Speedy Cash, founded in 1997, has carved out a significant slice of the payday loan market. It does business in 28 states, with more than 200 brick-and-mortar storefronts that provide loans and check cashing services. You can also borrow money from Speedy Cash online. The question is: Should you?

This article will examine how the company works and suggest alternatives to Speedy Cash. Armed with this information, you’ll be better able to decide which lender is your most suitable option.

Speedy Cash Offers Short-Term and Installment Loans at Payday Loan Rates

Speedy Cash offers conventional payday loans at astronomical rates (i.e., approximately 400% to 700%). What sets it apart is that it provides personal-loan lookalikes, which it calls installment loans.

While conventional personal loans are indeed installment loans, they have APRs no higher than 36%. Speedy Cash installment loans are payday loans with up to 18 months to repay at an APR of 176.61%.

By way of a car accident analogy, if a conventional personal loan is a financial fender bender, a Speedy Cash installment loan is a head-on collision. We’ll delve deeper into Speedy Cash’s loan products, but first, we’ll review alternative sources of online loans.

Best Online Loans Like Speedy Cash

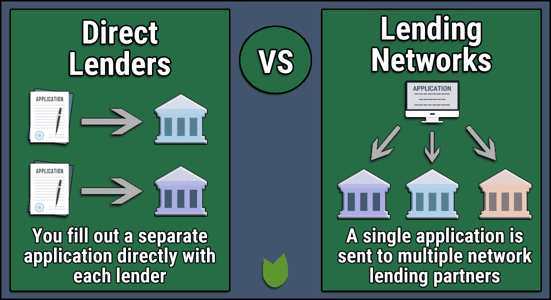

The following companies can help you obtain payday and/or personal loans through a speedy online process. Unlike Speedy Cash, a direct lender, these websites are lender-finding networks that prequalify loan requests and connect borrowers with one or more lenders willing to work with them based on the information submitted.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual isn’t a direct lender, but a service that matches you to one of the lenders on its network. The company is flexible since it can arrange both payday and personal loans.

You can obtain a fast cash loan that you repay in a single lump sum (a good choice if you have poor or limited credit)) or a personal loan that you repay in monthly installments. We consistently rank MoneyMutual as the top provider of network lending services.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group may be able to find you a personal installment loan of $500 to $35,000, but consumers with really bad credit should expect to receive a relatively small loan offer. Depending on the loan size, interest rate, and monthly payment amount, you may have up to six years to repay your loan.

This network has an Excellent rating from Trustpilot. If 24/7 Lending Group can’t find you a willing lender, it may recommend Secured Chime Credit Builder Visa® Credit Card as an alternative to help you improve your credit with responsible use.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com works with lenders that offer fixed-rate personal loans of $500 to $10,000 with a loan term range of three to 72 months. Its installment loans charge a maximum APR of 36%. You can prequalify if you are a US citizen or permanent resident, age 18 or older, receiving at least $1,000/month in after-tax income, with a valid phone number, email address, and active checking account in your name.

Once you prequalify, CashUSA.com will link you to a direct loan provider for a quick decision and likely next-day funding.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com is a sensible choice when you want multiple offers for a payday or personal loan of $100 to $20,000. This loan-finding service requires you to earn a monthly income of at least $1,000 to prequalify for a loan.

Lenders on the SmartAdvances network may perform credit checks with the three credit reporting bureaus: Experian, Equifax, or TransUnion. SmartAdvances.com belongs to the Online Lenders Alliance (OLA), which advocates a fair credit policy consistent with federal law.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

It’s all in the name: BadCreditLoans.com helps consumers with poor credit obtain personal loans of $500 to $10,000 with APRs below 36%. To prequalify, you must be a US citizen, at least 18 years old, and have a reliable monthly income, a checking account, a phone number, and a valid email address.

If Bad Credit Loans matches you to a lender that approves your loan, expect your money to appear in your linked bank or credit union account within one business day. Bad Credit Loans may connect you with offers for debt relief, credit repair, or other credit-related products or services if it cannot find you a loan offer.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Florida-based CreditLoan.com will search its network to find you an online payday or personal loan of up to $5,000. It specializes in finding loans for consumers with bad credit.

The company offers various online tools, including a loan calculator, and resources that have helped more than 33 million visitors since 1998. The CreditLoan website displays the TRUSTe® seal, a guarantee of data privacy and security.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com can help you get a fast cash advance or long-term installment loan through its network of payday and personal loan providers. You can borrow up to $5,000 through InstallmentLoans.com.

