While the harsh reality is that bankruptcy is the lowest point your finances can reach, it can also be the light at the end of the tunnel. Clearing your unpaid debts through a bankruptcy discharge is like pushing the hard “reset” button on your finances.

Whether due to an unforeseen circumstance, such as a job loss, a medical emergency, or even serious overspending, choosing to file is choosing to start over.

Thankfully, some credit card issuers understand that you want to work hard to rebuild your poor credit after the tough decision to file bankruptcy, and being approved for a credit card may be easier than you think.

Here we’ll answer four common questions about getting a credit card after bankruptcy.

In America, very few commercial markets go unserved. And so it is for the credit card market serving consumers who have undergone and completed bankruptcy proceedings, the ultimate in debt management. The credit cards serving this constituency have a mission: to provide credit to those who’ve undergone the severest of financial traumas while providing them a means to begin rehabilitating their credit.

To fulfill this mission, cards for consumers who have a previous bankruptcy in their credit history must accommodate low credit scores. That’s not hard for secured credit cards, as they are secured debt collateralized by a cardholder’s cash deposit, usually in an amount equal to the card’s credit limit (typically in the $200 to $5,000 range).

The landscape is riskier for issuers of unsecured bankruptcy credit cards, as these cards have no protective collateral. The issuers go out on a limb by providing an admittedly tight credit limit to folks who have already defaulted on unsecured debt.

To help reduce the risk in this endeavor, issuers of an unsecured credit card charge high interest rates and plenty of fees, while reducing perks to a minimum. This posture, combined with low credit limits, permits bankruptcy survivors to re-enter the credit market and start rehabilitating their credit scores.

This type of credit card may not offer some services, such as a cash advance or debt consolidation through balance transfer. Even if cash advance or debt consolidation balance transfers are available, the amounts may be extremely limited.

You’ll have to wait until the bankruptcy proceedings are complete before applying for a credit card. Issuers will not involve themselves in your credit until then, lest they get drawn into the bankruptcy proceedings themselves.

But once the bankruptcy court acknowledges the debt is discharged according to state bankruptcy law, the credit cards featured in this article will be happy to help you climb out of the credit crypt. Simply click on any of the card links to be transferred to the card’s landing page.

