Plastic surgery is big business in America. In fact, Americans went under the knife for nips and tucks to the tune of $16.5 billion in 2018. While insurance may cover plastic surgery required after an accident or debilitating disease, most procedures are not covered.

With average prices for common procedures ranging from $3,000 to $8,000 or more, many plastic surgery patients need financial assistance. Even if you have a low credit score, you can access plastic surgery loans for bad credit from the loan services reviewed below.

Loans | Alternatives | FAQs

Personal Loans For Plastic Surgery

The following four loan-matching services can help you arrange a plastic surgery loan despite having a bad credit score. Each utilizes a network of lenders that welcomes consumers with low credit scores or scant credit histories.

All offer convenient one-stop shopping and charge nothing for stitching you up with a lender. Eligible consumers must be a US citizen or resident, at least 18 years old, with a checking account, valid home/work phone numbers, and an email address.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% - 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group is a top lending network for large personal loans you can repay over time. If you can bring aboard a cosigner, you’ll likely receive better interest rates.

The direct lender you choose to work with will determine your loan payments and payoff term, but it’s free to compare offers, and there’s no credit check involved. This network has an Excellent rating on Trustpilot based on more than 2,200 reviews.

2. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

CashUSA.com can arrange bad-credit loans that range from $500 to $10,000 via its network of lenders. You can repay loans over three to 72 months in fixed installments.

To qualify, you must receive a post-tax income of $1,000 or more per month. If you’re eligible, you’ll be pointed to a lender that will specify the loan terms. As with all of these loan services, you can use your loan proceeds for any purpose, including plastic surgery.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

The CreditLoan lending network offers personal loans of up to $5,000 and repayment periods of up to 72 months. The recommended lender will specify the loan amount, interest rate, and other terms.

Your income must be at least $1,000 per month to qualify. Funding is quick, with the proceeds deposited into your checking account by the next business day. CreditLoan has assisted more than 750,000 consumers to acquire loans since 1998.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

Bad Credit Loans has been matching subprime lenders with bad credit borrowers since 1998. The lenders on its network will provide personal loans of up to $5,000 with repayment periods extending for as long as 60 months.

If you are approved, the lender recommended by Bad Credit Loans will provide the loan’s interest rate, monthly payment amount, and payback period.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com can arrange a bad credit loan of up to $35,000, repayable over periods as long as 72 months. To qualify, you need a regular income of at least $2,000 per month.

Uniquely, PersonalLoans.com facilitates network loans in all 50 states. The process is fast, with your medical loan proceeds available in your checking account as soon as the next business day.

Alternatives to Plastic Surgery Loans For Bad Credit

Unless you are receiving reconstructive surgery resulting from injury or disease, your health insurance usually won’t pay for plastic surgery that is considered elective cosmetic surgery. However, you have several financing options to pay for plastic surgery in addition to the personal loan services reviewed above, including:

Medical credit cards: Exemplified by CareCredit and Alphaeon credit, these cards may offer deferred interest for a set period when used for medical or dental expenses. Be aware that if you don’t fully repay the balance within the prescribed period, you’ll be retroactively charged the full amount of accrued interest.

Many medical practices, including plastic surgeons, offer and accept these credit cards. But make sure you are aware that your care provider is signing you up because they may be receiving a commission from the card issuer.

Regular credit cards: A regular credit card may be a good choice if you can get one that offers new cardmembers an introductory 0% APR period and perhaps a signup bonus. Be aware, however, that a card with these benefits is usually not available to consumers with bad credit.

In addition, you may exhaust your card’s credit limit paying for cosmetic surgery, which will boost your credit utilization rate and hurt your credit score even more.

Home equity loan or line of credit: This is a good alternative if you own a home and have built up equity. The interest rates are fairly low, and the interest is tax-deductible. However, your home is collateral, and you face foreclosure if you default on your loan.

Bank loan: Bank loans are difficult to obtain if you have bad credit. You may have a better chance if you can arrange a secured loan from your bank or credit union.

Provider financing: Your surgeon may offer to finance your procedure, especially if you can provide a cosigner. Some surgeons may offer interest-free payment plans, but others may charge interest and fees. Be sure you fully understand the interest rate and required payments. Failure to repay can severely hurt your credit score.

