Paying an old bill that a collection agency has asked you to pay doesn’t mean it will soon be removed from your credit report. A paid collection could lower your credit score for years. The good news is that help is out there, and we’ve come up with a list of the best services for removing collections from a credit report.

Removing a collection account from your credit report — even if the account has been settled or paid — is a good idea because a collection account that has a zero balance can remain on a credit report for up to seven years from the date of the default, according to the Fair Credit Reporting Act, or FCRA.

Collections are an indication that you’ve previously defaulted on an account. They can lower a credit score, which is used with your credit history by future lenders to determine if you’re approved for a loan and how much you’ll be charged for financing.

Along with removing a collection account that you’ve paid, you may also want to remove a collection account if it’s incorrect or outdated. You can dispute the account with each credit bureau, and the FCRA requires them to investigate such claims.

Services | FAQs | Methodology

Top Credit Repair Services For Removing Collections

Credit repair services can help consumers remove false information from credit reports and thus improve their credit scores. Incorrect information can include late payments that aren’t yours, or paid collections that are older than the seven years they’re allowed by law to be on credit reports.

Here are our top choices for the best services for removing collections from a credit report:

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

Lexington Law is a credit repair app run by a law firm with attorneys and legal aides who work on your behalf to challenge negative items with the credit bureaus and your creditors. Its clients have seen an average removal of 10.2 items, or 24% of negative items, from their credit reports within four months.

The service costs $99.95 per month, and the average client continues the service for six months.

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

Sky Blue Credit Repair disputes 15 items — five items per credit bureau — every 35 days with customized disputes, re-disputes, and statute of limitation research on debt items. It also identifies untapped opportunities when reviewing credit reports to give customers practical advice on how to raise their credit scores.

Sky Blue Credit Repair offers a 90-day, 100% money-back guarantee on its $79 monthly plan.

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

CreditRepair.com offers customized tools through an online dashboard and mobile application that allow clients to track the status of their disputes and follow changes in their credit score.

It has helped customers get an average 40-point increase in their TransUnion credit score during the first four months of using its service.

FAQs About Removing Collections From a Credit Report

Collections can stay on credit reports for up to seven years from the date of default on the original account. So, if you have a bill that was 180 days past due, it could stay on your credit report for up to seven years after its six-month past due mark.

That’s seven and a half years after you got the original bill, and a long time for an old bill to be haunting your credit report. Here are some answers to common questions about removing collections from a credit report.

How Do I Get a Paid Collection Off My Credit Report?

Once an unpaid bill is turned over or sold to a collection agency, the collection account will typically appear on your credit reports fairly quickly. It may not appear on all of your credit reports, but it can remain on the reports where it does appear for up to seven years — even if you’ve paid it off.

To get a paid collection off your credit report early, you may have to hire an attorney or credit repair service to fight on your behalf.

However, since the collection has been paid off, it’s unlikely that you’ll be disputing the validity of the collection account or that the credit bureau is reporting inaccurate information.

If you believe the information the credit bureau has is wrong, then you can write a dispute letter to the three major credit bureaus challenging the accuracy of the information on your credit reports. For example, a collection that is more than seven years old but is still listed on your credit report should be resolved by filing a dispute with a credit bureau.

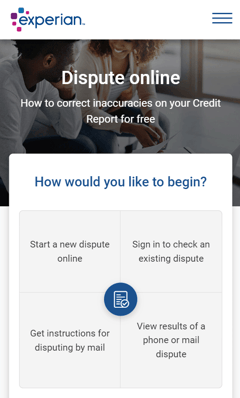

You can file online disputes with all three credit bureaus through their individual websites.

If the information is incorrect or the collection account can’t be verified, the credit bureau must remove it from your report. You’ll have to deal with each credit bureau separately to resolve each dispute.

If a paid collection on your credit reports is accurate, you can still get it removed early. One method is to ask the current creditor —the original creditor, such as the credit card provider or a debt collector — to make a “goodwill deletion.”

This is a letter you write to the collector explaining why you want this old debt removed. You may be applying for a mortgage loan, for example, and since you paid off the original collection, you’ve shown that you can pay off your debts and are asking for help in applying for a home loan.

The creditor may not extend you this courtesy, but it doesn’t hurt to ask. You’re not writing the letter to dispute an error, though pointing out an error that wasn’t your fault and wasn’t corrected may work in your favor.

If there was a technical error in processing your payment and you tried to pay your bill, or if this is just one mistake you made on your credit history, then a creditor may think it’s reasonable not to hold it against you.

