Even if you have bad credit, it is still possible to find credit cards with easy approval and relatively high credit limits. These products may be hard to spot, so we’ve rounded up a list of unsecured, secured, and business credit cards you can obtain without working up a sweat.

Even if the major credit card issuers have deemed you unworthy, you can qualify for a perfectly respectable card with enough credit to make a big-ticket purchase or two. Eventually, when you work yourself back into good credit, you’ll fondly remember the modest credit cards that helped you when you needed them most.

Easy-Approval Unsecured Cards With High Limits

These credit cards do not require a security deposit, offer easy approval, and have credit limits of up to $1,000. They are the best credit cards for subprime consumers who prefer unsecured cards and need a reasonable spending limit.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

The Aspire® Cash Back Reward Card provides tiered rewards on all eligible purchases, making it one of the best cash back cards for subprime consumers. The card also offers transaction alerts and free credit scores. You can prequalify for this rewards card without impacting your credit score.

The card gives you 24/7 online access on any device. Merchants worldwide welcome this genuine Mastercard, a product of the Bank of Missouri. You can expect the card to arrive shortly after account approval.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 29.99% APR (Variable) | Yes | 8.5/10 |

The Surge® Platinum Mastercard® offers an initial credit limit of up to $1,000 that will double if you pay your bills on time. That’s pretty rare for an easy-approval subprime card. The issuer sets your initial spending limit based on your recent credit history.

The Surge® Platinum Mastercard® does not require you to prepay a setup fee. It does charge the first year’s annual fee as soon as you activate your account, reducing your initial credit limit. The monthly maintenance fee doesn’t kick in until the second year, and the issuer may reduce or waive it depending on your payment performance.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 8 minutes | 29.99% APR (Variable) | Yes | 8.0/10 |

The Reflex® Platinum Mastercard® offers an initial credit limit as high as $1,000, based on your credit profile. If you pay your bills on time, the issuer may offer a credit limit increase to a maximum of $2,000 within six months.

This card can help you rebuild your credit when you use it responsibly, and you will need a checking account to qualify. The Reflex® Platinum Mastercard® is a sibling of the Surge® Platinum Mastercard®, both products of Continental Finance Company.

Easy-Approval Secured Cards With High Limits

You’ll be interested in these options if you prefer an easy-approval credit card that collects a refundable security deposit instead of charging high fees. Your security deposit defines your credit limit, which in one case can reach $10,000, an astounding figure for a subprime card.

- 1% Cash Back Rewards on payments

- Choose your own credit line – $200 to $2000 – based on your security deposit

- Build your credit score.¹ Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 19.24% (V) | Yes | 7.5/10 |

The First Progress Platinum Select Mastercard® Secured Credit Card accepts refundable deposits of $200 to $2,000 that fully secure your credit line. If offers a flat cash back reward rate on all eligible purchases. This secured platinum card does not require a minimum credit score for approval and reports your payments to the three credit bureaus.

Triple reporting helps you rebuild credit efficiently if you pay your bills on time. The card provides a 25-day grace period, during which your purchases don’t incur interest. Paying your entire balance each month allows you to avoid interest charges altogether.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A | Yes | 9.5 |

With the Secured Chime Credit Builder Visa® Credit Card, you can have a credit limit of up to $10,000, based on the amount of money you transfer to the account. You don’t need a credit check to apply, just a Chime Checking Account with a qualifying direct deposit of $200 or more.

The card is ideal for building credit without nuisance charges other subprime credit cards charge. Unlike other secured cards, you can use the money you transferred to the account to pay your monthly charges.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

The OpenSky® Secured Visa® Credit Card allows you to deposit up to $3,000 with your credit limit equaling the amount you put down. The issuer can refund your deposit if you use the account responsibly over a set period. OpenSky does not check credit and approves around 85% of all applicants.

The card’s annual fee and APR are well below those for the average unsecured subprime card. The issuer reports to all three major credit bureaus to help you build credit history. Unlike most credit cards, this one does not require you to have a bank account.

An Easy-Approval Business Credit Card With High Limits

This card is rare, as most business cards require average or better credit. Even more unusual – the card is easy to obtain and provides high credit limits. Small business owners, take note!