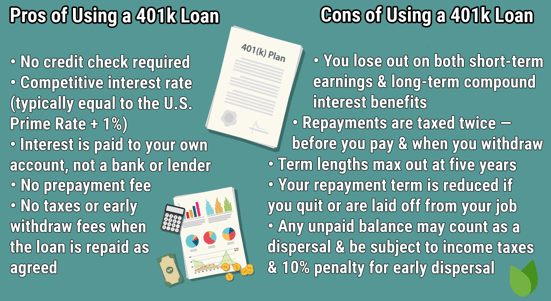

401(k) loan: If you happen to have a 401(k) retirement plan, your employer may allow you to borrow from it tax free. You will have to observe borrowing limits and repayment requirements — you must repay the loan within five years or it will be reclassified as a taxable distribution.

You have to pay interest on the loan, but the interest (minus fees) goes back into your account. This can be a good deal if you can arrange it. However, note that you will forgo tax-deferred growth on the loan until you repay it, and your plan may prevent you from making contributions (and receiving matching contributions) while the loan is unpaid.

Moreover, you will be repaying with taxed money. That means you are paying double taxation when you eventually withdraw the money from your 401(k).

Finally, if you leave your job, you may have to immediately repay the full loan balance or treat it as taxable income, perhaps with a 10% penalty if you are younger than 59½.

Gifts: You may be able to finance plastic surgery through the receipt of gifts from family, friends, employers, and others. You also may be able to solicit gifts through a crowdfunding website like GoFundMe or YouCaring. However, you will be competing with other medical crowdfunding efforts by people who require expensive non-elective medical treatment.

Can You Finance Plastic Surgery With Bad Credit?

The four loan services we reviewed here allow you to borrow funds for plastic surgery even if you have bad credit. You are likely to need at least $3,000 for a plastic surgery procedure, and perhaps a good deal more.

Here is a list of the average cost of popular cosmetic surgical procedures in 2018:

- Eyelid surgery: $3,156

- Liposuction: $3,518

- Breast augmentation: $3,824

- Nose reshaping: $5,350

- Breast reduction: $5,680

- Tummy tuck: $6,253

- Facelift: $7,655

Bear in mind that CreditLoan offers a maximum loan amount of $5,000, which may not be enough to cover your costs. If that’s the case, you may prefer CashUSA.com ($10,000 maximum) or PersonalLoans.com ($35,000).

However, larger loans amounts are reserved for borrowers with average or better credit.

If you have bad credit, your loan offer may be much less than the maximum. Nonetheless, these loan services can prove useful by providing at least partial funding for your surgery.

Since most plastic surgery is elective, you usually can decide when to schedule it. That means you have time to increase your credit score before applying for a personal loan.

Here are some ways to boost your credit score and make it easier to qualify for a loan:

- Fix your credit reports: You have the right to examine your credit reports from the three major credit bureaus (Experian, TransUnion, and Equifax) and dispute any errors you find. You can obtain your credit reports for free at AnnualCreditReport.com. Your credit score will immediately improve if a credit bureau removes an incorrect derogatory item.

- Hire a credit repair company: If you don’t have the time or inclination to personally dispute your credit reports, you can hire a credit repair company to do the job for you. Most of these companies offer several service levels with different costs, so you can pay for the degree of service you want. A credit repair company can be the fastest way to clean up your credit reports, and the fees usually start below $100 a month.

- Use your credit responsibly: You can improve your credit score by paying down your existing debt and paying your bills on time. This may take six months or more before you see your score rise, but sooner or later, the credit bureaus should recognize your creditworthy behavior and reward you for it.

Just raising your score from poor to average can vastly increase your access to credit in terms of the amount you can borrow, the interest you’ll pay, and the period to repay the loan.

What Credit Score Do You Need to Finance Plastic Surgery?

There is no universal minimum credit score required for plastic surgery financing because it depends on the funding source. The loan networks presented above do not state minimum credit score requirements, but they all help people with bad credit. A personal loan can be used for any purpose, including as a cosmetic surgery loan.

But plastic surgeons who offer in-office financing will have their own approval criteria. They are likely to determine approval based on your credit score and income, so it’s safe to assume that the worse your credit, the harder it will be to get approved for plastic surgery financing.

The cosmetic procedure you need and its medical necessity may also be approval factors. That is, the surgeon’s office may be more inclined to help you arrange affordable monthly payments for a procedure that is considered medically necessary rather than one that is purely cosmetic, but that is completely up to the doctor’s office.

Do Plastic Surgeons Offer Payment Plans?

