ACE Cash Express offers a broad range of financial products and services, including short-term loans, card services, check cashing, money transfers, bill payments, and money orders. It has provided financial services to more than 38 million unbanked and underbanked individuals with subprime credit since 1968.

The company makes loans online and at more than 850 brick-and-mortar locations, which adds plenty of overhead to its business model. We’ve assembled a list of online loan networks that don’t have to pay to run storefronts, so they offer an excellent alternative to an ACE Cash Express loan. And you can apply from the comfort of your favorite armchair.

ACE Cash Express Offers Payday, Installment, and Title Loans

ACE Cash Express is both a direct provider of installment loans and a Credit Service Organization (CSO) that helps consumers obtain payday and title loans from independent third-party lenders. Your state, income, and standard underwriting criteria determine the loan amount you can borrow.

Note that installment loans from ACE Cash Express charge APRs as high as 630%, much higher than the rates on personal loans from our reviewed online networks.

Currently, ACE Cash Express offers online installment loans in Delaware, Florida, Missouri, and Texas. If you live in Colorado, Louisiana, Ohio, Oklahoma, or Virginia, you must travel to an ACE storefront for an installment loan.

The company also offers payday and title loans in a limited number of states.

Best Online Loans Like ACE Cash Express

There are many ACE Cash Express alternatives, including Speedy Cash, Cash Central, Allied Cash Advance, and Money Mart, among many others.

But online loan networks offer the stiffest competition to ACE Cash Express.

The following loan-matching networks arrange competitive bids for borrowers who seek personal or payday loans. You can receive multiple offers from a single loan request form and, if approved, collect your loan proceeds by the next business day.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual doesn’t directly fund loans. Instead, it matches you to one of the many lenders on its network. The company has the flexibility to arrange both payday and personal loans.

You can obtain a personal loan that you repay in monthly installments or a fast payday loan that you repay in a single lump sum (a desirable choice if you have poor or limited credit). We consider MoneyMutualMoneyMutual to be the top provider of network lending services.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group can arrange a personal installment loan of up to $35,000, but you should expect much smaller loan offers if you have imperfect credit. Depending on the interest rate, loan amount, and monthly payments, you can take up to six years to repay your loan.

This network has earned an Excellent rating from Trustpilot. 24/7 Lending Group may recommend a secured credit card to help you build credit if it can’t find you a willing lender. These cards provide a way to help you improve your credit through responsible use.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com works with lenders that offer $500 to $10,000 personal loans with repayment periods of three to 72 months. Its installment loans charge an APR no higher than 36%. You can prequalify if you are a US citizen or permanent resident 18 or older. You need an income of at least $1,000 per month after taxes, a valid phone number, an email address, and an active checking account in your name.

Once you prequalify, CashUSA.com will link you to a direct loan provider for a quick decision — and likely next-day funding.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

BadCreditLoans.com helps consumers with credit issues obtain personal loans of $500 to $10,000 with APRs below 36%. To prequalify, you must be at least 18 years old, a US citizen with a reliable monthly income, a working phone number, a checking account in your name, and a valid email address.

Expect your loan proceeds to arrive in your linked bank or credit union account as soon as one business day after BadCreditLoans.com matches you to a lender that approves your loan. BadCreditLoans.com can also connect you with offers for credit repair, debt relief, and similar products and services if it can’t find you a loan offer.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com is a good choice when you want multiple offers for a personal or payday loan of $100 to $20,000. The loan-finding service requires you to collect monthly wages or government benefits of at least $1,000 to prequalify for a loan.

Personal loan providers on the SmartAdvances.com network may perform credit checks with the three credit reporting bureaus: TransUnion, Experian, or Equifax. SmartAdvances.com supports the Online Lenders Alliance (OLA), which advocates an honest credit policy consistent with federal and state law.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com, headquartered in Florida, can find you an online personal or payday loan of up to $5,000. Its network specializes in loans for consumers with poor credit.

The company offers several online tools that have helped more than 33 million visitors since 1998, including its popular loan calculator. The CreditLoan.com website displays the TRUSTe® seal, guaranteeing data security and privacy. It also has an A+ rating on the Better Business Bureau website.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com is a loan-finding service for consumers who need personal installment loans of $1,000 to $35,000 at an APR no higher than 36%. You can prequalify if you are at least 18 years old, a US citizen or resident, and have a dependable monthly income, a Social Security number, and an active bank account in your name.