If you obtain a loan from a network partner, you will likely receive the funds via a direct deposit as soon as the next business day. The site encrypts all transmitted data to ensure your information remains private and secure.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com is an excellent loan-finding service for consumers who need personal installment loans of $1,000 to $35,000 at an APR below 36%. You can prequalify if you are a US citizen or resident, at least 18 years old, and have a Social Security number, a dependable monthly income, and an active bank account.

Loans from network lenders are available with a loan term of three to 72 months, allowing for monthly payment installments that fit the budgets of many borrowers. The PersonalLoans.com network offers three types of loans: personal installment, peer-to-peer (P2P), and bank personal loans.

What Types of Loans Does Speedy Cash Offer?

Speedy Cash is a direct lender that provides four types of high-interest loans. You can repay these loans via a lump-sum payment, monthly installments, or on a revolving basis.

- Payday Loans: These are short-term loans of $100 to $1,500 with interest rates in the 400% to 720% range, which translates into loan fees as high as $420. You repay these loans in a lump sum on your next pay date, typically in one to four weeks.

- Installment Loans: You can get an installment loan of $100 to $5,0000 with up to 18 months to repay. The APRs for these loans start at 132% but top out at 680%. State laws set the maximum APR and loan amount for this type of loan.

- Lines of Credit: Speedy Cash offers revolving credit lines of up to $3,000, depending on your state. You pay interest only on the amount you draw from the credit line. You need to pay only the minimum amount due each month, which depends on your outstanding balance.

- Title Loans: You can get a Speedy Cash title loan if your vehicle has a clear title. You repay the loan through scheduled installments. If you miss a payment, Speedy Cash can repossess your car.

You can apply for all but the title loan online or at a Speedy Cash storefront. You must bring your car to your local storefront to apply for a title loan.

What Are Speedy Cash’s Credit Requirements?

Speedy Cash has no minimum credit requirements. You can apply for a loan with no credit, limited credit, or bad credit.

To apply for a Speedy Cash loan, you must be at least 18 years old, reside in the United States, and have a:

- Valid government-issued photo ID

- Working phone number

- Steady source of income

- Bank account

For a Speedy Cash title loan, you will also need a:

- Vehicle in driving condition

- Clear title or proof of a first lien

- Proof of address

- Valid driver’s license

- Proof of vehicle insurance

You don’t have to prequalify for a loan from Speedy Cash, but it does mail out Reservation Numbers you can enter online that may indicate preapproval.

What Is the Difference Between Direct and Network Lenders?

When you pursue a loan from a direct lender, you only work with that lender. Direct lenders frequently offer a suite of products from which to choose.

For example, a direct lender may offer credit cards, private student loans, payday loans, personal loans, business loans, car loans, and mortgages. Each online lender sets its qualification criteria and terms for each product.

You’ll find complete financial disclosures on the company’s website and in the fine print of each product’s terms and conditions.

Lending networks do not provide loans and other credit products. Instead, they find willing lenders for loan-seekers who submit online loan request forms. The networks generate leads for direct lenders — their affiliates — that want to earn your business.

Lending networks are essentially matchmakers whose sole purpose is to connect you with direct lenders and the products they offer. They offer several advantages, including the following:

- Easy comparison of competing loan offers

- Wide access to many lenders

- Prequalification of borrowers without any impact on credit scores

- Specialization in loans for consumers with bad credit

- The prequalification and loan-finding services are free and without obligation

Lending networks save you time and energy when you need to find an online lender willing to do business with a subprime borrower. They have the expertise that results from helping thousands of borrowers obtain loans every month.

Can I Get a Loan Without a Credit Check?

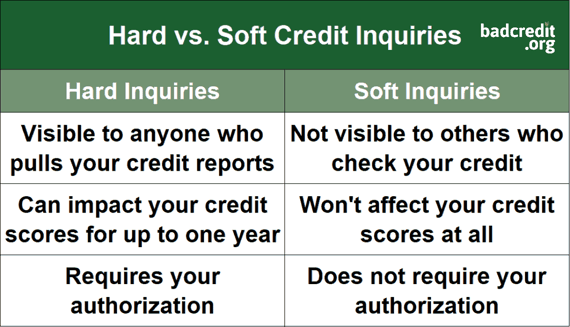

Some loans don’t require a hard credit check. These include payday loans, title loans, pawnshop loans, and some installment loans. A hard credit check should only occur when you apply for a new loan or credit account.

Hard credit checks appear on your credit reports and remain there for two years. They can have a small impact on your credit score. But if you apply for several loans or credit cards within a short period, the multiple hard inquiries may hurt your score more significantly.

