One of the unfortunate facts of life is that emergencies don’t wait for you to have extra money, which is why quick and easy small loans exist. But if you have bad credit, it’s not always easy to find a willing lender.

Fortunately, several companies offer small personal loans for bad credit borrowers who need a short-term financial boost. Short-term cash loans can come with extra terms and conditions, but if your emergency just can’t wait, a few lending networks can help connect you with lenders that can help.

Small Loans That Are Quick & Easy to Get Approved For

These lending networks partner with many lenders to connect borrowers with the personal loan option that fits their needs. Whether you need an installment loan, a small payday loan, or other types of fast cash, the following seven networks likely work with a company that offers the right option.

Of course, guaranteed approval isn’t truly possible because individual lenders have different criteria, and some bad credit cases pose too high of a risk. But many of the networks below work with companies that specifically cater to bad credit borrowers, so your chances of approval are higher.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual launched in 2010 and secured loans for more than 2 million customers in a little more than a decade. The lending network partners with banks and other lending companies across the US to connect prospective borrowers with the right loan option with the right terms.

MoneyMutual provides a short loan application and preapproves applicants based on a soft credit check to help decide which lenders may be a good fit. The company’s lenders offer a wide range of loan products, from small personal loan amounts to larger loans of up to $5,000.

2. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

Finding a bad credit personal loan can be tricky, but it’s easier to streamline the process by working with a lending network like CashUSA.com. The CashUSA lending network includes a lot of different quick loan types, but for an unsecured loan, you can use your money for whatever purpose you want.

While customers at CashUSA are satisfied overall with the loan experience, the company has faced complaints due to its selling of customer data to third-party marketers. While it may be frustrating to deal with marketers and email spam, customers cite that getting their loan was easy and quick. Be aware of the possibilities and take the usual precautions when dealing with telemarketers and spam emails, and put your emergency loan to good use.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

While many companies offer quick and easy small loans to bad credit borrowers, InstallmentLoans.com has the distinction of being featured on CNN, FOX News, and MSNBC, among other major media outlets.

This network doesn’t check your credit report with the credit bureaus. It instead uses its own algorithms to determine which lenders to match you with. The company does advise that any of its partners may (and probably will) perform a credit check prior to loan approval, but the site itself doesn’t perform even a soft check before starting the matching process.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

One major distinction that CreditLoan.com prides itself on is its status as a personal loan industry veteran. The site has helped borrowers with every type of credit history since its launch in 1998.

Bad credit borrowers can access a dedicated network of lenders that specifically work with people who have poor credit. This helps improve the loan approval odds because the lender isn’t comparing you with people who have never made any mistakes. Bad credit loans tend to have stricter terms and higher interest rates, but CreditLoan’s network of bad credit lending companies means you have more options.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

BadCreditLoans.com launched in 1998 with a simple, direct premise: helping bad credit borrowers find small personal loans. The lender network maintains a strong reputation for helping people with poor credit find the right emergency loan product for them.

The process is simple. Borrowers fill out a quick online application, including their monthly income, phone number, email and mailing address, bank account or credit union account info, and so on. Bad Credit Loans then shares your details with its lender network. Once you find the loan offer that appeals to you, you can accept it.

While the final loan approval process will almost certainly include a credit check, the preapproval process through Bad Credit Loans doesn’t affect your credit score. If you don’t see a loan option that appeals to you, like a payday loan or other cash loan type, there’s no obligation to accept an offer.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com stands out from the other companies on this list for several reasons. The credit score and history you’ll need to qualify with a lender in the PersonalLoans.com network is a little higher than some of the other sites we’ve mentioned, and the loan amounts offered are also higher.

If you have decent credit, PersonalLoans.com is a better option for you than it would be for someone with truly bad credit. The company does a soft credit check and uses the information to sort the wide range of options in its network. From there, you only have to follow the steps to complete your loan approval.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% – 2,290% | Varies | See representative example |

As with the other companies on this list, CashAdvance.com isn’t a lender. Instead, the site connects borrowers with a lending network of companies that offer various cash loan options, including payday loans.

Unlike the other companies on this list, CashAdvance.com lenders offer a narrower range of cash loan products, from $100 to $1,000. If you need an emergency loan for a larger amount, this network may not be the best choice for you.

But for small loan needs, especially to find a payday lender, CashAdvance has a strong reputation. As a member of the Online Lenders Alliance, the company adheres to strict compliance rules and delivers respect along with quick loan options.

What Makes a Loan Easy to Get?

A few qualifiers make a personal loan easy to get. The most basic thing to look for are easy approval requirements.

Almost every lender checks an applicant’s credit score as part of the decision process, but quick cash loan and bad credit loan providers generally have minimal credit history requirements. Some more common requirements for bad credit loan lenders include:

- Age: You must be at least 18 years old.

