When consumers have seriously delinquent debts (i.e., more than 90 days late), they may find themselves in the clutches of a collection agency. Despite federal and state laws limiting the brutality of collection tactics, being in collections is no picnic. Furthermore, it will savage your credit score and remain on your credit report for up to seven years.

The best thing you can do is to resolve a collection as quickly and favorably as possible. To that end, we review here three loans to pay off collections. Read on to learn more about your options when the bill collector comes calling.

Home Equity | Personal Loans | Retirement Loans | FAQs

1. Tap into Your Home’s Equity to Pay Off Collections

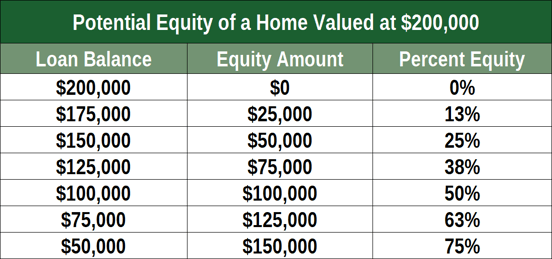

If you own a home, you may be able to tap into some of its value to pay off a debt in collection. The amount available to you depends on the amount of equity you have in your home, which is the current appraised value minus the mortgage balance.

Your equity represents your ownership in your home. You can use that ownership as collateral for a home equity loan. Typically, lenders will let you borrow up to 90% of your home equity.

For example, if your home is currently valued at $400,000 and your mortgage balance is $300,000, you may be able to borrow as much as (90% x ($400,000 – $300,000)), or $90,000. Below are some recommended providers of home equity loans:

LendingTree

This offer is currently not available.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

- Easy to OwnSM programs give options for those with lower income, limited credit history, and low down payment needs.

- Provides the potential for minimal out-of-pocket expenses with seller contributions.

- Offers loans that don't require monthly mortgage insurance.

- Requires less cash upfront for your down payment and closing costs.

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1852 | 6 Minutes | 8.0/10 |

- Loan programs include down payment and closing cost assistance.

- Variable and Fixed-Rate loans available with flexible qualification guidelines.

- Up to 100% financing—with as little as zero down payment for qualified borrowers.

- No maximum income/earning limitations.

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2008 | 5 Minutes | 7.0/10 |

A home equity loan is really a second mortgage. As such, if you fail to repay it, the lender can foreclose on your home and sell it to recover its money. Accordingly, you should seriously consider your ability to make monthly first- and second-mortgage payments before applying for a home equity loan.

You can use the proceeds of a home equity loan as you see fit, including paying off collections and pre-collection debts. A home equity loan is distributed as a lump-sum. By applying the proceeds to your debts in collection, you can repay some or all your debts at once, subject to how the loan amount compares to the debt size.

Alternatively, a home equity line of credit (HELOC) is a revolving credit line that lets you draw funds as you need them. This may come in handy if you work out a payment plan with your creditor. That is, you could draw amounts equal to the payment plan’s monthly installments, and then repay the HELOC at a more leisurely pace.

When comparing home equity loans, make sure you consider the loan’s APR, whether it has a fixed or variable rate, the repayment terms, and the closing costs.

2. Take Out a Personal Loan to Pay Off Collections

It may seem unlikely that lenders will give a personal loan to folks in collection. In truth, many won’t. However, we have found three personal loan services specifically attuned to the needs of consumers with poor credit.

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 4 minutes |

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

These are indirect loan services that work with networks of lenders. They do not offer loans directly, but rather put you in touch with one or more lenders willing to evaluate your loan application.

The process starts when you visit their websites and fill out a brief loan request form. The design of these loans transcends credit scores by evaluating your ability to repay. That’s why you’ll be asked to give some details about your monthly income and expenses. Other factors include any benefits you receive and your employment status.

The matching service then decides which lender on its network is your best bet and transfers you to that lender’s website. The lender will then collect whatever additional information it needs and quickly give you a decision, often in minutes.

