A name like Coffee Break Loans sends a strong message: It will energetically and quickly pursue a loan for you. You can complete a loan request faster than it takes to down a cup of the hot stuff.

Coffee Break Loans joins the roster of short-term loan providers we regularly review. Let’s see how it stacks up.

Coffee Break Loans Connects Borrowers With Lenders

Coffee Break Loans is a loan-finding service, not a lender. It works with a network of direct lenders that provide loans to consumers of every credit stripe. The loan amount can range from $500 to $5,000.

Coffee Break Loans deals primarily with personal loans, although it may be able to find you another type of consumer loan if necessary. You can use the proceeds as you see fit.

By using Coffee Break Loans, you avoid seeking out and applying to individual lenders. The service collects most of the data a lender will need and shares it with its lending network.

One or more lenders may respond within minutes and get you your money as soon as the next business day. You benefit from the speed and convenience of this arrangement.

3 Alternative Lender Networks

The following lender networks provide more or less the same services as Coffee Break Loans. Some may offer payday loans instead of or in addition to personal loans.

A payday loan is a high-cost alternative that doesn’t require a credit check and has a short repayment term (usually one to four weeks). Unlike a personal loan that you pay in monthly installments, the repayment term for a payday loan coincides with your next payday.

1. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% – 35.99% | 12 to 60 Months | See representative example |

2. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% – 35.99% | 3 or 5 Years | See representative example |

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

All these lending services operate similarly, so choosing which one to use may seem unimportant. But you can perform a small amount of due diligence to help select the right company for you.

You’ll want to check a service’s rating with the Better Business Bureau and other review sites. Look for reports from actual customers – they may indicate the areas where a service excels or lags. Also, check the services for the minimum and maximum loan amounts, the income requirements, and the types of loans on offer.

Frequently Asked Questions About Coffee Break Loans

Coffee Break Loans may be a new name to you because its history goes back only one year. Here are the answers to a few frequently asked questions that should help you better understand how Coffee Break Loans operates.

How Do I Apply?

It takes only five minutes to fill out and submit a loan request on the Coffee Break Loans website. The information required includes the following:

- Name and address

- Phone number

- Email address

- Bank or credit union routing and account numbers

- Driver license number and state

- Employment and income

- Social Security number

- Next payday and frequency

Coffee Break Loans will prequalify your loan request by verifying some basic information. To be eligible for a loan, most lenders in the Coffee Break Loans network require you to:

- Be employed at your present job for at least 90 days.

- Be a US citizen or a permanent resident over the age of 18.

- Have a minimum income of around $1,000 per month after tax deductions.

- Have a checking account in your name.

- Provide a working telephone number for your home and work.

- Provide a valid email address.

Coffee Break Loans does not perform a hard credit check during the prequalification process, although direct lenders will usually do so. If you successfully prequalify, you should hear from one or more lenders willing to work with you. Coffee Break Loans may forward you to a lender’s website where you can finish the application process, including by:

- Providing any additional required information

- Supplying documents verifying your employment, income, and other items.

- Permitting the lender to perform a hard credit check. This may have a small impact on your credit score and remain on your credit report for two years, but other factors may mitigate any harm. The lender will also ask permission to take automatic payments from your bank or credit union account.

- Reading and e-signing any loan agreement you receive. The lender will specify the loan amount, loan term, payment size, origination fee, late fee, and interest rate.

- After final approval, the lender will directly deposit the loan proceeds into your bank account, usually by the next business day.

Since all the network lenders access the information you provided to Coffee Break Loans, the entire process can proceed rapidly. If you permit, the lender will take the required amount from your bank account on each loan payment date. Otherwise, you’ll have to send a check or electronic payment each month by the due date or face penalties.

If your loan payment is 30 or more days delinquent, the lender will probably report you to one or more major credit bureaus (i.e., TransUnion, Equifax, Experian). This can harm your credit score and remain on your credit report for up to seven years.

What Interest Rates and Terms Can I Expect?