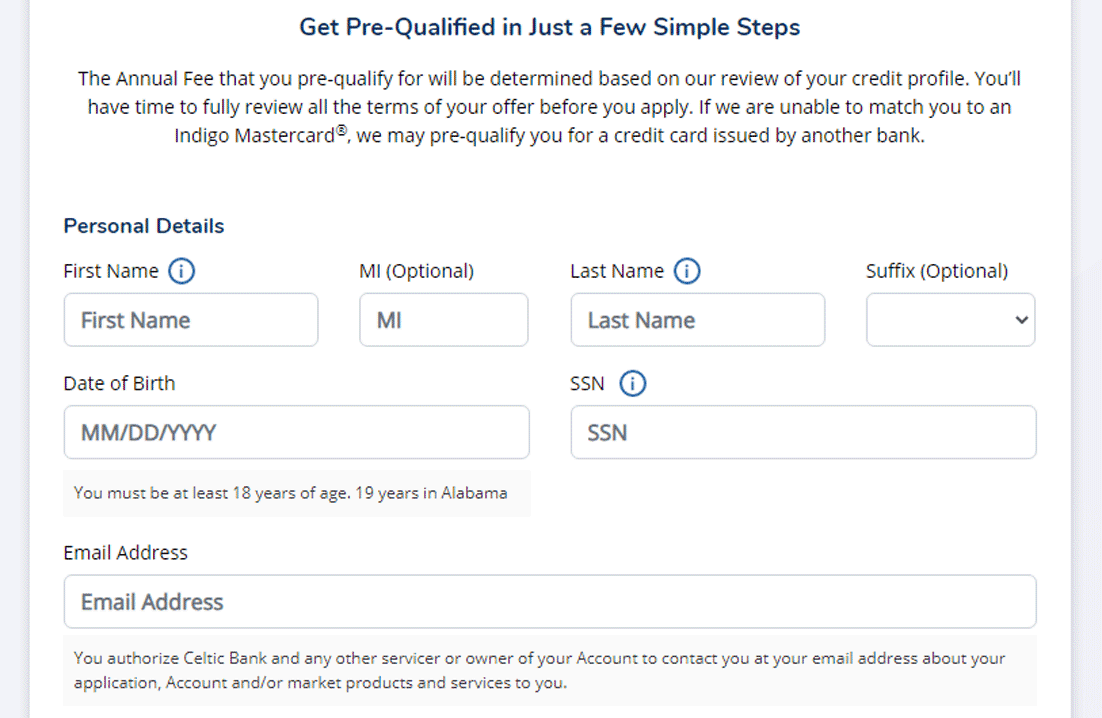

The first step is to fill in the online prequalification form with basic information, including your Social Security number and monthly income. You’ll receive an instant decision without suffering a hard pull of your credit reports.

If you successfully complete the prequalification step, you can finish filling out the application form and submitting it. Prequalification doesn’t necessarily mean that you’ll be approved, but it saves you a hard pull if you are disqualified.

Filling out a prequalification form will help you see your approval odds before you officially apply for the card.

Before you sign the credit card agreement, take the time to read and understand the rates and terms disclosure, starting with the Schumer Box. The Box contains information about the interest rate, fees, grace period, and more in a standard format imposed upon all credit cards.

You’ll also want to read the dreaded fine print. It’s best not to assume you know everything it says — surprises may hide there that may inconvenience you later. Expect your card to arrive in seven to 10 days after your final acceptance.

After filing for bankruptcy and going through all the motions of credit counseling and court judgments, your discharge will come through typically within a couple of months. After you receive your discharge and your debts are free and clear, it’s time to begin rebuilding your credit.

Though there are no specific guidelines as to when one should begin, about half of bankruptcy filers apply and are approved for new lines of credit within one year of filing, so it is safe to assume many apply — and are approved for — a new line of credit fairly quickly.

It’s more about when you feel ready to take on the responsibility of credit card ownership again and finding the right card to help you rebuild your credit.

A credit card is a great way to begin rebuilding credit. Just be sure to choose a card that reports to all three credit bureaus — Experian, Equifax, TransUnion — so there’s a record of your credit card usage and payments on file, also known as your credit report.

While most credit cards report to the major bureaus, some, including prepaid cards, do not so be sure to read the terms and conditions before applying.

To use the card as a tool to rebuild credit, you must follow a few rules:

- Always pay your bill on time. On-time payments account for 35% of your FICO credit score.