7. First National Bank of Omaha Business Edition® Secured Mastercard® Credit Card

The First National Bank of Omaha Business Edition® Secured Mastercard® Credit Card offers a credit limit between $2,000 and $100,000 with a security deposit equal to 110% of your credit line. Other benefits of this card include:

- Earns interest on security deposit

- Provides discounts on QuickBooks and TurboTax

- Low $39 annual fee

This business credit card includes Mastercard Easy Savings, free management reports, and flexible cash flow management. It also supports balance transfers and includes auto rental insurance.

How Do Credit Card Limits Work?

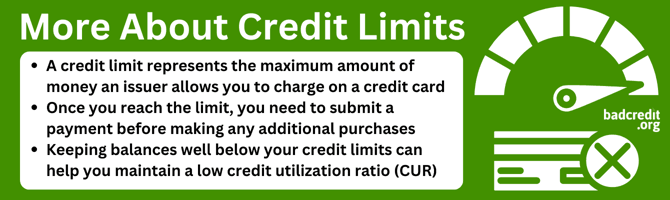

A credit card limit is the maximum amount of money that the card will let you charge. Issuers determine credit limits using various factors, including your credit history, income, and repayment ability.

When you make purchases with your credit card, the issuer subtracts the amount you spend from your available credit. For example, if you have a credit limit of $5,000 and make a $1,000 purchase, you’ll have $4,000 of available credit left.

Once you reach your credit limit, you must repay some of your balance before you can make additional purchases. Most cards won’t allow you to go over your credit limit. The card will usually decline any transactions that would cause you to exceed your credit limit.

Some cards offer overdraft protection, which allows a transaction to go through, but may result in penalty fees. Overdraft protection may enable you to automatically transfer funds from another account if you exceed your spending limit.

Secured cards set credit limits equal to your security deposit.

Charge cards (mainly from American Express) have no preset spending limits (NPSLs). You can spend freely with an NPSL card because you must repay the entire balance by the due date. American Express NPSL cards also give you a Pay Over Time option that does impose a credit limit.

You can ask the issuer for a higher credit limit, but approval depends on several factors, including your payment history, income, and credit score. Increasing your credit limit can improve your credit score by reducing your credit utilization ratio (CUR) which is the amount of credit used compared to the credit you are approved for. This works as long as you don’t go on a shopping spree with your additional credit.

Credit card issuers can also lower your credit limit if you’ve missed payments or your credit score or income has dropped significantly. A lower credit limit can increase your CUR and hurt your credit score.

Generally, you want to keep your CUR below 30% to avoid damaging your credit score. FICO, the dominant credit score system, prefers a CUR close to 1%.

How Do I Get a High-Limit Credit Card With Bad Credit?

Getting a high-limit credit card when you have poor credit isn’t easy. But here are a few suggestions to get the job done:

- Apply for a subprime card: Issuers design some credit cards for consumers with bad credit. These cards often have high fees and interest rates but may offer acceptable credit limits.

- Opt for a secured card: Secured credit cards require a cash deposit, which defines your credit limit. Some issuers will provide a credit limit increase without requiring an additional deposit if you consistently use the card responsibly.

- Improve your credit score: Improving your credit score is the most effective way to qualify for a high-limit credit card. You can do so by paying your bills on time and reducing your debts. This strategy frequently takes at least six months but can result in more favorable terms and interest rates.

- Add a cosigner: Having a cosigner with good credit can help you qualify for a higher credit limit. But this also means the cosigner is responsible for your debt if you can’t pay it. Unfortunately, many credit cards no longer accept cosigners.

- Opt for a card with a higher annual fee: Sometimes, cards with higher annual fees offer higher credit limits, even if you have less-than-perfect credit.

- Request a higher limit: After you’ve demonstrated your ability to pay your bills on time, you may be able to negotiate a higher limit with your credit card issuer. This strategy may also work when you get a raise or a new job with a higher salary.

The mechanics of applying for a high-limit card are no different from those for any other card. You submit an online application with the required information about yourself and your debts, income, housing costs, and employment. Most issuers will do a hard pull of your credit and give you a quick decision.

Some credit cards for imperfect credit — typically secured cards — do not check credit and are easier to obtain. Many cards offer to prequalify you without a hard credit inquiry, but remember, that prequalification does not guarantee final approval.

If you receive approval for a secured card, you must pay the deposit before the issuer will ship the card. The same is true for unsecured cards that charge a setup fee. Once you square away the payments, the card should arrive within 10 days.

