Although it can happen to anyone, a low credit score is not a source of pride. If you have less than good credit, chances are you’d like every opportunity to improve it, which requires credit bureau reporting.

So why bother with lenders that don’t report to credit bureaus? Because a lender that doesn’t report a payment to a major credit bureau is not checking a borrower’s credit history. That means anyone — whether they have fair, bad, or no credit history at all — can get these types of loans.

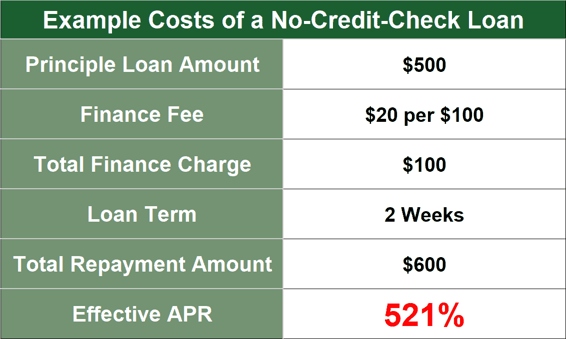

The interest rates on these loans run the gamut from 0% to more than 1,000%. Most of them are small and short-term. But none communicate with a major credit bureau — unless you fail to repay your loan. You want to avoid that kind of reporting because it can only worsen your credit situation.

1. Payday Loans

These three direct lender networks can arrange payday loans online without a credit check. They won’t communicate with a credit reporting agency unless you fail to repay as agreed.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

These three bad credit loan services operate similarly. You submit an online loan request by providing information about your job, income, expenses, and debts. The services do some basic checking to prequalify your eligibility to borrow, which requires that you:

- Are 18 or older

- Have a Social Security Number

- Have a steady job or receive regular government benefits

- Collect a specified minimum monthly income

- Are a US citizen or permanent resident

- Have a checking account in your own name

- Provide a valid email address

- Provide work and personal phone numbers

If you successfully prequalify, these services will distribute your loan request to their networks of direct payday lenders. You may receive one or more offers within minutes that you can pursue by providing any additional information the lender may need.

If a lender approves your loan (typically through a soft credit check), it will offer you a loan agreement for your electronic signature. Read it first — make sure you understand all the important details, such as the loan amount, financing fee, and repayment date (typically in one to four weeks, when you receive your next paycheck). The agreement may allow the lender to withdraw your repayment directly from your bank account.

You repay the entire payday loan in a lump sum — it is not an installment loan. Pay close attention to the consequences of non-payment, in which the lender:

- Will tack the original loan’s financing fee onto the loan principal

- Roll the bad credit loan forward to your next pay date

- Add a new finance charge to the loan, and repeat for each missed payment date

- Eventually, turn late loans over to a debt collector, which will likely report you to at least one credit reporting agency

You will find yourself in a deep financial hole if you miss a few payments in a row. With APRs ranging from 300% to 2,000% or higher, failure to pay on time can land you in bankruptcy court.

You can e-sign the loan if you find the terms acceptable. Your money should arrive in your bank account as soon as the next business day. Repay on time and the credit bureaus won’t have a clue about the loan.

2. Cash Advance Apps

Cash advance apps are much less expensive than payday loans, allowing workers to take low-cost advances on their next paycheck. These mobile apps can provide as much as $500 against the work you’ve already performed.

Cash advance apps resemble payday loans in size and timing but charge minimal interest rates and fees, and some cost nothing. As with payday loans, cash advance apps don’t report your activity to the credit bureaus unless you are seriously behind on your payments.

Three of the best are:

- Dave provides no-cost payday advances with a credit limit of up to $250. These are no-credit-check loans that don’t charge interest. An optional service reports bill payments and rent to the three major credit bureaus.

- Earnin links to your electronic timesheet and checking account. Fees are optional – you decide how much to pay for the service. You can initially borrow up to $100, but the credit limit can increase to $500 over time.

- Possible Finance is a mobile app that can advance you up to $500 until you receive your next paycheck. Possible doesn’t pull your credit, instead using your work history and pay schedule to approve your loan.

Cash advance apps link to your existing bank account, where you receive regular direct deposits. The apps review your payment history to determine how much you typically earn. That information will determine the maximum advance amount.

You become an app user by providing your name, home and email addresses, and your phone, Social Security, and bank account numbers. Cash advance apps use your bank account and routing numbers to transfer your borrowed money.

You can receive approval for your advance in a matter of minutes. The amount of time it takes to receive the money varies by app. Some apps provide online banking accounts that receive your funds faster. Others charge you for instant delivery.

3. Car Title Loans

You can use your paid-off car as collateral for a title loan. You assign the vehicle’s title to the lender to secure the loan.

This is a quick auto loan, often requiring no more than an hour to complete. They are also costly and risky. The APRs are well above 100%, and the lender can repossess your vehicle without court permission if you miss a payment.

