A $1,000 loan for bad credit can make a big difference in helping you manage a financial emergency. Personal loans can be a stepping stone to managing a crisis, whether you choose a payday loan, installment loan, debt consolidation loan, or a title loan.

Short-term loans provide quick access to funds, but for bad credit borrowers, they can be hard to access. Our experts have reviewed the personal loan options available, and these companies offer the best chance for success.

Small Loans For Bad Credit

It can be difficult to find a short-term loan if you have bad credit. Most loan companies aren’t willing to take the risk on a low credit score. These seven companies offer personal loan options from several lenders at once, making it easy to find the right loan product for your needs.

By working with lending networks instead of individual companies, you have a better chance of finding the right loan terms and getting the money you need.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

Finding a short-term loan can be difficult with a bad credit score, but MoneyMutual can make it easier through its network of lenders. The company launched in 2010, and has helped over 2 million customers find a solution to financial emergencies. The network simplifies the personal loan process by using one loan application for many lenders, saving time and frustration for the borrower.

A poor credit report means that fewer lenders are likely to approve an application, but by sending the same application to all of the lenders in the network, MoneyMutual increases your chances of getting a yes.

The network’s lenders provide personal loans of different types, and amounts vary from $200 up to $5,000. Customers can complete the application in less than 10 minutes and have their money in their bank account in as little as 24 hours.

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% – 35.99% | 3 or 5 Years | See representative example |

Upstart can help you secure a $1,000 loan through its exhaustive network of more than 100 banks and credit unions. To qualify, you must be at least 18, have a valid email address, SSN, and earn a minimum income of $12,000 or more per year.

You must also have a personal bank account and a verifiable source of income. Additional requirements may apply, depending on the lender.

Checking your rate on Upstart will not affect your credit, and there’s never any obligation to accept a loan offer. It takes just a few minutes to check your loan eligibility.

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com boasts a very powerful online lender network that users from all 50 states can access to find personal loan options ranging from $500 to $10,000. The lending network uses the information you submit in the prequalification form to help determine the best fit for your needs from among many different lenders at the same time, and streamlines the application process to make things easy.

The application process takes less than 5 minutes, and CashUSA uses the information you provide to perform a soft credit check. While you can use your personal loan for any purpose you want, CashUSA will ask what you intend to use your funds for to help connect you with the best possible match among its lenders.

A bad credit score won’t disqualify you, since the network includes companies that work specifically with borrowers with poor credit history.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

Another industry heavyweight that our experts recommend is SmartAdvances.com. The company has maintained high standards in helping borrowers find the right lender, regardless of their credit history. Borrowers can apply for a $1,000 loan with bad credit, and get an answer in minutes and their funds by the next day in many cases.

It’s true that the interest rates for cash advance loans tend to be much higher than rates for other loan types, and this is true of the short-term loans offered on the SmartAdvances.com network.

It can be hard for borrowers with poor credit to find a loan offer at all, but the people behind SmartAdvances.com want to help borrowers understand the risks. It is a member of the Online Lenders Alliance (OLA) and is committed to responsible borrowing that complies with federal law.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

Finding a bad credit lender can be tricky, whether you need a loan of $1,000 or more. BadCreditLoans.com specializes in connecting borrowers with poor credit history with lenders who are willing to take the risk. The lending network has several personal loan options available, from payday loans to secured loan options.

Bad Credit Loans stands apart from some of the other companies in this list because it offers options for business owners as well as for individual consumers. Business loans are a better option than a personal loan for business-related expenses, but business owners with bad credit often struggle to find resources.

Bad Credit Loans also offers educational resources to help borrowers build up their credit over time and avoid some of the pitfalls that can come with access to loans.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

The personal loan industry is a crowded place, and it’s difficult for companies to set themselves apart. CreditLoan.com has a unique feature that makes it easy for the lending network to distinguish itself from its competitors.

Instead of one big network of lenders, CreditLoan maintains separate networks to make it more likely to get the loan approval you seek. The separate networks make it easier to find a bad credit lender, instead of facing rejections from companies that aren’t willing to take a risk.