Soft credit checks do not impact your credit score and aren’t visible to any recipient of your credit report except you. Many creditors perform soft credit checks when you attempt to prequalify for a loan or credit card. The soft inquiries help creditors verify the information on borrower application forms.

The reviewed lending networks never perform hard credit checks, although most perform soft pulls when prequalifying loan requests. The direct lenders on the lending networks usually do hard credit pulls on consumers applying for personal loans but not payday loans.

Speedy Cash only performs soft credit pulls, so you can’t hurt your credit score when you apply to it for a loan. The flip side of this policy is that Speedy Cash doesn’t report your payments to the credit bureaus, which means the lender can’t help you build credit.

The personal loan providers on the lender-finding networks usually report your payments to at least one major credit bureau, so they can help you build or rebuild credit — if you pay your bills on time.

How Can I Increase My Approval Odds?

In the long run, raising your credit score is the most significant action you can take to increase your chances of getting approved for a loan. You can do so by paying your bills on time and keeping your debt relatively low.

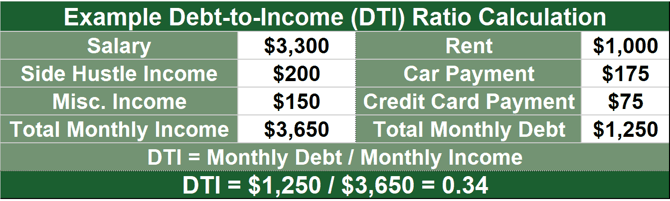

To that end, you should become familiar with the debt-to-income (DTI) ratio many lenders use when deciding whether to approve a loan. The ratio measures how much you shell out monthly to pay your debts divided by your monthly gross income.

A high DTI ratio may presage financial troubles ahead as you scramble to pay your monthly bills.

Many lenders require borrowers to have DTI ratios below 40%, although subprime lenders may have more flexible standards. The first step in taming a high DTI ratio is establishing a monthly budget to plan and track your spending.

A budget will show you where you can cut spending. If you can’t cut your spending enough to pay your bills, you may want to consider ways to increase your income. You can ask for help from a nonprofit credit counselor, who can help you improve your financial habits and perhaps consolidate your debts to reduce your monthly payments.

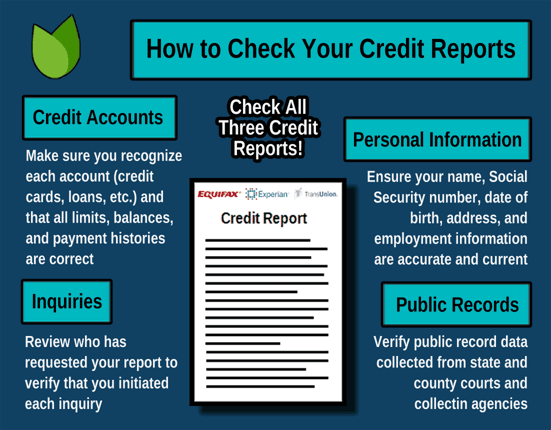

Another way to improve your credit is to remove inaccurate, obsolete, and unverifiable data from your credit reports. You can get free copies of your Experian, Equifax, and TransUnion credit reports from AnnualCreditReports.com.

Review your reports for errors that hurt your credit score. You can then dispute questionable items by contacting the credit bureaus online or in writing. Alternatively, you can hire a credit repair agency to do the work for you.

When you win a dispute, the credit bureau must fix your report and recalculate your credit score. The bureau must also inform recent report recipients of the correction.

Using a cosigner is an effective way to increase your odds of getting a loan. The cosigner should have a good credit score. If you miss a loan payment, the cosigner must step in and make it for you — an event that can ruin your relationship with the cosigner.

Is Speedy Cash Legit?

Speedy Cash has an A+ rating from the Better Business Bureau, yet the BBB has not accredited it. Moreover, customer reviews and complaints could have been better in the past three years.

Customers who commented to the BBB have given Speedy Cash a one-star rating out of a possible five stars. Clearly, Speedy Cash has yet to satisfy a broad cross-section of its customers.

Several Speedy Cash customers have filed class action lawsuits against the lender, citing loan overcharges. The outcome of these cases are still pending.

Despite these blemishes, Speedy Cash has offices in 29 states and has many positive reviews. At this point, there isn’t a sufficient basis to question the company’s legitimacy.

Check the Competition Before Borrowing From Speedy Cash

Before selecting a loan provider, it makes sense to research the alternatives available to you. A personal loan from any of the reviewed lending networks will charge far less interest than would an installment loan from Speedy Cash. We recommend you start with an online loan-finding service before dealing with Speedy Cash — doing so may save you a bundle.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.