Most title lenders neither pull credit nor report activity to the major credit bureaus. They do check your income to verify your ability to repay the loan by calculating your debt-to-income ratio. They also confirm the vehicle’s value and your proof of outright ownership.

If it approves the loan, the lender will place a lien on your car in case it needs to repo it for nonpayment. In the worst case, the lender can seize your vehicle, sell it, and recoup most or all of the money it lent you.

Title loans feature enormously high interest rates (as high as 25% monthly, which equates to more than 300% annually), short repayment terms, and low payouts. Most title lenders will let you borrow 50% to 85% of your vehicle’s Blue Book value. Some lenders, admittedly rare, will go as low as 20% or as high as 120%.

Few vehicle title lenders publicize their loan-to-value ratio standards, so it pays to speak with multiple title lenders to see how much they’ll lend you, what interest rates they charge, and whether they tack on expensive origination fees. Many car title loans end up in default.

4. Pawnshop Loans

Pawnshops make secured loans backed by your personal property (i.e., cameras, jewelry, collectibles, etc.). You can lose the items you hock if you don’t redeem your secured loan before it expires.

Pawn brokers don’t check or report credit. They base their loans entirely on your property, typically lending you 30% to 50% of your property’s value.

The interest rate on a secured loan from a pawnshop can range from 25% per month in Florida to 2.5% in California. The highest APRs exceed 300%, but the total cost need not be ruinous since pawnshop loans are short-term.

5. Tax Refund Anticipation Checks

Several tax-preparation services let you borrow money against your anticipated tax refund. The checks can come in handy when you can’t wait for your tax refund, which can take weeks or months.

These cash advance checks are typically interest-free and don’t require a credit check. But various fees may apply (usually between $30 and $50), so be careful before agreeing to one of these seemingly innocuous loans.

Also, if the IRS refunds less than the loan amount, you’ll be on the hook for the shortfall.

6. Loans From Family and Friends

Many folks turn to family and friends when they need a loan. These are often easy to obtain, at least on the first try, but become harder if you repeatedly ask for another one. The interest rate and repayment terms are usually quite lenient, and credit reporting is irrelevant.

While these loans seem ideal, they can lead to interpersonal problems if you don’t honor your obligation to repay. Think twice about the emotional risk these loans impose before approaching a loved one for money.

FAQs About Loans and Credit Reporting

Credit reporting can seem mysterious. Let’s shed some light on the topic by answering a few frequently asked questions.

How Does Credit Reporting Work?

Each month, many lenders and creditors report your payments, along with other information, to one or more of the three major credit bureaus — Experian, TransUnion, and Equifax. The bureaus keep record of your account and payment history in the form of credit reports, from which the information is used to calculate your credit scores.

Among the reported data items are:

- Loan source: The lender may be a bank, credit union, or lending company.

- Loan type: A popular way of categorizing loans is their repayment method. You pay off certain loans in a single lump sum, while others require periodic, usually monthly, installment payments. Credit card balances are revolving debt — you must pay the minimum amount due each month, but otherwise can schedule payments as you prefer. Lenders also report whether a loan is secured or unsecured such as a personal loan.

- Original loan amount: This value doesn’t change after the lender first reports the loan. Credit scoring systems use this figure to calculate and classify debt ratios, such as revolving vs. installment debt and credit utilization ratio (CUR). Loan servicers report student loans separately, one for each disbursement.

- Current loan balances: Lenders and creditors report how much you still owe on each of your debts.

- Scheduled monthly payment: Installment loans usually have fixed monthly payments, whereas credit card minimum payments depend on your current balances. FICO doesn’t use this data in its scoring system.

- Date a credit account closed: Lenders report when they close a credit account due either to successful repayment or other reasons. Credit card debts are revolving, so they don’t have a closure date until the card is canceled.

- Special comment codes: These codes report various actions or conditions, such as repossessions, write-offs, modifications, forbearance, settlements, foreclosures, and collections. Lenders and debt collectors routinely report comment codes to the credit bureaus, even if the original loan was non-reporting. Some codes can harm your personal credit score, while others (i.e., loan modification, forbearance) are neutral.

Credit bureaus use the reported information to update a consumer’s credit report and score. The dominant scoring system, FICO, measures the following factors:

- Credit history: 35%

- Amounts owed: 30%

- Account ages: 15%

- Credit mix: 10%

- New credit: 10%

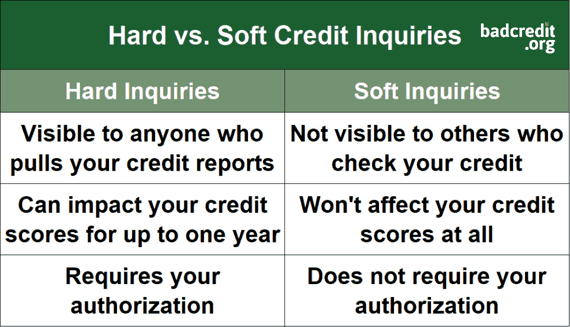

The credit bureaus maintain your credit reports, which are available to creditors and lenders via hard inquiries. A hard inquiry arises from a new loan or credit application and can impact your personal credit score.