If the lender approves your application, they’ll make you an offer that specifies the loan amount, APR, monthly payments, length of the repayment period, fees, and more.

In this context, you use your personal loan to help resolve your existing collections and perhaps other debts. In this regard, you can consider it a consolidation loan. You repay the personal loan in fixed monthly installments consisting of interest and principal.

It’s quite possible that the loan amount might not be enough to repay the entire debt in collection. However, it may be sufficient to bring you current with the debt.

Alternatively, you may be able to negotiate a settlement for less than you owe. Collection agencies and creditors will often show flexibility if you impress them with your serious intent to make things right.

3. Borrow from a Retirement Plan to Pay Off Collections

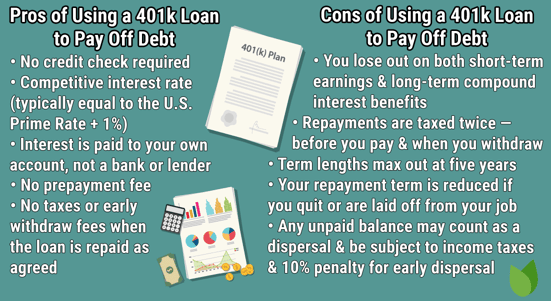

Many employees are fortunate to have an employer-based retirement plan such as a 401(k) or 403(b). Many employers allow you to borrow from your retirement plan, but you must adhere to the governing federal regulations.

The amount you can borrow depends on your account balance:

- The maximum amount you can borrow is capped at $50,000.

- If your balance is greater than $20,000, you can borrow up to half your balance, subject to the cap.

- For balances of up to $20,000, you can borrow the lesser of your balance and $10,000.

Because this is a loan, it does not add to your taxable income. However, if you don’t repay it within the prescribed period (typically, five years), the unpaid balance will be treated as a taxable distribution that may also be subject to an early withdrawal penalty.

You have to pay interest on your 401(k) loan. Typically, the interest rate is set at one to two percentage points above the prime rate. Happily, that interest, minus any fees your plan charges, goes back into your account.

Remember, you will be using post-tax dollars to repay the 401(k) loan, which consists of pre-tax dollars. At first, this may seem like a negative.

But consider that you’d repay any other type of loan with post-tax dollars, so the playing field is level. Plus, unlike most loans, you pocket the interest.

What you do lose is tax-free growth on the loan proceeds until repaid. All things being equal, this will reduce the ultimate value of your retirement plan, but the damage will be less than it would be from a taxable distribution.

Can You Get a Loan to Pay Off Collections?

As we see from the loan sources in this review, you may indeed be able to get a loan to pay off collections. The easiest route is to tap into home equity if you have any. Because a home equity loan is collateralized by your home, lenders are more willing to extend them.

You can increase your chances of approval by requesting less than the maximum amount (typically, 75% to 90% of your equity) available to you. You also may find it easier to obtain a home equity loan if you indicate you’ll use it to consolidate your existing debt.

Home equity loans are easily attainable if you have equity in your home because the loan is secured by your home. That is, your home may be foreclosed on if you default on your payments.

The personal loan services in this review, although geared toward poor credit borrowers, may not offer you enough funds to repay your collection debt. These personal loans are unsecured, so you should expect the lenders to be more risk-averse than mortgage providers.

Employer retirement plan loans are very attractive, but they require that you have a plan and that your employer allows loans. If you take this route, be sure you can repay the loan within the five-year time limit. Otherwise, you’ll have to contend with unpleasant consequences.

Other loan sources include cash-out auto refinance loans and credit card cash advances. If you refinance your car for more than your current auto loan balance, you can use the extra cash to pay your other debt. However, if you default on the auto loan, you’ll likely lose your car.

Credit card advances are an expensive way to pay off a collection. First, you must own one or more credit cards that offer cash advances. Second, a cash advance is usually expensive, with APRs in the 20% to 30% range, sometimes higher. Third, you rack up interest starting from the date of the cash advance — there is no grace period as there is for purchases.

