A soft pull is great for making taffy and for checking your credit. In the latter context, a “pull” is lingo for when someone requests a copy of your credit report from a credit bureau, otherwise known as an inquiry.

A soft pull is a background check of your credit that won’t damage your credit score. However, hard pulls are treated as attempts to get new credit accounts or loans and have a negative impact on your score.

Read on to learn more about the differences between hard and soft pulls, and our recommendations for six of the best soft-pull bad credit loan companies.

The Following Companies Use Soft Pulls to Find You a Loan

The following six loan-matching companies find loans for consumers, but do not issue loans. Instead, they prequalify applicants by gathering information through a short loan request form.

They may also submit a soft pull that won’t damage your credit score. In contrast, the direct lenders recommended by these six loan companies may run a hard credit check or no credit check at all.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual works with a network of direct lenders who compete for your business. You can be forwarded to a direct lender that provides loans from $250 to $2,500.

If approved, you can access your money in as little as 24 hours. Your lender will explain the interest rate and repayment terms before you accept the loan.

2. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

CashUSA.com does a soft credit inquiry on all potential borrowers. It can match you to a lender for loans of up to $10,000. You must have a reliable monthly income of at least $1,000 to qualify.

If approved by the direct lender, you may be able to access your loan proceeds as soon as the next business day. Loan payback periods run from three to 72 months.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan can connect you to a lender offering loans from $250 to $5,000. The company has facilitated loans to more than 750,000 borrowers since 1998.

It boasts a user-friendly website that includes a personal loan calculator for estimating your monthly payments. If you qualify for a loan, your direct lender will set the loan terms.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

Bad Credit Loans has been finding lenders for consumers since 1998. It may perform a soft credit pull but also provides the option for arranging no-credit-check loans.

Bad Credit Loans maintains simple prequalification requirements to allow almost all consumers to prequalify for a loan. Loan durations vary from three to 60 months.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com offers to arrange loans from $1,000 to $35,000. Typical loan durations range from three to 72 months.

Lenders on the PersonalLoans.com network can quickly approve and fund your loan as soon as the next business day. PersonalLoans.com does not make credit decisions or determine loan terms.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% - 2,290% | Varies | See representative example |

The CashAdvance.com arranges short-term loans of $100 to $999 without checking your credit and has been doing so since 1997. The direct lenders on the CashAdvance.com network may perform a hard pull, a non-traditional credit check, or no credit check.

If approved, the lender will deposit your cash into your checking account as soon as the next business day.

Can I Get a Loan without a Hard Inquiry?

It’s possible to get a loan without a hard inquiry, but it’s unusual. A no-credit-check loan is advantageous for consumers with bad credit or no credit history. To be sure, you should determine in advance whether the lender offers no-inquiry loans.

None of the loan-matching services reviewed above perform hard credit inquiries. However, they are not lenders and do not control whether the lenders they recommend will perform hard credit pulls.

Most, however, allow you to apply for a no-credit-check loan that guarantees you’ll avoid a hard pull.

Some of the lending services favor lenders who will not perform hard check credits. For instance, CashAdvance.com says its lenders typically do not make credit inquiries to the three major credit bureaus and that some lenders may conduct non-traditional credit checks.

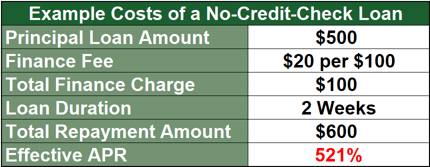

While a no-credit-check loan offers consumers additional access to credit, you should expect that the APR on these loans will be near or at the maximum rates charged by the lender. The high rate compensates the lender for assuming the perceived repayment risk associated with some folks who want to avoid credit inquiries.

What Do Soft Credit Checks Look for?

A soft credit check is usually done without your knowledge or your request for new credit. The typical information requested via a soft credit check comprises reviews of your credit score or history by:

- Landlords and potential landlords. The purpose is to help landlords differentiate you from competing applicants. A good review can help you snag a great apartment, while a bad review may scuttle your chances.

