Many people have questions about secured credit cards, but the truth is, a secured credit card works the same as a traditional credit card. While obtaining approval for an unsecured card can be difficult with poor credit, a secured card provides a viable option for someone with a low credit score, or someone looking to build their credit history.

It’s easier to be approved for secured cards because they require a deposit to secure the line of credit. Below we’ll explain how secured cards and deposits work and provide the answers to some common questions surrounding secured credit.

A secured credit card is a credit card that requires a deposit as collateral from the cardholder before approval, and, when used responsibly, can be a tool to help consumers with poor credit rebuild their credit.

They can also help people who have no credit history establish a line of credit, and, eventually, a credit score. Aside from the required deposit, secured cards work in the same manner as unsecured cards.

Secured Credit Card Definition

Investopedia defines a secured credit card as “A type of credit card that is backed by a savings account used as collateral on the credit available with the card. Money is deposited and held in the account backing the card. The limit will be based on both your previous credit history and the amount deposited in the account.”

What this means is that your credit limit is primarily based on your deposit amount — if you’re required to make a $300 deposit, you will likely be issued a $300 credit limit.

There’s also what’s known as partially secured credit, in which case your deposit is less than your assigned credit limit. Receiving a partially secured line of credit is based on your credit history and is at the sole discretion of the issuer.

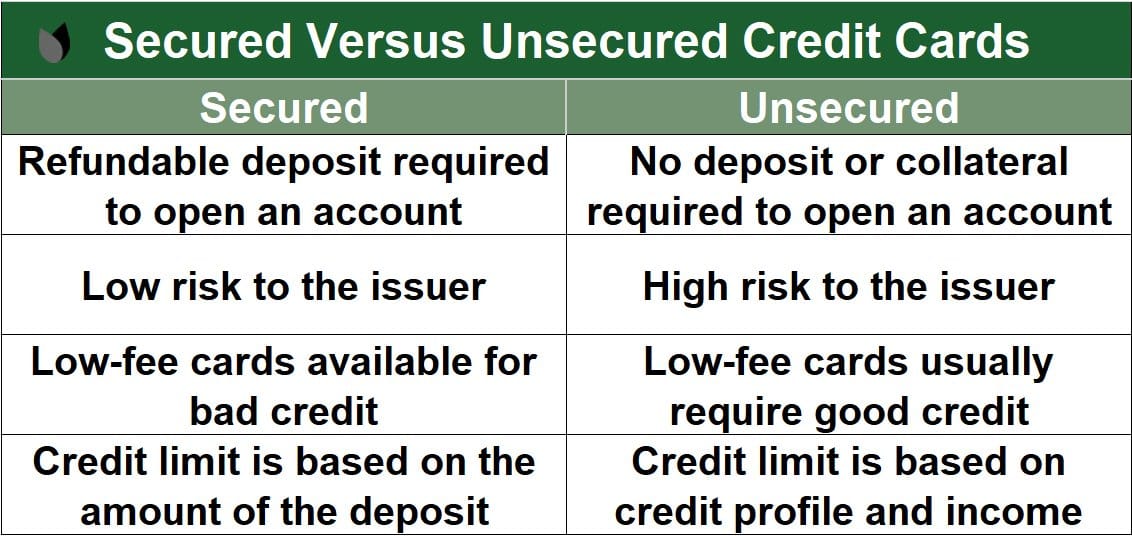

Secured Vs. Unsecured Credit

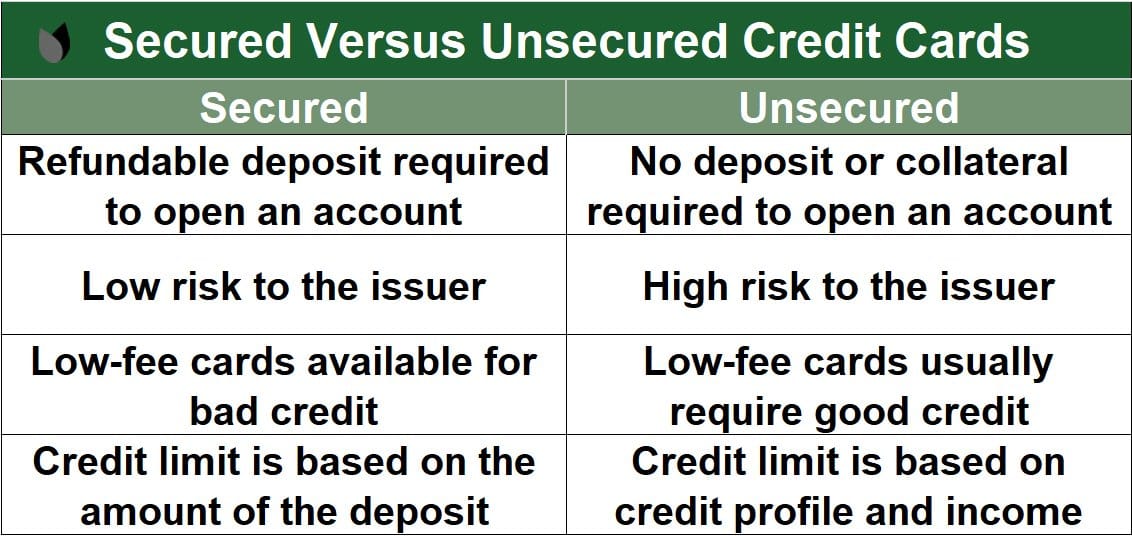

Secured credit cards are for people with bad credit or for those who have scant or no credit history. Unsecured credit cards are still available to those with bad credit, but the lower your credit score, the more difficult they are to obtain.

The deposit is the bank’s way of protecting itself in the event payments are missed or defaulted on, in which case the amount owed is deducted from your deposit. This is the primary difference between secured and unsecured credit.

