Georgia is one of the nation’s fastest-growing states. All types of individuals call it home, including those with bad credit. Fortunately, residents of The Peach State have online access to subprime lenders that operate nationwide.

Competition ensures that subprime borrowers in Georgia can obtain loans that charge reasonable interest rates and fees. Many Georgians may qualify for a loan that can provide same-day approval and funding by the next business day.

This article covers the best options for Georgia’s residents with poor credit, whether they’re looking for a cash, installment, or secured loan.

Bad Credit Short-Term Loans Available in Georgia

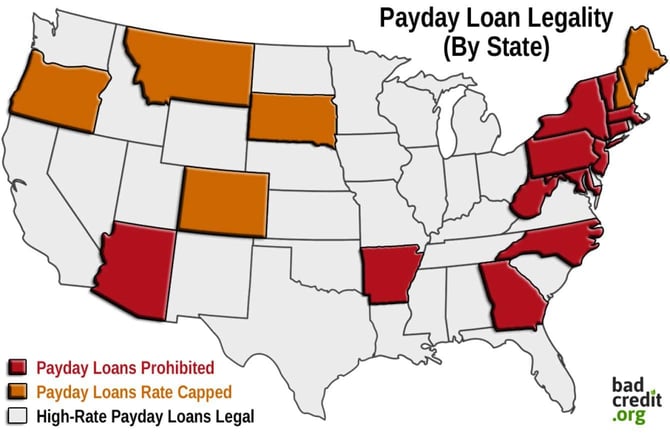

Cash loans typically provide smaller loan amounts and short loan repayment terms. They offer an excellent option if you need quick cash to tide you over for a short period. Payday loans are illegal in Georgia, so short-term cash loans in the state are typically installment loans of up to 60 days.

The following loan-finding services prequalify your loan request and submit it to networks of direct lenders that compete for your business. Ideally, you’ll be able to choose from several loan offers that can quickly process your loan application and fund approved ones within one day.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Online cash advance loans are fast, convenient, and don’t check credit, but their costs can be high, and failure to repay on time can cause significant debt. Be sure to communicate with your direct lender if you’re unable to make an upcoming payment.

Bad Credit Installment Loans Available in Georgia

Georgians can turn to bad credit personal loans when they need to borrow larger loan amounts that they repay in monthly installments over longer periods. You can apply online to the following loan-finding services that operate similarly to their cash-advance counterparts.

You may receive multiple offers, same-day approval, and next-business-day funding.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

5. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

With repayment terms of up to 72 months, these loans allow you to stretch out your payments so they won’t bust your budget. The lender-finding networks charge nothing for prequalifying and circulating your loan requests, and you’re under no obligation to accept any loan offers.

Bad Credit Auto Loans Available in Georgia

Georgia is a big state, and Atlanta has sprawling suburbs that often require you to drive to work, stores, schools, and recreational venues. Owning a car in the state is hugely important, and for most people, that means finding a vehicle loan regardless of credit standing.

These networks of auto lenders and dealers welcome customers with imperfect credit. They may have you behind the wheel of your next car on the same day you apply.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

9. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

Each direct lender specifies the terms of its loans. Paying your bill on time is essential to prevent the repossession of your newly purchased vehicle. These lending networks are eager to satisfy your financing request even if you have bad, limited, or no credit.

Bad Credit Home Loans Available in Georgia

A new housing development seems to spring up in Georgia every month. When the time comes to buy a new or vintage home, you can rely on these direct and network lenders to provide a wide variety of home loan options despite your poor credit.

10. Rocket Mortgage

- America’s largest mortgage lender

- The entire process is completed online

- Options for new mortgages and refinancing existing mortgages

- Award-winning customer service and cutting-edge digital platforms

- More than 90% of clients would recommend us

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

11. Quicken Loans

- Best for cash-out refinance

- Utilize your home equity with America’s #1 lender

- eClosing allows customers to close electronically, greatly speeding the process

- A+ rating with the BBB

- Receive cash for home improvements, college tuition, or paying off debt

- 24/7 access to your loan through the Rocket Mortgage app

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

12. eMortgage

- Get today’s mortgage rates from the top mortgage lenders and banks

- Easily compare and choose mortgage lenders with no obligations or fees

- Review current mortgage rates side by side

- Pick mortgage lenders that meet your specific needs

- Compare rates from pre-qualified and approved mortgage lenders — 100% online, 100% free

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1979 | 4 minutes | 8.5/10 |

These loan companies can help you get a conventional or government-guaranteed home loan quickly and conveniently. Some loans require little or no down payments, although you may have to buy mortgage insurance when you have less than 20% equity in the home.

What is a Bad Credit Loan?

