If you find yourself asking, “What is a good credit score?” you’re likely gearing up to make a big purchase like a new vehicle or perhaps a new home. The American dream is pretty simple: the pursuit of happiness. You want to better your life for you and your family, and to do that you often need a good credit score.

Your credit score not only helps you pay less interest on a mortgage, auto loan, personal loan, or credit card, but it can also help you rent an apartment and get a good job.

We’ve put together a resource to help you understand what a good credit score is and how to improve your score to where you want it to be.

Different Credit Scores | Check Your Score | Mortgages | Auto Loans

Personal Loans | Credit Cards | How to Improve Your Score

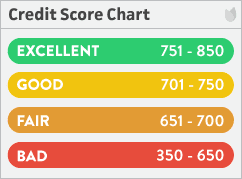

700+ is Generally Considered “Good”

Your credit score is a precise number, but its meaning should be taken in context. FICO score ranges used by lenders and creditors can be roughly organized as follows:

These interpretations aren’t cast in stone. Different lenders may evaluate your FICO credit score in various ways. What constitutes a “good” score for one purpose may be only “fair” for another. It’s also important you understand exactly which score is being used for a particular purpose.

These interpretations aren’t cast in stone. Different lenders may evaluate your FICO credit score in various ways. What constitutes a “good” score for one purpose may be only “fair” for another. It’s also important you understand exactly which score is being used for a particular purpose.

Different Credit Scores Have Different Ranges

The two most popular credit score models are FICO, developed by the Fair Isaac Corporation, and VantageScore, a joint development of the three national credit reporting companies (CRCs): Equifax, Experian, and TransUnion.

Both scoring systems have a point range of 300 to 850, although the score calculation and interpretation don’t exactly match up.

Consumers actually have dozens of FICO scores, including one for each CRC. FICO 8 and VantageScore 3.0 are the most commonly used versions, but other versions can be used for specialized purposes. VantageScore has several secondary point systems, each with a slightly different credit score range.

Other alternative credit scoring systems address particular niches and often use different point ranges or letter scores. These include Aire, eCredable AMP, FactorTrust, and more.

How to Check Your Credit Score

It’s easy to check your credit score, and you should do so at least once per year. You can go online to get your credit report and score from a reputable source like FICO — the credit score used in 90% of lending decisions.

You should always check your score before you apply for a loan or make a major purchase using credit. Your FICO score is not free, unless you’re able to get it through a credit card you currently carry or from your financial institution. You can always get a free copy of your credit report from each bureau once annually from annualcreditreport.com, but this does not include your credit score.

Credit Score Needed For 4 Common Loans

Your credit score summarizes your overall credit history into a single number that’s based on the information in your credit report. Basically, your score indicates how you’ve handled credit in the past. Lenders and creditors use your score to decide whether to approve or reject your applications for loans and credit cards.

A good score gives you access to lower interest rates and other favorable terms, including a higher credit line or loan amount, higher cash-back rewards, lower fees, and so forth.

You need to understand how to interpret your credit score, and how its meaning changes depending on the use you have in mind for it. If you find out that your score is less than “good” for a credit card request, for example, you may want to take steps to improve your score before filling out an application form.

Keep in mind that all the scores that follow are approximate, and you may find cases where credit is available at even lower score levels.

1. Mortgages

Different mortgage types and different lenders have varied requirements, but here are some typical ranges of FICO scores:

- Best interest rates from most lenders: 740+

- Minimum score for conventional loans: 620

- Minimum score for FHA-insured loans: 500 for loans with 10% down, 580 for 3.5% down

- Minimum score for USDA and VA loans: None

Check out our mortgage lender reviews for some of the best offers currently available. Bear in mind that the average credit score among homebuyers in 2016 is 728, and 6.8% have scores less than 620. Quicken Loans is the nation’s largest online lender, and allows you to be pre-approved before shopping for a new home so you know what you can afford beforehand.

