Identity theft has become a serious concern over the past decade, as the U.S. — and much of the world — moves steadily toward a digital economy with a growing number of online transactions occurring each year. In fact, online consumer spending jumped by 16% in 2017 alone, to the tune of $453.46 billion.

Online transactions, while convenient, do leave consumers vulnerable to the possibility of a stolen identity. Hackers can lift your credit card information or other sensitive data without even being in the same country as you. And you may be asking, “How will I know if my identity has been stolen?” It’s not as if the thieves who have done so will call you or shoot you an email to let you know.

To help you spot trouble, we’ve put together some telltale signs your identity may have been compromised. Let’s dive into our list which includes clues such as unfamiliar accounts on your credit report, sudden changes to your credit score, phone calls from collections agencies, and more.

Unfamiliar New Accounts Show Up on Your Credit Reports

If you happen to get a credit report and see an unfamiliar account, this is the biggest sign of identity theft. A new account not only requires a credit check, but it also requires access to your Social Security number.

This could open you up to a host of other issues, including medical identity theft (where someone uses your insurance to get their own medical procedures).

Any unfamiliar account on your credit reports should immediately trigger you to file an identity theft report with the FTC and credit bureaus, as well as your local police department. You’ll also want to go over all of your financial accounts with a fine-toothed comb, and consider changing online passwords and obtain new credit and debit cards.

You should also diligently check your credit report until all unauthorized accounts have been removed and annually thereafter.

You are entitled to one free credit report from each of the three major bureaus every year, which you can obtain through AnnualCreditReport.com.

While every American is entitled to one free credit report from each bureau every year, some companies offer consistent credit monitoring, which will alert you the second something changes on your credit report. If you are the type of person who likes to keep an eagle-eyed watch on your credit, you may already participate in such a program.

However, if you do a lot of online shopping, have a large social media presence, and are not currently using a credit monitoring service, now may be the time to do so, before someone gets their hands on valuable information about you.

There are Sudden Changes to Your Credit Score

For those who regularly check their credit scores, spotting a sudden change can be a warning sign that something is amiss with your credit, particularly if you haven’t changed any of your personal financial behaviors.

For example, a sudden increase in the amount of debt associated with your credit profile can cause a sharp decrease in your credit score. If you haven’t made any large purchases lately, that may be a sign of identity theft and you should check your credit reports for any new, unauthorized accounts.

Most credit cards now offer free FICO credit score monitoring, including many cards for those with poor credit who are trying to rebuild their credit, like our expert-rated options below.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A | Yes | 9.5 |

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 29.99% | Yes | 7.5/10 |

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

+See More Credit Cards for Bad Credit

Collection Companies Come Calling

If you’ve always paid your bills on time, have excellent credit, and are a generally responsible person, you might not check your credit regularly enough to catch any sudden changes, so you may not notice something is wrong until you get an unexpected call from a collection agency.

If the account they’re calling about sounds foreign to you, check your credit report immediately to begin taking steps to resolving the issue. In many cases, these items can be resolved, but arguing with the collection agency isn’t the place to start. You should first file identify theft reports with the authorities to get the law on your side.

You Stop Receiving Mail

Most Americans hate junk mail. It’s a waste of paper, it’s never that helpful or relevant to your life, and it takes up space in your mailbox.

However, if you suddenly stop receiving mail altogether, you may wish you were still getting that junk mail. A sudden stop in mail delivery is a warning sign that your identity has likely been stolen, and that highly-coveted junk mail (and, obviously, your necessary mail) has been rerouted to another address.

If you stop getting your mail, request a credit report immediately. If the address listed on the report does not match your current or past addresses, then you may have an identity theft problem on your hands.

Unauthorized Charges Appear on Your Financial Statements

If you open your credit card billing statement one month and happen to notice some unfamiliar charges — or even just one — that should be a very obvious clue that something is wrong, particularly if the charges are for places you never shop.

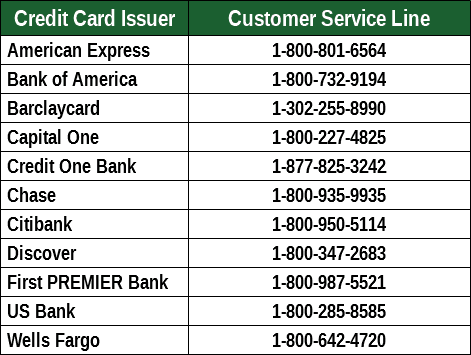

For example, if you haven’t jogged a day in your life, but your credit card statement shows a large expenditure at, say, Nordictrak, you might want to call your credit card company right away.

Many credit card companies can offer a certain amount of protection in the event of identity theft. For one, they’ll be able to immediately cancel your credit card, ensuring the thieves responsible cannot run up any more bogus charges.

For this reason, it’s a good idea to read your credit card agreement, which will inform you how your particular credit card company handles these types of situations. The Fair Credit Billing Act limits your liability in these situations, but some cards offer more additional protections than others.

You Get a Letter from the IRS

In general, the only time most Americans want to hear from the Internal Revenue Service is when receiving a tax refund. However, if your identity is stolen, you may get a letter from the IRS about unusual tax filings in your name, such as more than one return or income from an employer you never worked for or haven’t worked for in a long time.

If this happens, you’ll want to begin the resolution process immediately, which starts with — you guessed it — checking your credit report. After all, someone else is trying to cash in on your hard-earned tax return. You’ll also want to contact the IRS as soon as possible to inform them that your identity has been stolen.

Regular Credit Checks are Half the Battle

Identity theft is on the rise but companies are increasingly withholding information about data breaches, leaving consumers vulnerable. That’s why it’s important to stay vigilant about supervising your credit reports and scores, especially if you’ve made a lot of progress in repairing your credit.

There is good news, though: there are many resources available to those who do have their identity stolen in the form of identity theft nonprofit organizations, credit repair companies, individual debt counselors, government resources, and so much more.

Having your identity stolen doesn’t have to ruin all of the hard work you’ve put into building a strong credit portfolio, but it will take some work on your end to get it all resolved.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.