An inquiry from an employer, utility provider, or landlord is a soft credit check and doesn’t affect your credit score.

The best way to raise your credit score is to pay your bills on time and keep your credit card balances below 30% of your credit lines, but even less is better. Also, keep old credit card accounts open, refrain from opening too many new accounts in a short period, and maintain a broad mix of loan and credit accounts.

What Are the Pros and Cons of Credit Reporting?

Credit reporting can be a great force for good or evil. It can help you establish and build credit when you pay your debts as agreed, but it can hurt your credit when you don’t.

Pros:

- It helps provide credit to those who are most likely to repay

- Allows consumers to utilize debt to help manage their finances

- Rewards creditworthy consumers with lower costs and better perks

- Helps lower interest rates by withholding or raising the cost of credit for those who are more likely to default on their debts

- Creates hundreds of jobs and millions in revenues to participants in the credit reporting industry, including those who issue paid or free credit reports

Cons:

- More than 1 in 5 consumers may have a “potentially material error” in their credit files, unfairly penalizing consumers who should have higher credit scores.

- Credit reporting involves many assumptions about creditworthy behavior (such as limiting new accounts or having a broad mix of accounts) that do not always accurately reflect a consumer’s default risk.

- A consumer may need a long time, often greater than a year, to build credit through improved financial habits.

- Some parties may use credit reports to illegally discriminate against certain classes of consumers

For the most part, the disadvantages of credit reporting stem from misuse, either through innocent mistakes or purposeful malice. In any case, it is ingrained in the world’s financial fabric and isn’t going away anytime soon.

What Type of Loan Does Not Require a Credit Check?

Generally, providers of secured credit cards and secured loans are less likely to check applicants’ credit. Payday loans and apps, though technically unsecured (just like a personal loan), depend on future paychecks and therefore don’t rely on credit checks. Your property secures title and pawnshop loans, and they also disregard credit history.

A mortgage or an auto loan, although secured, requires a credit check. But some auto lenders offer no-credit-check versions of these loans but charge higher interest rates and fees.

You may find a secured credit card that doesn’t perform a credit check. But every secured credit card reports your payments to the credit bureaus.

What Is the Reporting Status of BNPL Loans?

Buy now, pay later – or BNPL – is a popular payment method in online marketplaces. It is a form of installment loan offered by merchants at online checkout as an alternative to credit and debit cards. Affirm, Afterpay, and Klarna, among others, extend credit tied to an existing bank or credit union account.

The financing, deducted from your checking or credit card account, is small-dollar and has a short loan term. In many instances, this type of financing costs nothing.

Until recently, BNPL loans didn’t appear on credit reports, but in December 2021, Equifax announced a plan to “formalize a standard process for reporting BNPL tradelines.” The reporting relies on voluntary compliance with the Fair Credit Reporting Act (FCRA) by BNPL lenders.

Undoubtedly, BNPL lenders will incur significant expenses for new personnel, equipment, and procedures if they furnish data to any major credit bureau. Additionally, reporting will allow BNPL lenders to advertise their credit builder capabilities.

By March 2022, each credit reporting company had announced plans to include BNPL loans on their credit reports. This was a few months after the Consumer Financial Protection Bureau launched an inquiry into BNPL industry practices.

Even as BNPL reporting catches on, FICO and the other scoring systems must accommodate it. For example, BNPL loans may hurt credit scores by reducing the average age of credit accounts.

Another problem is that BNPL billing cycles typically have a two-week loan term, not monthly as with most installment loans and credit cards. This may lead to credit balances appearing on your credit reports that you repay soon after the report date. TransUnion will report BNPL loan payments more frequently so as not to disadvantage consumers.

At this time, the BNPL companies are insisting on a uniform reporting approach that will benefit customers who pay on time. Until then, BNPL lenders and the credit bureaus will remain at loggerheads.

Consider Non-Reporting Loans If You Don’t Have Good Credit

Loans that don’t report to credit bureaus are a boon to consumers with bad credit who would otherwise have trouble getting a loan. Some non-reporting loans have astronomical interest rates (i.e., payday, title, and pawnshop loans).

In contrast, others are low- or no-cost (i.e., cash advance apps, tax refund anticipation checks, and loans from family and friends). In addition, BNPL loans are currently either not reported or have no impact on your credit score.

If you want a better credit score, opt for loans and credit cards that report to the credit bureaus — that’s the only way to build credit.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.