As influential as credit scores have become over your finances and your access to credit, it may seem like those three-digit numbers have been around forever, perhaps even as long as lending itself.

But, in reality, the credit scores as we know them are only a few decades old. They do, however, have quite an interesting, albeit brief, history.

The First FICO and VantageScore Credit Scores

The first-ever credit bureau-based FICO credit score became commercially available in 1989 through Equifax. This score was originally named BEACON.

Soon after, both TransUnion and TRW released credit scoring models built by FICO as well. At TransUnion, your FICO score was called EMPIRICA, and at TRW, it was called The TRW/Fair Isaac Risk Score.

So, whenever you saw a reference to your BEACON, EMPIRICA, or TRW/Fair Isaac scores, those were your FICO credit scores based on your Equifax, TransUnion, and TRW credit reports.

At one time, the three national credit reporting agencies were Equifax, TransUnion, and TRW. The data maintained by TRW’s credit bureau division was eventually sold and is now owned by Experian.

At one time, the three national credit reporting agencies were Equifax, TransUnion, and TRW. The data maintained by TRW’s credit bureau division was eventually sold and is now owned by Experian.

In 2006, the three credit reporting agencies collaborated to create the VantageScore credit score. VantageScore, unlike FICO, is a wholly-owned subsidiary of the credit bureaus.

The management of the VantageScore credit score is facilitated by VantageScore Solutions, LLC. The VantageScore credit score is the score’s commercial name.

What this means is that the two most used credit scores in the United States have been around for only 31 and 14 years, respectively. Relative to loans and credit cards, you can accurately refer to credit scores as being a comparatively new lending tool.

Despite their somewhat recent introduction, credit scores have grown to become invaluable for lenders in the United States. Lenders rely so heavily on credit scores that over 20 billion credit scores are used to make lending decisions each year.

To fully understand and appreciate the history of credit scores you have to also understand a little bit about the history of credit reporting. All credit scores are based on credit report data, so a credit score cannot exist without a credit report first being compiled.

The Beginning of Credit Reporting

Credit reporting has been around, in one form or another, since the late 1800s. Equifax, in fact, was established in 1899, so its existence spans three centuries.

In the beginning, credit reporting appealed primarily to commercial lenders and local merchants who needed ways to assess the risk of their prospective customers. The need to assess risk, of course, still exists today.

Several smaller, local credit reporting agencies were formed around the country to fulfill the need for risk assessment information. These were called merchants associations because their data was provided and aggregated by local merchants. For example, one of the most notable credit reporting agencies at that time was the Mercantile Agency, later renamed R.G. Dun & Co., located in New York.

These merchants associations collected and sold credit information about borrowers from sources called subscribers. Mercantile created an alphanumeric score that aimed to predict the creditworthiness of commercial credit applicants.

A competitor, the Bradstreet Company, provided similar services to commercial lenders as well. Eventually, in 1933, the two rival credit reporting agencies consolidated to form Dun & Bradstreet, or D&B, a leader in business credit reporting.

There were, at the time, other similar local and regional consumer credit reporting companies located throughout the country. However, through the process of consolidation and acquisition, we are now left with three national credit reporting agencies: Equifax, Experian, and TransUnion.

Consumer Protection Laws and Credit Scores

It made sense that lenders wanted to find ways to reduce their risk of loaning people money and not getting paid back. As the years passed, credit reporting in the consumer lending marketplace became the status quo, but the common credit score wasn’t around just yet.

Early credit reporting wasn’t without its problems. It was often subjective, unfair, and didn’t lend itself to consistent credit decisions. In response to these problems, Congress passed a series of laws designed with consumer protection in mind.

In 1970, Congress passed a federal law called the Fair Credit Reporting Act (FCRA) to discourage unfair credit reporting practices. Some of the key protections and rights the FCRA provides include:

- Credit reporting time limits on negative information

- The right to dispute inaccurate information on a consumer report

- Limitations on who has permission (or “permissible purpose”) to access your credit reports

- The ability to request a free report from a consumer reporting agency once every 12 months

- Free credit freezes

Essentially, the FCRA regulates what consumer credit reporting agencies can do with the information they collect about you. The law applies to the Big 3, as Equifax, TransUnion, and Experian are sometimes called. It also regulates other consumer reporting agencies that gather and sell your personal information.

And, as one would expect, the FCRA also defines what a credit score is and mandates their disclosure to consumers if they are denied credit or apply for a mortgage loan.

In 1974, Congress passed the Equal Credit Opportunity Act (ECOA). The Consumer Financial Protection Bureau describes the ECOA as a federal civil rights law that serves to protect consumers from lender discrimination. Thanks to the ECOA, lenders cannot discriminate against you based on any of the following:

- Religion

- Race or Color

- National Origin

- Sex or Gender

- Marital Status

- Age (If you’re old enough to sign a contract)

- Receipt of Public Assistance Income

If you apply for financing, lenders can’t use the information above to deny your application or charge you more (known as adverse approval) than they would otherwise.

