Fast Loan Advance allows anyone with bad credit to apply for a short-term installment loan of as little as $100 (and up to $35,000) with APRs from 5.99% to 35.99%. Unlike a payday loan with an ultra-short shelf life, these loans have repayment periods from 91 days to 72 months.

This wide range offers greater flexibility with monthly payment amounts, comfortably fitting repayment amounts into your budget.

In this Fast Loan Advance review, we’ll review everything you need to learn about the service. Plus, we’ve included five alternative lending networks that are equally competitive with lender selection, rates, and terms.

What to Know About Fast Loan Advance

Fast Loan Advance is a funding company based in California that attracts subprime borrowers with 5.99% to 35.99% APR loans of up to $35,000.

Unlike banks, credit unions, and some online lenders with stricter qualifying criteria, the platform offers favorable loan terms for those with bad credit. In many cases, lenders even forgo application and origination fees or eliminate prepayment penalties, which contribute significantly to the total cost of borrowing.

You must prequalify through a quick online form for a Fast Loan Advance payday loan. Once submitted, you will match with lenders based on your profile. You must meet the minimum age, monthly income, and debt-to-income ratio requirements imposed by the lender.

Fast Loan Advance’s homepage offers representative loan examples that provide insight into the costs of borrowing based on specific loan amounts and interest rates. The more knowledge the consumer has, the better.

5 Alternative Lender Networks

While Fast Loan Advance is a legitimate option for quick funding, other networks also stand out for their service, terms, and flexibility. Here are five other networks to consider before taking out a loan.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual is the preferred lending network of many subprime borrowers. It features a roster of short-term installment loan companies that can provide borrowers up to $5,000 with attractive APRs and customizable repayment terms of up to five years.

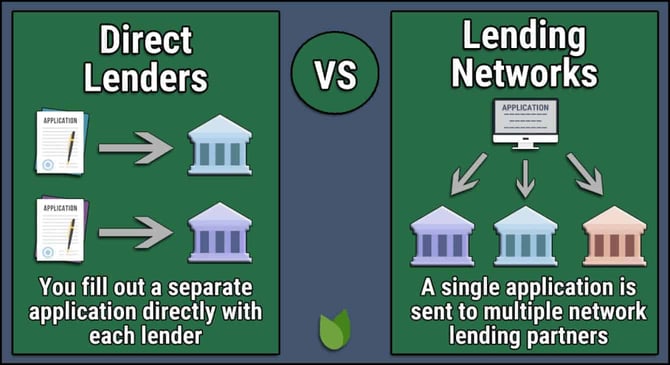

As with most lending networks, you need to complete an online prequalification form to match with lenders. Receiving several loan offers at once is also an ultimate time saver because you don’t need to prequalify with direct lenders one at a time.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group is a lending network that offers short-term loans between $1,000 and $35,000 for bad to fair credit borrowers. You must complete a short, five-minute application to qualify. Then, you can receive multiple loan offers, choose a direct lender, and submit a formal loan application with funds appearing in your bank account as early as the next business day.

Like MoneyMutual, 24/7 Lending Group accepts most bad credit types. There is no charge for using the service.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com is an online lending marketplace that offers loans of up to $10,000 with 5.99% to 35.99% APRs and 90-day to 72-month repayment terms. It’s an excellent option for bad credit borrowers struggling to qualify for loans from banks and credit unions.

You can use loan proceeds from CashUSA to pay for anything, including debt consolidation, emergency medical expenses, or even an impromptu trip to your favorite island destination.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com connects borrowers with loans of up to $20,000 through its extensive short-term loan network. APRs on SmartAdvances loans range from 5.99% to 35.99%, with two to 72-month repayment terms and no origination or prepayment penalties, depending on the lender and your credit profile. Your state of residence, desired loan amount, repayment term, and credit score affect the quality of loan offers you receive.

You must be a US citizen 18 or older with a valid Social Security number, active bank account, and a regular source of income to qualify for a SmartAdvances loan. Some lenders may require you to meet additional requirements, such as a minimum monthly income.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

Tacoma, Washington-based BadCreditLoans.com offers an easy way to request loans between $500 and $10,000. This free service provides instant access to an extensive network of direct lenders and third-party online marketplaces that all offer fast funding to your bank account as early as the next business day.

Other benefits of using BadCreditLoans.com include its generous terms. Rather than the outlandish APRs charged by payday, auto title, and pawnshop lenders, APRs on the network range between 5.99% and 35.99% with minimum 90-day and maximum six-year repayment terms.

What Is Fast Loan Advance?

Fast Loan Advance is a lending network that allows subprime borrowers to tap into a network of bad credit lenders offering short-term installment loans from $100 to $35,000 at varying APRs — generally up to 35.99%.

One of Fast Loan Advance’s biggest strengths is its online personal loan prequalification process. Completing one form may connect you with multiple loan offers from direct lenders.

Borrowers can assess loan offers on the strength of their rates and terms, selecting the right one based on their needs. Proceeds can be sent to your bank account in as little as 24 hours, a timely option for expenses that need to be paid quickly.

Is Fast Loan Advance a Reputable Company?