After your deposit is received, you’ll be mailed a credit card to use as you would any other credit card. Whether you’re reserving a hotel room online or making a purchase at your local grocery store, the person on the other side of the register will be none the wiser to the fact your card is a secured card.

With many secured cards, you’ll have the opportunity for credit line increases with responsible use. By using the card to help elevate your credit score and/or establish credit history, you should then be able to close the account and apply for an unsecured card.

Your deposit will then be refunded to you, so long as it wasn’t used to cover missed payments.

Yes, but only when used responsibly. There are two primary rules to follow when using your secured card to improve your credit.

Always Pay On Time

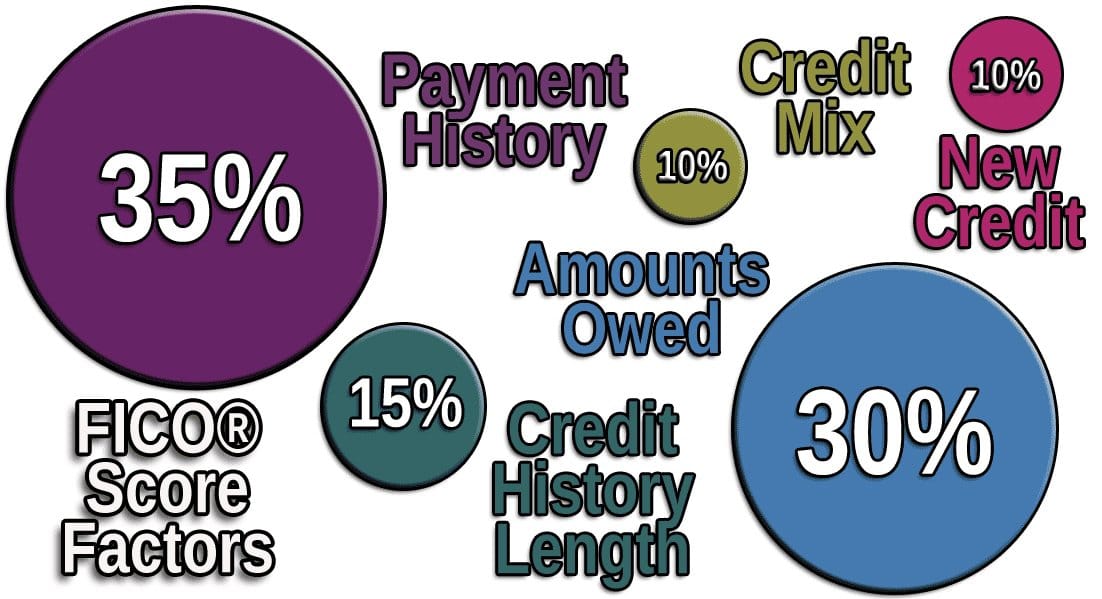

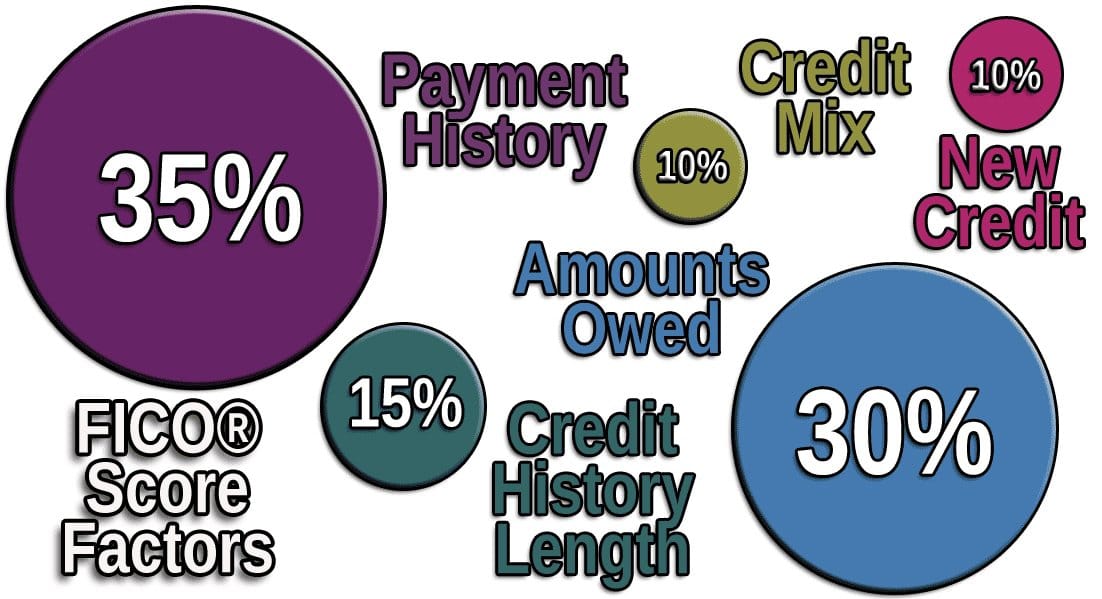

On-time payments are the most important factor when calculating your FICO credit score. In fact, on-time payments account for 35% of your credit score.

Paying your bills on time is the single most important thing you can do to build and improve your credit score over time.

Keep Your Credit Utilization Ratio Below 30%

Your credit utilization ratio is a percentage of how much debt compared with available credit you have. For example, a credit line of $1,000 with a $500 balance has a 50% utilization ratio.

In this example, you would never want your balance to exceed $300. Your credit utilization ratio, or rather your amounts owed, is the second-most important credit score determinant, accounting for 30% of your FICO score.

By following these two best practices, your secured credit card can help you improve your credit history and score. Additionally, you want to be sure to choose a secured credit card that reports to the major credit bureaus — Experian, Equifax, and TransUnion — otherwise, your good credit behavior will have no impact on your credit reports and scores.

