Credit scores have been used by lenders in the financial services market in the United States for more than three decades. Your credit scores influence your ability to procure new credit and the terms and costs associated with loans and credit cards.

Accordingly, many consumers make it a priority not only to improve their scores but also to track their scores over time.

When your scores go up or improve, people reasonably tend to be happy about the result. But when scores go down, people tend to be unhappy about it and wonder, “Why did my credit score drop?”

Credit Scores Don’t Move Up or Down

Because your credit scores — and you have many of them — are not a permanent part of your credit reports, they don’t dynamically move up and down over time.

Many people think their scores move like the mercury in a thermometer measures temperature, constantly going up and down as the temperature changes. But your scores don’t move up or move down like the mercury in an old-fashioned thermometer.

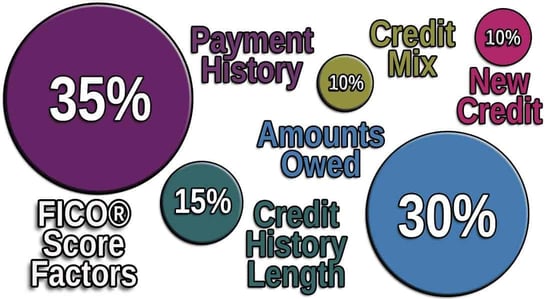

When your scores are calculated, they are based on a snapshot of your credit report at that point in time. FICO scores are calculated using the following factors:

If your scores are calculated again a month later, they will likely be different. This gives the impression your scores moved from one three-digit number to another different three-digit number. Because your credit report data was different across the two points in time, your scores were also different.

For example, let’s say one of your FICO scores was 750 on March 15 and 700 on April 15. This gives the impression your FICO score actually moved downward, from 750 to 700. As in, it moved from 750, passed downward through 740, 730, 720, 710, and then landed on 700.

No, this isn’t what happened. It was 750 in March and then 700 in April when it was calculated the second time.

But Why Are My Scores Lower?

If you track your scores and notice they are getting lower over time, there is always an explanation. Scores change because the data on your credit reports change.

If the data on your credit reports change and those changes are indicative of elevated credit risk, your scores are going to be lower the next time they’re calculated. Credit scores exist to help lenders identify the risk associated with their customers and potential borrowers.

Some of the changes to your credit reports that lead to lower scores are going to be blatantly obvious. Other changes are going to be less obvious, and some are going to be a straight-up mystery.

- Blatant Reasons: Missed payments, defaults, bankruptcy, and other negative personal finance events are going to end up on your credit reports. These are examples of changes to credit reports that are likely to lead to lower scores.

- Less-Obvious Reasons: You ran up a larger than normal balance on a credit card because you needed new tires for your car. It’s the Christmas shopping season, and you opened a few retail store credit cards at the mall to get the 15% discount, and now you have new credit card inquiries on your credit reports. These are the types of changes that can lead to lower scores, though the changes aren’t considered derogatory in nature.

- Mystery Reasons: You had your name added as an authorized user to a credit card account that was opened a few months ago, so the average age of your accounts went down. You got divorced, and your ex-spouse didn’t make payments on joint accounts that were opened when you were still married, and now you have late payments on your credit reports. These are the types of changes that can lead to lower scores.

Credit Scores Are Not A Part of Your Credit Reports

Your credit scores are not a permanent component of your credit reports. Credit scores are an ancillary product sold with your credit reports as an optional upgrade.

The best comparison I can think of is when you’re shopping for a car and you have the option to add leather seats, a sports package, or an upgraded audio system. These are options that do not come with the car and cost extra.

This is how credit scores work relative to credit reports. The credit report is the data, and the credit scores can be purchased by lenders along with the credit reports. This is so common that people reasonably think all credit reports come with credit scores, which is incorrect.

You may have noticed this in practice when you claim your free credit reports from AnnualCreditReport.com. Credit scores are not part of the freebie.

That’s because the Fair Credit Reporting Act gives you the right to free credit reports but not to free credit scores. And because a credit score isn’t a part of your credit report, what you claim does not include any scores.

What Can I Do?

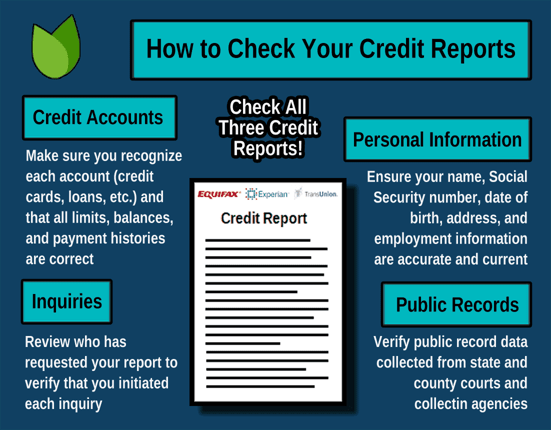

Because changes to your scores are always the result of changes to your credit reports, the best and most effective way to identify and address decreases in your scores is to regularly check your credit reports.

There is also no shortage of places where you can get free credit scores. In fact, many lenders and credit card issuers participate in FICO’s Open Access program, whereby you can see the same FICO score your lenders have access to for their account management processes.

In sum, regularly checking your credit reports and scores is always going to be the best way to determine whether your credit is in good standing and, if it’s not, what work needs to be done to yield improvements.