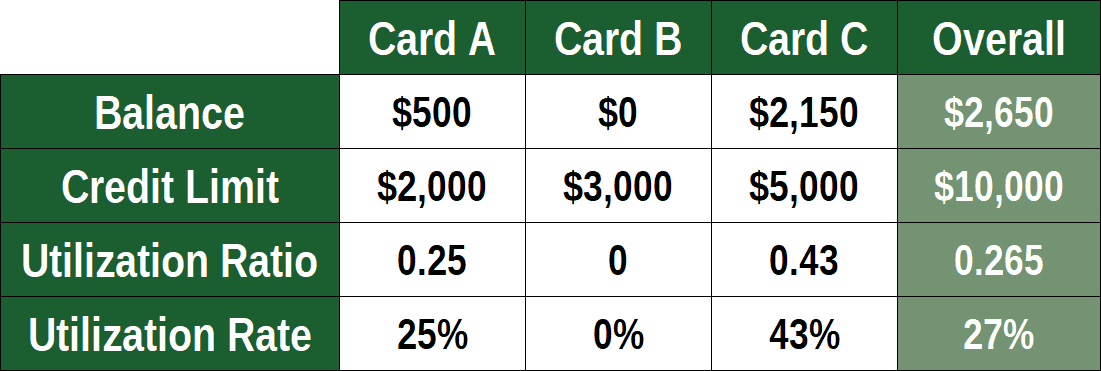

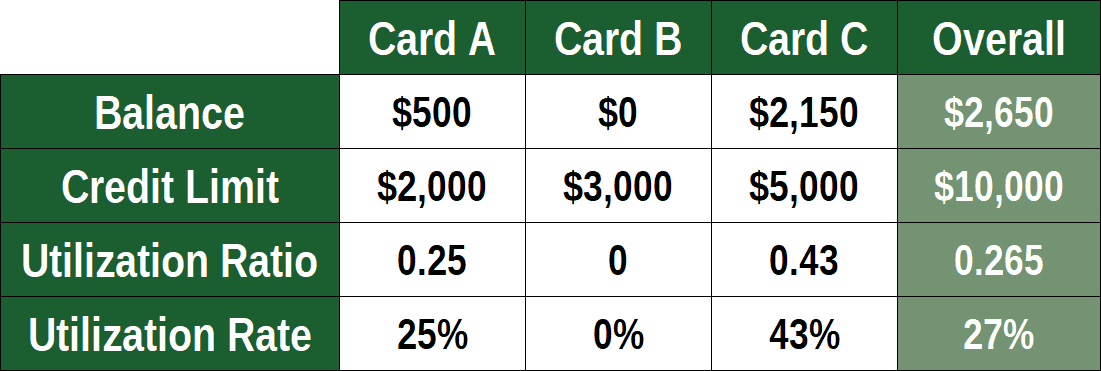

- Keep your credit utilization ratio low. Most experts recommend 30% or lower. This is your debt-to-credit ratio. So, for example, if you have a credit limit of $1,000, never keep a balance of more than $300 unless you intend to pay the balance in full at the end of the month. Your credit utilization accounts for 30% of your FICO credit score.

- Be sure to use the card — just applying for the card and having the open line of credit available is helpful, but if you’re not using the card, you’re not creating a positive payment history. Again, your payment history is the most important factor when calculating your credit score.

Furthermore, the card issuer can close the account for non-use. Your average age of accounts represents 10% of your FICO credit score — the longer an account is kept in good standing, the better.

Maintaining on-time payments and keeping a low balance on your new credit card are two proven ways to help you rebuild your credit.

Not necessarily. While taking out a new credit account may improve your credit, accumulating a lot of debt on the card is not a good idea.

This is true for everyone, not just bankruptcy filers. This ties back to the credit utilization ratio mentioned earlier.

If your utilization rate is kept at a healthy level, such as the recommended 30% or lower, lenders won’t consider you to have unmanageable amounts of debt. It’s when your utilization rate shows that you have more debt than available credit that your credit score begins to see negative impacts.

Example of credit utilization across three different cards.

Using a credit card responsibly really is as easy as paying your bill on time and keeping your credit card balance low. It’s even better if you can pay it off each month, but a little credit card debt will not hurt your credit, so long as it’s manageable.

Many credit cards can prequalify you and render an immediate decision. But no credit card can guarantee final approval, whether after bankruptcy or at any other time.

The best you can do is to seek out cards that market themselves to consumers with bad credit and to those who have been discharged from bankruptcy according to bankruptcy law administered by the state bankruptcy court. Secured debt in the form of credit cards is consumer debt that fits naturally into this group and comes as close as possible to guaranteeing acceptance, assuming you pony up the required security deposit.

Some consumers don’t like the idea of depositing a couple of hundred dollars to get a credit card. But consider this — secured cards are much easier to obtain, usually have lower interest rates and fees, and can be upgraded over time as you raise your bad credit score.

While it’s no secret that we endorse secured cards for those just emerging from bankruptcy, you may prefer to turn to any of the several unsecured cards that we recommend.

As you ponder whether to go secured or unsecured, consider the initial amount you’ll be shelling out. For example, one unsecured credit card requires an $89 application fee and a $75 annual fee. That’s $164 you won’t be seeing again.

Compare that to a secured card requiring a refundable $200 deposit but no other fees. While that’s an immediate extra cash outflow of $36, you eventually get it all back. In the long run, the secured card is much cheaper.

Here’s another scenario favoring secured credit cards. Imagine you have a $200 balance but simply can’t afford to pay even the minimum payment of, say, $40. With an unsecured card, your missed credit card payment will be reported to each credit bureau after 30 days, and the credit card company will probably close your account or send it to a debt collector within 90 days.

If instead the card was secured and you couldn’t afford the minimum payment, you could arrange to forfeit your $200 deposit and close your account without creating any negative items on your credit reports or triggering a debt collector. This would prevent the significant credit score drop you’d experience in the unsecured card scenario.

