All throughout grade school, we’re taught to live in fear of the Permanent Record, a nebulous file that forever documents our every schoolyard transgression. Skip a class? It goes on your record. Get detention? Yep, that gets recorded, too. For many of us, it isn’t until college that we finally realize that Permanent Record isn’t so permanent after all.

In many ways, your credit report is a lot like the dreaded Permanent Record — except your credit report will follow you well past college. And, instead of keeping track of how many times you are late to homeroom, your credit report knows how many times you are late with your credit card payment (or other financial obligations). The general rule is that those financial transgressions stay on your report for seven years. But that doesn’t have to be the case. Keep reading about how to remove negative items from your credit report before seven years.

Your credit report is used by potential lenders, landlords, and even employers to get an idea of your ability to manage credit and debt. So, when you make a mistake that gets recorded in your credit report, you’ll often face real financial consequences.

Certain Items Should Fall Off Your Report in Less Than 7 Years

No matter how damaging to your score, however, the negative items on your credit report won’t live forever. Much like the hairstyle you wore in high school, negative credit information has a shelf life, after which time it expires. In other words, once a negative item has reached the time limit, it automatically disappears from your report.

This awesomeness is thanks to the Fair Credit Reporting Act (FCRA), which provides a number of consumer credit protections. In addition to dictating how long negative information can remain on your reports, the FCRA also gives you the right to know what information is in your credit reports, as well as guaranteeing you have access to your credit scores.

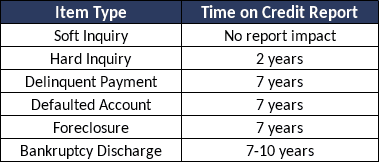

As outlined in the FCRA, the exact amount of time a particular item is allowed to hang out on your report depends on the specific type of item. Most positive account information can remain for up to ten years after the account is closed. The majority of negative credit accounts — including delinquent payments, defaulted accounts, paid tax liens, and foreclosures — may only stay on your credit report up to seven years.

The main exception for these items is if a separate state statute of limitations exists, in which case, it’s whichever period of time is longer. Moreover, bankruptcies can remain for up to 10 years from the date of discharge, or, if unsuccessful, from the date of dismissal. And hard credit inquiries aren’t specifically mentioned in the FCRA’s guidelines, but the industry standard is that they only last for two years.

For legitimate items that can be substantiated by the creditor, only time will erase these items from your credit report. While seven years (or even just two) can seem like a long time to wait for a clear credit report, it probably won’t really take that long to see the impacts on your credit score start to diminish. This is because credit scoring models give more weight to new information than they do old information.

This effect can be increased simply by maintaining your current accounts in good standing. As you add recent, positive payment history to your credit report, the older, negative information will have less and less impact, particularly as it ages. Indeed, short-lived items, such as hard credit inquiries, may even stop impacting your credit score altogether after the first year or so.

Some Negative Items May Be Successfully Disputed

Of course, just because something should fall off your credit report, doesn’t mean it always will. Furthermore, credit reporting bureaus — and the lenders and creditors that report to those bureaus — are staffed by humans, who can make mistakes. Thankfully, among the many protections provided by the FCRA, is the requirement that the information in your credit reports must be fair and accurate.

Along with this requirement, the FCRA gives you the right to dispute any information on your reports that is incomplete or inaccurate, including outdated information and unsubstantiated accounts. Although you have the option to file these disputes yourself, you may also choose to hire an experienced credit repair company to make disputes on your behalf, such as our expert-rated picks below.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

+See More Credit Repair Companies

Depending on the number of items you wish to dispute, hiring a credit repair company can be significantly easier than attempting to successfully dispute the items on your own. The process can often be quite involved, particularly if you need to do a little legwork to find evidence to support your claim.

If you’d like to try it yourself, you have a few options. While you can head online and file a dispute through the credit bureau’s website using the links below, anecdotal evidence suggests this method isn’t always effective and may be best suited for simple fixes, such as misspelled names or wrong addresses. Your better option is to draft a dispute letter and mail it directly to the credit bureau, as well as to the creditor that furnished the information.

Whether you DIY your repair or hire a pro, it’s important to remember a few key things about consumer credit reports. First, each of the three major credit reporting bureaus — Equifax, Experian, and TransUnion — maintains a separate credit file for each consumer. Additionally, since the credit bureaus don’t actively seek out information, they rely on your creditors to furnish the information that goes on those reports.

Not only does this mean you have three separate credit reports to check, but it also means any mistakes caused by a creditor furnishing the wrong information could wind up on all three of your reports. Furthermore, because the credit bureaus are individual entities, you’ll need to file a separate dispute with each bureau to address the specific error on that report, even if you’ve already addressed it with another bureau.

Time Heals All Credit Report Wounds

Despite the many sermons from teachers and administrators on its power, few of us are haunted by the specter of our Permanent Records once we’ve left grade school behind. Unfortunately, entering the adult world means you gain a new kind of record, one with real impact on your future: your consumer credit report.

Thankfully, laws outlined by the FCRA are in place to protect you from being burdened by permanent credit damage. While you may have to live with the consequences of your financial mistakes for several years, time will eventually heal the wounds to your credit report, giving you a fair chance at a better financial life. And remember, once those financial missteps become a distant memory and your credit score begins to climb once more, it’s imperative not to make the same mistakes again so be sure to pay your bills on time every month.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.