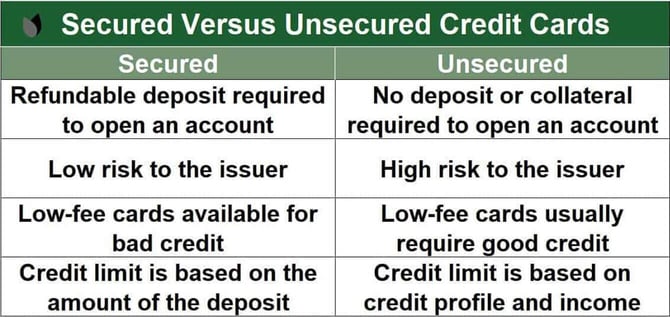

What Are the Differences Between Secured and Unsecured Credit Cards?

The chief distinction between the two types of cards is the mandatory deposit that secured cards require. They also have several other important differences.

Secured Credit Cards

A secured credit card offers easy approval and may even omit the credit check. Instead, you deposit a refundable sum that matches the card’s credit limit.

For example, you can submit up to a $1,000 security deposit when you sign up for a secured card with a $1,000 credit limit. The bank holds your money in escrow until you close the account or the issuer promotes you to an unsecured card. At that point, you’ll receive a refund for the total amount of your deposit — minus any fees or unpaid balances.

Your deposit is not a payment — you still must pay some or all of the balances you charge on the card. Your monthly minimum payment amount depends on your current balance.

Secured cards offer some advantages over their unsecured counterparts, including the following:

- Refundable deposits: Imagine a scenario where you can choose between a secured credit card and a subprime unsecured card. The secured card requires you to submit a $200 deposit but waives most other fees. Compare the secured card to an unsecured one with a $200 credit limit that charges a one-time setup charge of $99 and a $79 annual fee. That’s $178 in fees that have already taken up most of your balance, whereas the secured card will eventually refund your $200 deposit.

- Higher credit limits: Most secured credit cards allow you to bump up your initial deposit to support a higher credit limit, sometimes as high as $10,000 — or considerably higher for a secured business card. Those high limits are virtually impossible to obtain with a subprime unsecured card, which may cap your credit line at $2,000. Occasionally, a secured credit card issuer will raise your credit limit without an additional deposit. But more often, the issuer will refund your deposit, making you the owner of an unsecured card.

- Lower costs: You may prefer a secured card to a subprime unsecured version to minimize your bank credit card fees and interest charges. A secured card’s deposit reduces the issuer’s risk of loss, allowing it to impose fewer fees and charge a lower APR. Very few secured cards charge a setup or monthly maintenance fee, and secured cards typically have interest rates several percentage points below those of their unsecured counterparts.

- Better perks: Some secured cards offer cash back or points. Most subprime unsecured cards do not offer rewards.

- No credit check: Your security deposit is a substitute for a good credit score. That’s why Issuers will almost always approve applications for secured cards. Most do not check your credit, and applying does not impact your score.

Secured cards have most of the same benefits that you’d expect from unsecured cards. Merchants treat them the same, you can carry balances from month to month, and you can rebuild credit through timely payments because the card issuers report your payment history to the three major credit bureaus.

Unsecured Credit Cards

Unsecured credit card issuers don’t take collateral, and you can’t make a security deposit to enhance your chances of approval. The lack of collateral requires issuers to take extra measures to guard against cardmembers defaulting on their accounts. As a result, you’ll have trouble finding a subprime unsecured card with a credit limit greater than $2,000, and the card’s APR may be close to the 36% maximum.

Many issuers that offer unsecured credit cards for bad credit provide a small initial credit limit, typically $200 to $300. Some cards, including the Surge® Platinum Mastercard®, will start qualified applicants off with a credit limit of $300 to $1,000.

Unsecured cards often include higher interest rates, an annual fee, setup fees, monthly service fees, and other charges. Issuers reduce the risk of losing money by imposing these extra costs when they extend credit to subprime consumers.

Unsecured cards for poor credit usually don’t offer consumers the best deals. Issuers must protect themselves from defaults, so subprime unsecured cards have several disadvantages, including the following:

- Low credit limits: Your initial credit limit may start at only $200. Issuers set a low limit to minimize the losses from cardmember defaults. Eventually, you may see your credit limit grow if you pay your bills on time and keep your unpaid balances relatively low.

- High interest rates: Subprime unsecured cards typically charge APRs in the 25% to 36% range. These rates can be hard on your budget, but you can avoid interest charges by paying your entire balance by the monthly due date. And you should avoid the few cards that charge interest starting on the transaction date.

