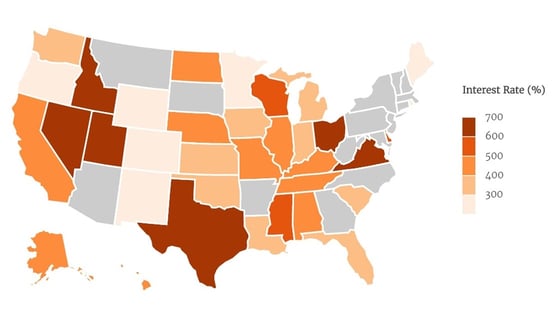

When you think about bad credit loans in Texas, the term “Wild West” comes to mind. That’s because Texas has laws governing payday and auto title loans that cause residents to pay almost twice as much as they do in other states.

However, Texans have better alternatives to these high-cost loans, such as personal, auto, and home loans, that need not send you into a debt spiral. Accordingly, we’ve reviewed and rated the best bad-credit loan options for residents of the Lone Star State, so keep reading to find the alternative that works best for you. We’ll offer a rundown of our top choices when it comes to cash loans, auto loans, and home loans, as well as answer some of the most commonly asked questions on the topic.

Bad Credit Cash Loans in Texas

Personal loans can provide quick cash to folks with all types of credit. These cash loans do not require you to pledge collateral to secure the loan — just a signature (and perhaps a cosigner) will do. Naturally, you’ll pay a higher APR when your credit score is low, but the following three loan matching services give you access to cash loans despite having bad credit.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual connects borrowers to the lenders in its personal loan marketplace, where you can request a loan of up to $2,500 in just a few minutes. This lending service has arranged loans for more than 2 million customers.

To qualify, you must earn at least $800 per month, be a U.S. resident who is 18 years or older, and have a checking account. The ultimate lender may have additional requirements.

2. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

CashUSA.com is a matching service for personal loan providers catering to folks with below-average credit. You can apply for loans as small as $500 or as large as $10,000.

Even with bad credit, you can qualify for a loan if you are a U.S. resident, age 18 or older, have earnings of $1,000 a month after taxes, and a checking account in your name. It only takes a few minutes to request a loan, and if you accept a lender’s offer, you can retrieve your money as quickly as the next business day.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Since 1998, CreditLoan has helped more than 750,000 customers get approved for loans despite having bad credit. You will need a checking account to qualify for a loan ranging from $250 to $5,000.

Filling out the short loan request form will allow you to receive one or more offers from the CreditLoan® lender network. Once you agree to the loan terms with a lender, you can have your money deposited into your account as quickly as the next day.

Bad Credit Auto Loans in Texas

Having bad credit is not a deal-breaker in Texas when you need an automobile loan. The following three lending services work to find you a dealer that will finance a new purchase or provide you with cash out refinancing.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

Auto Credit Express works with a network of more than 1,300 bad-credit auto dealers and has arranged more than 1.8 million auto loans since its founding in 1999. It takes a minute or less to qualify for an auto loan and about three minutes to request one.

The lenders in the Auto Credit Express network are ready to lend to consumers who have bad or no credit histories, including folks who have experienced repossessions or bankruptcies.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.com began arranging auto loans in 1994. It works with the country’s largest network of car dealers and lenders for all credit types, including bad-credit borrowers.

After filling out the short loan request form, you may be contacted by one or more lenders that are interested in working with you. If approved, you can access your loan in a day.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

With myAutoloan.com, you can quickly be matched with up to four loan offers, and bad credit is not a problem. The lending service’s network includes automobile dealers, banks, finance companies, affiliates, and credit unions.

You can use the loan proceeds for new or used car loans, cash out refinancings, lease buyouts, and private party purchases. When your loan application is accepted, you can receive an online check or loan certificate within 24 hours. Loan terms generally range from 24 to 72 months.

Bad Credit Home Loans in Texas

Providers of home loans will fight for your business, even if you have bad credit. The three lending services reviewed here can get you one or more offers for various types of home financing, and when lenders compete, you can’t lose.

7. LendingTree

This offer is currently not available.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

LendingTree, founded in 1996, is a peer-to-peer lending marketplace that can get you up to five loan offers within minutes. You can fill out a loan request form in less than 10 minutes, and the service is free.