You can apply for a secured credit card just as you would other credit cards. The simplest and fastest way to do so is online.

Most banks will approve or deny your application within minutes, if not seconds after the application is submitted. However, some secured credit cards may take longer to approve or deny an application. Read the terms and details pages of cards and applications to understand the approval criteria.

Some people aren’t comfortable giving personal identifying information online, and that’s OK — you can still apply over the phone if you prefer. You can easily find any issuer’s application phone number on its website.

Our experts have reviewed some of the best secured cards on the market, and the top picks are listed above. You’ll want to choose a card that reports to all three major credit bureaus and one that doesn’t have exorbitant fees associated with it.

Some secured cards charge annual fees, monthly maintenance fees, late payment fees, and credit limit increase fees.

These can be avoided by reading the terms and conditions for each card and choosing one that isn’t trying to nickel-and-dime you. While you may have to settle for a higher APR, you shouldn’t have to settle for outrageous fees.

In general, secured credit cards for bad credit are far and away the easiest cards to get when you have a poor credit score. The deposit you put down to secure the card largely replaces your personal credit score in the approval process. With required deposits starting as low as $49, virtually anyone can receive approval for a secured card.

First Progress Platinum Elite Mastercard® Secured Credit Card and its sibling, the First Progress Platinum Prestige Mastercard® Secured Credit Card, are examples of cards that are easy to obtain. They don’t require you to have a minimum credit score or even any personal credit history at all, and the minimum refundable deposit is only $200.

Because First Progress doesn’t do a hard pull of your credit report, your credit score won’t suffer when you apply for these cards.

Since all secured cards are relatively easy to obtain, choose one that offers good rewards and benefits. For example, the Discover it® Secured card offers a signup bonus and cash back rewards (including the famous Cashback Match at the end of the first year for new cardmembers). Sensibly, the card charges no annual fee and sends your payment information to each credit bureau monthly.

While secured cards are the easiest to get and the subject of this article, bear in mind that certain other types of cards are also easily obtained despite bad credit:

- Student credit cards: If you attend a post-secondary-school institution on at least a half-time basis, you’re eligible for a student credit card. Generally, this kind of card doesn’t require you to have any credit history, and acceptance is virtually automatic.