- Lenders and creditors with whom you already have an existing loan, credit card, or line of credit. These credit checks aren’t requested by the consumer. They are performed for various reasons, such as when the creditor evaluates whether to offer you a better credit card, to increase your credit limit, or to maintain your current loan.

- Insurance companies. Before an insurance company offers you a life, health, or an auto policy, it may want to review your credit history and score.

- Preapproved credit offers. You may receive preapproved offers for credit cards and other credit products. These are unsolicited and therefore do not involve hard credit pulls unless you actually apply for the credit.

Remember, soft credit checks will not damage your credit score. A record of hard pulls remains on your credit reports for two years, which allows you to see who has been checking your credit.

Are Soft Credit Checks Bad?

Soft credit checks may be bad if your credit is bad in the sense that they may reduce your access to credit from worried creditors. However, soft checks won’t reduce your credit score and can help you get a lower APR if your score is above average.

Soft credit checks are important tools for lenders because they help determine which borrowers are less likely to default on their loans. From a societal viewpoint, soft credit checks help lenders allocate credit to the people who are most likely to repay it.

This efficiency helps reduce the prevailing interest rates, which would need to be higher if no attention were paid to the creditworthiness of borrowers.

Soft credit checks can help you get an apartment or a job. You can’t blame a landlord or employer for rejecting an applicant with a history of derogatory credit events.

On the other hand, if you have rebuilt your credit, a soft credit check can help you obtain an apartment or job, as well as an unsolicited credit card or a higher credit limit.

Hard credit checks can mildly hurt your credit score if you have too many within a short period. The damage is usually around five to 10 points and lasts no longer than a year.

However, if you have many hard pulls within a short period, you may experience much greater harm to your credit score. That’s because it may look like you are in financial distress when you are looking for multiple new sources of credit.

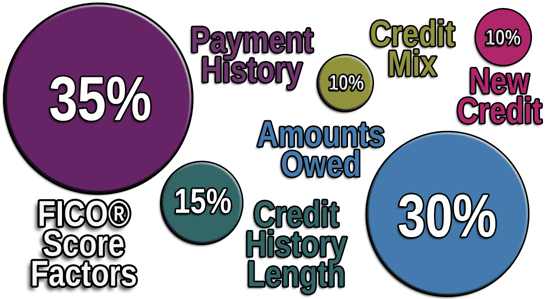

Ten percent of your FICO score accounts for new credit requests, and multiple hard pulls within a short period represent a greater risk to lenders.

However, the damage from multiple hard pulls is limited if you are rate shopping for, say, a mortgage or auto loan. When you are rate shopping, the credit bureaus give you a time period in which multiple hard pulls count as a single pull and thus do minimum damage.

Can I Perform a Soft Credit Check on Myself?

Yes, you can! In fact, every time you check your own credit is by definition a soft pull — you can’t hard pull yourself. Typically, you check your credit by requesting your credit history and score from one or more of the three major credit bureaus.

You are entitled to one free copy per year from each credit bureau. You can get them from AnnualCreditReport.com, the only source authorized by federal law.

You may have to pay for the FICO score maintained by a credit bureau. When you see offers for free credit scores, note that they may be alternative scoring systems. These are typically less important than your FICO score.

An important reason to regularly check your credit reports is to identify and dispute errors that may be hurting your credit score. Removing mistaken derogatory items can immediately improve your credit score. You can receive additional credit reports by subscribing to one or more of the three credit bureaus.

Soft Pulls are Generally Better than Hard Pulls

When it comes to pulling your credit report, soft is better than hard. We reviewed six loan matching companies that do not perform hard pulls when you request a loan. They may recommend you to a direct lender that may perform a hard pull, although you can specifically apply for a no-credit-check loan.

It’s always considered a soft pull when you check your own credit. That’s something you should regularly do to keep mistakes from hurting your credit score. Soft pulls from other parties can help you obtain a job, an apartment, a better credit card, or a higher credit limit.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.