Bad credit loans in Florida aren’t as hard to find as you may think. But to find the most affordable loans, you may have to look at online lenders outside of the Sunshine State.

So much competition currently exists within the online lending industry that consumers can often find loans with fair interest rates and fees despite having a bad credit score. And if you live in Florida, you may qualify for a loan that can provide same-day approval and funding within one business day.

Whether you’re looking for a cash loan, an installment loan, or a loan to purchase a vehicle or home, we have you covered with the best options for every Florida man or woman.

Bad Credit Cash Loans in Florida

A cash loan typically has a short loan repayment term and is for smaller loan amounts. This is a great loan option if you need quick cash to cover a small, unexpected expense or to get you to your next paycheck.

The lending networks below all submit your single loan request to several partner lenders that can then compete for your business. This can net you multiple loan offers to choose from with quick approvals and funding after you formally apply.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

We’ve recommended MoneyMutual for a long time because the network partners with a diverse group of lenders that consider loan applications from just about any borrower. These short-term loan offers typically come with a monthly payment and competitive interest rate and repayment term.

And since MoneyMutual is available to residents in every state except New York and Connecticut, Floridians can enjoy a quick loan request process and even faster approvals and processing.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

InstallmentLoans.com maintains an online lender network that provides bad credit personal loan options with smaller loan amounts and shorter repayment term obligations. This is a great choice for a small, short-term emergency loan with affordable rates.

The quick turnaround on these loans makes them ideal if you don’t have a lot of time to hassle with long applications and underwriting processes. Instead, you can wrap up your loan in less than one day and have money in your account when you wake up the next morning.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan claims that it’s helped hundreds of thousands of consumers find loan options despite having a bad credit score. The lenders that partner with this network consider applications from consumers with any credit history.

If you qualify, you can extend your loan terms to lower your monthly payment to fit your budget. The affordability alone makes a personal loan a tremendous option for borrowing money without overextending yourself financially.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% - 2,290% | Varies | See representative example |

CashAdvance.com offers a short-term loan option that requires repayment in full — including interest — within seven to 31 days. Also known as a payday loan, this type of loan is intended to bridge the gap between paydays.

In addition to this online network, you can find cash advance loan centers throughout Florida. Although these loans are convenient and may not require a credit check, they’re very expensive and can lead to substantial debt if you don’t repay your loan on time.

Bad Credit Personal Loans in Florida

A bad credit personal loan can usually offer you a larger loan amount and a longer repayment term than the cash loan options listed above. A personal loan is also referred to as an installment loan because it allows you to repay your debt over time with a series of monthly payments, or installments.

And just like the cash loans above, Florida residents can apply online with the lending networks listed below and receive same-day approvals and next-day funding in most cases.

5. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% – 35.99% | 12 to 60 Months | See representative example |

Avant partners with WebBank to issue loans to borrowers in Florida and elsewhere. Its minimum loan amount is on the higher side, but if you’re 18 years old, make at least $800 per month, and have a 550+ credit score, you can fill out the prequalifying form to see what you may be offered.

You can use the loan for any purpose, and approval decisions are made in real time. You could have up to five years to repay your loan.

6. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% – 35.99% | 3 or 5 Years | See representative example |

Upstart can approve Floridians for loans as high as $50,000, though borrowers with bad credit are unlikely to be approved for the highest amounts offered. Upstart uses AI underwriting to match borrowers with lenders in a way that increases approval rates by as much as 44% compared to traditional lending models.

All loans offered are within the 36% maximum APR under the Military Lending Act, so you don’t have to worry about predatory lending rates that some short-term lenders charge.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% - 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group can help both consumers who have good credit and those who need bad credit financing. That means your application will only go to the lenders ready and willing to work with you.

That’s important to note because you’ll only waste your time if you submit applications to lenders who are not willing to work with you. Instead of researching each lender’s qualification criteria, this network does the work for you.

8. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

CashUSA.com can connect you with an online lender network that specializes in special finance for consumers who have bad credit. That means you’ll work with a loan officer who understands your needs and is motivated to find a subprime loan for you.

The CashUSA.com network is open to residents of all 50 states and accepts loan requests from Floridians in any county. If approved, you could have cash in your account within one business day.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

As you may expect, Bad Credit Loans specializes in finding loans for consumers who have trouble obtaining approval from a traditional lender. As a result, your bad credit score may not keep you from finding the bad credit financing you need.

If you qualify for a loan, you may receive up to 60 months (five years) to repay the debt. Not every loan offer will include a repayment time frame this long — smaller loans typically have shorter repayment terms.

Bad Credit Auto Loans in Florida

A car loan is an important part of your financial portfolio. Not only does it improve your credit mix, but it also gives you access to reliable transportation that you can use to make a living.

