Earning solid credit reports and credit scores is a smart move for your long-term financial health. Good credit can save you money in many ways, including lower interest rates, better insurance premiums, and deposit waivers on apartments and utilities.

And, in some scenarios, a solid credit report may even be the difference between getting a job, or not.

Unfortunately, bad luck or bad decisions can set you back where credit is concerned. If you’ve gone through hard times or you’ve made financial mistakes in the past, rebuilding your credit may feel impossible.

There is, however, some good news. No matter what shape your credit is in today, you can work to improve your situation. Following these five steps is a great place to start.

1. Pay on Time, Every Time, All the Time

You didn’t need to read an article representing the importance of paying your bills on time. You, and most everyone else, knows the first key to rebuilding your credit is to make sure all payments from this day forward are made on time.

If you want to give your credit scores a chance to improve, you must break the late payment habit, forever.

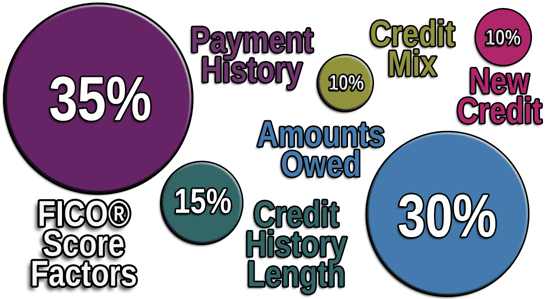

What you may not know is the mathematical value of your payment history. It’s the number one factor that influences your credit scores. The presence or lack of negative information accounts for roughly one-third of the points in your FICO and VantageScore credit scores.

If you want a chance to rebuild better credit, it’s critical to avoid the following:

- Late Payments

- Collection Accounts

- Repossessions

- Foreclosures

- Bankruptcies

While making your payments on time won’t erase past mistakes from your credit reports, time is on your side. As derogatory credit information grows older, it will impact your scores less.

Eventually, after seven to 10 years, negative items are removed from your credit reports as a matter of law.

2. Pay Down or Pay Off Your Credit Card Debt

First things first, there’s absolutely nothing wrong with credit cards. They have iron-clad fraud protections, fantastic rewards programs, portable capacity, and interest is entirely optional.

Having said that, how you manage your cards has a significant influence over your credit scores.

Roughly one-third of the points in your FICO and VantageScore credit scores are influenced by how well you manage your debt. And, a large portion of those points is derived by how well you manage your credit cards and your credit card utilization rate, also known as your balance-to-credit limit ratios.

When your credit reports indicate a low balance-to-income ratio on your credit cards, your scores will generally benefit. Yet, if you utilize a large portion of your credit limits, your scores will likely decline.

The most effective way of gaining back these points is to pay down your existing credit card balances.

Pro Tip: Don’t misread this as a suggestion that you close your credit cards once you’ve paid off your debt, however. Closing your cards may cause your debt ratios to increase, which can hurt your scores. Remember, as long as you use credit cards responsibly, they can be powerful allies in your quest to rebuild credit.

3. Establish New Credit

Getting approved for a new credit card can be difficult when you’ve had past credit problems. Yet, with the right approach, you may be able to establish new accounts even with less-than-stellar credit history.

- Secured Credit Cards: A secured credit card has the potential to help you rebuild a positive credit history. Because you put down a security deposit to open the account, card issuers are more willing to approve your application with poor credit scores.

- Credit Builder Loans: With a credit builder loan, the lender doesn’t let you access the money you’ve borrowed right away. Instead, the funds are held in an interest accruing savings account until you make your final loan payment (usually six to 12 months later). In the meantime, you’ll have an installment loan with a positive payment history reported to the credit bureaus.

Pro Tip: Be sure the lender reports to all three credit bureaus before you apply for a new secured card or credit builder loan. It’s also critical to manage new accounts well; paying on time, and, in the case of a credit card, paying in full each month.

4. Become an Authorized User

Do you have a family member who already has a credit card account? If so, your loved one may be willing to do you a favor and add you to the account as an authorized user.

To add you as an authorized user, the primary cardholder will need to give their credit card issuer a call and add you to their account. Once you’re added to the account, a card in your name will be mailed to the primary account holder, usually within a week or two.

Many credit card issuers report the card’s account history to the credit bureaus for both the primary cardholder and authorized user. So, there’s a good chance the account will show up on your three credit reports with Equifax, TransUnion, and Experian.

Assuming the account is managed well (i.e., it’s paid on time and the balance is low), your credit scores could benefit when it shows up on your credit reports. If the account is older, your length of credit history may increase, and potentially trigger an additional credit score boost.

5. Check Your Credit Reports Often

It’s always smart to monitor your three credit reports with Equifax, TransUnion, and Experian. But if you’re trying to rebuild your credit, checking your credit reports is essential. Otherwise, you won’t know from what point you’re starting in your rebuilding endeavors.

Thanks to the Fair Credit Reporting Act (FCRA), you can claim a free copy of all three of your credit reports once every 12 months. Visit AnnualCreditReport.com to access your free reports. You won’t need a credit card because it’s free.

Once you have your reports, look through them carefully for mistakes. Credit reporting errors, if any, could be harming your credit scores. Thankfully, the FCRA is here to help if you do find errors.

You have the right to dispute errors with all three credit bureaus, and they must investigate your claim, at no cost to you.

It’s Never too Late to Rebuild Your Credit

There’s no such thing as a magic wand or silver bullet when it comes to credit improvement. However, you shouldn’t believe the naysayers either. It’s never too late to work toward improving your credit scores.

Thanks to the FCRA, most negative information must eventually be removed. If you work hard to build better credit management habits now and avoid new problems, your efforts could pay off tremendously in the future.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.