- Citizenship: You must be a US citizen or resident and have a valid Social Security number.

- Income: You must meet a minimum income threshold, either through a regular paycheck, benefits, or another method.

- Bank account: You must have an active bank or credit union account registered in your name.

- Identification: You must provide a Social Security number, valid email address, bank account details, and work and/or home phone numbers.

Beyond these factors, each individual lender may have specific criteria. You don’t have to submit to a credit check for some payday loans, so the lender won’t request to see your credit history with the credit bureaus.

How Do I Apply For a Loan?

To apply for a small personal loan, you usually start with a preapproval form with a lending network, like one of the companies on this list. The preapproval step includes a soft credit check to verify your credit score and other basic details.

From there, the lending network will recommend one or more small loan companies that it thinks will approve your application. The lender will likely request more information. In many personal loan approvals, the lender will also check your credit score before making a decision.

You should review the details in your short-term loan offer, including the:

- Repayment terms

- APR/interest rate

- Monthly payment amount

- Consequences for default or other issues with your loan account

If the terms work for you, choose the offer that makes the most sense. The loan funds will be in your bank account within 24-48 business hours after signing the loan contract.

How Much Can I Borrow?

The amount you can borrow depends on a few factors. The lending networks in this list include lenders that offer loan amounts that range from $100 to $35,000.

The type of personal loan you apply for makes a difference. Small cash loans, such as cash advances on your credit card or loans from a payday lender, are for smaller amounts. But a business loan will generally be for much more.

Another factor is your credit score. A bad credit score leads to a lower loan approval amount because the lender doesn’t want to risk too much money without the confidence that you’ll pay it back. Higher loan amounts go to borrowers with better credit history.

When Will My Loan Need to Be Repaid?

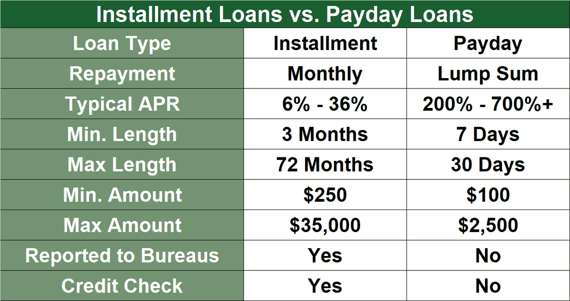

Repayment terms can vary from one state to another, especially for payday loans. Each state has different laws and statutes about payday loan policies. But other personal loan types can also have different terms.

The loan amount also plays a role in how long it takes before you repay it. Small cash loans tend to have a shorter repayment term, while larger loans have a longer repayment term. The term can be anywhere from three to 72 months.

What Is the Easiest Loan to Get?

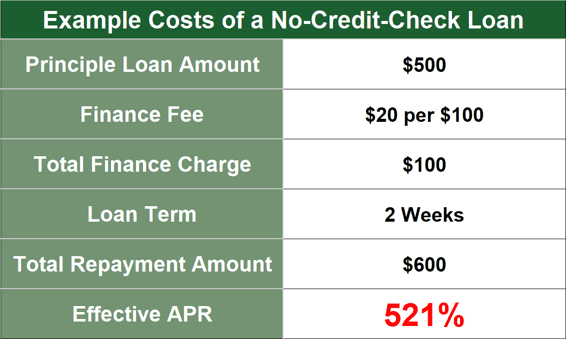

Payday loans are some of the easiest loans to get approval for. While they aren’t guaranteed approval, in many cases, they are a good “no credit check loan” option. Many payday lenders don’t check your credit score and instead just verify your income.

Of course, a bad credit score doesn’t restrict all of your personal loan options. Secured loans based on your car or other collateral are also easier to get approved for if you have assets to cover the debt if you don’t repay.

How Can I Instantly Borrow Money?

Some direct lenders offer same-day and instant deposits into your bank account for an additional fee, but this is far from the norm. Your credit card may offer a cash advance service through an ATM, but it’s worth checking the interest rates and terms before using that option.

If you need same-day funds, your best options are to visit a local payday lender, borrow from friends or family, or look into some of the newer cash advance apps that provide funds on the same day, in some cases for no extra fee.

Carefully Read the Terms and Conditions of Quick and Easy Small Loans

If you need a bad credit loan to cover a financial emergency, many options are out there. But while some lenders may look past a bad credit score, it’s still important to check the terms of quick and easy small loans before signing the contract.

Make sure the monthly payment is manageable and that the interest rate and other terms of your loan won’t make more trouble for you down the line. Once you’re confident that your loan offer is fair and what you need, take a moment to relax! Your financial emergency will be solved.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.