With the auto lending networks below, you can connect with a private lender or local dealer in your area that specializes in finding bad credit car loan options for just about any borrower. In most cases, you can apply and purchase your new or used car on the same day.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

Auto Credit Express partners with new and used car dealers throughout the U.S. to help car buyers who need to find a loan. Whether it’s in-house or private financing, most dealers can find the loan you need within a matter of hours.

Once the dealer contacts you — which typically happens shortly after you submit your loan request — you can schedule an appointment to go over each car-buying and financing option available to you. If all goes well, you can drive off in your newly purchased vehicle that same day.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.com claims that its network can give you loan preapproval in three minutes or less, which allows you to immediately begin shopping for your next automobile. That’s because Car.Loan.com has the largest online network of auto dealers trained in special finance arrangements for bad credit consumers.

The network indicates on its website that once you submit a loan request, you’ll hear back from a local dealer within 24 hours — though many applicants get a call or email from a dealer within a matter of minutes. That dealer will walk you through the rest of the process needed to purchase your vehicle.

12. myAutoloan.com

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

MyAutoLoan.com doesn’t just provide access to new and used car loans. This vast lending network also includes private lenders that consider applications for auto refinance loans and lease buyouts.

Once you submit your short loan request, you could receive up to four loan offers, each with a different loan term, interest rate, and monthly payment. This network’s lenders will consider your financing request regardless of your credit history.

Bad Credit Home Loans in Florida

If your low credit score is preventing you from obtaining a conventional loan to purchase a home, consider a government-backed loan program that’s designed to help consumers purchase a home with less money down and provide an affordable monthly payment.

The bad credit home loan options below can help you find a VA, HUD, or FHA mortgage loan that may help you get into your new home faster than you’d expect.

13. Rocket Mortgage

- America's largest mortgage lender

- The entire process is completed online

- Options for new mortgages and refinancing existing mortgages

- Award-winning customer service and cutting-edge digital platforms

- More than 90% of clients would recommend us

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

The FHA Rate Guide is the largest direct lender of home loans in America. This company helps connect home buyers with the best mortgage option for their needs.

This may include government-backed loans that only require a small down payment with forgiving minimum credit score requirements.

- Easy to OwnSM programs give options for those with lower income, limited credit history, and low down payment needs.

- Provides the potential for minimal out-of-pocket expenses with seller contributions.

- Offers loans that don't require monthly mortgage insurance.

- Requires less cash upfront for your down payment and closing costs.

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1852 | 6 Minutes | 8.0/10 |

Wells Fargo Home Mortgage is one of the nation’s largest mortgage lenders. It’s also one of the only national banks that approve loans for manufactured or mobile homes.

And since Wells Fargo allows you to apply for a mortgage online, you can get the ball rolling toward purchasing your new home without even visiting a bank branch. Even if you don’t have a physical bank location in your area, you can still qualify for a mortgage from Wells Fargo.

- Loan programs include down payment and closing cost assistance.

- Variable and Fixed-Rate loans available with flexible qualification guidelines.

- Up to 100% financing—with as little as zero down payment for qualified borrowers.

- No maximum income/earning limitations.

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2008 | 5 Minutes | 7.0/10 |

Bank of America is one of the most popular banks in the U.S., so it’s only logical that Bank of America Mortgage would also be a top destination for mortgages and refinancing loans with affordable interest rates and repayment terms.

Through Bank of America, you can apply for a government-backed FHA loan, HUD loan, or VA loan that makes it easy — and more affordable — to get into your new home without a large down payment.

What is a Bad Credit Loan?

A bad credit loan is a financial product that lends money to someone who has previous mistakes on their credit history and a resulting low credit score. A bad credit loan can be a personal loan, a hard money loan, or a small business loan.

You can also find a bad credit car loan, a bad credit student loan, or a bad credit home loan that may allow you to make a large purchase and repay the debt over time.

The lender or loan officer you work with to complete your bad credit financing will provide you with an interest rate, a loan term, and a monthly payment schedule. Study every loan offer you receive before choosing which loan to accept.

You may also see various fees attached to your loan, such as an origination fee, a processing fee, or an application fee. Not every loan will include these charges, but they can add up quickly and make your loan more expensive over the long haul.

What Credit Score Do I Need to Get a Loan?

There typically is no minimum credit score requirement for a loan, but each lender has different rules it sets for approval.

A general rule of thumb is that the larger the loan, the harder it is to qualify. That’s why you’ll have more difficulty being approved for a bad credit home loan than you would a bad credit personal loan.

