Your credit score is an important number that affects your life in more ways than you may realize. Lenders and even some service providers, including insurance companies, utility services, and wireless carriers, may use your credit score to determine how likely you are to pay your bills on time.

If you have a low credit score, you could be denied a loan, lose out on a home rental, or have to dish out high deposits and fees to open certain service accounts.

While consumers generally understand that it’s important to build and maintain a healthy credit score, many don’t know how their score is calculated in the first place. In fact, a survey from LendingTree found that about 4 in 10 Americans are unsure how their credit score is determined.

Spending time to review the factors that go into your score will give you insight into how you can better manage your finances and ultimately improve your credit.

Credit Score Factors

Paying bills on time, keeping balances low on credit accounts, maintaining a long history of positive credit management, and the different types of credit accounts you have all affect your credit scores and reports.

But knowing how these factors impact your credit score is only one part of the puzzle. The other area you need to familiarize yourself with is which types of accounts will help you build credit.

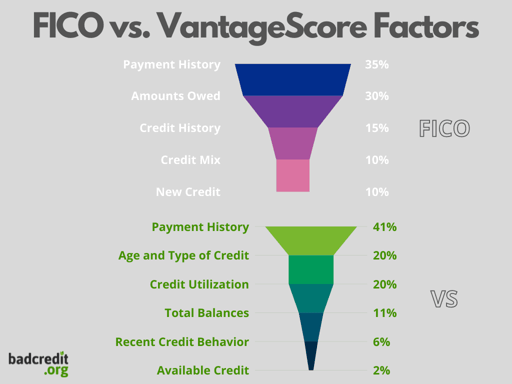

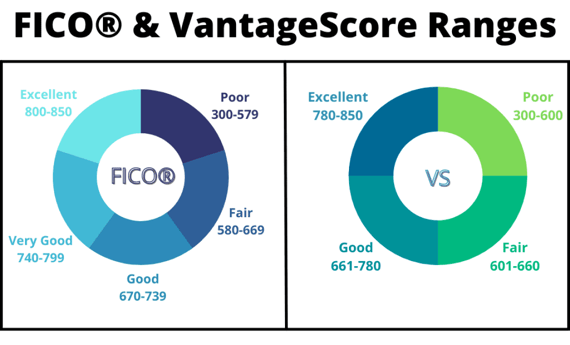

Before digging into the different types of credit building accounts available, let’s take a look at the two most popular credit scoring models used by credit reporting agencies to determine your average credit score — FICO and VantageScore.

Both of these models analyze credit reports to determine your final credit score which can vary since they value criteria slightly differently.

The good news is both use a scale of 300 to 850, and people with a score of at least 670 for FICO and 700 for VantageScore will generally qualify as having good credit.

While your credit score can vary between these models, the differing scores will generally fall within a close range of each other, so taking the average sum can give you an idea of how lenders view your creditworthiness.

Accounts That Build Credit

The different types of accounts you open throughout your life can be important financial tools to establish and build a top credit score. Here are the six most common types of credit building accounts you will encounter and how they affect your credit.

1. Credit Cards

Many consumers use credit cards on a daily basis, and they are perhaps the most accessible account type. This includes both secured and unsecured credit cards. Accounts with most major credit card companies will appear on your credit reports, so it’s very important to manage your account wisely.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 29.99% APR (Variable) | Yes | 8.5/10 |

Secured Sable ONE Credit Card

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

Not only is it crucial to keep up with timely payments, but it’s equally important to keep your balance low. It’s not just how much you owe that is used to determine your credit score but how much money you owe in proportion to what is available, often referred to as your credit utilization ratio.

Someone who maxes out their credit cards and carries a high revolving daily balance will appear as a potential risk to lenders since they may take on more debt and not be able to repay a bill or loan in full or on time. So it’s prudent to pay down balances and show more available credit than you’re using to improve your credit score.

You should use no more than 30% of your available credit to keep your utilization rate low, which will have a positive influence on your credit score.

To maintain a low credit utilization rate, track purchases and monitor your daily balance, make payments before your statement billing date is due, and spread out charges across multiple credit cards so you don’t rack up a big balance on a single card.

Opening a credit card account isn’t the only way to build credit. You can leverage someone else’s credit card account to boost your credit score by becoming an authorized user.