- Fees, fees, fees: All cards, even those for excellent credit, routinely charge for cash advances, balance transfer transactions, and overdue payments. But some unsecured cards for imperfect credit may add fees for subprime consumers. These fees cover the one-time setup, monthly maintenance, extra cards, and even credit limit increases.

- Puny perks: Many subprime unsecured cards offer minimal benefits. They seldom pay rewards on purchases or offer signup bonuses or 0% introductory APRs. Some cards provide little more than fraud protection and free credit monitoring.

- Hidden costs: A few subprime cards bury fees in the cardmember agreement’s fine print. For example, we know of at least two cards with no grace periods, meaning you immediately incur interest on purchases. Another sneaky cost is the fee for credit limit increases. Some cards charge up to 25% of each credit line increase.

Consider taking a personal loan if you need $2,000 but can’t afford the security deposit. These loans don’t provide the revolving credit you get from a credit card. They instead lend you a lump sum that you repay in monthly installments. Personal loans report payments to at least one credit bureau, so you can still build some credit by paying on time.

How Do I Select the Best High-Limit Card For Subprime Credit?

First, decide whether you want a secured or unsecured card. You’ll have better luck getting a high credit limit if you choose a secured card.

Compare cards based on their costs and benefits. On the cost side, secured card APRs are relatively low, but you can typically avoid interest on any card by paying your entire balance each month. Avoid cards with high fees, especially setup and monthly maintenance charges.

Regarding benefits, look for cards that offer cash back rewards on eligible purchases. A signup bonus or 0% intro APR is a definite plus, but hard to find. You may prefer cards with specific features, including rental car insurance or a $0 annual fee.

Which Credit Cards For Bad Credit Give You a $5,000 Limit?

Among the personal credit cards reviewed above, only the Secured Chime Credit Builder Visa® Credit Card can offer a $5,000 limit. In fact, you can set the limit at $10,000 if you are willing to make a matching deposit. Several other cards can offer a $2,000 to $3,000 credit line.

Business credit cards can provide the highest credit lines. Consider one of these if you are self-employed or own a small business and need a high-limit credit card.

What Are the Pros and Cons of High-Limit Cards For Consumers With Poor Credit?

A high-limit credit card for consumers with poor credit offers a mix of advantages and disadvantages. Here’s a rundown of the pros and cons.

Pros

A high-limit credit card is attractive for several reasons:

- Increased spending flexibility: A higher credit limit provides more credit for necessary or unexpected expenses, which can be helpful during emergencies.

- Potential for credit score improvement: A high limit can help you keep your credit utilization ratio low. Using only a small percentage of your available credit can improve your CUR and credit score.

- Opportunity to consolidate debt: You can use a high-limit card to consolidate other high-interest debts via balance transfers. These transfers can simplify payments and reduce interest expenses if you move your balances to a credit card with a lower interest rate. A balance transfer fee applies to each transaction.

- Rewards and benefits: High-limit credit cards often have rewards programs, cash back offers, and other perks. But these benefits come primarily from cards for consumers with good credit.

- Business and travel use: A high-limit card can help you manage sizeable expenses more efficiently, especially if you travel frequently or own a business.

Some of the cards we’ve reviewed offer these advantages.

Cons

It may not be initially apparent, but high-limit cards can have a few negatives:

- Risk of overspending: You may face the temptation to spend more than you can afford when you have a high-limit credit card, especially if you have poor financial habits or lack discipline.

- Potential for increased debt: You may accumulate debt you can’t easily repay, which can only worsen your credit situation.

- Higher interest payments: Subprime cards often have high interest rates. You’ll end up paying significantly more interest if you frequently carry a balance across multiple billing periods.

Adverse impact on credit score: Overspending may cause you to max out your high-limit card and increase your credit utilization ratio, which can harm your credit score. - High fees: High-limit credit cards for consumers with lousy credit often impose higher costs, including annual, late, setup, and maintenance fees.

- Difficulty in qualifying: Qualifying for a high-limit unsecured card is generally more challenging when you have bad credit. You will have better results with a secured card, but you’ll have to put down a large deposit.

The positives of a high-limit card outweigh the negatives, but only if you have the discipline to use the card responsibly.