Yes, Fast Loan Advance is a reputable company for personal loans. Here are a few of the reasons why:

256-bit SSL Encryption: The website safeguards your data using 256-bit SSL (Secure Sockets Layer) encryption, which means a more secure communication method between the website and your web browser. Think of 256-bit SSL encryption as constant static on a phone line, preventing eavesdroppers from listening to your conversation. With site data containing your home address, bank details, and other sensitive information, we appreciate this level of security.

Disclaimers: Near the bottom of every Fast Loan Advance page, you’ll find a lot of fine print that reminds people it is not a direct lender that does not originate or process its loans. It also clearly specifies a physical address, which can signal relief as many scam loan companies do not disclose their location at all.

Examples: On the Fast Loan Advance website, you’ll find installment loan examples, providing you with a greater understanding of what a loan looks like and potential borrowing costs. As of this writing, it includes example loans of $1,000, $2,000, $5,000, and $10,000 at varying interest rates, terms, and finance charges to provide a better picture of what you can expect to pay over time.

How Do I Qualify for a Loan with Bad Credit?

You must meet the criteria established by Fast Loan Advance direct lenders to qualify for a loan with bad credit. You must be of legal age, employed with a healthy debt-to-income ratio, and possibly meet a required minimum credit score. You also need a bank account to receive loan proceeds and must agree to automatic monthly payment withdrawals.

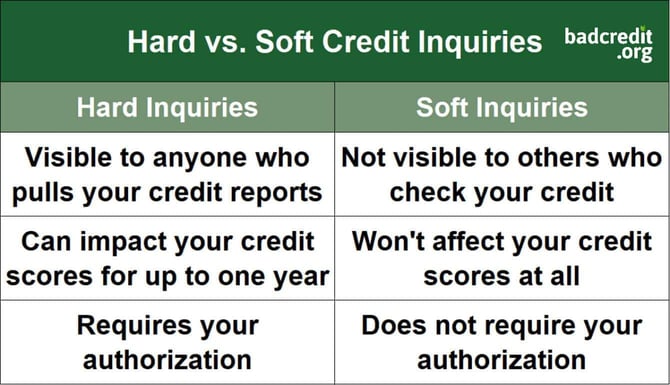

Lenders do not run a credit check at the prequalification stage; this does not happen until you choose a loan offer and are sent to the lender’s website to finalize the application. Lender networks help minimize loan applications by matching you with lenders willing to work with you based on your single loan request form. This helps you avoid multiple hard inquiries and potential denials from several lenders.

Fast Loan Advance is a platform for subprime borrowers with poor to fair credit. If you do not know your credit score, we recommend visiting AnnualCreditReport.com or a similar reporting service for a free credit score.

Remember, the higher your credit score, the better your potential loan terms, so boosting your score before your next loan application may make sense if you are not in a rush for funding.

Do Quick Loans Hurt Your Credit?

In short, no. Quick loans do not directly hurt your credit. But the following factors may impact your score to varying degrees:

Late or Non-Payment: Paying late or not at all can cause your credit score to drop by dozens of points. The lower your credit score, the higher your borrowing costs on quick loans — including interest rates and finance charges.

Credit Inquiries: Watch your number of new credit applications. A single hard inquiry is nothing to be concerned about, but multiple hard inquiries within a short period can temporarily lower your credit score.

Missed Payments: Even a single missed payment on your credit account can cause your FICO score to drop by as much as 110 points. The actual credit score impact depends on several factors, including your credit history, the number of days the payment is late, and the type of account with a missed payment. For example, missed credit card payments typically have a bigger impact than a missed utility bill payment.

How Do I Know if a Loan Company is Scamming Me?

Be on the lookout for the many telltale signs that a loan company is scamming you. Here are a few common ones to keep in mind:

High-Pressure Sales Tactics: These are among the most evident signs of a scam lender. Have they pressured you to act immediately in any way? If so, they’re doubtful to have clear transparent loan disclosures on their website and likely to include hidden charges on your loan.

Request for Upfront Fees: Another sign of a lending scam is a request for upfront fees or advanced payments in exchange for more favorable loan terms. Remember, legitimate lenders will never ask for upfront payment. At best, they withdraw any fees from the actual loan, as they may do with application or origination fees.

Little Disclaimer Information: A legitimate lender has well-written disclaimers on every page of its website. They should indicate a physical address, terms of use, privacy policies, and advertiser disclosures that let you know if third-party partners can access your information.

Do not let scam loan companies set you further back on your journey to rebuild damaged credit. Avoid lenders that use high-pressure sales tactics, request upfront fees, or have poorly written disclaimers, and you’ll be on your way to finding a worthwhile lending partner.

Lender Networks Help Consumers Who Need Fast Cash

Some lenders make it easy for those with poor credit to obtain short-term loans at accessible rates and terms. Lending networks such as Fast Loan Advance, MoneyMutual, and others can connect you to an expansive network of direct lenders that commit to honest lending practices.

Submit a loan application through your preferred lending network to prequalify and compare loan offers before signing any agreement. With some leg work, you can find the quick cash you need.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.