NetCredit provides personal loans and lines of credit to consumers with bad or fair credit. It is headquartered in Chicago and has been in business for more than nine years. NetCredit is a subsidiary of Enova International, Inc., a technology company trading on the New York Stock Exchange that leverages artificial intelligence to inform its lending models.

Loans of up to $10,000 and lines of credit of up to $4,500 are available in 29 states. Each state has laws that govern the loan terms NetCredit can offer. Borrowers face APRs ranging from 34% to 155% and a repayment term of six months to five years.

All NetCredit loans and lines of credit originate from a member of the NetCredit family of companies or a lending partner bank (i.e., Republic Bank & Trust Company or Transportation Alliance Bank, Inc.). NetCredit services all loans and lines of credit it and its partners originate.

If you live in one of the 21 states NetCredit doesn’t service, the following nationwide lending networks can help you source a similar loan.

Best Online Personal Loans Like NetCredit

The following loan-finding services can provide unsecured personal loans with an APR no higher than 36%. Some lenders in these networks can also arrange personal lines of credit. All loans are available to consumers with bad credit who satisfy a set of basic requirements.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual works with a network of lenders and has provided personal loans to millions of customers since 2010. It is a member of the Online Lenders Alliance, an advocate for best practices and education in the loan industry.

It takes only a few minutes to request an unsecured loan from MoneyMutual and receive one or more offers. Each offer specifies a loan term and interest rate. Your money is usually available within 24 hours of e-signing a loan agreement.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group works around the clock with several online lenders to accommodate consumers with poor credit. These direct lenders analyze more than just your bad credit score and have more flexible requirements than most traditional banks and lenders.

You can use your loan funds for any purpose, including big-ticket purchases, emergency expenses, or debt consolidation. Reasonable interest rates and flexible repayment terms may make finding an acceptable unsecured loan easier.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com is adept at finding fast, reliable funding for consumers with imperfect credit. This lender-matching service is cost-free and won’t affect your already bad credit score.

The website’s quick prequalification process can match you to multiple direct lenders willing to provide you with a personal loan. Your loan offers, including the APR, loan term, loan amount, fees, and monthly repayment amount, depend on each lender’s review of your credit history.

4. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com connects consumers with lenders offering loans of various sizes to qualified applicants. You need a monthly after-tax income of at least $1,000 to be eligible.

CashUSA.com uses industry-standard encryption and security measures to protect your personal information. It does not charge any fees when you submit a loan request. CashUSA.com can also find you offers for credit repair, debt relief, or similar services.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

BadCreditLoans.com began finding loans for subprime borrowers in 1998. In addition to providing traditional personal loans from state-licensed businesses and Tribal lenders, some lenders in its network offer lines of credit.

The BadCreditLoans.com website offers information that can help borrowers avoid predatory lending traps and scams. Please carefully review your loan offers — you are under no obligation to accept any.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com offers a network of direct lender companies dedicated to subprime borrowers. To prequalify, you must answer a few questions and submit to a soft pull of your credit — which won’t affect your score.

The lenders in the company’s bad credit network may limit loan amounts to less than $5,000 instead of the higher amounts available to consumers with good credit. An approved borrower usually receives the loan proceeds by the next business day.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com is a relative newcomer to the bad credit loan space. Nonetheless, our research shows it to be a legitimate option for loan offers from the lenders in its network.

InstallmentLoans.com provides a loan request form for you to complete and submit. It performs a soft inquiry of your credit history to determine which of its lenders is likely to be a good fit.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com finds lenders for borrowers of every credit situation. But don’t expect the maximum loan amount if your credit is poor.

The network can provide you with multiple loan offers within minutes. Once you select a loan option, PersonalLoans.com transfers you to the individual lender’s website, where you can complete the loan process.

How Does NetCredit Operate?

NetCredit offers costly personal installment loans and lines of credit online to consumers with subprime credit. You can prequalify for a loan by completing and submitting a loan request form. Requesting a loan will not affect your credit score.