Coffee Break Loans states that the maximum APR on the loans it arranges is 35.99%. Direct lenders on the loan network decide the amount to offer and the loan term based on your income and credit history. Loan amounts range from $500 to $5,000.

Although most Coffee Break Loans are unsecured, you may have another loan option: a secured loan from a network lender. In return for collateral, a secured loan (for example, a home equity loan or an auto loan) is much easier to obtain than an unsecured loan and should have a lower interest rate.

Unless otherwise specified, you will repay your unsecured loan in equal monthly payment installments. Coffee Break Loans does not participate in any financing and has no input into the terms.

Its financial services are free, but direct lenders may charge an origination fee (usually between 1% and 10%) in addition to monthly interest. Any fees (such as a late fee) appear in the loan’s APR.

Can I Get a Loan from Coffee Break Loans If I Have Poor Credit?

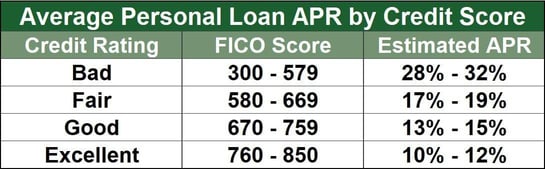

The Coffee Break Loans network lenders deal with all credit scores from excellent to bad. You can get a loan with poor credit but expect to pay a relatively high interest rate and fees. If you have some discretion over the timing of the loan, you can improve your approval chances by adopting habits that raise your credit score.

You can develop good credit by paying your bills on time, keeping your credit utilization ratio (i.e., credit used / credit available) below 30% but even lower for the best scores, and removing any derogatory mistakes on your three credit reports. You can clean up your credit reports yourself or hire a credit repair company to do the work for you.

How Is My Private Information Used?

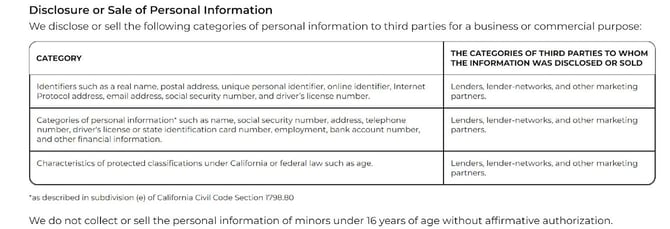

The following chart summarizes how Coffee Break Loans uses the data it collects. As you can see, it will share virtually all your data with lenders, lender networks, and other marketing partners. These terms are customary for lending networks.

If you live in California, you have the right to opt out of the sale of your personal information. Residents of the other 49 states can limit data sharing by emailing the company at support@CoffeeBreakLoans.com.

Is Coffee Break Loans Legit?

Coffee Break Loans appears to be a legitimate loan option based on the following evidence:

- A website active for more than one year

- An A+ rating from the Better Business Bureau. Trustpilot is yet to review the company.

- A secure, well-designed website that uses an extended SSL certificate and 2048-bit encryption

- The site has About Us and Contact Us pages

On the negative side, Coffeebreakloans.com does not have a presence on social media sites such as Facebook, Twitter, or Instagram.

As far as the legitimacy of the lenders on the Coffee Break Loans network, the company reveals:

“CoffeeBreakLoans.com receives compensation from its lenders and lending partners, often based on a ping-tree model similar to Google AdWords where the highest available bidder is connected to the consumer… CoffeeBreakLoans.com uses commercially reasonable efforts to ensure that the information on this Site is accurate, but accuracy is not guaranteed. CoffeeBreakLoans.com makes no representations regarding your use of this Site or results that you may or may not obtain through such use.

This is standard language for online loan-finding financial services.

Lender Networks Help Consumers Who Need Fast Cash

Lending networks save you time when you need emergency funds. Coffee Break Loans is a relatively new entrant in this field, with very few online comments from users. Its website has a professional look and feel to it.

Given its A+ rating from the BBB, we believe Coffee Break Loans works well, and you should have no problem including it on our list of reputable financing networks.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.