Let it be known that we like Fig Loans. We had the opportunity to interview them and appreciate what they have to offer, which is a payday loan alternative that lets you repay your balance over a few months rather than weeks.

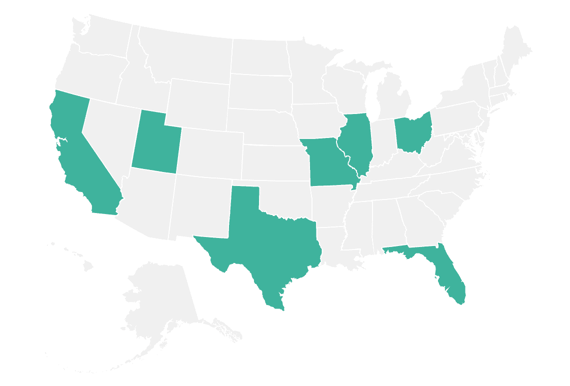

That said, its installment loans are only available in seven states, and the maximum available loan amount currently available is $500. If you live in one of the 43 states Fig doesn’t yet service, we present the following loan alternatives that may better suit your needs.

Best Loans Like Fig Loans

The following companies are lender networks that partner with direct lenders like Fig Loans. You can fill out a short loan request form to see the loan options you qualify for. These lenders span the gamut of available loans, including large installment loans and small short-term personal loans.

Be sure to carefully compare each loan offer so you can choose the best interest rate and repayment term for your budget. There’s no obligation to accept any loan offer you receive, and submitting a loan request is free.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

2. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% – 35.99% | 12 to 60 Months | See representative example |

3. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% – 35.99% | 3 or 5 Years | See representative example |

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

5. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

Unlike Fig Loans, these companies work in most states and offer higher loan amounts. There’s no minimum credit score requirement to apply for a loan from any of the lending networks. But only applicants with fair or good credit will qualify for a large personal loan.

There are no restrictions on how you spend your money, and loans are usually available in your bank account by the next business day. Not all lenders report payments to the bureaus like Fig Loans does, so if that’s important to you, ask the lender whether that’s an option.

What Is Fig Loans?

Fig Loans is a direct lender that offers emergency loans in the following states: California, Florida, Illinois, Missouri, Ohio, Texas, and Utah.

It offers small loans that you can repay over four to six months. Payments are reported to the three major credit bureaus — Equifax, Experian, and TransUnion — to help you build credit when you make your payments on time.

If you can’t repay your loan within the allotted time, you can extend your loan term without any additional interest or fees — something unheard of in the payday lending industry.

Fig Loans says its loans are best suited for people who need to cover an unexpected expense and want to avoid predatory payday loans.

How Much Can I Borrow From Fig Loans?

Loan amounts range from $50 to $500, but how much you can borrow depends on where you live. For example, the minimum and maximum loan amounts in California are $50 and $150, whereas the minimum and maximum loan amounts in Texas are $300 and $500, respectively.

California: $50 – $500

Florida: $300 – $500

Illinois: $50 – $100

Missouri: $300 – $500

Ohio: $200 – $300

Texas: $300 – $500

Utah: $300 – $500

The interest rate you pay also depends on where you live:

California: 211.00%

Florida: 208.56%

Illinois: 35.99% (Loan amounts are capped at $100)

Missouri: 199.00%

Ohio: 199.00%

Texas: 199.00%

Utah: 199.00%

There’s a disclaimer on the Fig Loans website that says, “Advertised APRs are exemplary and may change based on application quality.” We can’t say for sure what other APRs would look like under Fig’s underwriting standards.

Depending on what you need the money for, the loan amounts may be a bit restrictive. And other than in Illinois, the average loan APR is about 200%, which is much higher than the APR for a typical personal loan that tops out at 36%.

What Credit Score Do You Need For a Fig Loan?

There is no minimum credit score requirement to apply for a personal installment loan from Fig Loans. In fact, Fig Loans says it will not perform a hard credit check when you apply. But it does state that you must have a steady income to qualify for a loan, and it will ask you to link your bank account to further assess your application.

These are the things Fig Loans says it looks for when evaluating applications:

- Personal info

- Bank account balance

- Income

- Consistency of deposits

- Number of returned checks or insufficient funds fees

- Number of open loans with other lenders

- Amounts of open loans

- Previous history with Fig Loans

- Active military status or a family member

- State regulations

- Identity check with Clarity Services

If you are denied, Fig Loans will send you an email that details the reason(s) you were denied for a loan. But poor credit alone shouldn’t be a barrier to loan approval.

How Quickly Can You Get a Fig Loan?

According to the Fig Loans website, “Applications are reviewed daily and funds are often deposited by the next business day.” But it also claims to offer instant cash deposits upon approval:

“Loans funded to debit cards are deposited instantly. ACH deposits may take several days.”

Note that a deposit taking several days to clear isn’t a drawback of Fig Loans, but rather the time it takes your financial institution to accept the deposit. So based on this information, if you apply early in the day and supply your debit card information for the deposit, you could get your loan on the same day you apply.

Get the Loan You Need From a Reputable Lender

If you need a small personal installment loan you can repay over a few months and live in one of the seven states Fig Loans services, it may be worth applying. Fig’s interest rates can still be high, but perhaps not as high as those for a payday loan, and there are no hidden fees.

But if you don’t reside in an eligible state or need more money than Fig can offer, the lending networks we recommend can help you secure a speedy cash loan you could receive as soon as the next business day. You may qualify for a quick cash advance you can repay with your next paycheck or an installment loan with a monthly payment you can afford.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.