Banks and auto dealers aren’t always your best option when seeking a loan because they aren’t quite as impartial as you’d like them to be. That’s why many consumers today look for alternatives to in-house car financing.

By finding and securing your own auto loan, you aren’t at the mercy of the dealership, which often drafts your loan based on the commission the sales representative gets — and not the terms that are best for you.

Here are our top choices if you want to expand your lending options without relying on a dealer’s financing terms. We’ll take a look at several lenders that specialize in providing auto loans for consumers with bad credit and explore a couple of personal loan options that may be suited to your personal situation.

Auto Lenders | Personal Lenders | FAQs

Best Overall Direct Lender

When it comes to securing the best rates and terms, credit unions can’t be beat. They’re owned by their members, which would be you if you were to open an account and apply for a loan with PenFed Credit Union. That means its borrowers’ best interests are always at the forefront of the products they offer.

- Prequalify in minutes without impacting your credit score

- Refinancing loans save an average of $191 per month

- 125% financing available for cash-out refis

- PenFed Credit Union membership required but can be applied for at the same time as your loan

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.19% and up | 1935 | 5 minutes | 8.5/10 |

You can see your rate with no impact on your credit score. If you decide to start a loan application after checking your rates, you will then be required to authorize a hard credit check. If you choose to refinance with PenFed, your vehicle must have fewer than 60,000 miles on it.

Auto Loan Alternatives to In-House Car Financing

Our top three alternatives to in-house auto financing specialize in working with consumers who have bad credit — even if those consumers have repossessions or a bankruptcy in their past. Since they’re lending marketplaces, each will shop your application to a host of partner lenders and could return with multiple loan offers for you to choose from.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

3. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

Since you may receive multiple loan offers, be certain to read the fine print and fully understand the terms of each loan before accepting an offer. Just because a loan may offer a lower monthly payment doesn’t mean that it’s the best deal.

Personal Loan Alternatives to In-House Car Financing

Shopping for a car doesn’t mean you’re limited to loans from auto financiers. Depending on the price of the car, you may be able to get better terms from a personal loan.

Below are our top choices for personal loan providers that work with applicants who have poor credit.

5. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.99% – 35.99% | 1998 | 4 minutes | 9.5/10 |

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.99% – 35.99% | 2001 | 5 minutes | 7.0/10 |

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.99% – 35.99% | 1997 | 4 minutes | 9.5/10 |

These networks have no minimum credit score requirements, but each individual lender has its own approval criteria. Not every applicant will qualify for a large personal loan.

What Does In-House Financing on a Car Mean?

Over the last decade, the growth of Buy Here, Pay Here auto dealerships has helped millions of Americans get auto financing despite having a bad credit history.

These dealers provide in-house financing, meaning they sell you the car and loan you the money to purchase the vehicle. So, instead of borrowing the money from a bank or credit union, you make your monthly payments — with interest — to the dealership.

Dealerships provide this service because they can typically make far more money through your interest payments than they can through just selling you a car. And, since most in-house financiers work with consumers who have bad credit, they can jack up the interest rates to earn even more money on the transaction.

In fact, buy here, pay here dealers may charge more than 20% interest on your loan, which is substantially higher than what you may pay at a bank, credit union, or through many lending networks, such as those listed above.

By going through a lending network, you can access dozens or even hundreds of independent lenders that specialize in working with consumers who have bad credit histories. You could receive multiple loan offers to choose from — with some possibly beating out an in-house financing deal and saving you a lot of money.

Many consumers turn to in-house financing because they feel they have no other option due to their credit profile. But thanks to online auto lending, this is no longer the case.

Does In-House Financing Affect Your Credit?

This depends on the dealership and its financing practices. Many American cities now feature smaller buy here, pay here used car lots that both sell and finance automobiles. There are also many large national chains that now specialize in this type of financing.

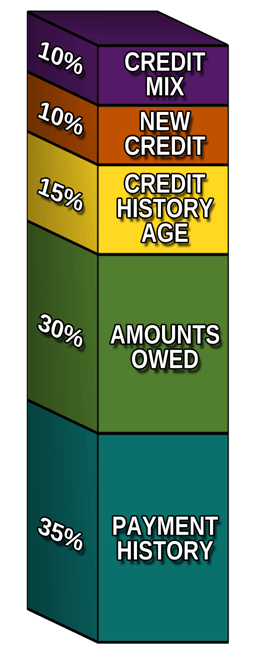

The larger companies typically report your payment history to the three major credit reporting bureaus. That means that your on-time payments will help improve your credit score over the long haul — and late payments will further hurt your credit history. Payment history is the most important factor used to determine a credit score, and even a single late payment can lower your score by 100 points!

