If you’ve seen the word derogatory on your credit report, you may understand that it’s probably not good. But you may also be wondering what, exactly, does derogatory mean — credit report or not.

Perhaps one of the best and, simultaneously, worst things about the English language is the vast number of words we have at our disposal. Rather than simply eat your pizza, for instance, you could partake in it, devour it, ingest it, masticate it, or gourmandize it if it’s particularly delicious. But while the wealth of words from which we can choose is a boon to writers, it can be a major source of confusion for everyone else.

This can be especially true when deciphering jargon, where everyday words can take on whole new meanings. One important piece of jargon you’ll need to know when dealing with your finances (though hopefully not from first-hand experience) is the term derogatory. An unpleasant concept in any case, derogatory items can be particularly harmful to your finances when they show up on your credit report. In this article, we’ll take a look at what it means to have a derogatory mark on your credit and several ways in which you could potentially remove it.

What It Means to Have a Derogatory Mark on Your Credit

As with most words, the definition of derogatory will vary based on which dictionary you use, but a good all-purpose definition from Dictionary.com describes it as, “tending to lessen the merit or reputation of a person or thing.” In the context of your credit reports, the definition is still fairly accurate, though derogatory marks refer specifically to negative items that detract from your overall credit profile.

Essentially, creditors use your credit report data to determine your credit risk. Any items on your credit report that increase your apparent credit risk are considered negative items, or, in jargon speak, derogatory marks. The types of derogatory marks that commonly appear on credit reports include:

- Hard credit inquiries

- Delinquent payments

- Charge-offs

- Collections accounts

- Repossessions

- Foreclosures

- Bankruptcy discharges

Since derogatory marks indicate higher credit risk, they can also impact your credit score, as your credit score is calculated based on the information in your credit reports. Some derogatory marks, like hard credit inquiries, will have minor negative impacts to your credit score, while more serious derogatory marks, such as charge-offs or bankruptcy discharges, can have much larger impacts.

And don’t think that closing an account will get rid of derogatory marks. For example, canceling a credit card that is delinquent won’t take the derogatory mark off of your credit report — nor will it make the credit card company stop trying to collect what you owe. Similarly, loans or other debts that have been closed, charged-off, and sold to a collection agency by the lender will still show as derogatory on your reports.

How to Remove a Derogatory Mark

So, how do you get derogatory marks off of your credit reports? The short answer is: you usually don’t.

Once a derogatory mark has been placed on your credit report, it generally lives there until it ages off of your reports. Unfortunately, paying a collections account or overdue bill won’t undo the damage that’s already been done. That being said, paying those negative accounts is still the best idea, as it will help prevent additional credit damage.

The long answer is, you might be able to use credit repair to remove derogatory marks from your credit report sooner rather than later. Keep in mind that this method only works for derogatory marks that are unfairly or inaccurately reported. Otherwise, you’ll need to be patient, wait it off, and work on building a new positive payment history to blunt the damage in the meantime.

Credit Repair May Help Remove Some Items

Thanks to the Fair Credit Reporting Act (FCRA), every consumer has the right to fair and accurate credit reports. As such, you have the right to dispute information on your reports that is outdated, inaccurate, fraudulent, or unsubstantiated. Credit repair is the process of disputing an item on your credit report with the credit bureau by filing a dispute.

If a derogatory mark on your credit report fits the requirements for dispute, you can file a dispute to have it removed. You’ll need to file a separate dispute for each item with each credit bureau. While the credit repair process can be done completely on your own, many consumers have found it easier and more successful to hire an experienced credit repair company, like our expert-rated picks below.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

+See More Credit Repair Companies

Most Negative Items Will Age Off Your Report

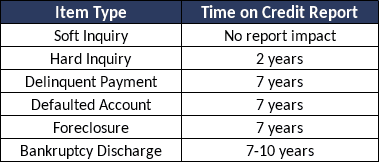

If the derogatory items on your reports don’t qualify for removal through credit repair, you’re going to have to wait them off. But those items won’t hang around forever. Negative credit report items all have a specific length of time they can remain on your credit report, which ranges from two years to 10 years, depending on the item.

And it gets better. The impact those items have on your credit score will actually start to diminish over time, with some derogatory items losing much of their impact before they actually fall off your report. Basically, credit scoring models give the most weight to items that are the most recent, so older items will have less influence in the calculations.

You can also help reduce the damage of derogatory items by working to build your credit in other ways. For instance, building a more recent positive payment history can help reduce the impact of derogatory marks, particularly if you can reach six to 12 months of perfect payments. You can also pay down revolving debts to improve your utilization and debt-to-income ratios, which may boost your score.

Avoid Derogatory Marks to Maintain Good Credit

While all the jargon in finance can make it confusing, not every adapted term is nonsensical in its use. Given its definition, it definitely makes sense to refer to the negative items on your credit report as derogatory marks. Even if you don’t agree, however, you need to know what derogatory marks mean in the context of your credit reports, if only so you may avoid them in the future.

And avoiding them is the way to go. While you can potentially remove them through credit repair, it’s far more effective to never need to remove them in the first place. Luckily, avoiding derogatory marks is simple, you just need to follow the most important rule of consumer credit: always, always, always pay your debts on time and as agreed.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.