Doing business with an upstanding lender is important when you want to borrow money. The loan cost will be kept to a minimum, and you will have confidence that the loan was issued based on your ability to repay.

Unfortunately, predatory lenders exist, and these companies — and sometimes individuals — can hurt your finances, credit, and even your life.

So how do you know when you are dealing with a predatory lender? Here are 12 signs to look for.

1. The Interest Rate Is Sky High

Unless you are dealing with a generous benefactor, all lenders will charge interest for a loan. Determine the average interest rate for a person with your credit rating, then compare it to what you’ve been offered.

The higher your credit scores, the lower the interest rate will likely be, and vice versa. But some lenders take advantage of people with no or low credit scores, charging astronomical rates that greatly increase the cost of borrowing.

2. Exorbitant Fees

Many loans and credit cards come with fees, but they should be reasonable. For example, a credit card issuer may charge an annual fee to cover the cost of the rewards program.

In the case of a personal loan, the lender may charge an origination fee of between 1% to 8% of the amount you borrow, which is tacked on to the principal. A predatory lender will jack up the cost of those fees.

It may also add a ridiculous number of fees for things you can do for free, such as charging you for checking your balance or calling the lender to discuss your account over the phone.

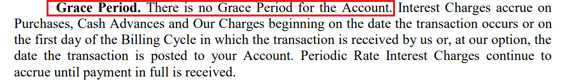

3. Grace and Payment Periods Are Short

Credit cards give you a grace period during which interest is not added to the amount you have charged. All you have to do is pay the entire balance by the due date and no fees will be applied. Typical grace periods are between 23 and 27 days.

If the grace period is shorter than that, you have less time to gather the funds before the lender adds financing fees. Payment periods for loans should be 30 days.

For example, your payment may be due on the 10th of every month. A predatory lender may expect the payments to come in every two weeks, putting enormous pressure on your finances.

4. The Terms Aren’t Properly Disclosed

Every lender you deal with should provide you with a written agreement that clearly states all of the loan terms. You need to see everything, including the interest rate, the fee structure, payment due dates, and penalties for nonpayment.

As per the Truth in Lending Act, a federal law, it is the lender’s responsibility to disclose all of the terms in language the average consumer can understand. If it doesn’t, and you only have an oral or incomplete agreement, find another lender.

5. It Doesn’t Report to the Credit Bureaus

The three major credit reporting bureaus are TransUnion, Equifax, and Experian. Legitimate lenders will regularly furnish the bureaus with information about your account activity, including when a loan or credit card was granted and your monthly payment pattern.

If the lender doesn’t report to the major credit reporting bureaus, your positive data when you manage your account responsibly won’t be listed in your file. Not participating in the credit reporting system is also an indication that the lender may operate outside of the norm.

6. Penalties For Nonpayment Are Especially Severe

If you do not make your payments as agreed, a predatory lender will swoop in and hit you with severe fees and increased interest rates.

For example, you may have to pay a whopping fee to keep the account in good standing. That can keep you in a perpetual state of debt rather than helping you get out of financial trouble because the amount you owe will grow instead of decline. Meanwhile, the lender profits from the process.

7. No One Else Will Give You Credit

You’ve turned to every conventional financial institution you can find and not one is willing to give you a loan or credit card. If a lender comes along that will extend you credit, it’s smart to wonder why.

A sound decision to lend money is usually based on capacity (ability to repay the loan) and predictability (you have evidence that you’ve repaid your debts in the past and sent payments as promised).

So if well-regarded small and large financial institutions have determined that working with you is too risky at this time, you probably aren’t ready for a loan. A lender that ignores your ability to repay or doesn’t take into account your past credit problems may not have your best interest in mind.

8. The Lender Is Unusually Persistent

Maybe you’ve been in communications with a lender, and you have gotten a bad feeling about them and have decided against the loan. But the lender refuses to accept your answer.

Now you are getting phone calls, emails, and texts, asking you to reconsider and even offering to sweeten the deal. Don’t take this persistence as a compliment — something is wrong.

9. The Lender Encourages You to Falsify Your Income

You need a loan but don’t qualify because your income is very low or inconsistent, and your household expenses are fixed and high. The lender is compassionate and understanding of your predicament, explaining that all you have to do is change those numbers so you are eligible for the loan.

This is not only illegal, but it will put you in a terrible position when you cannot make the payments as agreed because they are, in fact, unaffordable to you.

10. You Have to Put Down Collateral You Can’t Afford to Lose

Many loan types are secured with property, such as homes and vehicles, and credit cards that have a security deposit. It’s a way for the lender to minimize risk because it can claim the collateral if you fail to pay and the loan or credit card account goes into default.

But you have to be certain that you can make the payments and can afford to lose that collateral if you don’t.

Predatory lenders capitalize on a borrower’s desperation. If you default on a loan, the lender has the right to repossess the car you put up as security — the same car you need for work, school, or to drive your kids around. That will leave you and your family in a very bad position.

11. The Lender Has a Bad Reputation

Unless you are working with a major lender that has a renowned reputation for being both legitimate and positive, it is imperative to research its business practices. Look online to see what other borrowers say about the lender.

The Better Business Bureau (BBB) is an excellent source to see whether complaints against the lender exist. Lenders are also required to register with state agencies, so contact your state’s attorney general to find out whether the lender is registered and a good company to work with.

12. You Don’t Have to Complete an Application

Although it may be a relief not to have to complete all the paperwork involved in getting a loan, especially when you are dealing with a financial emergency, it’s a disaster waiting to happen.

Any lender that instructs you to sign a blank or incomplete application form, or says that they will fill it out for you later, is one to avoid. After all, the lender can write in anything, but your signature will be on the agreement, forming a legal contract.

What to Do if the Lender is Predatory

In addition to not accepting the loan or credit card from a lender you suspect is predatory, take further action by filing a complaint with the Consumer Financial Protection Bureau (CFPB).

Once you create a user account with the CFPB, you can use the drop-down form to describe what happened and why you believe the lender is acting unlawfully. The bureau will share your complaint with state and federal agencies, which may lead to an investigation.

What you experienced will also be published in the CFPB’s Consumer Complaint Database (which is where you can see any other complaints filed against the lender). You may also file a complaint with the BBB.

The Bottom Line on Predatory Lending

It is seldom worth it to do business with a lender that does not have demonstratively good business practices. If you do, the loan or credit card will cost you far too much, and you will end up in a worse financial position than you are now.

Follow your instincts and look for the signs we’ve outlined. When a lender is pushy or secretive, the loan seems too good to be true, or you know the overall price and consequences are abnormally high, move on — quickly.