on your credit report and credit score information to assess your risk, determine whether they want to do business with you, and calculate how much to charge you if they do. That’s it’s wise to understand as much as possible about how credit works, even down to the fine points.

Unfortunately, that’s not always as easy as it sounds because the credit environment can be very complicated.

One such point that often confuses consumers is the difference between a FICO score and anything else commonly referred to as a credit score. Many people use the two terms interchangeably, but a FICO Score is a brand of credit score. We’re going to clear it all up for you.

What Is a Credit Score?

A credit score is the numeric representation of your credit risk based solely on the information contained in your credit reports from Experian, TransUnion, and/or Equifax, the three generally recognized national credit reporting agencies.

Credit scores, which are derived from credit scoring models, are an empirical evaluation of the information on your credit reports. The scoring models generate credit scores, which are designed to predict your future credit behaviors.

In this case, the term “behaviors” indicates how likely you are to make future payments in a timely manner. And, if you’re not, how likely are you not to do so?

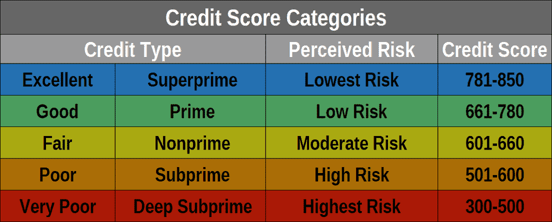

Most of the commonly used credit scores used in the United States financial services market range from 300 on the low end to 850 on the high end, although there are some exceptions to that rule.

What is always true, however, is that a higher credit score indicates lower credit risk, and a lower score indicates higher credit risk. That means you want to earn and maintain as high a score as possible.

If your credit report contains certain types of negative information, a credit scoring model will likely determine that your risk of missing future payments is higher. And in this scenario, you would earn lower credit scores than you would otherwise earn if your credit reports did not contain derogatory information.

Working to earn higher credit scores is important for a variety of reasons. Good credit makes credit card issuers and lenders less likely to decline your application for financial products like credit cards and loans. Credit card issuers and lenders also tend to offer their most attractive interest rates and borrowing terms to consumers with good credit scores.

By comparison, you may have to pay higher interest rates and fees when you borrow money if you have low credit scores. Or you may be declined outright or otherwise have fewer mainstream borrowing options.

Your credit scores can also affect other aspects of your financial life. If you try to rent an apartment, for example, your credit scores may come into play. Mobile phone services, utility providers, and insurance companies may also review credit scores when you apply for new services. The only difference is instead of being designed to predict credit risk, these types of scores are designed to predict things like insurance risk or the risk of not paying utility accounts.

A FICO® Score Is a Brand of Credit Scores

FICO is a brand of credit scores in the same way Coca-Cola is a brand of soft drink and Ford is a brand of automobile. Conversely, not all credit scores are FICO scores. But FICO scores are used by 90% of top lenders.

In fact, FICO invented credit scoring. Fair, Isaac and Company, the creators of the FICO Score, helped pioneer the creation of the modern credit scores we use today in the United States and around the world. In 1989, Fair, Isaac and Company (today known simply as FICO for Fair Isaac Corporation) introduced the first credit bureau-based FICO score in partnership with Equifax, called BEACON at the time.

By 1991, FICO credit bureau scores became available from all three major credit reporting agencies. Back then, they were Equifax, TransUnion, and TRW — Experian wasn’t around yet.

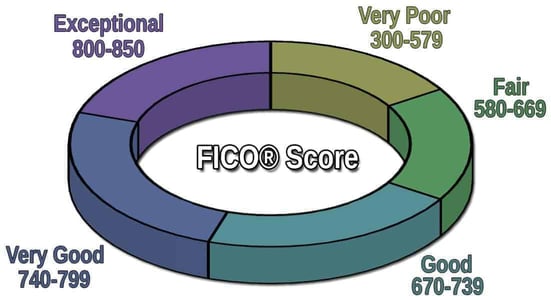

The FICO Score range has always been 300-850 for generic FICO scores. As with other types of credit scores, a lower FICO score signaled elevated credit risk and a higher FICO score meant the opposite.

FICO’s scoring models derive your scores based on metrics that fit nicely into five different categories of information found on your credit reports.

- Payment History: 35% contribution to your FICO score

- Amounts Owed: 30% contribution to your FICO score

- Length of Credit History: 15% contribution to your FICO score

- Credit Mix: 10% contribution to your FICO score

- New Credit: 10% contribution to your FICO score

Other Types of Credit Scores

When you apply for financing, a lender will almost certainly check one or more of your credit scores as part of the application process. For example, when you apply for a mortgage loan, the lender/broker is going to pull all three of your credit reports and three of your FICO scores. If you apply jointly, the lender/broker will pull the joint applicant’s three credit reports and three of their FICO scores as well.

While mortgage lending always uses FICO scores, you may not know in advance whether other lenders will review your FICO scores or some other type of credit score, like a VantageScore-branded credit score.

Most lenders (90%, according to FICO) use FICO scores. But VantageScore credit scores are an increasingly popular credit scoring option among credit card issuers, lenders, and other companies. More than 3,000 companies used 14.5 billion VantageScores between March 2021 and February 2022.

It’s also important to point out that even if you know ahead of time which credit score brand a lender is going to use when it checks your credit reports, that doesn’t mean you’ll know exactly which version or generation of that credit score it will consider. You may only have three credit reports (Experian, TransUnion, and Equifax), but you have many different credit scores.

Credit score developers like FICO and the credit bureaus (the credit bureaus collectively develop the VantageScore credit scoring models) release redeveloped credit scoring models on a periodic basis (think version 1.0, 2.0, 3.0, etc.).

They do this to make sure the credit scores remain as predictive as possible by staying up to date with changing consumer behaviors. How consumers used credit in 1989, the year of the first FICO Score, certainly isn’t similar to how consumers use credit in 2023. So the models have to evolve to remain relevant.

Lenders use different versions of both FICO and VantageScore credit scores. There are also various credit score options for different industries, such as the FICO® Auto Score and the FICO Bankcard Score, both of which are immensely popular in those respective industries.

Note: Both the FICO Auto Scores and FICO Bankcard Scores range from 250 to 900 instead of 300 to 850. So if you check your score and it’s, for example, 875, you’ll know you’re likely looking at one of FICO’s industry-specific scoring models.

If you apply for a loan with one lender, it may use FICO® Score 8 based on your TransUnion credit report to assess your credit risk. The next lender may review a FICO® Score 9 based on your Equifax report. And the next one may use FICO 10T based on your Experian credit report.

They’re all FICO scores (and all credit scores), but they’re certainly not the same thing and won’t be the same three-digit number.

Dozens of Scoring Models Exist, But All Are Based On Your Credit Reports

Chasing a bunch of different credit scores is next to impossible. There are dozens of different scoring models in commercial use today. Some are FICO scores, some are not. But they’re all based on the information contained in your three credit reports.

And if your credit reports are all in good shape, your credit scores will be too. You can check all of your credit reports for free on a weekly basis at www.annualcreditreport.com.