Like many lending networks, CreditLoan does a soft credit check to sort applicants according to their credit score and submit their applications to the right lenders. The site can even help borrowers with past bankruptcies in their credit history find a lending company to work with. CreditLoan makes it clear in its FAQs, however, that it’s difficult to impossible to get approval on an installment loan with an active bankruptcy in progress.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

Most lending networks use fairly basic methods to connect borrowers to lending companies. PersonalLoans.com takes things a step further to make it easier to connect with the right lender. The site uses a proprietary algorithm to match borrowers to lenders based on the information provided.

Another way that PersonalLoans.com sets itself apart from other lending networks in this list is through the range of loan options available. PersonalLoans.com lenders include peer-to-peer lenders, and bank and credit union loans in addition to the standard offerings like a payday loan or a secured loan like a title loan.

The company also provides industry-leading customer service and resources to help guide borrowers to the best choices.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

If your credit score is less than perfect, InstallmentLoans.com may help steer you toward an online lender willing to take a chance. The lending network doesn’t perform a credit check — not even a soft one — so submitting your application is even faster.

The network casts a wide net in helping borrowers with bad credit find a lender. It doesn’t have many testimonials, but all indications are that it’s a valid resource with generally satisfied customers.

How Do I Get a $1,000 Loan For Bad Credit?

The process to get a $1,000 loan for bad credit is fairly simple. The loan application generally only takes a few minutes, and if you choose to work with a lending network instead of a direct lender, you only have to fill out one application to get answers from multiple lenders.

Fill out the loan application with the required information. While not every application asks for the same details, most lending networks request key pieces of information.

- Date of birth (you must be at least 18 years old to apply for a loan)

- Proof of citizenship or residence in the US

- Proof of income

- A valid checking account to deposit the loan into

- Loan amount

From there, the requirements can vary depending on the type of loan that you want to apply for. Secured loan products like title loans usually require information on the item you’re using as collateral, such as the make and model of your car and whether it’s paid off. Payday loans may require information on how often you’re paid.

Once you’ve submitted your initial application, you may have to provide additional details to the lender you choose to work with. The direct lender you select may also check your credit history with a credit bureau like Experian or TransUnion if you apply for an unsecured loan.

From there, if you get loan approval, you only have to read and sign your contract and wait for your funds to arrive. Generally, personal loan companies can get the funds to you within one to two business days. Discuss general qualifications and approval criteria.

What Credit Score Do I Need For a $1,000 Loan?

Unfortunately, personal loan companies don’t provide specific guidelines on what credit score they accept from loan applicants. But there are a few key factors that our experts agree make a difference.

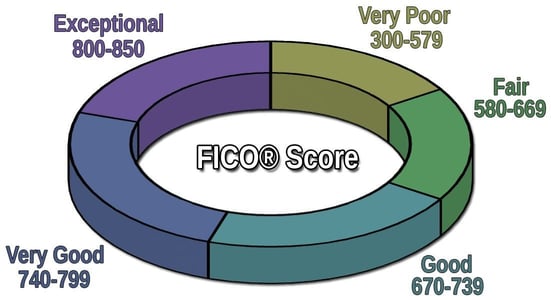

According to FICO, anything below 580 is considered a poor credit score.

You may notice that your credit report looks different depending on which credit bureau provides the report. While there’s no way to know for sure which credit report a loan company will check, it’s best to keep an eye on all of your credit reports and scores.

People with credit scores below 580 will find it difficult to get a personal loan. The closer you are to the minimum credit score of 300, the lower your chances are. But the closer you are to 580, the better your chances.

If you have a few months’ time before you need a loan, try to get your score above that threshold. A bad credit lender will work with low scores, but the lower your score, the more limited your options are.

How Can I Borrow $1,000 Fast?

