Most adults have credit scores. Financial institutions rely on these three-digit numbers to quickly determine loan and credit qualification and to set the terms if you are eligible.

FICO and VantageScore have developed the most commonly used risk assessment models, and though each company uses a different algorithm, they share many commonalities. Both companies use the 300 to 850 scoring range, with higher numbers being preferable because they indicate less lending risk. When your scores are at the top of the scale (and you meet other financial criteria), you may qualify for the best credit products.

Credit scoring companies use the information in your consumer credit reports from TransUnion, Equifax, and Experian to calculate your scores. You can use your credit cards to supply the data that results in high scores. Here are seven ways.

1. Use Your Credit Card Regularly

Regular, responsible credit card usage will help your credit scores rise. Remember, the data listed on your credit reports are used by credit scoring companies to develop a score. That means you have to feed your credit reports data.

Therefore if you already have a credit card but have been reluctant to use it, change course. The first step is to develop a budget. Then determine a small expense that you can charge and repay without any trouble. You can make it a cost that doesn’t change, such as a cellphone bill, or one that fluctuates, such as groceries.

Regularly using and paying your credit card bill shows lenders that you can responsibly manage credit.

2. Make Your Credit Card Payments On Time

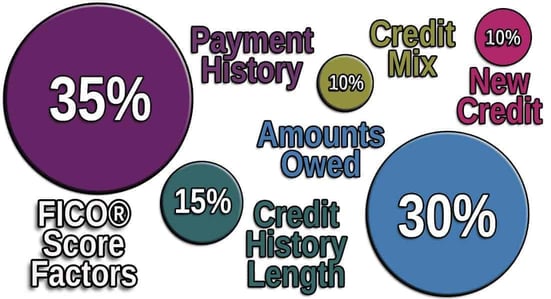

The most important credit scoring factor is your payment history. You want to pay on time, every time. When you have many months, and then many years, of on-time payments listed on your reports, your scores will increase.

To ensure that your payments are posted on time, automate them with the bill pay system through your bank. The payment will be deducted from your checking account and applied to your bill on a fixed day each month. This ensures your payments are posted on or before the due date.

If you don’t automate payments and forget about a bill, contact the credit card issuer immediately and ask for a reprieve. Delinquencies typically don’t appear on a credit report until you are 30 days past due, so call the bank quickly. You may be able to stop the late payment from appearing on your credit report and have the late fee waived if it is your first late payment.

3. Mind Your Credit Utilization Ratio

The spread between the amount you owe on your credit cards and the credit limit, both per account and in aggregate, is called your credit utilization ratio, and it strongly influences your credit scores.

Ideally, you pay your bills entirely, but if you do want to buy something and pay the debt in installments, you can still keep your credit utilization ratio in a healthy place. The general rule of thumb is to revolve no more than 30% of the amount you can charge.

Let’s say you have a credit card with a $1,000 credit limit and added $900 worth of charges. That means you used up 90% of your credit line. If you were to only make the minimum payment, your credit utilization ratio would be negatively impacted because the debt would remain high.

Instead, take steps to reduce the balance within a few months. With each large payment (made on time, of course), your credit utilization ratio will expand. Eventually, it will be back in the safe zone, which can cause your scores to rise.

Tip: Credit scores can be calculated before you have a chance to repay the debt in full. To offset this from happening, either pay the bill immediately or make a couple of payments throughout the month.

4. Start With a Secured Card

So what happens if you do not have a credit card? Get one! If you haven’t developed a credit history yet, your best bet may be a secured card. Secured credit cards are also great if you have damaged credit and can’t qualify for a good unsecured credit card.

A secured credit card can get your foot in the door because the money you put down guarantees the credit line. Your deposit is fully refundable when you close the account with no balance due, and some creditors will give the money back after a certain number of months of responsible account use.

Look for a card that has a low APR (especially if you will use it for installment payments), a low or no annual fee, and a rewards program. Here are some of our favorites:

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A | Yes | 9.5 |

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

- 1% Cash Back Rewards on payments

- Choose your own credit line – $200 to $2000 – based on your security deposit

- Build your credit score.¹ Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 19.24% (V) | Yes | 7.5/10 |

After you are approved, the credit card will appear on your credit reports in about 30 days, though some issuers can take longer. Once listed, it will show information such as the account opening date, credit limit, high balance, and current balance. It will not be noted as “secured.”

Now all you have to do is charge at least once a month and send the entire amount you owe (or as much as you can) by the due date.

5. Become an Authorized User

Don’t have the money to spare for a security deposit but know someone who will let you piggyback on their account for a while? Wonderful! If they make you an authorized user, that person’s credit card will appear on your credit report.

As an authorized user, you will have a credit card imprinted with your name, even though you are not liable for the account. You are a guest, so the primary cardholder will always retain control.

As long as the account owner pays the bill on time and in full, it will be positively factored into your scores. Then when your scores are high enough to qualify for a credit card of your own, you can apply for it and start to use that card to further build credit.

At that point, you can thank your relative or friend who gave you the boost and be removed from their account.

6. Open a Second Credit Card

Having multiple credit cards — or credit report tradelines — can help your credit score rise when you use your accounts responsibly. There is no exact “best” number of cards to have for scoring purposes, but a couple in use is generally perceived as better than just one. Consequently, this may be the perfect opportunity to open a second credit card.

Adding to your plastic portfolio can also expand your credit utilization ratio since each card has its own credit line.

In the beginning, the new card may cause a slight decrease in your credit score because it can lower your average age of credit. But after a few months, your scores should go back up and then eventually exceed where they were before you opened the account.

When searching for a new credit card, look for one that does what your other account doesn’t. For example, maybe your current card offers cash back and you would like to accumulate points to redeem for flights. In that case, consider travel cards. Or maybe you want a gas card or one that gives the most rewards in certain categories, like grocery stores or dining out.

7. Transfer Expensive Debt to a Balance Transfer Card

If one of the reasons your credit scores are low is that your credit card debt and the APR attached to the account are high, consider a balance transfer credit card. These products frequently come with 0% APR for an introductory period of between 15 and 21 months.

Not only can a 0% APR balance transfer card help open up your credit utilization ratio (when you shift the debt to the new card, the old card will either be paid off or the debt will be much lower), finance fees won’t be added to the balance. Every payment you make will go toward the balance, helping you pay off the total debt faster and for much less money.

And as long as you repay the debt in full by the time the intro period is over, you’ve proven that you can manage the card responsibly, further enhancing your credit rating, while avoiding any unnecessary interest when the regular rate goes into effect.

Just be aware that balance transfer cards do have a fee of between 2% and 4% of the transfer, which is added to the debt. Also, you may not qualify if your scores are very low, so this method is best for people who want to go from good to excellent credit.

Track Your Progress

Watching your credit scores rise after making the effort can be very exciting. Write down what they are today and then check up on them every few months.

If they aren’t rising, pull your credit reports from AnnualCreditReport.com to ensure the listed information is correct. If it’s not — or if you spot evidence of fraud — immediately dispute the errors on the credit bureau’s website. The credit bureau has 30 days to investigate and will purge the data dragging it down if they rule in your favor.

You should see an upward trajectory by using your credit cards effectively over time. When they’re at the top of the scale, celebrate. You earned it!

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.