This strategy adds you to another person’s credit card account as a secondary user. You are not legally responsible for paying the balance, but you benefit from the primary account holder’s positive credit habits, assuming the account is in good standing.

2. Credit Builder Loans

A credit builder loan is a type of installment loan designed specifically for consumers who have no credit or very poor credit. It can help you start rebuilding or repairing your credit with less hassle and fewer fees.

But instead of getting the cash upfront like you would with any other type of loan, the funds are set aside in a separate savings account with the lender. You are then required to make fixed monthly payments until you pay off the total amount of the loan at which point the lender will return the money to you.

The lender reports your account information and payments to all three credit reporting agencies to establish your creditworthiness and boost your score. In the end, this loan helps you build savings while simultaneously building your credit.

3. Mortgage Loans

Unless you have amassed enough savings to buy a home with cash, you will need a home loan or mortgage to finance this big-ticket purchase. But unlike other types of unsecured loans such as personal and student loans, mortgage loans are secured since the home is used as collateral if you can’t keep up with payments.

- Get today’s mortgage rates from the top mortgage lenders and banks

- Easily compare and choose mortgage lenders with no obligations or fees

- Review current mortgage rates side by side

- Pick mortgage lenders that meet your specific needs

- Compare rates from pre-qualified and approved mortgage lenders — 100% online, 100% free

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1979 | 4 minutes | 8.5/10 |

Your home loan will appear on your credit report and can boost your score as long as you make timely payments.

4. Auto Loans

Buying a new or used vehicle isn’t cheap, so most people take out auto loans to afford their new ride. These loans can be funded by a dealership or financial institution such as a bank or credit union and are reported to all three credit reporting agencies.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

As with a mortgage, these installment loans are secured since lenders leverage the vehicle as a guarantee on the money borrowed. The lender can repossess the car or truck in the event the loan isn’t repaid.

Assuming you stick to your agreed-upon payment schedule, auto loans can be a helpful tool to establish and boost your credit score.

5. Student Loans

Obtaining a college degree comes with a high price tag, and many students have no other financial means to pay for this higher education other than by taking out a loan. There are two types of student loans, federal and private student loans, both of which build credit.

Student loans are considered unsecured installment loans that don’t have to be repaid until a certain period after graduation. But federal student loans often appear on your credit file while you are in school, even before you’re required to make repayments, which can give your credit a little boost.

Lenders of federal and private student loans have different repayment terms, so it’s important to familiarize yourself with your account and financial responsibilities before graduation so there are no surprises and to ensure you can manage your payments. Otherwise, you may be able to defer repayment if you’re experiencing financial hardship.

6. Personal Loans

Personal loans are unsecured cash loans that can be used for various purposes, from consolidating multiple debts to financing a big expense such as a medical procedure, wedding, or home improvement.

You make fixed monthly payments on a personal loan until the total debt is paid off. This can help build your credit as long as you pay your bills on time and in full.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

If you are starting from scratch or made a lot of credit errors in the past, a credit builder loan or a credit card may be easier to obtain and cost you less in the long run because personal loans for bad credit can charge high interest fees.

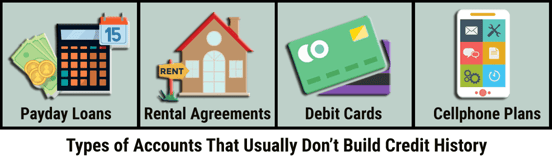

Accounts That Don’t Build Credit

If your goal is to build credit, it’s important to avoid accounts that don’t report to the credit bureaus. This includes prepaid cards and most utility accounts. Another big expense that, unfortunately, doesn’t affect your credit rating is rent payments.

Your checking and savings accounts don’t affect your credit score either, but they do appear on another type of report – your ChexSystem bank report – which affects your ability to open new bank accounts.

One way to add nontraditional accounts to your Experian credit report is to use a service called Experian Boost. This service allows you to add positive payment history to your Experian credit report, and the average user sees a 14-point increase to their Experian FICO 8 Score.

No Matter the Account, Pay Your Bills On Time to Achieve Good Credit

The bottom line is that achieving an excellent score comes down to managing your money responsibly. This means paying bills on time and in full and only charging what you can afford to pay off regardless of what type of account you have.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.