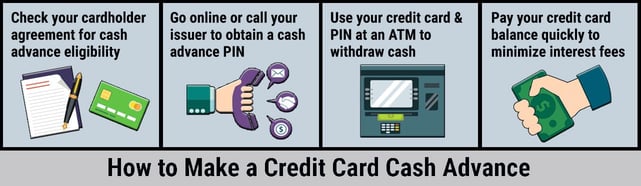

In addition to working with the companies on this list, there are a few other ways to borrow $1,000 quickly. If you need an emergency loan, you can contact your credit card company and find out what the rates for a cash advance are on your card.

A $1,000 loan on a credit card can be a tricky proposition, but if you have the credit available and you can afford the interest rate, it’s a possibility.

Another option is a cash advance app. These mobile apps offer different short-term loan products like payday loans and installment loans from a variety of companies. Many of the lenders on these apps don’t care about credit history and only ask about work history and income to help them make a decision.

Other options depend on your resources. If you own valuable jewelry or collectible products, you could consider getting a pawn loan. Pawnshops offer a kind of secured loan based on the value of an item that you provide as collateral. If you don’t think you’ll be able to pay back the pawn loan in time, you can also consider selling a valuable item.

Finally, you can seek out peer-to-peer or personal loans from friends and family.

Can I Get a Debt Consolidation Loan to Pay Off My Credit Card Debt?

Yes, it is possible to use a debt consolidation loan to pay off credit card debt. In general, small personal loans for bad credit are not the best option for paying off your credit card because many of these loans have a higher interest rate than those of credit cards.

Debt consolidation loans are an option that you can discuss with a credit counseling company as one way to reduce your debt over time.

While you can use an emergency loan for any purpose, it’s better to look for installment loans that are geared more toward helping bad credit borrowers pay off existing debt because the credit terms tend to be more forgiving. A debt consolidation loan is a simple loan and tends to be for a larger loan amount with a fairly low APR.

What Are the Risks of Short-Term Cash Advances?

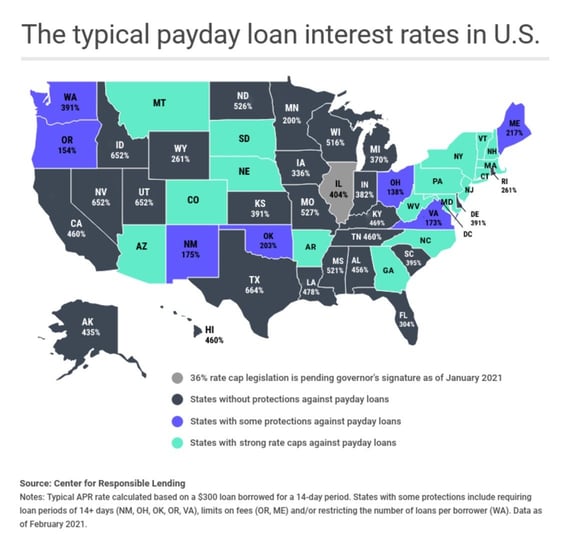

If you’re in the midst of an emergency, short-term cash advance loans, like a payday loan, can seem like a good solution. Cash advances are one of the most common bad credit loan types, and unlike installment loans, a payday lender may not check your score with a credit bureau before approving your loan.

But there are some major risks to keep in mind. Payday loans have to be paid back in a very short time frame, unlike other bad credit loan types. The interest rates tend to be very high, and your payback amount can balloon quickly.

If you know absolutely that your budget can handle paying back your unsecured loan in a short amount of time, and that you’re not likely to run into even more financial complications in the meantime, a cash advance loan can be helpful for emergency funds.

But there are a lot of small personal loan options out there with better terms and a longer repayment period, so if you have other online loan offers available, it’s best to explore them first.

Compare $1,000 Loan Offers For Bad Credit Online

Finding a $1,000 loan for bad credit can be a lot more difficult than finding a personal loan when you have good credit. Most direct lenders are less willing to take the risk on a bad credit borrower, and those that are willing often charge much higher rates.

The companies in this list provide options for people with bad credit who need access to emergency cash, without having to fill out several different loan applications or wait around for answers. When you have an emergency, getting what you need fast is always a relief.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.