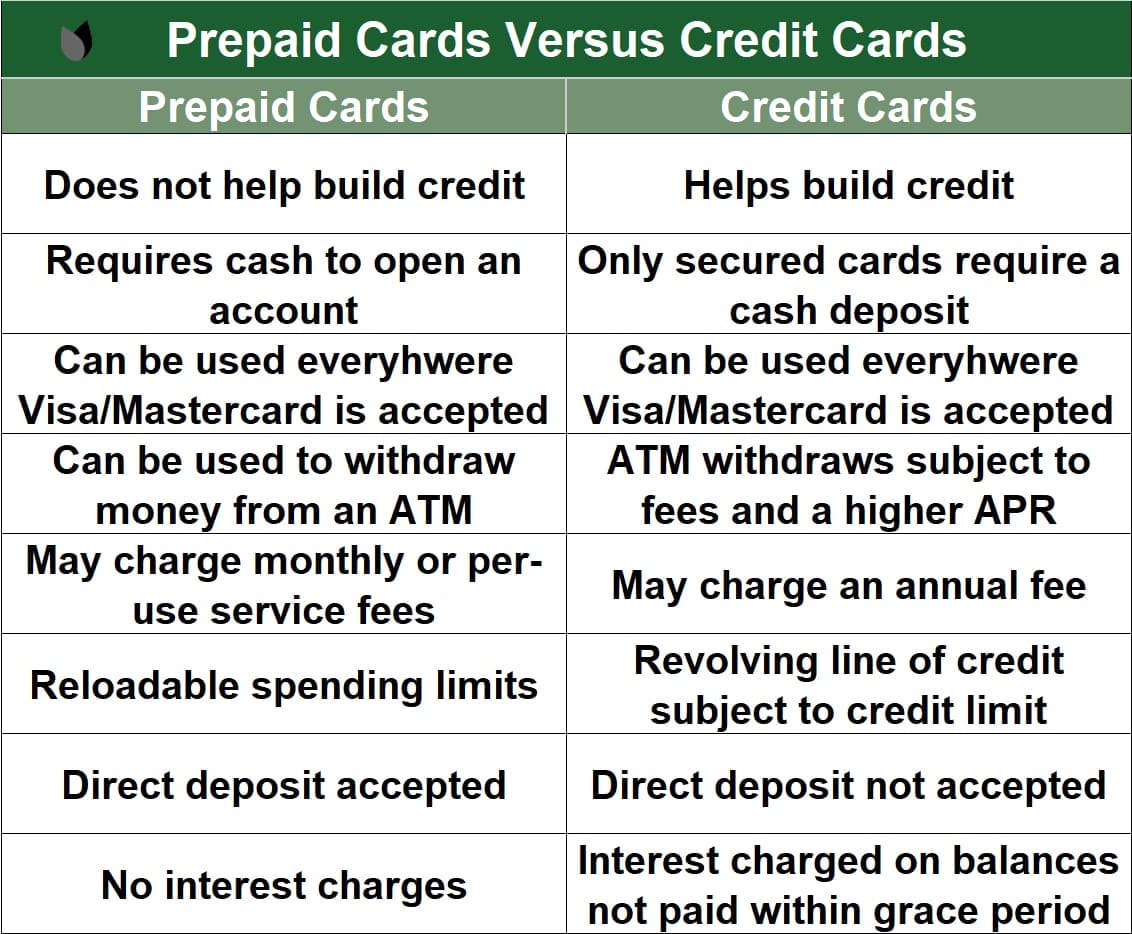

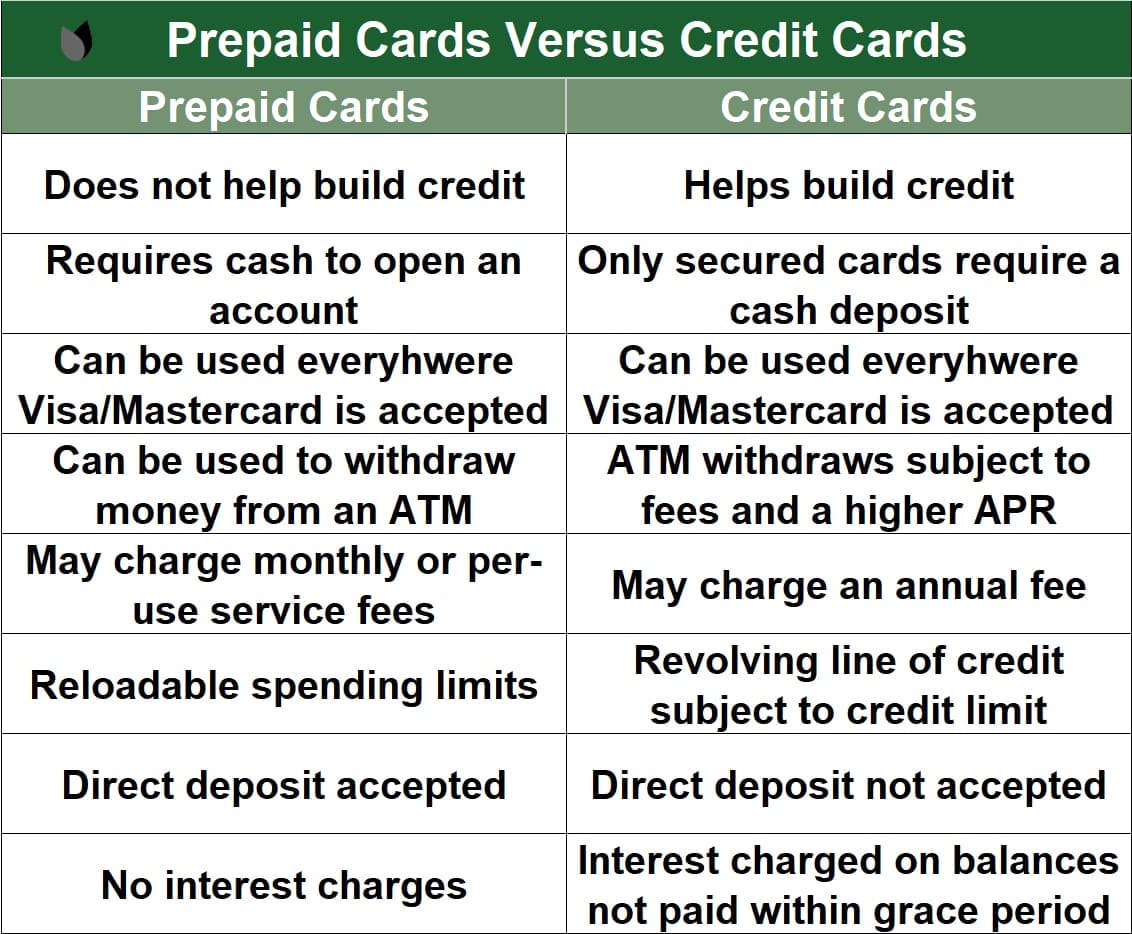

- Prepaid cards: These are not credit cards, but instead resemble debit cards. The twist is that they are secured by your cash deposits rather than your checking account. Prepaid cards do not check your credit, but they also don’t report your transactions to the credit bureaus and therefore can’t help improve your credit score.

- Unsecured credit cards: Several unsecured cards are designed expressly for consumers with bad credit. You may qualify for one of these despite having a low credit score. Before applying, check the fees of the regular credit card — some are festooned with extra charges.

- Store credit cards: These are closed-loop credit cards that can only be used at the issuer’s store or website. While these cards are unsecured, they are usually much easier to get than are general-purpose unsecured credit cards. Many of these cards report your payments to the credit bureaus.

You have several options when your credit is bad, but if you want to rebuild credit without worrying about getting approved, apply for a secured credit card. Over time, you may be able to trade in the secured card for an unsecured one and receive your deposit back.

In these modern times, most credit cards give you an approval decision in just a few minutes. Secured credit cards offer very quick acceptance, but you can’t get your card until you send in the required deposit. Virtually all cards can prequalify you in under a minute or two without a hard inquiry, and although prequalification doesn’t guarantee acceptance, it helps you rule out cards without experiencing score damage due to a hard pull.

For some folks, instant approval is not enough. If you are one of these demanding consumers, you’ll want to use your card as soon as it’s approved — no waiting a week or two for the card to arrive at your mailbox (some issuers offer overnight or expedited handling, but it’s not generally available).

Happily, several cards provide instant usability via features such as virtual account numbers and mobile digital wallets.

Virtual account numbers are temporary stand-ins for your permanent card account. The issuer gives you one or more virtual account numbers, either reusable or one-use only. You use virtual account numbers for card-not-present (CNP) purchases (i.e., online, mail order, or phone order).

Because the merchant never gets hold of your real account number, the chances of identity theft are almost eliminated. Furthermore, virtual numbers are often limited to a single merchant, further protecting the card against fraud. Several issuers offer virtual card numbers, including:

- Citi: You can request virtual account numbers from the Citi credit card website and then use the number for a CNP transaction.

- Capital One: You can use the issuer’s Eno browser extension to request and manage virtual card numbers.