The request form collects the following information:

- The amount you want to borrow

- The purpose of the loan

- Your date of birth

- Whether you own or rent your home

- Your home address

- Your email address and a password

- Your Social Security Number

- Employment details

- Income details

You’ll receive an immediate response from NetCredit after it performs a soft pull of your credit. The lender reviews your credit history, including any previous loans and credit cards.

You’ll then exchange additional details with NetCredit if you are eligible for a loan. Those details include your banking information and the loan terms.

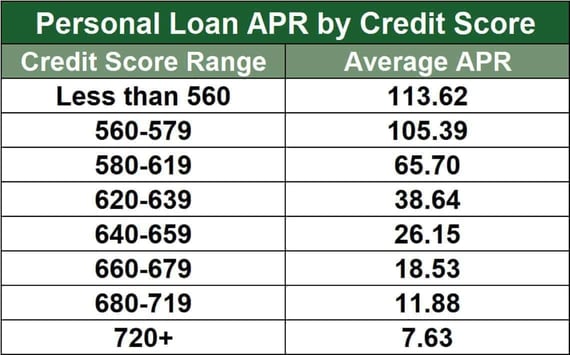

Depending on the state, your loan’s APR can range from 34% to 155%. The loan’s interest may exceed the amount you borrow. For example, you would pay $5,158 in interest if you borrowed $5,000 for two years at an 80% APR.

NetCredit makes a final determination by performing a hard pull of your credit, which may have a small impact on your credit score. If NetCredit approves your loan, you can review and e-sign the loan agreement online. Your money should arrive in your bank account on the next business day.

NetCredit allows you to adjust the payment schedule to match your pay dates. You can change the plan but must provide two days’ notice. NetCredit reports your payments to two credit bureaus: TransUnion and Experian.

What Are the Requirements to Get an Online Personal Loan?

Many personal loan websites share a standard set of requirements. To qualify for a loan, you must:

- Be 18 or older

- Be a US citizen or permanent resident and live in a state where the lender operates

- Have a verifiable source of income

- Have an active email account and phone number

- Have a valid personal checking account

Each lender sets the terms of its loan offer and the credit requirements necessary for approval. NetCredit and the reviewed lending networks accept borrowers with poor credit. Your chances for approval depend on your score, income, and recent credit history.

How Does a Personal Loan Differ From a Line of Credit?

Personal loans are also known as signature loans because you can get one without posting collateral —you only need to sign your name.

You’ll receive the loan funds in a lump sum and repay the money in monthly installments, usually over three to 72 months. Personal loans typically have fixed interest rates and monthly payments.

A personal line of credit behaves similarly to a credit card cash advance. It is a revolving loan account that allows you to withdraw and repay any amount at any time, up to the line’s credit limit. You must pay no less than the minimum due each month.

You pay interest only on the money you draw from the line. The lender applies an interest charge to the outstanding amount. And you’ll never have to pay interest if you never borrow from your credit line.

Lines of credit may charge a fixed or variable interest rate. They usually set a period, such as 10 years, during which you can draw funds from the line. You typically have up to 10 additional years to repay any unpaid balances once withdrawals are no longer available.

While each online lender is different, most require consumers who apply for a line of credit to have a FICO score better than that required for a personal loan. Lenders offering loans of either type may check your debt-to-income ratio and reject applicants with DTI ratios above a set cap (often 36%).

Your preference for either type of bad credit loan may depend on whether you need a flexible source of cash over an extended period or a lump sum available all at once.

How Can I Increase My Approval Odds?

In the long run, the most effective way to increase your odds of loan approval is to improve your credit score. You can also boost your score quickly by removing inaccurate, unverifiable, and obsolete data from your credit report.

You can fix your credit reports on your own or with the assistance of a credit repair company. Removing derogatory information from each bureau’s credit report can raise your scores within a couple of months.