You can start rebuilding credit as soon as your bankruptcy is discharged. Any of the recommended credit cards will consider your application, and a secured card will provide you the best odds for acceptance following a debt relief action.

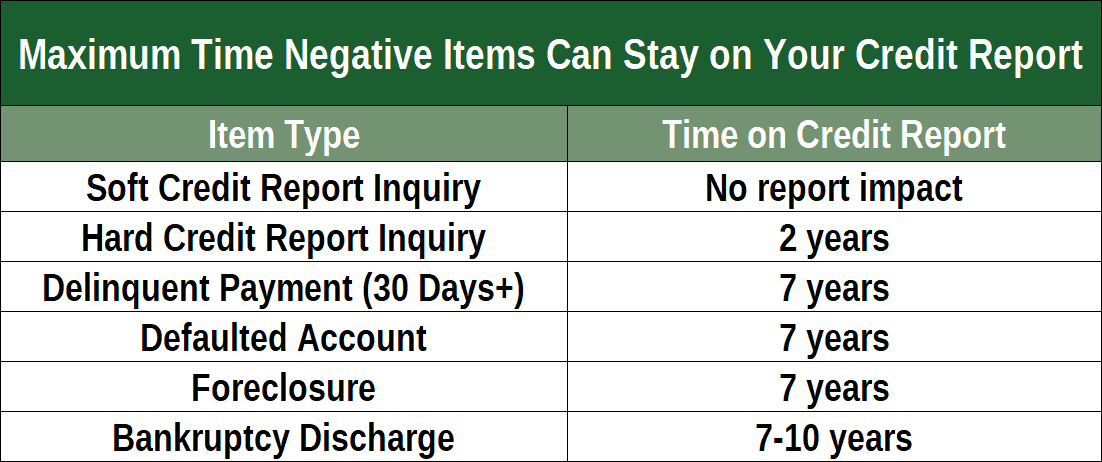

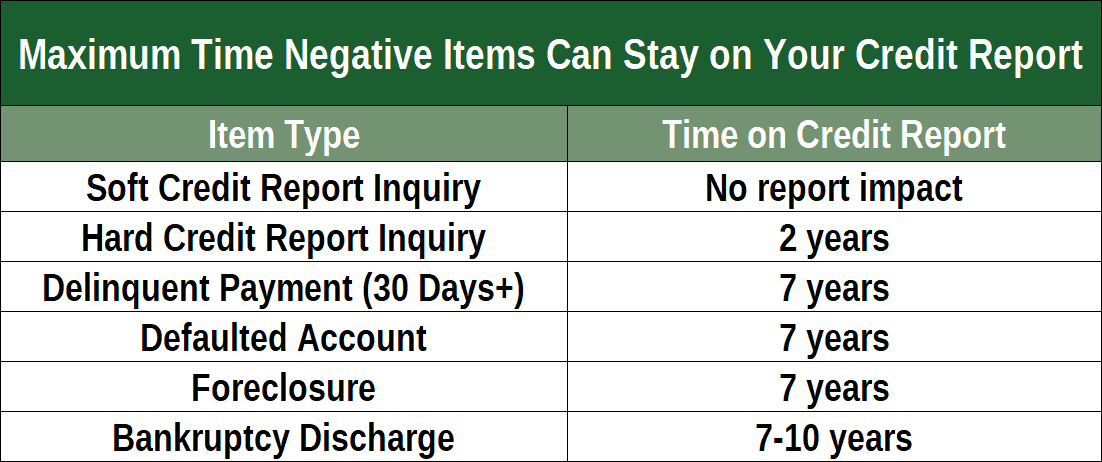

A bankruptcy or other debt relief will drop your score by perhaps hundreds of points. Although the bankruptcy will remain on your credit history reports for seven to 10 years, be aware that the impact begins to wear off two to three years after the event. So even if you did nothing else, you would see a slow recovery in your credit score.

Your new card will report your credit card payment activity to the three major credit bureaus. This is your opportunity to prove that you are serious about improving your credit profile. By always paying your credit card bill on time and minimizing your card balance, you should see your credit score begin to rise in 6 to 12 months.