A bad credit loan provides money to someone with a troubled credit history and a low credit score. Your options for subprime borrowing include payday cash advances, personal loans, secured loans backed by collateral, and loans to finance small businesses.

You can find bad credit loans to pay for vehicles, college, emergencies, and homes that allow you to borrow substantial amounts and repay the debt over time.

Your lending service or loan officer will help you complete your bad credit financing and provide you with an interest rate, a loan term, and a monthly payment schedule. Carefully read every loan agreement you receive before choosing the one that’s right for you.

You may also encounter various charges attached to your loan, such as processing, origination, or application fees. These charges can quickly accumulate and make your loan more expensive. Look for loans that do not impose fees for early payoff or refinancing.

What Credit Score Do I Need to Get a Loan?

Minimum credit score requirements depend on several factors, including the loan type, funding source, collateral, and recent credit history.

It’s usually less challenging to borrow money when you secure your loans with property. That’s why you’ll typically pay a higher interest rate on a payday or personal loan than a home or car loan.

The costs are also greater for subprime loans. Higher fees and interest rates help lenders offset the default risk associated with bad credit loans.

The following chart shows the average personal installment loan interest rate by credit rating. But note that short-term personal loans can charge much highest interest rates.

| Credit Score | Average Interest Rate |

|---|---|

| 300 – 629 | 28.50% – 35.99% |

| 630 – 689 | 17.80% – 19.90% |

| 690 – 719 | 13.50% – 15.50% |

| 720 – 850 | 10.73% – 12.50% |

If you think your bad credit may prevent you from getting approved for a loan, you can attempt to prequalify with a soft credit pull. Prequalification will not impact your credit score and will give you a better idea of your loan approval odds if you decide to apply.

Be sure to check with the lender before you apply to see whether they offer prequalification — not all lenders provide this service.

Does Georgia Permit Payday Loans?

According to the state’s official website, “Payday loans are generally illegal in Georgia, unless made by a lender licensed by Georgia’s Department of Banking and Finance, though some lenders may qualify for exemption from licensure. Lenders are subject to the terms and limitations of Georgia’s Installment Loan Act, Payday Lending Act, and usury law. In Georgia, a licensed lender cannot charge more than 10% interest on a loan of $3,000 or less.”

Georgia also prohibits prepayment penalties, rollovers, and cooling-off periods, and breaking usury laws is a felony in the state.

What is the Easiest Type of Loan to Get With Poor Credit?

A secured loan is the easiest type to get, but it does require you to post acceptable collateral. The following sections describe secured loans that you can get despite poor credit.

Pawnshop Loans

When you need cash fast, you can hock personal property, such as guns, watches, jewelry, cameras, musical instruments, etc., at a pawn shop. These loans usually advance a small percentage of the item’s worth, and the pawnbroker may sell the item if you fail to repay the loan by the due date. The typical APR for pawnshop loans is 200%.

Auto Loans

Your car collateralizes your auto loan. You can add collateral by making a sizable down payment and/or trading in your old car.

You also can refinance your existing car for more than the current loan amount owed, taking the difference in cash. Cash-out refinancing will increase your debt but may reduce your interest rate and/or monthly payments. Auto loans for bad credit typically charge an APR below 36%.

Title Loans

You can get a loan collateralized by your current car if you don’t owe any money on it. Unlike regular auto loans, title loans are easy to get without a credit check but charge high interest rates. The car dealer can repossess your car without going to court if you fail to repay a title loan.

Home Loans

You can use your home to secure a mortgage, home equity loan, or home equity line of credit. Though the details of each home loan differ, they generally charge a low APR and have long repayment terms. Failure to repay a home loan can lead to foreclosure and the loss of your house.

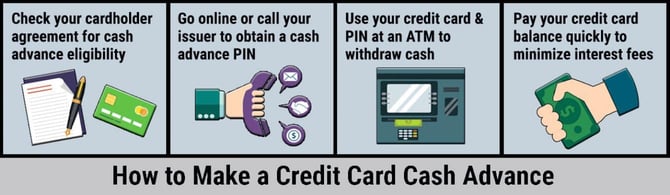

Credit Card Cash Advances

You can use a credit card to take cash advances up to your available cash advance credit limit. Once you own the card, you can get a cash advance without filling out forms, submitting to a credit check, or obtaining permission. You can simply waltz over to your local ATM, swipe your credit card, press a few buttons, and walk away with cash in hand.

The APR on a cash advance is typically 28% to 36%, and interest accrues daily from the transaction date.

What Is the Difference Between a Secured Loan and an Unsecured Loan?