Many types of medical professionals, including plastic surgeons, offer payment plans and medical credit cards to their patients.

Plastic surgery practices can self-finance their payment plans. These are usually interest-free arrangements in which a patient can pay their bill through monthly installments.

In effect, these are free loans, but you’ll have to identify which surgeons in your area offer interest-free payment plans. Even though they don’t charge interest, these plans will require you to make monthly payments on time and in full.

Therefore, you need to fully understand the terms of the plan and only accept them if you know you can make the payments. If you fail to pay up, your doctor may send your debt to collections.

Typically, a plastic surgery practice will not report your payments to a credit bureau, which means you don’t have the opportunity to improve your credit through a payment plan. But if you go into collection, the agency will report you to the credit bureaus.

Medical collections may not affect your FICO 9 credit score but may impact other scoring systems. Also, it isn’t clear whether elective plastic surgery qualifies for exclusion from your credit report.

The most ubiquitous plan out there involves a partnership between the doctor and CareCredit, a company specializing in medical and dental financing.

The most ubiquitous plan out there involves a partnership between the doctor and CareCredit, a company specializing in medical and dental financing.

The CareCredit card offers promotional periods — usually six or 12 months — of deferred interest. The interest only becomes due if you fail to repay the loan during the period.

In addition, CareCredit offers medium-interest extended payment plans running from 24 to 60 months. Many plastic surgeons offer to enroll you while you’re in the office. The medical practice may receive a commission for this service.

Will Insurance Cover Plastic Surgery?

Most health insurance plans do not cover elective cosmetic surgery that is considered medically unnecessary. Conversely, medically necessary reconstructive plastic surgery may be eligible for insurance coverage.

For example, procedures that relieve pain may be considered necessary, such as certain breast reductions, nose jobs, and weight-loss surgery. Disfigurement caused by injury, birth defect, or disease may also qualify for insurance coverage.

The following cosmetic procedures may be covered by health insurance if they are needed to correct a medical problem:

- Deviated septum: This is a structural defect in your nose. You may be covered if it interferes with your breathing, even if the surgeon throws in a cosmetic tweak or two.

- Otoplasty: This is ear surgery, and it may be covered if your ear structure interferes with your hearing, but that is rare.

- Blepharoplasty: Eyelid surgery may be covered if it corrects vision problems caused by droopy eyelids or damaged eyelid muscles.

- Moles: A skin mole can be covered if the doctor considers it suspicious — i.e., it may be cancerous or precancerous, bleeding, itching, or growing. However, beauty marks are usually not covered by insurance.

- Breast reconstruction: You may be covered for breast reconstruction surgery that treats disfigurements caused by mastectomy, lumpectomy or congenital deformities. You also may be covered for the removal and/or reconstruction of faulty breast implants.

- Breast reduction: If large breasts cause you pain or discomfort, your insurance may pay for breast reduction surgery. You may have to prove you’ve first tried non-surgical remedies (i.e., weight loss, exercise, chiropractic care, massage, supportive bras) that haven’t provided relief.

- Gynecomastia surgery: Up to 50% of males experience enlarged breasts during their lifetimes, and this surgery removes excess fat and glandular tissue to correct the problem. Teens and young adults may qualify for insurance coverage, but typically, older men don’t.

- Panniculectomy: This is surgery to remove excess skin caused when obese individuals lose a lot of weight. When obesity is diagnosed as a disease, this surgery may be covered by insurance, but it depends on the state where you live.

- Abdominoplasty: Also known as a tummy tuck, this procedure may be covered if performed in conjunction with breast reconstruction. In a DIEP Flap procedure, the surgeon harvests abdominal fat and skin to replace breast tissue removed by a mastectomy.

- Bunion: You’re covered if the bunion causes pain or impacts the proper functioning of your foot.

- Varicose veins: Depending on the severity of the condition, you may be covered by health insurance. If due to medical necessity, such as venous insufficiency that doesn’t respond to non-surgical treatment, your insurance should pay for surgery.

This is not an exhaustive list, so check with your physician and your insurance company for guidance.

Many Providers Help Finance Their Patients

If you’re interested in plastic surgery loans for bad credit, check out the four loan services reviewed in this article. However, if you need reconstructive or medically necessary plastic surgery, first see if you are covered by your health insurance.

You can also finance cosmetic surgery with a credit card, bank loan, or a gift. Many plastic surgeons offer medical credit cards and payment plans to finance their patients’ procedures.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.