With respect to the use of credit scores, the ECOA plays a gatekeeper role. For a lender in the United States to use a credit score, it must be both empirically derived and statistically and demonstrably sound.

In other words, the ECOA dictates that for a credit scoring system to be considered empirically derived, it must be calculated using sound scientific methods and be periodically revalidated.

FICO’s Credit Scores

Even after the passage of the FCRA and the ECOA, there wasn’t a uniform empirical credit scoring system for interpreting credit report data and evaluating risk. Credit evaluation was still largely manual and subjective in nature — varying from lender to lender.

For example, imagine a risk manager at a bank staring at a 20-page printed credit report trying to divine whether a consumer was going to pay his or her bills on time. And now imagine that the same risk manager has a stack of 1,000 of those to review. This was a problem that credit scoring would solve.

In the late 1980s, a groundbreaking change occurred. A company called Fair, Isaac and Company created a credit scoring algorithm designed to evaluate consumer credit report data through a consistent, automated, and unbiased process. It became commonly known as the FICO credit score.

FICO is the acronym for Fair, Isaac and Company or, more contemporaneously, Fair Isaac Corporation.

The FICO score’s purpose was and still is to empirically assess an applicant’s credit report data and predict how likely he or she is to pay a credit obligation 90 days late or later within the next 24 months. This is formally referred to as the scoring model’s performance definition or its stated design objective.

Applicants who are more likely to pay late score lower on FICO’s 300 to 850 scale. On the other hand, applicants with cleaner credit histories and other positive factors on their credit reports scored higher, indicating less credit risk.

Credit Score Usage and Options Expand

As time passed, FICO began to venture outside of its initial scoring models to create more specialized credit scores. By 1993, the company had introduced FICO scores that were used for the following industries:

- Installment Lending

- Bankcard

- Auto Lending

- Personal Finance

- Small Business Lending

- Mortgage Lending

In 1995, the use of FICO scores skyrocketed thanks to changes in the mortgage world. Both Fannie Mae and Freddie Mac began requiring lenders to use FICO scores on residential mortgage applications, and by the late 1990s, credit reports used for mortgage lending were scored using FICO’s scores.

And because Fannie and Freddie required that three credit reports be pulled per applicant, a joint mortgage application meant six credit reports and six FICO scores.

Over time, FICO continued to create newer generations of its credit scoring model (think Gen 1, Gen 2, Gen 3, etc.). FICO redevelops its models periodically to keep up with changes in consumer credit behaviors, which consequently became even more predictive of risk.

The score known as FICO Score 8, introduced over a decade ago in 2009, is the most used FICO score version today, although there is a FICO 9 and the FICO 10 Suite.

FICO’s scores are still the most widely used credit scores in the U.S. lending marketplace. Some 27 million FICO Scores are purchased each day. Furthermore, according to the company, 90% of top lenders use FICO scores in lending decisions.

Even though Fair Isaac paved the way for modern credit scoring, their scoring models don’t represent the only option available and the aforementioned 90% of lenders don’t use just FICO’s scores exclusively to make decisions. In fact, most sophisticated lenders use multiple scores and data points to make decisions, rather than just one.

As previously mentioned, the three major credit reporting agencies joined forces to create their own credit scoring platform in 2006 — the VantageScore credit score. Four generations of the VantageScore credit score have been made commercially available (VantageScore 1.0, 2.0, 3.0, and 4.0).

The first two VantageScore versions featured a score range of 501 to 990. VantageScore 3.0 and 4.0 feature the same 300 to 850 score range as FICO scores.

It is often and incorrectly reported that VantageScore is rarely used or that it’s not a real credit score. Not only is that patently false, but the exact opposite is true.

According to market research company Oliver Wyman, some 12.3 billion VantageScore credit scores were used between July 2018 and June 2019, which can hardly be referred to as rarely used. And, because they’re used in the United States by lenders, the score is also ECOA compliant.

The Rise of Consumer Permissioned Scorable Data

The way consumers use and manage their credit changes over time. How my father managed credit is different from how his grandchildren will manage their credit.

As a result, the way lenders evaluate credit risk needs to evolve to remain relevant and competitive. Adjustments in consumer credit behavior are the reason why companies like FICO and VantageScore will continue to release new scoring algorithms every few years.

Some of the newest innovations in credit scoring involve what’s called consumer-permissioned data. Historically, the accounts on your credit reports came from financial services related companies (banks, credit unions, debt collectors) that supplied information to the credit bureaus on a voluntary basis.