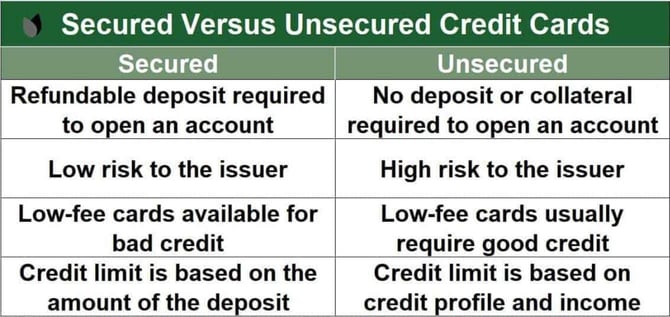

Lenders rely on credit scores and reports to help predict a borrower’s default risk. A practical method for lenders to reduce the cost of this risk is by asking borrowers to “put skin in the game.” The result is a secured loan.

Secured Loans

Secured credit is an account backed by something of value, commonly called an asset or collateral. Lenders may accept collateral in the form of vehicles, real estate, cash, investments (bonds, stocks, etc.), collectibles, or something else.

A lender can seize your collateral if you secure financing with an asset and can’t repay the debt as agreed. Foreclosure or repossession occurs when lenders take back the property you pledged.

Some common examples of secured credit include:

- Secured credit cards

- Home equity loans & lines of credit

- Mortgages

- Auto and title loans

- Motorcycle and boat loans

- Loans for large equipment

- Pawn loans

Because secured loans pose minimal risk for lenders, they may be willing to do business with you even if your credit is in the doghouse. A secured credit card, for example, can be an excellent way to rebuild credit after a financial mistake or establish credit for the first time.

Putting up collateral may also help you secure a lower interest rate on specific financial products, such as home equity loans or lines of credit. In most cases, the asset you are financing secures the loan. Examples include home loans, auto loans, and pawn loans.

Remember: Secured credit places more risk on you, the borrower. Regardless of what you pledge to secure a loan, you’ve agreed to let the lender take possession of your property if you default on your payments.

Unsecured Loans

You may qualify for unsecured loans if your recent credit history is unblemished. An unsecured loan is sometimes known as a signature loan because your John Hancock is all that secures the loan.

Lenders dispense unsecured loans based on the strength of your credit profile and your promise to repay. The lender’s “security” is limited to expectations stemming from your credit history.

A few common examples of unsecured credit include:

- Unsecured credit cards

- Student loans

- Personal loans

- Payday loans

These accounts carry more risk for the lender because no tangible asset backs the debt. In other words, the lender can’t quickly seize property— such as your house or car — to offset its losses if you don’t repay your debt.

But, even though unsecured debt doesn’t rely on an asset, that doesn’t mean you’re off the hook if you can’t afford to pay it back. A lender may not be able to seize collateral if you default on an unsecured debt, but it can sue you in court to collect what you owe.

A judge may even garnish your wages to repay your creditor. The added risk of default from an unsecured debt explains why its interest rates are typically higher than those for secured credit.

In-Person Options for Bad Credit Loans in Georgia

Georgia has unique laws that affect the loans and interest rates available to residents. Nonetheless, Georgians with poor credit have many options when they need a loan.

Consider visiting a loan office in person when weighing your options for cash, personal, auto, and home loans. A loan officer can answer your questions efficiently, consider factors beyond the numbers, and approve your loan application instantly and send funds to your bank or credit union account in one business day. Here are some in-person options for bad credit loans in Georgia:

Anchor Finance Company

101 S Jackson St

Albany, GA 31701

Kinsmith Finance

873 Ralph David Abernathy Blvd STE B

Atlanta, GA 30310

Regional Finance

3412 Wrightsboro Rd Suite 902

Augusta, GA 30909

Service Loans

4036 Lexington Rd

Athens, GA 30605

1st Franklin Financial

95 Altama Connector Suite D

Brunswick, GA 31525

World Finance

3941 Victory Dr Ste A

Columbus, GA 31903

OneMain Financial

324 Northgate Dr

Dalton, GA 30721

World Finance

250 John W Morrow Jr Pkwy Ste 101

Gainesville, GA 30501

World Finance

1211 Gray Hwy Suite B

Macon, GA 31211

Kinsmith Finance

595 Roswell St NE B

Marietta, GA 30060

Security Finance

2204 Shorter Ave NW #11

Rome, GA 30165

OneMain Financial

1570 Holcomb Bridge Rd #345

Roswell, GA 30076

Coastal Finance Company

8406 Abercorn St

Savannah, GA 31406

1st Franklin Financial

1213 Russell Pkwy

Warner Robins, GA 31088

Lendmark Financial Services LLC

1601 Baytree Rd A2

Valdosta, GA 31602

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.