At first glance, payday loans that accept unemployment benefits seem self-contradictory. But it’s true — you don’t need a job to get a payday loan, just verifiable income.

Borrowers can get unemployment payday loans based on government benefits, including those from the Social Security Administration, the Veterans Administration, and your state’s employment department.

Unemployment income isn’t permanent but provides a window of opportunity that enables recipients to get an emergency loan. We review online loan services you can use while collecting unemployment benefits.

Payday and Other Short-Term Loan Options That Accept Benefits

The following companies are loan matching services that can connect you with a direct lender. One loan request form can match you with multiple lenders to help ease the process of finding a willing lender matched to your credit profile. Loan offers may come from payday lenders or other financial service companies that offer short-term loans.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

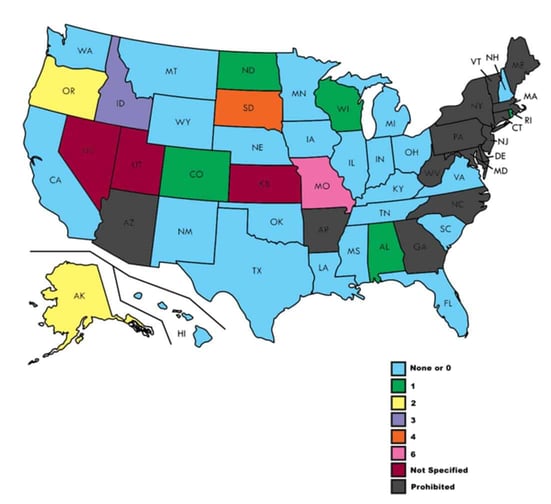

MoneyMutual arranges short-term loans for folks with regular income. The matching service is free, and loan offers carry no obligation. You do not have to be employed to get a payday loan, but the company requires you to have a monthly income of at least $800. MoneyMutual is not available in New York and Connecticut.

2. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

If you collect at least $1,000 a month in benefit payments, you can prequalify for the CashUSA.com lender-matching service. Lack of a job needn’t disqualify you from a payday loan. The reputable lenders on its network will give you an instant loan decision — you may receive loan approval for $500 or more within a few minutes and funding within 24 hours.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com can help you obtain a fast payday or personal loan. Prequalification doesn’t require a credit check, but you must have a steady source of income, such as unemployment payments. This service matches you to multiple lenders so you can select the best loan offer.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com can help an unemployed borrower who receives benefit payments and needs $250 or more. Its network of reputable lenders provides unemployment payday loans as soon as the next business day. The company began operating in 1999 and has helped more than 750,000 borrowers obtain loans.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

BadCreditLoans.com can prequalify you for a payday or personal loan of $500 or more, even if you are currently not working and have bad credit. If you receive unemployment benefits or other reliable income, the members of its loan network can approve your application in minutes and fund the loan by the next business day. BadCreditLoans.com uses advanced encryption methods to ensure your information remains secure.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com can arrange small, bad credit loans to suit the needs of borrowers who receive government benefits. You must collect at least $500 a month to prequalify. As with all the reviewed lending networks, PersonalLoans.com has lenders that approve applicants with poor credit.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com can quickly prequalify you for multiple payday loan offers. You must collect at least $1,000 a month from a dependable source to qualify for a loan. SmartAdvances.com is a member of the Online Lenders Alliance (OLA), an organization committed to responsible lending.

What Is a Payday Loan?

You may be familiar with payday loan storefronts in your community. Online payday lenders provide the same types of loans without the inconvenience of traveling.

Payday loans advance cash until your next paycheck or benefits check. They are short-term loans that you repay all at once on the due date, typically one or two weeks later.

Lenders offer payday loans to help you through to your next income check, not as recurring sources of extra funds.

You shouldn’t depend on frequent payday loans because they are costly. You’ll pay an APR of several hundred percent for this type of loan.

Unlike high-cost loans from a pawnshop or title loan company, payday loans don’t require collateral. Instead, payday lenders can approve loans by relying on their borrowers’ dependable short-term income.

Online payday lenders send a direct deposit to your bank account, usually by the next business day following loan approval. You repay your loan automatically on the due date when the payday lender draws the funds from your account.

The loan-matching services cost nothing and don’t harm your credit score since they don’t make a hard inquiry when you apply for a loan. The services match prequalified consumers to one or more direct lenders that work with all types of borrowers.

The matching services do not influence the approval decisions that payday lenders make. The matching service drops out of the process after transferring you to the lender’s website.

How Do I Get a Payday Loan?

It’s easy to apply for an unemployment payday loan through an online loan-finding service. A few of the advantages of using these services include:

- They work with networks of lenders, increasing the odds you’ll find a willing loan provider.

- They charge nothing for the work they do.