If you use cash advances from multiple credit cards to repay a debt in collection, you may consider consolidating your credit card balances via balance transfers. If you have or get a new card, it may offer an introductory 0% APR for balance transfers that will save you some interest expense, although you’ll have to pay a transfer fee, typically 3%.

Can Paying Off Collections Raise Your Credit Score?

Typically, paying off a collection will not raise your credit score. On the other hand, having a collection marked “repaid” might grease the gears when you next apply for a loan. And, if you can get the agency to expunge the collection, you’ll remove a score-destroying derogatory that should result in an immediate boost to your score.

The three credit bureaus (Experian, TransUnion, and Equifax) keep collections on your credit report for seven years. However, the negative score impact of a collection evaporates in a few years. In other words, after two or three years, your credit score will begin to recover from the havoc wreaked by a collection.

Getting a collection removed from your credit report requires some negotiating. You can start by dealing directly with the collection agency. The quid pro quo is this: You’ll pay some or all of the debt if the agency removes any mention of the debt. That includes the entry listing the creditor’s delinquent/defaulted account and the separate entry for the collection.

Three outcomes are possible:

- The collection agency agrees and has the power to remove both derogatory entries.

- The collection agency refers you to the creditor, who must agree to your offer.

- The collection agency refuses to remove the entries.

Naturally, the first outcome is ideal, especially if you can arrange to pay less than the full amount due. Make sure you get the agreement in writing before proceeding.

The second outcome depends on how well you can negotiate with the creditor. Frequently, it will attempt to accommodate your request in return for full or partial repayment.

If you can negotiate a settlement agreement with the collection agency or the creditor, verify that it will submit to the three major credit bureaus a Universal Data Form that deletes the derogatory entries. If the collection agency refuses to delete the entry on your credit report, at least get a written agreement that it will mark the debt “satisfied in full.” While this won’t help your credit score, it may melt the hard heart of a future lender.

Bear in mind that there might be tax consequences when you settle a debt for less than the full amount. The IRS may consider the amount of forgiven debt to be taxable income. Speak with your tax advisor for more information.

Can I Pay My Original Creditor Instead of a Collection Agency?

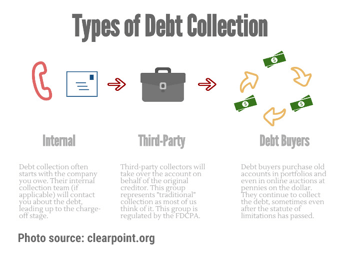

To know how to negotiate a settlement of a debt in collection, it’s important to understand the relationship between the creditor and the collection agency.

Sometimes, the creditor keeps the debt on its books and hires the collection agency to recover it. In this case, it makes sense to repay the original creditor, since it still owns the debt. But this depends on the creditor’s policies.

For example, you may be able to reach a quick settlement with the creditor by offering a lump sum to repay most of the loan.

However, if you instead offer to repay in installments, the creditor may insist you establish a repayment plan with the collection agency. Perhaps after a few months of payments, the creditor will re-establish your credit and/or remove the delinquent payment entry from your credit reports.

Frequently, the original creditor sells the debt to the collection agency in return for partial payment. In this case, you’ll have to negotiate with the collection agency — as far as the original creditor is concerned, you’re dead meat.

However, as outlined earlier, if you can arrange a settlement with the agency, you may be able to get the entries for the collection and the original default expunged.

Collections Happen to the Best of Us

We’ve reviewed three sources of personal loans geared to consumers with bad credit. You can use these loans to repay some or all of your debts, including ones in collection. We’ve also looked at home equity loans and 401(k) loans to help repay your accounts in collection.

Collections are bad news, but they can occur to the best of us under adverse circumstances. It can be good for your long-term finances, and certainly for your karma, to settle outstanding collections. Even if you can’t get the collection deleted from your credit history, having it marked “satisfied in full” can help you secure a future loan.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.