You can get a home purchase loan, a home equity loan or line of credit, home refinancing, or a reverse mortgage. Your chances of getting an offer are good, considering that LendingTree has handled more than 55 million loan requests and $250 billion in loans.

- Options for home purchase or refinance

- Get 4 free refinance quotes in 30 seconds

- Network of lenders compete for your loan

- Trusted by 2 million+ home loan borrowers to date

- Interest rates are near all-time lows

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2004 | 4 minutes | 8.5/10 |

FHA Rate Guide, a service of LeadPoint, Inc., works with a network of lenders that offer home loans and refinancings. In business since 2004, FHA Rate Guide has helped more than 2 million borrowers obtain home financing.

You can apply for cash out refinancing to turn some of your home equity into money. The FHA Rate Guide network provides an opportunity for multiple lenders to compete for your business, and you can get up to four refinance quotes in less than a minute.

- Easy to OwnSM programs give options for those with lower income, limited credit history, and low down payment needs.

- Provides the potential for minimal out-of-pocket expenses with seller contributions.

- Offers loans that don't require monthly mortgage insurance.

- Requires less cash upfront for your down payment and closing costs.

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1852 | 6 Minutes | 8.0/10 |

Wells Fargo Home Mortgage offers FHA, VA, and Easy to OwnSM Guaranteed Rural Housing programs, as well as loans not guaranteed by the government. Guaranteed loan programs give consumers with bad credit access to mortgages with low down payments and reduced income requirements.

Wells Fargo also offers refinancing opportunities to pay down your mortgage, reduce your interest rates, lower your monthly payments, or convert to a fixed rate. Some loan programs do not require mortgage insurance.

How Can I Get a Personal Loan with Poor Credit?

Unexpected expenses can crop up at any time, and a personal loan can be a viable solution even if you have poor credit. Ideally, you would take steps to improve your credit before the need for a loan arises.

You can frequently improve your credit by reducing your debt (without closing accounts you no longer use), always paying on time, and paying more than the minimum balance due. You should also order your free credit reports, review them, and correct any mistakes. Finally, look up your credit score so you know where you stand.

When the time comes to apply for a personal loan, you can save time and effort by using one of the lending services we review here. The services are free and geared toward consumers with bad credit.

You can also take certain steps to improve your access to credit. Two classic strategies are to have a cosigner and to pledge collateral. Both strategies reduce the lender’s exposure to risk, which makes it easier for them to extend credit and charge lower interest.

You may also want to consider alternative borrowing sources. You can use LendingTree, FHA Rate Guide, or Wells Fargo Home Mortgage to obtain a home equity line of credit or to get a cash out mortgage refinancing. Or, if you have equity in your car, contact Auto Credit Express, Car.Loan.Com or myAutoloan.com to arrange car loan cash-out refinancing. If appropriate, you can also consider a credit card cash advance.

In any event, you surely want to avoid a title or payday loan, as they are risky, expensive, and can leave you in a hopeless debt spiral.

Are Online Loans Legal in Texas?

Online loans are perfectly legal in Texas. However, lenders who want to charge more than 6% APR must register with the Texas Office of Consumer Credit Commissioner. By doing so, online loan providers agree to observe these limits in Texas:

- For personal loans up to $2,010, the maximum effective interest rate is 32%.

- For personal loans between $2,011 and $16,750, there is a three-tiered maximum rate of 30%, 24%, and 18%.

- All other personal loans have a maximum rate of 18%.

- Signature small installment loans of up to $1,340 have a maximum effective interest rate of 240%.

- However, a borrower and lender can sign an agreement that waives these limits, thereby defeating the caps on interest rates.

The story is different for payday and title loans, where the nominal maximum APR is 10%. Texas has a complicated procedure that centers on the Credit Services Organization Act.

The Act provides for the establishment of Credit Access Businesses (CABs) that broker payday and title loans. When you take a payday or title loan in Texas, you go through a CAB that matches you to an independent lender.

Although the lender can only charge you 10%, the CAB is free to charge you any amount for arranging and guaranteeing the loan. Under this arrangement, APRs for payday and title loans exceeding 500% are the norm.

To make matters worse, if you miss a payment on your title loan, the lender can repo your car. Invariably, late payments on payday and title loans trigger substantial late fees. Your payments go to the late fees first, and, of course, those payments do not reduce your principal amount. This is how a debt spiral begins.