- You can apply conveniently without traveling to a storefront.

- They work quickly, and you can often collect your money as soon as the next business day.

You may receive your money sooner if you go to a payday loan storefront. But if you can wait one business day to receive your funds, the extra effort hardly seems worthwhile.

As mentioned earlier, the matching services do not lend money. Instead, they find you direct lenders willing to review your loan application. These direct lender networks include banks and other funding sources that work with every type of borrower.

You begin the loan process by completing an online request form. The loan-finding services review your information but do not check your credit.

The online lending services can prequalify you for a loan if you meet a set of requirements:

- You must be a citizen or permanent resident of the United States.

- Only folks 18+ years old can apply.

- You need a verifiable source of regular income to repay the loan. The funds usually come from a job, but unemployment benefits and other reliable sources are acceptable.

- You need a valid email address and telephone number.

- You must have an active checking account in your name to collect the loan proceeds and repay the money electronically.

- You will have to provide a Social Security number or similar official identifier.

In addition, the lending service may collect information about your current debts and your monthly mortgage or rental payments.

Once you prequalify for a loan, the lending service will transfer you to a direct lender, where you’ll fill out a loan application. The payday lender or other short-term loan company may collect additional information about your job or finances and ask for various types of documentary proof.

Alternatively, you may receive a set of links to multiple lenders that you can contact when convenient.

On the direct lender’s website, you may have to provide additional details to apply for a loan. By submitting the required data, you authorize the payday loan lender to do a hard pull of your credit, which remains on your credit report for two years. But many payday lenders neither check credit nor report your payments to the major credit bureaus.

The online lender may offer you a set loan amount and must disclose the loan’s costs and repayment terms. After carefully reviewing the loan offer, you can accept the offer by e-signing the loan agreement. The online lender will electronically transfer the loan proceeds to your bank account within a business day or two.

How Else Can I Borrow Money When Unemployed?

You have borrowing alternatives, even if you are currently unemployed. These include:

- Pawnshop loans: These may be the fastest loans on the planet. You bring a personal item (e.g., a camera, watch, musical instrument, jewelry, gold coin, etc.) to a pawnshop, where it is collateral for a loan. You’ll get a pawn ticket to redeem your property by a set date. If you miss the date, the pawnshop will put your property up for sale. Pawnshop loans typically provide less than 50% of your property’s value. These loans charge an astronomical interest rate. But pawnshop loans are easy to obtain — you don’t need a job or good credit.

- Car title loans: Your car’s title secures this type of loan, giving the lender the right to repossess your vehicle if you miss a payment. These loans provide cash in a hurry. They are costly, as their APRs easily exceed 100%, and you can forfeit your car by failing to pay on time.

- Credit card cash advances: These provide fast cash, assuming you already own a credit card. The amount you can withdraw depends on your current balance and credit limit. Credit cards often limit the maximum amount you can receive through a cash advance loan. In addition, cash advance APRs are usually higher than those for purchases, and each transaction carries a fee of 3% to 5%. Cash advances charge daily interest — there’s no grace period — so it’s best to repay them as quickly as possible.

You may also be able to borrow from a family member or friend when you’re not working. Although you may get excellent terms, you may alienate the lender if you fail to repay the loan.

What Happens If I Can’t Repay a Payday Loan?

If you don’t have enough money in the account on the due date, the lender will roll your payday loan’s due date to the next time you’ll receive benefits. It will add the owed interest to your loan principal and charge you a new round of fees.

Unfortunately, an unemployed borrower may have trouble repaying a payday loan. The Consumer Financial Protection Board estimates that 4 out of 5 payday loans are renewed within 14 days, and 20% of these loans lead to default.

We advise caution when considering payday loans because you risk falling into a debt spiral that may lead to bankruptcy. If possible, you may want to apply for an installment loan to repay your payday loan and receive better financing terms.

Can You Be Denied a Payday Loan?

Sometimes, a loan-finding service can’t match you to a direct lender. If that’s the case, the service may send you information about other credit services, such as credit counseling or debt consolidation.

The lending services make money by receiving fees from direct lenders when loans close, so they are highly motivated to find a way to yes. If you can’t find a willing lender this way, consider the alternative loans discussed earlier. They are viable choices for folks who are currently not working.

Compare Payday Loans That Accept Unemployment Benefits

Looking for a job is no fun. Even worse is searching for an emergency loan when strapped for cash. We hope our review of payday loans that accept unemployment benefits helps you through any such stressful times.

Payday loans are among the most expensive ways to borrow money. If you must use one, try to repay on time — late fees and interest can snowball your debt and create massive headaches. There are two reasons why you may prefer to sell some of your belongings in an orderly fashion: You’ll raise some quick cash, and you won’t create any new debt.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.