If you’ve ever struggled with the consequences of poor credit, you may feel like everyone except you seems to know some higher credit score secrets. How do some people make building and maintaining a high credit score look so easy?

While none of the strategies needed to achieve a higher credit score are actually secrets, learning these few essential steps can make the world of personal finance a whole lot easier. After that, it’s just about consistently applying the principles you’ve learned.

That’s why we’ve put together a complete guide on how to raise your credit score. Read on to get started.

1. Correct Credit Report Mistakes

Credit report mistakes are more common than you may think. A report from the Federal Trade Commission found that 1 in 5 people had mistakes on their credit reports. Removing these mistakes can improve your FICO credit score.

Checking your credit report regularly will help you spot these mistakes so you can dispute them. If you know you’re going to apply for a mortgage or another loan product, be vigilant about checking your credit report. A mistake could disqualify you or affect the interest rate you receive.

You can look up your official credit report at AnnualCreditReport.com. You would usually only get one free credit report a year through the credit reporting agency, but you can temporarily view your credit report for free once a week through all three credit bureaus until April 30, 2021. Try to check your credit report once a week with at least one credit bureau.

Some banks and credit card providers offer basic credit report monitoring. You can sign up to be notified when something changes on your account, giving you the chance to respond proactively.

2. Ask Your Card Issuer For a Higher Credit Limit

The second most important factor in a FICO score is your credit utilization ratio (CUR), or how much credit you have used compared with your total credit limit. Your credit utilization rate makes up 30% of your credit score. The maximum utilization ratio you should have is 30%, but an ideal ratio is 10% or less.

One way to lower your credit utilization is to get a credit limit increase on your credit cards. As long as you don’t increase your spending, this will ultimately lower your ratio.

For example, let’s say you have a $4,000 balance on a credit card account with a $10,000 total credit limit. Your utilization ratio would be 40%, which is higher than the recommended limit. You call and ask the credit card provider to increase your credit limit, which they agree to.

Your new credit limit is $14,000, so your credit utilization drops to 28.5% — just under the recommended ratio.

Increasing your credit limit will usually result in a hard inquiry on your credit report, so you should only do it if improving your utilization ratio is a top priority. If you have multiple credit cards, do the math and see which has the highest utilization percentage. Once that card provider agrees to increase your limit, call the next card issuer and ask if they can offer you a higher credit limit.

3. Consolidate Credit Card Debt into a Personal Loan

Having a lot of credit card debt often means having a high credit utilization rate, which can make it harder to have an excellent credit score.

You can reduce the credit utilization ratio by taking out a personal loan to pay off your credit card debt. This is also known as a debt consolidation loan.

This strategy will lower your utilization ratio and possibly improve your credit score. You may also save money on interest if you can find a personal loan with a lower interest rate. Below are our top-three personal loan networks that can help match you with a loan for debt consolidation purposes:

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

A debt consolidation loan may also help your credit score if you don’t have an installment loan in your credit mix. Having both installment loans and revolving credit on your credit report shows a diverse credit mix, a factor that makes up 10% of your credit score.

Credit cards are an example of revolving credit. If you only have credit cards, then you won’t have a healthy credit mix. A mortgage, an auto loan, a personal loan, and a student loan are examples of an installment loan.

4. Request a Lower Interest Rate

If you have credit card debt, paying down your balance can take months or even years. You can speed up this process by getting a lower interest rate with the credit card company.

If you have several credit cards, find out which has the highest interest rate and call that card issuer. Remind them that you’ve been a responsible cardholder and ask if they’d be willing to reward your loyalty with a lower interest rate.

Once you get the lower rate, you’ll be able to pay down the balance faster and decrease your utilization ratio.

5. Transfer Credit Card Debt to a New Card

Having a credit card balance with a high APR makes it more difficult to pay off the balance quickly. This can also cause a high credit utilization ratio, which will hurt your credit score.

Consider applying for a credit card with 0% APR on balance transfers. After you’re approved, you can transfer the balance and pay it off faster because all the payments will be going toward the principal and not the interest. Most credit cards charge a 3% balance transfer fee, but this will still be much less than what you would spend on interest.

Most 0% APR offers last between 12 and 20 months, and you won’t pay any interest at all if you can repay the balance within that time frame.