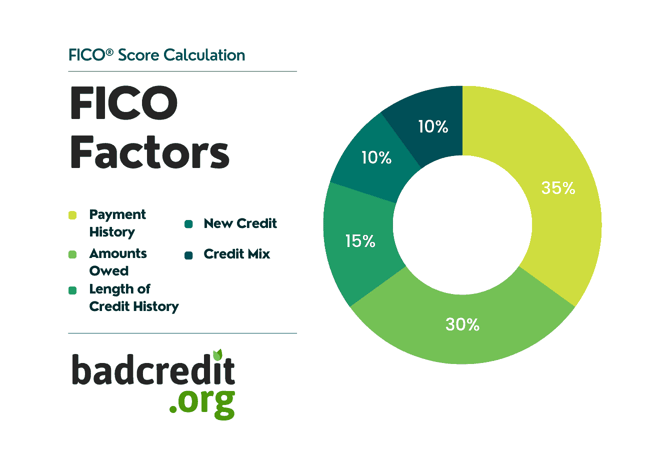

How Can I Use a Credit Card to Improve My FICO Score?

You can use your credit card to improve your FICO Score in several ways, starting with timely payments. On-time payments account for 35% of your FICO score, so consistently paying your bill on time will drive your score higher over time.

To ensure your payments arrive on time, use a bill pay system through your bank or a personal finance app, such as Quicken. The payment will automatically apply to your bill on a fixed day each month. Autopay ensures your payments will post on or before the due date.

If you forget about a bill and haven’t implemented autopay, immediately contact the credit card issuer and explain the problem. Call promptly because delinquencies don’t appear on your credit reports until they are 30 days past due. Ask the issuer to keep the delinquent payment from appearing on your credit report. You may get the issuer to waive the late fee if it is your first missed payment.

Another 30% of your FICO score stems from the amount of money you owe. The difference between your unpaid credit card balances and their credit limits — per account and in the aggregate — is your credit utilization ratio and strongly influences your credit scores.

Ideally, you can pay your entire balance each month, but sometimes you need to finance purchases over multiple periods. You should keep your credit utilization ratio at no more than 30%. FICO wants to see a CUR as close to 1% as possible.

Try to reduce your unpaid balance within a few months. Your CUR will improve with each large payment — made on time, of course. Eventually, it will return to the safe zone, which can help boost your credit score.

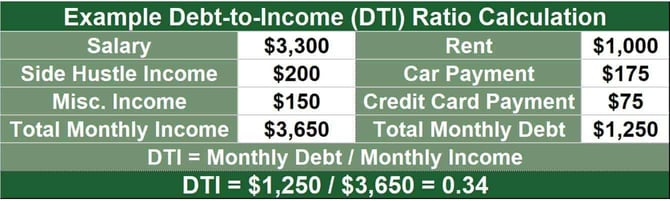

Reducing your debt will also decrease your debt-to-income (DTI) ratio. Creditors generally want to see a DTI ratio no higher than 36%, although some exceptions exist.

Issuers may calculate credit scores before you have a chance to repay your balances in full. To prevent this from happening, either pay your credit card bill immediately or make a couple of payments throughout the month.

Other steps you can take to support your credit score are:

- Keep old credit accounts open to preserve your average credit account age

- Refrain from applying for new cards more than once every six months to avoid too many hard credit inquiries

- Increase the mix of credit card types you own

A broad mix of loans and credit cards tells FICO you can manage your credit in various situations.

What If the Credit Card Company Rejects My Application?

Sometimes, an issuer will reject your credit card application even if it prequalified your request. When this happens, the issuer will send you an Adverse Action Notice (AAN) if it used your credit history to help make its decision.

The AAN explains why the issuer denied your application and the next steps you can take. An AAN can be a valuable resource because it tells you how to ensure your next credit card application succeeds.

You can also consider becoming an authorized user of another person’s credit card. As an authorized user, you will receive a credit card with your name, even though you are not legally liable for the account.

The owner’s credit card and payments will appear on your credit report. As long as the account owner pays the bills on time, you and the owner will both receive favorable reporting to build your credit scores.

Once your scores rise enough to qualify for your own credit card, you can use it to build credit further.

Don’t Let Bad Credit Keep You From a High-Limit Credit Card

Don’t be discouraged by the idea that your crummy credit will keep you from getting a high-limit credit card. Several options exist, and we’ve shown you where to apply for the right one.

We recommend you start with a secured credit card because it is easy to qualify for, will save you money in the long term, and gives you a chance to raise your credit scores. Eventually, you’ll be ready for an unsecured card, hopefully one for fair credit or better, and sporting a high credit limit.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.