- American Express: Many Amex cards offer virtual account numbers that expire when you receive the real account number. You can request a virtual account number from Amex Customer Service.

Of more general use are cards that work with digital wallets. You load these cards into an approved digital wallet and you’re ready for online shopping or checkout lines that accept them. The secret is that the wallets use a numeric token instead of the real account number for transactions.

The biggest news on this front is the Click-to-Pay digital wallets for online purchasing, issued by the four payment networks (American Express, Discover, Mastercard, and Visa). Other wallets that offer numeric tokens include Samsung Pay, Google Pay, PayPal, Apple Pay, and Eno.

Some of the virtual account numbers and digital wallets can be used for in-app purchases as well.

Yes, you can get a secured credit card with a 450 credit score, or even no credit score at all. As described earlier, secured credit cards rely on your cash deposit to act as collateral for your purchases. Therefore, your credit score is largely immaterial for secured cards.

The other credit card candidates available to consumers with a 450 score are retail store cards, some student cards, and some subprime unsecured cards. As mentioned earlier, prepaid cards do not reference your credit score, but they are more like reloadable gift cards than credit cards.

The Fingerhut Credit Account is one of the easiest store accounts to open. You can use the card for online purchases from Fingerhut, and the issuer reports your activity to the three credit bureaus.

If you decide to go with a prepaid card, we recommend the PayPal Prepaid Mastercard®. It offers direct deposit, a mobile app, and acceptance wherever a Mastercard credit card or debit card can be used.

While you are unlikely to be denied a secured credit card based on your credit score, your other credit cards can still trip you up. Several of the big card issuers put the brakes on new cards for applicants that have too many cards, and not always cards from the issuer.

The most infamous example of card limitation is the Chase 5/24 Rule. The rule limits you to no more than five new credit cards within a 24-month period, no matter who issued the cards. That’s unique in the business, as all the other limitation rules apply only to the issuer’s credit cards.

Citi restricts new cards with the 8/65/95 Rule. This rule means you must:

- Wait 8 days to apply for a second card after applying for another Citi card.

- Wait 65 days before applying for a third Citi card.

- Wait 95 days before applying for a second Citi business credit card.

The Citi 8/65/95 Rule applies only to Citi accounts.

Capital One has a straightforward limit: You can own up to two Capital One credit cards. Some exceptions may apply — for instance, the rule may not apply to some cobranded Capital One cards.

American Express enforces its 4/4 Rule, limiting you to four Amex charge cards and four Amex credit cards each. Charge cards are like credit cards except that you must pay your full balance each month, and there is no preset spending limit.

Discover limits you to no more than two of its cards at any one time. You must own the first Discover card for at least a year before applying for the second card.

Consumers with bad credit have varying preferences. Some are happy to put down a deposit for a secured credit card as a way to build credit. Others are willing to settle for a store credit card, which will be easy to get albeit of limited usefulness.

But for others, only an unsecured credit card will do. Several credit cards (and issuing banks) specialize in the subprime credit market. These unsecured cards share several characteristics:

- While all are available to folks with bad credit, most enforce some minimum credit score.

- Almost none offer rewards for purchases and benefits are meager, often limited to $0 fraud coverage.

- Most come with extra charges, including an annual fee, a signup fee, a monthly servicing fee, a cash advance fee, penalty fees, an additional card fee, a credit limit increase fee, and possibly more.

- All have tight credit limits, typically $300. However, when you get your card, it may already have subtracted its application fee and/or annual fee. For example, a card with a $75 annual fee may put the fee on the card, leaving you with a credit limit of $225. Once you repay the $75, your credit limit will be $300.

- Typically, the card will have fees for late and returned payments.

- Typically, the card will have an APR of around 29.99% to 35.99%.

- These cards rarely offer balance transfers.

As you can see, unsecured cards for bad credit are not the stuff that dreams are made of. Nonetheless, they are a good first step on the road to credit score recovery, as they will report your payments to the three credit bureaus. By paying your bills on time each month and, if possible, paying the entire bill each month, you should start to see your score improve within six months to a year.

In fact, six or more months of timely payments may earn you an invitation from the issuer to increase your credit limit, although you may have to pay a fee for the privilege of building credit.

Another approach to getting an unsecured credit card is through shared ownership:

- Authorized user: You can ask someone who trusts you and has a good credit score to make you an authorized user on their card. You’ll get your own copy of the card with your name on it, and you’ll be able to use the card just like the owner does (although some cards allow the owner to put limits on your spending). Technically, only the owner is responsible for payments, but you’ll risk your relationship with the owner if you try any funny business.

- Cosigner: Many cards encourage applicants to recruit a cosigner. This is someone with a good credit record who will guarantee card payment if you fall down on the job. Typically, only you use the card, while your cosigner remains out of the picture unless a payment is late.

In the long run, you will want to improve your credit score through creditworthy behavior. This will allow you to graduate to better quality credit cards that offer ample rewards and sizable benefits.

Indeed, we have identified a few secured cards that are a good fit for the needs of business owners. Even if these cards are a bit obscure, they are readily available to businesses and owners with bad credit. They include:

- Wells Fargo Business Secured Credit Card: You can establish a credit line as high as $25,000 through your cash deposit. This business credit card gives you a choice of cash back or points rewards. Up to 10 employees can receive free cards, allowing you to accumulate rewards on their purchases.

- BBVA Compass Business Secured Credit Card: Available in only seven states, this secured card offers tiered cash back rewards. You secure the card’s credit line, starting as low as $500, with your BBVA savings account. The credit limit will equal no more than 90% of the savings account balance. The card offers many business services including free employee cards.

- OpenSky® Secured Visa® Credit Card: Although not marketed specifically to businesses, this card is known for its high acceptance rate of business owners. Credit limits range from $200 to $3,000, and you can get the card without a credit check.