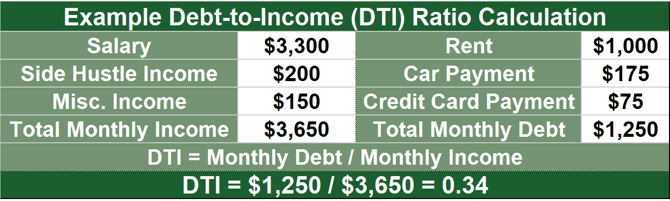

In the long run, your credit score should improve if you consistently pay your bills on time and maintain relatively low debt levels. Your debt-to-income (DTI) ratio is a standard measure of your indebtedness.

The DTI ratio divides your monthly debt payments by your monthly gross income. Most lenders prefer borrowers to have a DTI ratio no higher than 36%, although some loans are available despite a higher percentage.

If you have credit card debt, you can improve your FICO score by reducing your credit utilization ratio (i.e., the total credit used divided by credit available). FICO considers 1% the ideal CUR, whereas VantageScore sets the target at 30%.

Your indebtedness accounts for 30% of your FICO credit score, so paying down debt can help your score rise, possibly within a month or two.

You may find a debt consolidation loan helpful. The proceeds from the loan pay off your other debts, leaving you with one monthly payment. Many personal loans waive fees for early repayment, so you can aggressively pay down your debt consolidation loan without penalty.

Other tips for improving your credit score include keeping old credit card accounts open, having a broad mix of loans and credit cards, and not applying for new credit more than once or twice yearly.

FICO uses these factors to calculate your credit score. Another step you can take is to sign up for Experian Boost, a program that adds a broader range of credit-building monthly payments (such as those for rent and utilities) to credit bureau reports.

Many lenders encourage subprime applicants to recruit a cosigner for a loan. A cosigner shares your responsibility to repay a loan on time, dramatically increasing your approval odds. You and the cosigner are vulnerable to credit damage if payments are more than 30 days late.

What Is the Easiest Type of Loan to Get Approved For?

A no credit check loan that you secure with collateral offers you the best chance for approval. Examples of secured loans include:

- Pawnshop loans: You can borrow money hassle-free by taking your personal belongings to a pawnshop. Typical pawn items include electronics, cameras, guns, and jewelry. A pawnshop can sell your property if you don’t reclaim it before a set expiration date. These loans are expensive (typically with APRs exceeding 200%), and the secured loan amount is only a tiny percentage of the pawned item’s value.

- Auto title loan: Your car is the collateral for an auto title loan. The lender takes temporary possession of the title until you repay the secured loan, often at an APR above 200%. The lender can repossess the car if you miss a payment, so be sure to pay on time. These secured loans usually don’t require credit checks.

- Secured credit card cash advances: You can take a cash advance from a secured credit card and pay a relatively reasonable interest rate (i.e., no higher than 36%, and the best credit cards usually charge significantly less). Secured cards typically don’t check credit because your cash deposit collateralizes your card balances. A credit card cash advance is a revolving loan, similar to a personal line of credit.

Home equity loans and car loans also involve collateral, but both require credit checks. The typical payday loan doesn’t perform a credit check or accept collateral and has an astronomical APR (sometimes higher than 1,000%).

Payday loans don’t help you build credit. In addition, the maximum amount of a payday loan is usually less than $1,000. We advise you to avoid payday loans and seek less expensive ways to borrow.

A friend or family member may offer you a no credit check loan with no collateral requirement, but you can damage your relationship if you fail to repay the loan. In the worst case, this can be a very costly loan option.

Check the Competition Before Borrowing From NetCredit

If you don’t qualify for an installment loan from NetCredit, these alternative loan-matching networks can provide you with multiple loan offers. We recommend that you exhaust your possibilities before choosing a lender so you can source the best loan terms for which you qualify. You may qualify for a lower interest rate from a lender other than NetCredit.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.