Is Wage Garnishment Legal in Texas?

Wage garnishment (which Texans call wage attachment) is a court order or government instruction to divert some of your paycheck to your creditors. Your employer must withhold the garnished amount and forward it to the recipient.

Texas is a state that limits the types of debt that can be garnished and the amounts subject to garnishment. In particular, only the following debts can lead to garnishment in Texas:

- Child support/alimony: When a court orders child support in Texas, the paying parent’s income is automatically withheld. But if that parent falls behind, the other parent can request the court to order wage garnishment. Texas law allows up to 50% of a person’s disposable earnings to be garnished for domestic support obligations. The state defines disposal earnings as those remaining after tax and other deductions, as well as payments for certain types of insurance.

- Student loans: Defaulted student loans can lead to an administrative garnishment from the U.S. Department of Education or one of its collection agencies. The garnished amount is limited to 15% of disposable income, but no more than 30 times the minimum wage.

- Unpaid taxes: The IRS can garnish your wages for unpaid taxes without requiring a court order. The amount that can be garnished depends on your deduction rate and number of dependents. State and local governments can also garnish for unpaid taxes.

Texas has strong protections for garnished employees. An employer cannot discipline, fire, or refuse to hire someone just because of wage garnishment.

Can a Debt Collector Sue Me in Texas?

Debt collectors must observe Texas state rules when attempting to collect a debt. Collectors can sue you, but they can’t idly threaten to do so. In other words, a collector can threaten to sue only if they actually intend to sue and are legally allowed to do so.

They can never threaten you with arrest for owing money, nor can they garnish your wages unless you owe money on student loans, domestic support obligations, or back taxes. In fact, Texas has some strong rules the curtail what a debt collector can do.

These rules are codified in the Texas Debt Collection Act (TDCA). First, they can’t adopt abusive tactics, including:

- Threatening violence

- Obscene language

- Making false accusations of fraud or other crimes

- Threatening arrest or property seizure without required court proceedings

- Harassing phone calls

Additionally, fraudulent collection tactics are forbidden, including:

- Falsifying identity

- Lying about the amount owed or court status

- Sending counterfeit court documents to the debtor

- Hiding the identity of the creditor

- Misrepresenting the services rendered by the collector

- Misrepresenting information to wangle information

Finally, the Texas Statute of Limitations prohibits a debt collector from suing individuals to collect debts that are four or more years past due.

Note that the TDCA applies to anyone in Texas who tries to collect a consumer debt. This contrasts federal law, which applies only to collectors working for designated debt collection agencies and to lawyers employed to collect debts.

Texans Have Alternatives to Payday and Title Lenders

Storefront payday and title lenders are ubiquitous in Texas. However, as we show, there are much better sources for bad credit loans in Texas.

Our top picks are MoneyMutual for cash loans, Auto Credit Express for auto loans, and LendingTree for home loans. And all of the loan sources reviewed in this article offer reasonable solutions to folks with bad credit who need a loan.

In-Person Options for Bad Credit Loans in Texas

Applying for a bad credit loan might be one of those times when it pays to speak face-to-face with an expert. For all the conveniences of online transactions, an actual conversation can be more effective.

You’ll be able to make your case by outlining the financial challenges that led you to a visit and get any questions answered promptly. Here’s a list of bad credit loan office locations throughout Texas:

GBC Finance Co

601 Sawyer St # 100

Houston, TX 77007

Southern Finance

3655 Fredericksburg Rd

San Antonio, TX 78201

Mariner Finance

2525 W Wheatland Rd #280

Dallas, TX 75237

Southern Finance

3851 Airport Blvd

Austin, TX 78722

World Finance

2901 Alta Mere Dr Ste 500

Fort Worth, TX 76116

Oportun

5505 Montana Ave

El Paso, TX 79903

Sun Loan Company

2824 S Cooper St Ste 121

Arlington, TX 76015

Western Finance

4316 Ayers St

Corpus Christi, TX 78415

Sun Loan Company

1110 E Parker Rd Ste 105

Plano, TX 75074

Atlas Credit Co., Inc.

604 W Calton Rd A

Laredo, TX 78041

World Finance

4136 34th St

Lubbock, TX 79410

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.