These cards allow you to build credit, as long as you pay your bills on time, keep your balances low, and don’t exceed your credit limit. In some cases, the credit card company may increase your credit limit over time without additional deposits.

In fact, after a period as short as six months, you may be upgraded to an unsecured card and receive a full refund of your deposit, a sure sign that you are building credit.

We don’t like annual fees in general, and certainly not for secured cards, since they already have your money locked away, often with a 0% interest rate. However, we admit that some secured cards offer strong benefits that arguably justify a reasonable annual fee. By reasonable, we mean no more than $60 per year, tops.

We have identified the following secured credit cards that charge no annual fee:

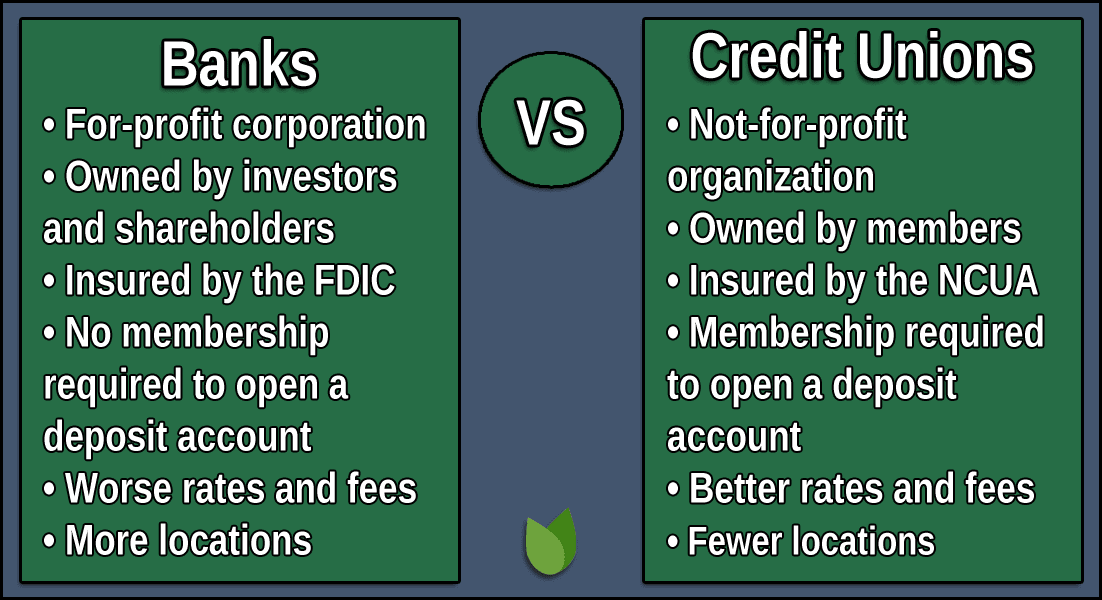

Of these, four are bank-issued, two are issued by credit unions, and one is a product of a payment network. By charging no annual fee, they leave you more money for paying your bills and reducing your credit balances.

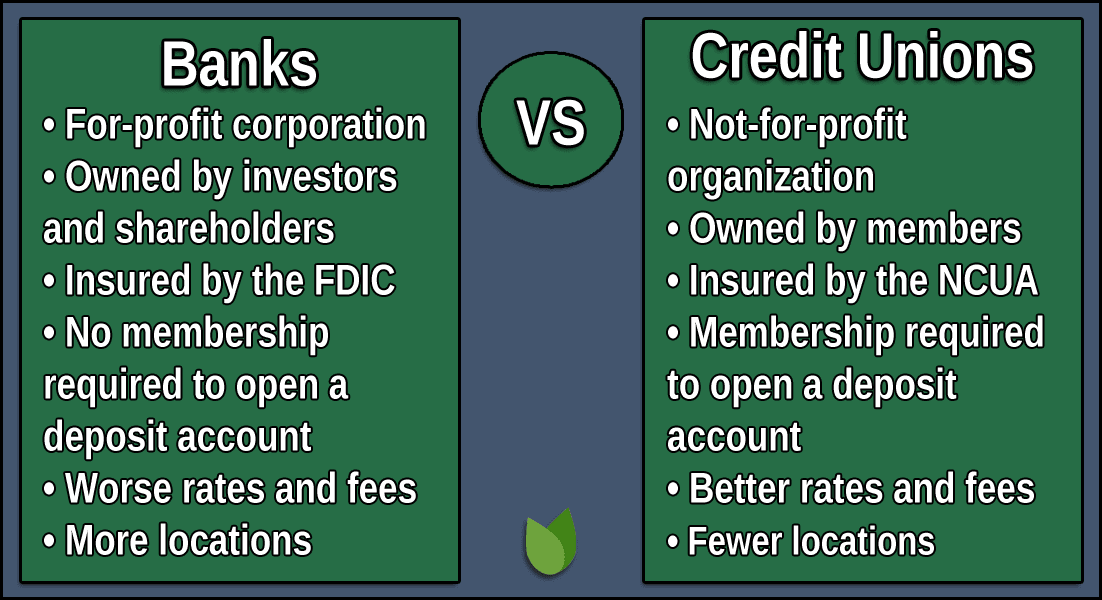

Yes, many credit unions offer secured cards, and we think you should strongly consider them if you are eligible to join the credit union.

There are several reasons to seek out credit unions. Relative to banks they:

- Charge a lower interest rate on credit products and loans.

- Offer better access to credit products and loans even if you have bad credit.

- Offer higher APRs on savings products.

- Frequently offer credit-builder accounts to establish or rebuild credit.

- Charge lower fees and fewer of them, especially on checking and savings accounts.

- Offer personalized customer service and education.

- Are nonprofit institutions and return their revenues back into their products and services.