- America's largest mortgage lender

- The entire process is completed online

- Options for new mortgages and refinancing existing mortgages

- Award-winning customer service and cutting-edge digital platforms

- More than 90% of clients would recommend us

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

- Best for cash-out refinance

- Utilize your home equity with America's #1 lender

- eClosing allows customers to close electronically, greatly speeding the process

- A+ rating with the BBB

- Receive cash for home improvements, college tuition, or paying off debt

- 24/7 access to your loan through the Rocket Mortgage app

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

- Get today's mortgage rates from the top mortgage lenders and banks

- Easily compare and choose mortgage lenders with no obligations or fees

- Review current mortgage rates side by side

- Pick mortgage lenders that meet your specific needs

- Compare rates from pre-qualified and approved mortgage lenders — 100% online, 100% free

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1979 | 4 minutes | 8.5/10 |

+See more mortgage lender reviews

2. Auto Loans

Credit scores are a little more lenient for auto loans, because it’s easier to repossess a car than it is to foreclose on a home. These scores can vary by lender.

- Best interest rates for purchasing a car from most lenders: 720+

- Minimum score for conventional auto loans: 640

- Minimum score for lease: 600

- Minimum score from lenders for people with poor credit: 500

If you have poor credit, be sure to check our reviews for car loans. Note that the more money you can put down, the better access you’ll have to an auto loan. Our top partner, Auto Credit Express, specializes in working with bad credit, no credit, and prior bankruptcies and repossessions.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

3. Personal Loans

Personal loans are not secured by collateral, and the score approval range varies by institution. Taking out a loan is a great way to consolidate your debts so that you can make just one monthly payment. Here are some average score ranges required:

- Best interest rates from banks and credit unions: 720+

- Minimum credit score from online lenders: 550-600

- Minimum credit score for short-term and payday loans: None

You can find many personal, short-term, and payday loans intended for those with good to poor credit — see our reviews for personal loans for people with bad credit to pick one out yourself. PersonalLoans.com is our top recommended source, and funds can be received as soon as one business day.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% - 35.99% | 12 to 60 Months | See representative example |

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn't impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% - 35.99% | 3 or 5 Years | See representative example |

+See more personal lender reviews

Even if you have a bad credit score, you might be able to borrow from $300 to $1,000 via a short-term or payday loan.

4. Credit Cards

A credit card is the most versatile form of credit. Unsecured credit cards do not require a deposit or collateral. A secured credit card, including the Secured Sable ONE Credit Card recommended below, is backed by funds deposited into a bank account and is best suited for consumers with poor or non-existent credit.

- Best unsecured credit cards: 780+

- Minimum credit score for unsecured card: 600

- Minimum credit score for secured card: None

Don’t let bad credit prevent you from getting a credit account – check out our reviews of secured and unsecured cards. Note that your bank may offer to upgrade you to an unsecured card if you manage your secured credit card responsibly.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 29.99% APR (Variable) | Yes | 8.5/10 |

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

Secured Sable ONE Credit Card

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

5 Ways to Improve Your Credit Score

No matter what kind of loan or credit you need, you’ll always get a better deal if you raise your credit score. You can improve your credit rating by understanding the factors used to calculate it, and then taking action to correct your behaviors in these important areas:

- Payment history: Avoid late or missed payments, and try to pay back more than the minimum amount each month. Avoid bankruptcy, foreclosure, liens, lawsuits, wage attachments, and other derogatories – there is almost always a better option.

- Amounts owed: Try not to utilize more than 30% of the available credit limit on any one account. This is known as your credit utilization ratio and it is the second-most influential factor to your credit scores. Reduce the number of accounts with open balances, but do not remove revolving accounts (such as credit cards and home equity lines) even if zero balance.

- Length of history: It’s a good idea to get a credit account early in life — even if it’s secured — to build your credit history. Managing your credit wisely over several years will boost your score.

- Credit mix: It helps to have a mix of responsibly handled retail accounts, installment loans, mortgages, finance company accounts, and credit cards, especially if you do not have a long credit history.

- New credit: Don’t open too many accounts within a short time period, and try to avoid having too many inquiries made upon your credit history. Keep accounts open, even if you don’t plan to use them again.

For more specific recommendations about improving your credit rating, read our best credit-building practices.

A Good Credit Score is Within Your Reach

Your credit score is one of your most important assets, and there’s a lot you can do to protect and improve it. When seeking credit or a loan, remember that your credit score, whether FICO or VantageScore, will be interpreted in light of what you are applying for.

With our tips for how to improve your credit, you should be on your way to a higher credit score and the American dream in no time. Good luck!

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.