Your credit can have a tremendous influence on your overall financial health. Good credit makes it easier to obtain more affordable financing when you need to borrow money. Good credit can also mean cheaper insurance, utility deposit waivers, and even an easier time getting a job.

Conversely, poor credit can make it harder and more expensive to obtain essential needs like housing and transportation for you and your family. That’s why it’s critical to keep a close eye on the health of your credit — it’s simply too important to turn your back on for any extended period.

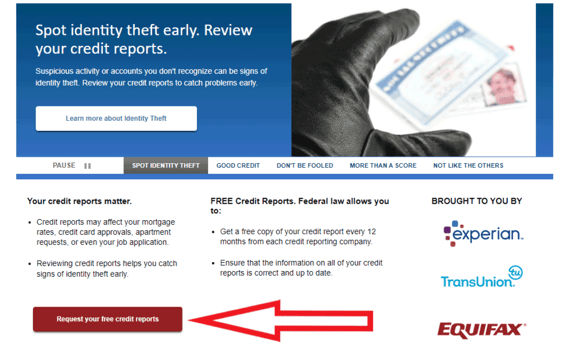

You must get in the habit of checking your three credit reports from the three major credit bureaus — Experian, TransUnion, and Equifax — and doing so often.

You Are Entitled to 1 Free Credit Report From Each Bureau Every 12 Months

The Fair Credit Reporting Act, known as the FCRA for short, gives consumers the right to check their credit reports free of charge once every 12 months. The three credit bureaus are offering consumers free weekly credit report access through at least the end of 2022 in response to the COVID-19 pandemic.

You can claim these free reports at AnnualCreditReport.com, formally referred to as the Central Source. It’s a website mandated by the FCRA and has been around for almost 20 years.

For those of you who have never checked your own credit, it’s not difficult, and I’m about to make it easier. What follows is a step-by-step guide on how to use the website to check your credit reports when you’re ready. And a little unsolicited advice: You should do this today!

Step 1: Visit AnnualCreditReport.com – Pay Close Attention to the URL

First, go to www.annualcreditreport.com. Be sure not to accidentally type in the wrong address, or you may end up on a squatter website that will refer you to fee-based credit report services rather than your official free credit reports.

Click the red button on the homepage of the website that says “Request your free credit reports.”

This link will take you to a second webpage entitled “3 steps to your free credit reports” where you’ll find basic instructions on how to do the following:

- Fill out a form to request all three of your credit reports from Experian, TransUnion, and Equifax or just one or two of the available reports.

- Be prepared to answer questions to confirm your identity with each credit bureau. The questions may be difficult because they’re intended to make sure no one other than you can answer them. This process is referred to as authentication.

Click “Request your credit reports” when you’re done reading the instructions to move forward.

Step 2: Fill Out a Form

Next, you’ll fill out a form to request your first credit report. You’ll only need to enter most of the personal identifying details once, even if you plan to request copies of credit reports from all three of the credit bureaus.

Here are some of the details you may need to provide:

- Name

- Address

- Previous address, especially if you have recently moved

- Social Security number

- Date of Birth

After you enter the requested data, click “Next.”

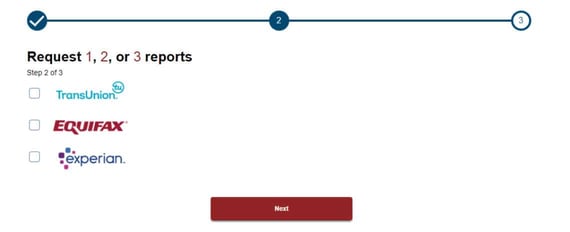

Step 3: Request Your Reports

You’ll need to decide whether you want to ask for all three of your credit reports (Experian, TransUnion, and Equifax) or if you prefer to spread out your reports over time.

You may want to request all three credit reports if:

- You plan to apply for financing in the near future, and you’re not sure which credit report(s) the lender may review when you apply for a loan or credit card.

- You want to be thorough in your own personal credit review process because different credit reports can contain different information.

Remember that all three credit bureaus currently allow consumers to access their credit reports for free once a week, so there’s no need to save additional free credit report access for the future. Use it or lose it!

Step 4: Complete Individual Credit Bureau Forms

Once you choose the credit report(s) you want to access, the AnnualCreditReport.com system will connect you to the credit bureau. At this point, you may have to provide additional identifying information, such as your email address or phone number where you can receive a secure passcode for added security.

Depending on the credit bureau, you may also need to answer some security questions. Most security questions come from details found in your credit report.

Here are a few examples of security questions you may encounter:

Example #1: Based on our records, you previously lived on ABC Street. Please choose the city where this street is located.

- Chicago

- Boston

- Houston

- Seattle

- None of the Above/Does Not Apply

Example #2: Based on our records, you opened a mortgage around January 2018. Please select the dollar range of your total monthly mortgage payment.

- $1,000 – $1,500

- $1,501 – $2,000

- $2,001-$2,500

- $2,501-$3,000

- None of the Above/Does Not Apply

Once the system accepts your security code (or the answers to your security questions), it should take you directly to your credit report. You’ll have the option to review your credit report from that credit bureau and print or save a copy for your records.

If the system cannot verify your identity, it may prompt you to upload additional proof of your identity (e.g., driver’s license, Social Security card, birth certificate). Otherwise, you may need to request your free report via phone or mail.

Tip: If you can access your free reports online, be sure to save a copy before you move on to the next credit report. You can’t access the report you’re currently viewing again later in the process.

Steps 5: Repeat the Process for the Remaining Bureaus

After you review (and save) your first credit report, it’s time to repeat the process. The system will allow you to return to AnnualCreditReport.com where you can get a copy of your next credit report as long as you indicated in Step 3 that you wanted to review more than one credit report.

As before, you will either need to verify your identity via a security passcode or by answering some security questions. Remember to save copies of each report for your records.

Check Your Credit Reports Often

Checking all three of your credit reports often is important to make sure your credit stays in good shape. You also want to keep an eye out for potential issues such as fraud, identity theft, and credit reporting errors that may require action on your part.

Checking your credit reports once a month is ideal. But, if that frequency feels like too much, it’s okay to aim for a goal that feels more realistic. Even quarterly or bi-annual credit checks are better than nothing. I’ll be thrilled even if you check them once every few months. It’s still much better than never checking them.