6. Setup Bills On Autopay to Never Miss a Payment

Tracking your household bills can often feel time-consuming, but it’s also one of the most crucial aspects of managing your finances. The most important factor in calculating your credit score is your payment history, which makes up 35% of your total score.

Just one late payment could ding your credit score by as many as 180 points. If you currently pay your bills manually, you run the risk of forgetting a payment and harming your credit and your payment history.

One secret to easily building credit is to sign up for automatic payments for all your bills. This will help you avoid late payments and simplify the bill-paying process.

Setting up automatic payments is simple — log onto your bill provider or lender’s website and click on the payments section. Scroll down to find how to set up automatic payments. You’ll have to link a bank account to the provider and decide if you want the payment to go through before or on the due date.

You may also have to choose how much to pay each month. For example, credit card providers let you pay the statement balance, the minimum payment, or a custom amount. Choose whichever amount you can comfortably afford to pay each month.

It can often take one billing cycle for automatic payments to work properly after being set up. Make sure to track your accounts for the first month to see if the payment has gone through.

You can also set up automatic bill pay through your bank, in which case your bank will send a check or electronic payment to the provider. This may be less effective than using the company’s own payment portal because payments can get lost or not credited to your account properly.

Most providers have their own reminder systems that you can sign up for. For example, your student loan provider can send you an email or text reminder a few days before your payment is due.

If you still don’t like the idea of automatic payments, try using multiple reminders to ensure you don’t miss a payment. Whether you prefer a physical calendar or setting up reminders on your phone, having some kind of system in place can help you avoid late payments. Remember, payment history is crucial to having the highest credit score.

7. Remove Negative Marks From Your Credit Reports

If you have a poor credit score, it may be because of negative items like late payments, defaults, foreclosures, evictions, and repossessions. Fortunately, these can’t stay on your credit report forever. In general, most negative items stay on your credit report between seven and 10 years.

But sometimes lenders fail to stop reporting negative items, even when it’s past the cutoff. For example, if you filed for a Chapter 13 bankruptcy eight years ago, it should have already fallen off your credit report.

If it hasn’t, file a dispute with the credit bureaus and ask them to remove it. Follow up every few weeks to ensure it’s been deleted. Removing these negative marks from your credit report will improve your score and make you a more appealing applicant for loan products.

You can also hire a reputable credit repair company to help you identify mistakes and negative items that can be disputed with the credit bureaus. Our top-recommended credit repair companies are:

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

Credit repair consultations are free. You can chat with someone to have your questions answered and see whether the information on your report is worth paying someone to remove.

8. Call the Provider When You Notice a Late Payment

Lenders, utility companies, and service providers only start reporting late payments once it’s been 30 days since the due date. If you’re at or near that mark, call the company as soon as possible and ask them if you can pay over the phone.

The company may be willing to process the payment immediately and not report the late payment to the credit bureaus. It may help if you’ve been a customer for a while with a previous record of on-time payments.

9. Build Credit With a Secured Credit Card

A secured card is one of the best ways to improve your credit scoring if you don’t qualify for other types of loans. Because secured cards are designed for those with bad credit, they’re very easy to obtain.

When you apply for a secured card, you usually have to put down a deposit equal to the total credit limit. Some secured card providers will let you make a deposit that is less than the credit limit, but this can be hard to find. The deposit is usually $200 or more.

Below are our top-rated secured cards for building credit:

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A | Yes | 9.5 |

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

- 1% Cash Back Rewards on payments

- Choose your own credit line - $200 to $2000 – based on your security deposit

- Build your credit score.¹ Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 19.24% (V) | Yes | 7.5/10 |

Once the account is open, you can use the secured card as you would a regular credit card. If you pay the bill on time every month, your score should improve, and you may be able to upgrade your secured card to an unsecured card after a few months.

10. Pay Your Credit Card Bill More than Once a Month

Credit card companies calculate your utilization ratio at the end of the billing cycle. If your utilization exceeds 30% at that point, your credit score will take a ding — even if you pay off the entire balance.

You can easily lower your utilization ratio without changing your spending habits by paying down your credit card balance more than once a month.

Here’s how it works. Let’s say you have a $4,000 balance on a credit card with a $10,000 total credit limit. Your utilization ratio would be 40%, which is much higher than it should be.