Loans from the network’s lenders can have terms of three to 72 months. You repay in monthly payment installments that fit your budget. The PersonalLoans.com network offers three types of loans: Personal installment, peer-to-peer (P2P), and bank personal loans.

What is ACE Cash Express?

The Populus Financial Group, Inc., does business as ACE Cash Express. The company offers direct and network loans online and from storefronts located in selected states.

Loans from ACE Cash Express are expensive. The states in which the company operates specify the maximum rates and loan amounts ACE can offer.

The company also offers some of the same services you’d expect from a traditional bank, and typical loan amounts range from $1,000 to $2,000. You must repay its payday loans in a single lump sum.

Its installment loans charge interest rates starting at 96% and topping out at 630%. You have up to 180 days to repay an ACE installment loan.

As a CSO, ACE Cash Express arranges third-party payday loans that can have a loan term of nine to 35 days and APRs as high as 830%. Its online payday loan offers are available in the following states:

- California: $100 to $255

- Idaho: $100 to $1,000

- Kansas: $100 to $500

- Louisiana: $100 to $300

- Minnesota: $100 to $500

- Texas: $100 to $1,500

ACE offers storefront payday loans from ACE in 10 states. You can refinance an ACE payday cash advance up to three times if you repay 25% of the principal each time.

The company offers auto title loans in which your vehicle serves as collateral to secure the loan. ACE can repo your car if you fail to pay on time. The company offers title loans only in-store, not online.

Storefront title loans are available in Arizona, Louisiana, Oregon, and Texas (not offered in Austin, Dallas, or Fort Worth).

What Other Products and Services Does ACE Cash Express Offer?

ACE Cash Express offers several banking products and services to help consumers who don’t have traditional bank accounts. They include the following:

- Porte Mobile Finance App: This app provides banking services through Pathward National Association, Member FDIC. It offers a spending account, savings account, mobile check capture, account alerts, and provision for charitable giving. You can avoid the $9.95 monthly charge if you receive at least $1,000 a month in direct deposits to your spending account.

- Flare Account: This is the ACE deposit account; you can link it to the Porte savings account. The account’s debit card donates five cents for each $100 in purchases. You can accept up to $400 in fee-free cash withdrawals daily from your Flare Account using your debit card at participating ACE Cash Express locations. The debit card offers optional overdraft protection.

- ACE Elite Visa Prepaid Debit Card: You can use this prepaid card to take no-fee cash withdrawals of up to $100 per day at participating ACE locations with qualifying direct deposit. The card pays cash back rewards on qualifying purchases and offers a reduced monthly rate of $5 when you receive at least $500 per month in payroll or government benefit direct deposits.

- Money Services: These services include check cashing, bill pay, money orders, and money transfers. You can use these services at any ACE storefront or through the ACE app.

- ATMs: You can check your balance or withdraw cash in increments as low as $5 at ACE Cash Express locations. These ATMs accept most debit and credit cards.

ACE Cash Express is a viable alternative for unbanked or underbanked individuals who require financial services. It offers many of the same products you’d find at a traditional bank.

What Are ACE Cash Express’ Credit Requirements?

ACE Cash Express does not perform credit checks for any of its loans. You must be 18 or older and have a deposit account to be eligible for an ACE loan. You must provide your name, address, email address, phone number, and a valid Social Security Number or Individual Taxpayer Identification Number.

You cannot currently be a debtor in a bankruptcy case or intend to file for bankruptcy relief voluntarily. You also cannot be an active member of the military.

Additionally, you may have to provide the following documentation:

- Proof of income

- Driver’s license

- Government-issued photo ID

- Proof of citizenship or residence permit

- US tax identification document

ACE Cash Express welcomes loan cosigners.

How Does Ace Cash Express Verify Income?

Borrowers must provide proof of a steady source of recurring income, such as employment, disability, retirement, self-employment, or another income source. Generally, your monthly income must be at least $1,000.