Another route toward rebuilding your credit is to use a credit builder account. This kind of account is available from community banks, credit unions, and some online banks (such as Self, Republic Bank, and Fig Loans).

The idea behind credit builder accounts is to repay a secured loan while reporting your activity to each credit bureau. Here’s how a credit builder account works:

- If you already have an account at a credit union or bank, check to see if they offer credit builder loans. If you don’t have an account, open one at an institution offering this type of account.

- Sign up for a credit builder account and agree on the size of the loan.

- After approval, your loan proceeds will be placed in a locked savings account or certificate of deposit controlled by the creditor.

- As the debtor, begin repaying the loan in monthly installments. Make sure each payment is made on time, as you should for all consumer debt.

- Your monthly payments will be reported to the three major credit bureaus (Experian, Equifax, and TransUnion).

- Continue making monthly payments until the loan is fully repaid.

- Upon completion, the money in your savings account will be released to you. The only cost for the credit builder account is the interest a debtor pays on the loan minus any interest earned in the savings account. A creditor may return all the loan interest charged.

What do you do with your sudden windfall when your savings is returned to you? You may deposit some or all of the money into a secured credit card account. This will further build your credit score and also provide you with a decent initial credit limit.

For example, suppose the credit builder loan was for $2,400 and you repaid it over 12 monthly installments of $200 (plus interest). After the year is up and you receive the $2,400, you may select a secured credit card and deposit $1,000, a common maximum initial credit limit. You can then use the remaining $1,400 to establish or augment your emergency savings account, something everyone should have.

Our top pick in the secured card category is the First Progress Platinum Prestige Mastercard® Secured Credit Card. It requires neither a credit check nor a minimum credit score. In addition, it offers relatively high credit limits and a low interest rate.

Among the unsecured credit cards, the Total Visa® Card is a good choice, as the application process takes less than 10 minutes. But even as the top-ranked card in this category, it still is expensive in terms of APR and fees.

Another good choice is the Credit One Bank® Platinum Visa® for Rebuilding Credit. You can prequalify in less than a minute and receive final approval in less than 10. The annual fee may be waived, and it is one of the few cards in this category to offer cash back rewards.

They say time heals all wounds. Apparently, Amex will require at least 61 months to heal from your bankruptcy filing, according to forum reports. That’s how long it reportedly took for Amex to approve several bankruptcy survivors.

Amex’s behavior regarding post-bankruptcy may turn upon a few questions:

- Was Amex involved in your bankruptcy filing? We would think that Amex may be less forgiving if it was an unsecured creditor in your bankruptcy proceedings. One consumer reports acceptance after five years when Amex was not involved in the bankruptcy.

- Which Chapter did your bankruptcy petition reference? Declaring bankruptcy under Chapter 7 discharges your previous unsecured debt and remains on your credit reports for 10 years, while a Chapter 13 bankruptcy petition (which remains for seven years after discharge) has you pay back at least some of your old debts. We imagine Amex would be more forgiving had you survived Chapter 13 bankruptcy rather than Chapter 7, since you’ll have demonstrated your willingness to work things out.

- Slip through the cracks? While the consensus post-bankruptcy waiting period is five years, we have seen a report in which a consumer was approved after 1.5 years. We think that such a short recovery period after debt settlement may be a fluke, perhaps due to a clever bankruptcy attorney.

- Can you sneak back in as an authorized user? Reports indicate that Amex has shut down this back door after declaring bankruptcy.

- Does it help to repay Amex for a discharged debt? This definitely signals your repentance and may help your case for reinstatement. You may want to reimburse every unsecured creditor.

Of course, once the bankruptcy ages off your credit history report, Amex won’t know about it unless the credit card company was part of your debt settlement case. If Amex lost money because of your debt management or bankruptcy case, the prospects for eventually letting you back in seems less promising, even if you hire a clever bankruptcy attorney.

One interesting anecdote appeared in the online forums. Someone who went bankrupt in 2011 was re-approved for an Amex card in 2017. When the card arrived, it read “Member Since 1978”, which may have been when the account was first opened. Policy or blunder? You decide.

During periods when bankruptcy prevents you from getting a credit card, consider using a prepaid debit card that is backed by cash.