Recently, however, both Experian and TransUnion have introduced programs that let consumers give permission for other types of accounts to be added to their credit reports, which are also considered in their credit score calculations.

In 2018, Experian introduced a service called Experian Boost. You’ve probably seen their commercials. Boost is free and allows you to add certain video streaming (Netflix, Spotify, Disney+, etc.), utility, and telecom accounts to your Experian credit report as scorable entries. If you’re able to add these accounts to your Experian report, it may improve your FICO and VantageScore credit scores.

The average Experian Boost user improves their Experian FICO Score 8 by 13 points.

More recently, a company called eCredable rolled out a service called eCredable Lift. Lift similarly allows you to add utility-style accounts to your TransUnion credit report. Adding positive accounts to your TransUnion report may improve your FICO and VantageScore credit scores.

There is currently no similar option for consumer-permissioned data for Equifax.

How to Build Your Credit Scores

Hundreds of credit scoring models are commercially available and in use today. That includes all of FICO’s models, VantageScore’s models, and the unbranded custom models used by countless lenders. With so many credit score options, you may feel overwhelmed at the prospect of figuring out how all these complicated algorithms work.

What actions do you need to take to earn good credit scores? And do you need to manage your credit in a different way to maximize your points under each scoring model?

Truth be told, you’ll never be able to keep up with hundreds of scoring models, most of which you’ll never encounter. But managing and tracking all those numbers is entirely unnecessary. It’s the information on your credit reports that truly matters because it is the basis for all of your credit scores.

If you want to earn and maintain solid credit scores, you need to focus on your credit reports. Positive credit management will always benefit you, regardless of the credit score brand.

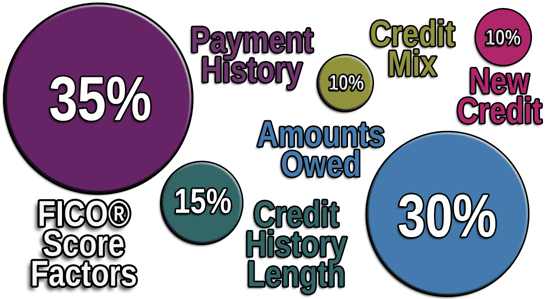

You should also avoid credit mistakes that work against you. Derogatory information, including collection accounts, charge-offs, late payments, repossessions, and bankruptcies, can lower your credit score. That’s why on-time payments are a must and so is keeping your credit card balance-to-limit ratio (a.k.a. your revolving credit utilization ratio, or how much credit card debt you owe) as low as possible.

If you can do those two things repeatedly, your scores will take care of themselves.

If you have no credit scores, that’s not a good thing. Having no score means you’re what the CFPB calls credit invisible. As such, it may help to establish some positive accounts.

Secured credit cards may be a good place to start if you have no credit or credit problems. Or you may ask a relative to add you as an authorized user to an existing, well-managed credit card account. Credit builder loans may also be worth considering as they too will result in positive information being added to your credit reports.

With any credit account, the key is to manage it well. The payment history and debt balances are worth roughly two-thirds of the points in your credit scores. Manage those responsibly and you’re well on your way to great scores.

At the risk of sounding like a broken record, watch out for the negative information. The FCRA allows the credit bureaus to maintain most negative information on your credit reports for up to seven long years.

Tracking Your Credit Scores

The FCRA makes it easy to claim your credit reports from Equifax, TransUnion, and Experian. Simply visit AnnualCreditReport.com.

Normally, you can download your free report from each credit bureau every 12 months. But because of COVID-19, all three credit bureaus are allowing free weekly credit reports from the same website.

You can check your credit reports for free on AnnualCreditReport.com.

You will also want to track your credit scores from time to time. With so many credit score options available, it’s unlikely that you’ll see the same exact score a lender would see when you apply for a loan, credit card, or other types of financing. But the scores you review could still help you get an idea of where your credit stands.

Even though they are different companies and different models, most of your FICO and VantageScore credit scores will be similar, meaning if you have good credit you’re going to have good scores. This means you can track the same credit score online over a period of time to see whether your risk level is improving or declining. Many lenders and some websites will give you free access to FICO and VantageScore credit scores.

The Bottom Line in 2024 and Beyond

Credit reporting and scoring are ever-evolving, though generally at a slow pace. History — starting in 1989, to be exact — has proven that some sort of credit risk-evaluation system is here to stay. As long as people want to borrow money, lenders will need ways to predict with whom it’s safe to do business, and who is unlikely to repay as promised.

When you work hard to earn good credit scores, you can reap wonderful rewards. This was true in 1989 and still is today.

Good credit can open the door to attractive financing offers, like attractive rewards credit cards and low-interest loans. Higher credit scores may save you money on your insurance premiums, utility deposits, and more. It’s worth the effort to learn how credit scores work so you can keep yours in tip-top shape.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.