Your billing cycle ends on the 30th, so on the 25th, you pay $3,000 toward your balance. Your new balance is $1,000, so your utilization ratio is now 10%. When the billing cycle ends, the credit card company will report a 10% utilization ratio.

This method requires monitoring your credit accounts regularly and manually calculating your utilization ratio. First, figure out when your billing cycle is over. This should be on your credit card or your monthly statement.

Then, set a reminder in your calendar to check the utilization ratio a week or so before the billing cycle ends. If your utilization is above 30%, make an extra payment to decrease the ratio.

11. Don’t Cancel Old Card Accounts

The average age of your credit history makes up 15% of your credit score. The older your accounts, the higher your credit score will be.

Plus, if you cancel your card, your credit utilization ratio will rise if you have balances on other credit cards. This is because you are reducing your total available credit.

Consider keeping old accounts open — and using them — for the sake of your credit score.

It’s not enough to just keep the card open, however. You also have to use it regularly so the card company will report your activity to the credit bureaus. There are two ways to do this.

You can keep it in your wallet and remember to use it a couple of times a month, but an easier method is to add a small recurring bill to the card, like a Netflix or Spotify subscription. Then, set the card to auto-pay. This lets you get the benefit of the card’s age on your credit report without having to carry around a card you never use.

12. Avoid Opening New Accounts

Opening new accounts reduces the average age of your credit accounts. Avoid opening a new credit card and other new credit accounts you don’t need, like a store credit card offering an extra 15% off your purchase.

You should especially avoid this if you’re about to apply for a mortgage or another type of loan.

Every new hard inquiry can cause your score to drop between five and 10 points. If you’re applying for a mortgage, that could result in paying thousands of dollars more in total interest.

13. Add Utility and Rent Payments to Your Credit Report

Achieving a good credit score is often a catch-22. If you don’t have a credit history, it can be difficult to get a loan or a credit card to build your credit history — but you need a credit account to improve your credit history.

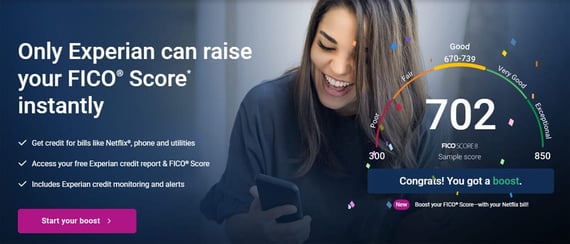

One easy way to boost your credit history is to add utility and rent payments to your credit report. Some services, including Experian Boost, will do this for free.

Experian Boost is a free service that can help you raise your FICO Score 8 by an average of 13 points.

Other services like Rental Kharma will help you do this for a fee. It could be worth the price, especially if you’re currently in the market for a loan.

14. Be Mindful of the Rate Shopping Period

When you apply for a major loan such as a mortgage or auto loan, you may decide to get quotes from several lenders to find the best offer. Every time you complete a loan application, it will count as a hard inquiry on your credit report.

The only exception is when you apply for a mortgage or auto loan and all your applications are within the same 14- to 45-day window. In that case, those multiple applications will only count as one hard inquiry. This lets you find the best offer without harming your credit score.

However, if you apply for a loan once the shopping period has closed, it will count as a separate hard inquiry and may reduce your score. Before applying for a major loan, figure out which lenders you’re interested in and what kind of terms you want. Then, apply for those loans within a few days of each other to ensure you’ll be within the window.

15. Freeze Your Credit

If you recently had your identity stolen or your personal information leaked, freezing your credit will prevent anyone from opening an account in your name. As of 2018, setting up a credit freeze is free with all three credit bureaus.

Freezing your credit reports is free and prevents anyone from accessing them.

After freezing your credit, no one will be able to access your credit report. While this won’t improve your score directly, it will prevent hackers from running up a balance on a credit card, increasing your utilization ratio, and hurting your credit score.

Focus On Building Good Credit Habits

All these higher credit score secrets have a basic concept in common: Use credit responsibly and avoid taking on more debt than you can handle. If you avoid credit card debt and pay your bills on time, your score will likely improve.

Consumers also need to be patient. It can take months or even years to improve your credit score, so settle in for the long haul. Just focus on building good credit habits and your score will steadily improve.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.