ACE does not verify your income through a hard credit check. Applying for a loan from ACE Cash Express will not impact your credit score.

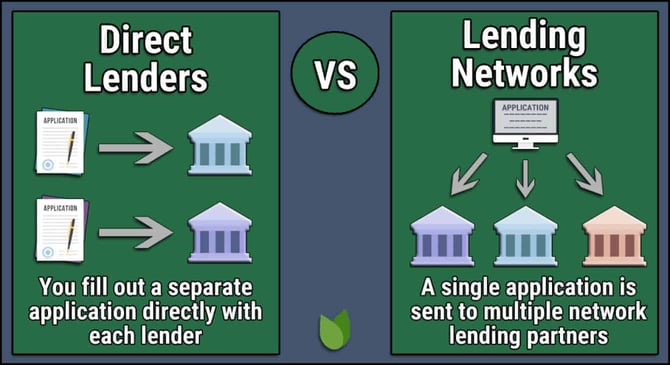

What Are the Differences Between Direct and Network Lenders?

When you apply for a loan from a bank or credit union, you work with a single financial institution that funds its own loans. These direct lenders usually offer you several types of loans from which to choose.

Direct lenders may offer personal loans, credit cards, private student loans, business loans, car loans, payday loans, and mortgages. The direct lender sets the qualification criteria for each product. The lender’s website will provide the terms and conditions of each loan product.

Online lending networks do not directly provide loan products. Instead, they are loan-matching services that generate leads to networks of direct lenders.

Lending networks are intermediaries that connect you to lenders and their products.

Network lenders understand that looking for a loan can be frustrating if you have poor credit. They find suitable lenders, so you don’t have to spend your time searching and worrying. Their partnerships with sound financial institutions cater to consumers with bad credit.

ACE Cash Express is a direct lender for certain loans, and it offers third-party payday loans.

Can I Get a Loan Without a Credit Check?

ACE Cash Express doesn’t require a credit check for its loans. Neither do the reviewed lending networks when they prequalify your loan request.

Direct lenders found through the network usually perform a hard credit pull when you apply for a personal loan. But the typical payday lender does not pull your credit file, instead relying on your income information. The same is true for title loan providers.

How Can I Increase My Approval Odds?

Using a loan-matching network is a smart way to improve your approval odds. These networks match you with the lenders most likely to approve your loan application.

By finding multiple lenders, the networks support the natural competition among the direct lenders, helping to ensure you get the best possible deal.

Increasing your credit score is the best way to improve your loan approval odds in the long run. You can boost your score by paying your bills on time and reducing your debt.

Many lenders welcome cosigners who have good credit. Your approval chances significantly improve when you recruit a suitable cosigner. Lenders will seek money from a cosigner if you fail to pay your bill on time.

Checking your credit reports for harmful misinformation is another excellent way to improve your approval odds. You can do the work yourself or hire a legitimate credit repair organization.

Credit bureaus must correct or remove disputed information that is inaccurate, obsolete, or unverifiable. Deleting misinformation can lift your credit score within a month or two.

Is ACE Cash Express Legit?

In 2022, the Consumer Financial Protection Bureau filed a lawsuit against ACE Cash Express for concealing free repayment plans. The CFPB alleges:

“Because of ACE’s illegal practices, individual borrowers paid hundreds or thousands of dollars in reborrowing fees when they were, in fact, eligible for free repayment plans. These practices generated at least $240 million in fees for ACE while keeping borrowers in debt.”

In December 2022, a Fifth Circuit Court vacated the CFPB suit as unconstitutional. The CFPB is appealing this decision.

ACE Cash Express has an Excellent rating from Trustpilot. Unless the courts reinstate the CFPB lawsuit against ACE, we can expect its ratings to remain solid.

Check the Competition Before Borrowing From ACE Cash Express

ACE Cash Express offers consumers valuable services. But its installment loans are very expensive compared to those from the loan-finding websites we’ve reviewed.

The ACE storefronts are convenient when you need a loan in minutes. If you prefer an online loan’s safety, convenience, and security, consider using loan-matching networks or ACE’s online services.

If you are looking for a personal loan, online lending networks should be your first choice, as their interest rates are much lower than at ACE Cash Express.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.