Many smaller, local dealers, however, may not report your payment information to the credit bureaus. That means your payments will keep you in possession of your vehicle but won’t help improve your credit score.

The best way to determine how a loan will affect your credit score is to ask the dealer if he or she reports your payment history to the credit bureaus.

Aside from reporting on-time payments, an auto loan can still have varying impacts on your credit score. A new loan adds debt to your credit profile, which can increase your debt-to-income ratio and temporarily lower your credit score.

But your loan balance will decrease as you pay it down, which will improve your debt ratios and give your score a boost. So, any negative impacts your credit score might have from the new loan can disappear over time if you stay current with your payments and slowly eliminate your debt.

Is Bank Financing or In-House Financing Better?

Both have the same impact on your credit score, as long as you make on-time payments and the lender reports those payments to the credit bureaus.

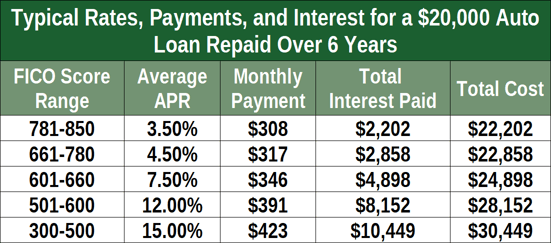

The big difference between the two is the effect they have on your wallet. The average interest rate of a bank auto loan currently hovers around 4.21%, while the average in-house financing interest rate can be upwards of 20%.

To put that in perspective, a three-year, $7,500 loan with a 20% interest rate will cost you $10,034 to completely pay off. The same loan with a 4.21% interest rate will cost $7,997.

That’s a total savings of $2,037 — or $57 every month.

That said, not everyone can qualify for an auto loan with a bank. In fact, tighter lending standards have many Americans struggling to acquire such loans. That’s why a lending network may be a more suitable alternative to bank or dealer financing if you have bad, limited, or no credit.

With a lending network, you gain access to several lenders at once — which increases the chances you’ll receive a loan offer (or possibly multiple offers) that could beat the terms offered through in-house financing. While the presented terms may not beat the average bank rates on an auto loan, a good lending network has more flexible acceptance standards and is more likely to approve your application than a bank.

And, in the end, you’ll still save money every month if you can secure an interest rate that’s lower than the rate offered by a dealer. Just remember that longer loan terms — meaning loans that extend extra years in exchange for lower monthly payments — will always cost more than shorter-term loans.

That’s because every month you add to your loan means you’ll pay more in interest charges, and those charges add up quickly.

Is it OK to Finance Through a Dealership?

If you have bad credit, you may feel the need to accept any financing you’re offered when shopping for a car. That may include in-house financing through a buy here, pay here dealership.

These dealers are very attractive to buyers who have bad credit since they tend to approve most applicants who meet their minimum income requirements. This isn’t necessarily a bad option for purchasing a new vehicle, but it can be a very expensive option.

That’s because many car dealers that offer in-house financing charge interest rates of 20% or higher — or seven times more expensive than what most banks offer through loans. They can get away with this because they know many of their customers have no other option.

Which may have been the case in recent decades, but not today.

Online lending has exploded over the last decade and many lending marketplaces now feature several lenders that deal specifically with consumers who have bad credit. These are reputable companies that offer flexible loan terms and more competitive interest rates.

Most lenders on these networks can process your loan application on the same day you submit it. Many can fund your loan via a loan certificate or direct deposit into a linked checking account within 24 hours.

With such a fast turnaround, you can compare offers to possibly trim some money off your monthly payment without slowing down your car shopping experience.

Since your loan originates from an accredited lender, you’ll make your monthly payments to the lender instead of the dealership — which means the dealer has less incentive to push a specific loan onto you and can focus more on finding a car that meets your needs.

Compare Multiple Auto Loan Offers Online

Some people say that less is more, but that saying doesn’t apply to the world of auto lending. If you limit yourself to only buy here, pay here dealers, you’ll have only one loan option — and that option can cost you thousands of extra dollars in added interest charges over the life of the loan.

An online lending network can possibly yield multiple loan offers from which to choose. The competition for your business forces these lenders to offer fair rates that can save you money.

So, while less may be better in some instances, you don’t want to limit your options when shopping for an alternative to in-house auto financing.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.