The best chance of a goodwill letter to an original creditor being successful is if you have a great credit history and had only this one isolated error or a short series of late payments.

Can Collection Agencies Remove Items from My Credit Report?

Collection agencies can remove collection accounts from your credit report, but it may not work for a few reasons.

Called pay for delete, this practice is where debt collectors erase collections in exchange for payment of the account. You may have heard of this practice before and can initiate it by calling or writing the debt collector with a proposal to pay off the account if they remove it from your credit reports.

Credit reporting agencies don’t like this practice because it’s an attempt to remove accurate information from their reports. Also, creditors are obligated by law to report accurate and complete information when reporting to credit bureaus.

The credit bureaus ask collection agencies not to perform pay for deletes and sometimes ask them to sign agreements ensuring they won’t do this. If the collection agency violates such an agreement by not reporting an account it was paid to delete, it could lose the right to report information to credit bureaus and would likely be out of business.

Without this requirement by the credit bureaus to avoid pay for deletions, collection accounts would be removed all of the time from credit reports, and the reports wouldn’t accurately reflect someone’s creditworthiness. It’s like having a continuous mulligan in golf or being allowed to take a test again and again until you get it right.

Even if an account is deleted, it may not matter anyway because the latest credit scoring models — FICO 9 and VantageScore 4.0 — ignore collection accounts that are paid. The paid account will still be on your credit report, but it will hurt your credit score less than if it weren’t paid.

No matter what — if anything — a collection agency removes from a credit report, the original information reported by the original creditor that led to an account going to collections will still likely be on your credit report. Late payments that led to collections will still be reported by the original creditor.

How Long Does it Take For a Paid Collection to Come Off My Report?

Paying a collection account without getting it removed usually won’t improve your credit scores. As long as the collection account remains on the credit report, it will hurt your credit scores — though some recent credit scoring models don’t give it much weight, if any.

What makes a paid collection come off your credit report? Time. Lots of it.

It takes seven years for a paid collection or other negative information to fall off a credit report. It can run as long as seven and a half years because the clock can start running six months after you first fell behind with the original creditor. The debt collector may not report it until six months after the debt started.

Before those seven or so years transpire, a paid collection would have less of a negative impact on a credit score over time. If you’re building your credit with new and positive credit habits, such as paying your bills on time, that will have more of an impact on credit scores than old collections that were paid off.

The seven-year clock for debt collections starts from the date of the delinquency with the original creditor that caused the collection, not when the debt collector took over the account or collected the debt.

To keep track of those seven years, keep written evidence of the date of the delinquency, such as a bill from the original creditor. Many creditors will wait until the original bill is at least 120 days past due before hiring a collection agency or selling the account. Keep track of the first late day that your bill was due.

A collection agency may try to push back the start date, which would keep the debt on a credit report longer.

How Many Points Will My Score Increase When a Collection is Removed?

Your credit score is always a moving target. Positive and negative events may constantly be added or subtracted from it, though most likely, they’ll be added before being removed.

The latest scoring models, FICO 9 and VantageScore 4.0, mostly ignore paid collections. The accounts will still be on your credit report, but they won’t hurt a score as much as not paying the account would.

Many creditors, however, may still be using older versions of FICO. FICO 8 ignores collections under $100, but the one used by mortgage lenders still counts all collection accounts. You can ask your lender which credit scoring model it uses before applying.

It’s difficult to say how much a credit score can increase when a collection is removed. If you check your score regularly and know what it was before the collection was listed on your report, then you can compare it to what it was before the collection was deleted.

If your score fell 50 points when a collection was added, then it should increase by 50 when it’s deleted. Your lender may be able to give you an idea of what to expect.

There are reports of credit scores rising by more than 100 points within 45 days of paying off collection accounts.

The older a paid debt, the less impact it should have on a credit score, so removing an old collection won’t have as much of an impact as adding a recent one. If a debt is old, such as five years or so, and you don’t plan on buying a home or needing a loan in the next few years, it may be worthwhile to wait until the debt is seven years old and is automatically removed from your credit reports.

When it comes to removing collections from credit reports, time is on your side.

Ranking Methodology

Our rankings of the best services for removing collections from a credit report are based on Better Business Bureau ratings, reputation scores, monthly costs, and overall customer satisfaction with each service provider. BadCredit.org’s reviews undergo a thorough editorial integrity process to ensure that content is not compromised by advertiser influence.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.