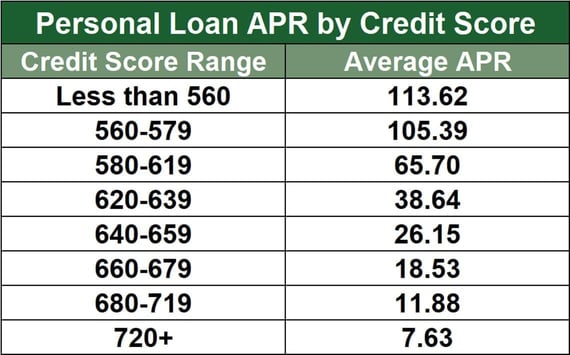

You may also find that the fees associated with your loan, including the interest rate you receive, increase as your credit score decreases. This is how lenders offset the risk associated with bad credit loans.

If you’re concerned that your low credit score may keep you from qualifying for a loan, you can attempt to prequalify with a soft credit pull that will not harm your credit score and will give you a better idea of your chances of approval if you decide to apply.

Not all lenders provide this service, so be sure to check with the lender before you apply to see whether they offer prequalification.

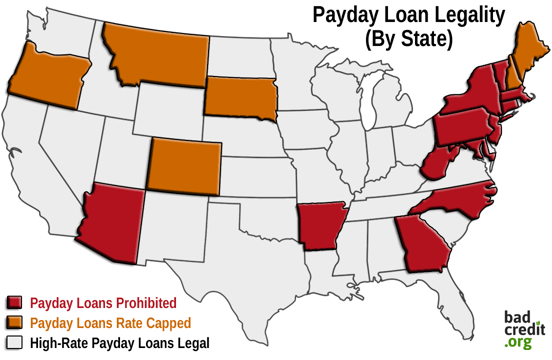

Does Florida Permit Payday Loans?

Florida state law allows payday loans of up to $500. A borrower can accept a Florida payday loan with a repayment term of seven to 31 days with a maximum finance charge of 10% for every $100 borrowed (plus a verification fee of no more than $5) and a 304% APR.

Florida’s terms are slightly more favorable than the national average, which typically requires approximately $15 in finance charges for every $100 borrowed.

What’s the Difference Between a Secured Loan and an Unsecured Loan?

A secured loan requires collateral for approval, whereas an unsecured loan only requires your signature on a legally binding loan agreement to guarantee repayment.

Common secured loan types include an auto loan, a pawnshop loan, or a title loan. These loans use your vehicle or other valuable items as security in case you default on your loan. If that happens, the lender can repossess your vehicle or keep your pawned valuables and sell them to recoup the money lost in the bad loan.

These loans often come with terms that heavily favor the lender and may cost substantially more than a conventional loan. This means it’s in your best interest to research unsecured loan options before you accept or apply for a secured loan.

In-Person Options for Bad Credit Loans in Florida

Handling your finances online is an easy way to do business, but applying for a bad credit loan might be one of those times when it pays to speak face-to-face with an expert. Loans aren’t always just about numbers, and for all the conveniences of online transactions, nothing is more streamlined than an actual conversation.

You’ll have the chance to make your case by explaining the financial challenges that led you to a visit. And if either you or the loan officer has further questions, it’s a no-brainer that you’ll get them answered much more quickly and efficiently.

Here’s a list of bad credit loan office locations throughout Florida:

BMG Money

444 Brickell Ave #250

Miami, FL 33131

Mariner Finance

11160 Beach Blvd #131

Jacksonville, FL 32246

Mariner Finance

11218 W Hillsborough Ave

Tampa, FL 33635

InstaLoan

5540 W Colonial Dr

Orlando, FL 32808

ACE Cash Express

500 34th St S

St. Petersburg, FL 33711

Advance America

2221 S Monroe St

Tallahassee, FL 32301

OneMain Financial

1393 NW Saint Lucie West Blvd

Port St. Lucie, FL 34986

Fairview Lending

1425 Del Prado Blvd S

Cape Coral, FL 33990

OrangeFi

501 E Las Olas Blvd #300

Fort Lauderdale, FL 33301

Advance America

1735 N Federal Hwy Unit 103

Hollywood, FL 33020

ACE Cash Express

806 NE Waldo Rd

Gainesville, FL 32641

OneMain Financial

4901 E Silver Springs Blvd #308

Ocala, FL 34470

InstaLoan

2800 Creighton Rd

Pensacola, FL 32504

The Money Stop Center

4120 Cleveland Ave B2

Fort Myers, FL 33901

OneMain Financial

4298 Bee Ridge Rd

Sarasota, FL 34233

Advance America

4700 Babcock St NE Ste 22

Palm Bay, FL 32905

Advance America

1352 W International Speedway Blvd

Daytona Beach, FL 32114

Mariner Finance

2905 N Military Trl Ste. A

West Palm Beach, FL 33409

Advance America

1283 Ariana St

Lakeland, FL 33803

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.