Credit unions offer pretty much the same services as do banks but are just, well, friendlier. They are run by boards consisting of volunteer members, so they have a natural regard for their members, who are also the shareholders. Most limit membership on several bases, including where you work, live, or worship and some include members of specified organizations.

When you become a member of a credit union, you generally have better odds of getting approved for a loan or an unsecured credit card. If your card application is initially turned down, you may be more likely to have your application reconsidered.

Even if you don’t qualify for an unsecured card, many credit unions offer secured credit cards and report your payments to the three credit bureaus, thereby allowing you to build your credit. Though credit unions have many positive attributes, there are a few issues to consider when you apply to them for a credit card:

- Credit limits: Smaller credit unions may offer lower credit limits than those available from big banks. This may apply to both secured and unsecured credit cards.

- Cross-collateralization: This may apply if you have both a credit card and one or more loans from your credit union. Say, for example, that you have an auto loan and a credit card, both in arrears. The credit union may repo the car and refuse to return the title until you become current again on your auto loan and your credit card payments.

- Fewer perks: Most credit unions are rather modest in size, especially compared to large banks like Chase and Citi. It’s therefore not surprising that they probably can’t afford to offer all the amazing credit card perks you can get on some big bank credit cards. For example, a credit union credit card may be more likely to provide a decent rewards program than a generous signup offer.

If you are eligible to join a credit union, you will probably have paid a very modest one-time membership fee and/or opened a checking or savings account. Some credit unions allow you to first apply for a credit card before joining.

The whole name of the game when it comes to secured credit cards is that they are easy to obtain. After all, you are guaranteeing payment by depositing cash collateral, so card issuers don’t have to worry about delinquent payments — they simply take the money from your refundable security deposit (and quite possibly close your credit card account).

Therefore, you would think that issuers wouldn’t bother with credit checks when you apply for a secured credit card. Well, that’s not exactly true — card issuers tend to be a conservative (if not timid) lot who leave little to chance.

Nonetheless, several issuers skip the credit check (at least, the hard inquiry) when they receive your application for a secured card, and others may perform the check but ignore your credit score.

To be fair, an issuer has several solid reasons to check your credit when you apply for a secured card. The first is to determine how much credit it is willing to approve, which then governs the size of your refundable security deposit.

For example, a credit card company offering initial credit lines from $300 to $2,000 may hug the lower limit if your credit history includes very negative items like bankruptcies, liens, and fraud convictions.

Before you take offense at such considerations, remember that limiting your initial credit line protects you as well as the issuer. A higher credit line may lead to overspending and all the bad things that follow. It’s probably better for all concerned to set a credit limit amount you can reasonably afford.

Another reason for an issuer pulling your credit report when you apply for a secured credit card is based on the Know Your Customer (KYC) banking regulations. Credit reports are an excellent way for a card issuer to confirm your identity.

Card issuers Open Sky, First Progress, and the State Department Federal Credit Union are known to skip credit checks on their secured cards. Credit checks may also be skipped when you apply for a secured card from an issuer with whom you already have a (good) relationship. In addition, if you are already a member of a credit union, you may not be subjected to a credit check on your secured card application.

Almost as good as no credit check is no minimum credit score, and that’s the case for secured credit cards issued by Capital One, Discover, and First Progress. For those of you with no credit history, Capital One, Discover, and U.S. Bank will be happy to issue you a secured card anyway. And for businesses shy about credit checks, Wells Fargo, BBVA, and MidFirst Bank are waiting to receive your secured card application.

A few secured credit cards offer balance transfers. For example, the Capital One Secured Mastercard® allows you to transfer balances at the same APR as that used for purchases and without a transfer fee. The Discover it® Secured card also offers balance transfers.

What you are unlikely to encounter are any secured credit cards offering a 0% introductory APR on balance transfers.

The OpenSky® Secured Visa® Credit Card allows balance transfers as a form of cash advance, an unusual arrangement for a Visa credit card.

In addition, check with your local credit unions and community banks — they may offer a secured credit card with a balance transfer offer. This is true, for example, of secured cards issued by BrightStar and Provident credit unions as well as the OneUnited Bank.

