If you’re like most people, you want to build and maintain a high credit score so you can borrow money at the best rates and terms. What that number should be, though, depends on what you want to do. Some credit products demand higher scores than others.

The financial data that appears on your credit reports is factored into credit scoring models such as the FICO Score, which ranges from 300 to 850. The current average FICO Score is 716.

Before approaching any lender, it is important to know what your credit score is and what the requirements are for the loan or credit you’re after.

Your Credit Score Should Be 700+ For the Best Deals

First, try not to worry if your credit score is below the national average. If you are just starting out with credit, it takes time and effort to build a good score. Also, rest assured that credit products are available for people with a variety of credit ratings.

Once you have a loan or credit card, you can use it to your advantage. The account will appear on your credit reports, and regular responsible usage, such as paying every bill on time, will help your credit scores rise.

Here is what is considered poor to exceptional credit scores, according to FICO:

300 to 579 – Poor

580 to 669 – Fair

670 to 739 – Good

740 to 799 – Very good

800 to 850 – Exceptional

Scores in the mid-700s and above (good to very good) will open the most doors, but plenty of options exist for people who have lower scores too.

What Should My Credit Score Be to Buy a House?

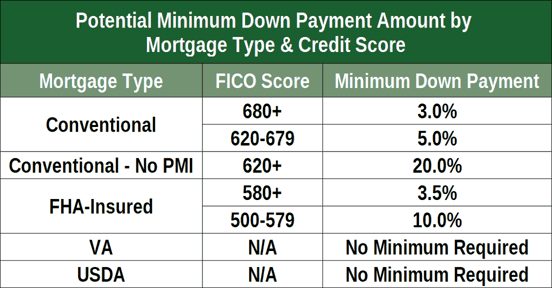

The good news is you do not have to have an exceptional credit score to qualify for a mortgage.

For many conventional loans, a score of at least 620 is usually necessary, but even that number isn’t written in stone.

Subprime lenders will work with borrowers who have scores of 580, and if you use a program like an FHA loan, you may be eligible with a score of 500. There are no fixed credit scoring requirements for VA loans.

Just remember that lower credit scores will result in a higher APR, and each point translates into more interest paid.

What Should My Credit Score Be to Buy a Car?

There is no specific minimum credit score you need to finance a car, but that doesn’t mean individual lenders won’t have their own underwriting requirements. And the best financing terms generally go to people who have a score of 760 or higher.

Some lenders will only work with people who have credit scores of 670 and above, so that’s a good goal to have when shopping for a car loan.

What Should My Credit Score Be to Get a Credit Card?

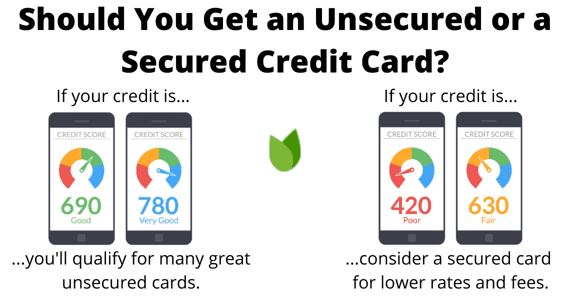

The great news about credit cards is that some are specifically developed for people who don’t yet have credit scores, such as students, and for people with bad to fair credit scores. If you fit in this category, you may want to consider a secured credit card, where a refundable deposit guarantees the credit limit and there is no minimum credit score requirement.

Most issuers of unsecured credit cards expect you to have a FICO score that is at least 550. This score can qualify you for a basic starter account, but if your credit score is above 700, you will likely qualify for a credit card that comes with exceptional rewards and perks.

What Should My Credit Score Be to Get a Personal Loan?

A credit score of at least 600 should put you in the running for a personal loan. But some personal loans don’t check credit at all.

For example, a payday lender bases the loan amount it issues you on your upcoming paycheck, and pawnshop loans are determined by the value of the item that you bring in.

What Should My Credit Score Be to Get a Business Loan?

As an entrepreneur or a small business owner, you may want to borrow capital for everything from start-up costs to operations and expansion. Lenders that grant business loans will check your credit to determine qualification, terms, and amount, in addition to other factors, including how long you have been in business, your revenue, and the industry you’re in.

To get a business loan, you will usually need a credit score of 680 or higher, though certain lenders will work with people who have lower scores, especially if the loan is collateralized.

Steps to Improve Your Credit

Because interest rates and other terms are largely based on credit scores, when you want to borrow money, it pays to establish a strong credit score before you apply.

Here’s how to raise your credit scores as quickly as possible:

- If you don’t already have one, open at least one credit card. All the activity you make with this account — the balance, your payment history, how long the account’s been open, among other things — will show up on your credit reports and be factored into your credit scores.

- Make all of your payments on time. For every account that appears on your credit report, you will want to demonstrate that you can and do meet your due dates. Payment history is the most important scoring factor, so this is an essential task.

- Pay off any recent collection accounts. If you have not paid a creditor and the debt landed in a collection agency in the last year or so, satisfy the balance. Collection accounts affect the payment history part of your score, and recent information matters more than older data. If the debt is several years old, it will age off your reports in seven years and is less important to repay.

- Expand your credit utilization ratio. The second most important factor in a credit score is how much you owe to a revolving credit product, such as a credit card, compared to the amount you can borrow (i.e., the credit limit). The less you owe, the better. You can expand your credit utilization ratio by deleting or reducing the balance, requesting a credit limit increase, or by using a debt consolidation loan to pay it off. Because installment loans aren’t factored into your credit utilization ratio, debt consolidation can boost your credit score.

- Add non-traditional data to your credit report. The credit bureau Experian has a free program called Boost that allows you to have your utility, cellphone bills, and rent payments added to your credit report. When you pay those bills on time, that positive payment history can give your scores some extra points. If your landlord enrolls in Piñata, your rent payments can be reported to all three bureaus.

- Have a variety of credit products in use. A couple of credit cards and a loan with a long track record of responsible use will help your credit scores rise over time.

- Refrain from unnecessary applications. You may be tempted to apply for an attractive credit product without finding out whether you are a good candidate. But every credit application you submit will result in a hard inquiry on your credit file and will be factored into your scores. Too many hard inquiries, particularly if your credit scores are already low, can have a negative impact on your scores. Instead, make use of prequalification processes to see whether you qualify.

High Credit Scores Are Worth the Effort

Your credit scores will benefit when you use credit products the right way. That means paying your bills on time and keeping credit card balances low. Most credit cards come with free credit monitoring, so you can easily keep track of your credit-building progress and stay motivated.

Obtaining a loan, no matter what it’s for, is possible with a subpar score, but you will come out ahead financially when your credit score is near the top of the scale. High credit scores mean lower interest rates and favorable repayment terms, so it’s worth putting in the effort to earn high scores.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.