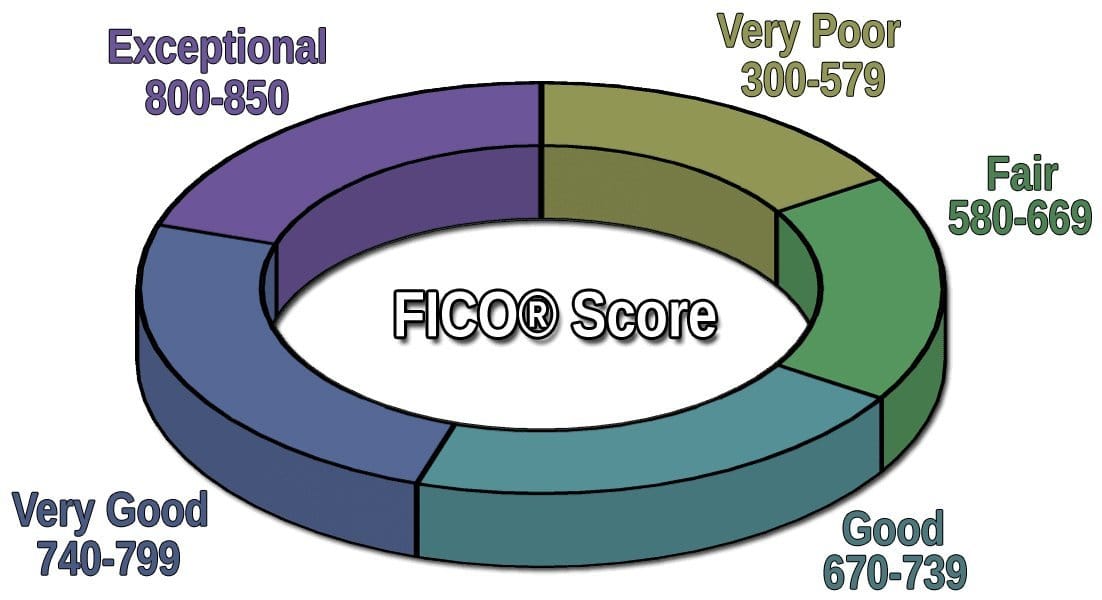

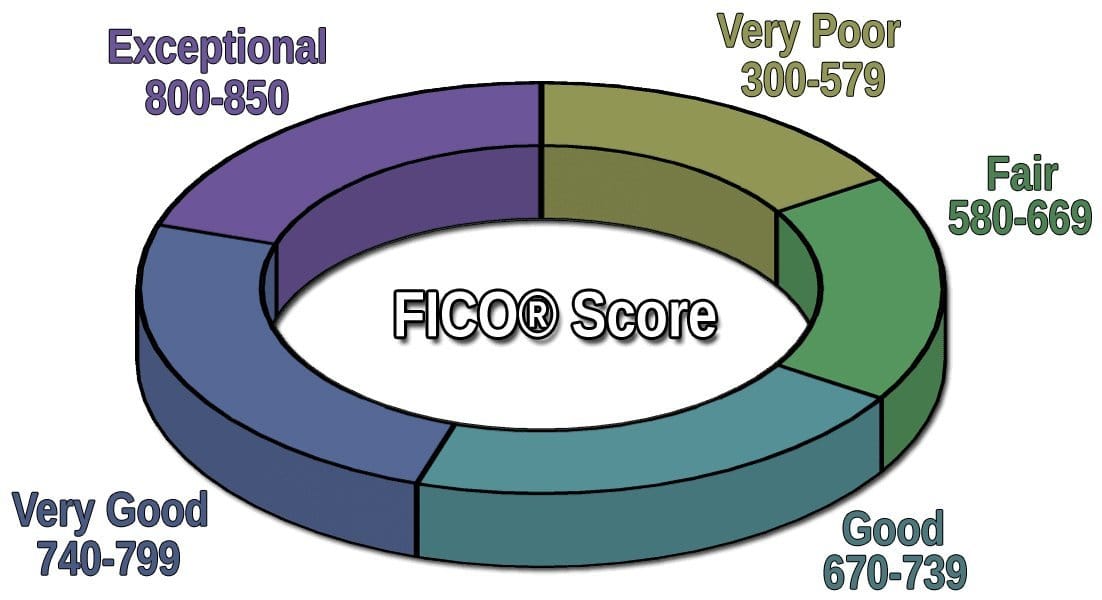

A fair credit score is generally considered to lie in the 580 to 670 range. Truth be told, you shouldn’t need to resort to a secured card if you have fair credit — secured cards are really designed for consumers with bad credit.

However, if your credit score hovers around 600, you may prefer the features of a good secured card to those of the unsecured cards you may be eligible for, considering you are on the dividing line between fair and bad credit. If that’s your situation, any of the better secured cards mentioned in this article would be suitable choices.

Another reason why consumers with fair credit may hold a secured card is because they got the card when their credit score was bad, but their praiseworthy financial habits — such as timely payments — have lifted their score into the fair range.

You can continue to use the secured card, but it’s a better idea to trade it in for a regular credit card so you can receive a refund of your security deposit.

Much depends on why you were denied a secured card, which can be due to external circumstances beyond your credit score:

- Required account: The issuer may require that you have a valid checking account in your name to get a credit card. That should be easy enough to fix, and you’ll find that most banks and credit unions offer some form of free checking.

- Citizenship: You may be required to be a U.S. citizen or resident. You may be able to get around this restriction by marrying a U.S. citizen, but that’s a pretty heavy undertaking just to get a credit card.

- Income: It’s illegal for an issuer to approve a credit card for applicants who lack sufficient income to cover their monthly payment, based on the minimum credit line It may help to increase your wages or perhaps work a second gig to pass the income test.

- Bad karma: Financial institutions have long memories and keep complete records that may go back way longer than do your credit reports. If you’ve had troubles with the institution, such as written-off accounts, collections, and so forth, you may be unlikely to receive favorable treatment in the here and now. Though unfortunate, you are free to apply elsewhere.

- Bankruptcy filing: Your chances of getting a credit card when you are in the midst of a bankruptcy filing are slim, since granting you credit may entangle the issuer in your court proceedings. Try again after the bankruptcy is completed.

- They’re just not that into you: Even if you pass all the other tests, the issuer may feel that you will not generate enough income or profit for it to be worthwhile. In this case, the cost of acquiring you as a cardmember may outweigh your value as a customer.

If an issuer turns down your credit card application, it must send you an adverse action notice giving up to five reasons for its decision.

Life teaches us that there are always possibilities, and when you’ve been turned down for a secured credit card, consider becoming an authorized user on someone else’s card or enlisting a cosigner to get your foot in the door, as we discussed above.

Another option is to open a credit builder account at your bank or credit union.

In this setup, you borrow a modest amount that is placed in a locked account maintained by the issuer. You then repay the loan in monthly installments — the issuer will report each monthly payment to the three credit bureaus, allowing you to build your credit. After repaying the loan, your money is returned to you and you’ll be well-positioned for getting a credit card.

Of course, it never hurts to improve your credit score when you’re looking to acquire a credit card. As we often point out, you can lift your score by paying your bills on time, reducing your credit utilization ratio (i.e., your total credit used divided by total credit available) below 30%, keeping each old credit card account open, not applying for new credit but once or twice per year, and fixing up your credit reports to remove inaccurate information.

As your score approaches 700, your chances of approval greatly improve.