The best bad credit loans in Pennsylvania don’t necessarily have to be from lenders with offices in the Keystone State. Thanks to the internet, an online lender can be headquartered anywhere and still help consumers in Pennsylvania.

Having bad credit can often make getting a loan difficult. But some lenders specialize in working with people with bad credit and can help residents in Pennsylvania and other states qualify for loans they may not be approved for otherwise.

These include a cash loan, a personal loan, an auto loan, or a home loan. Most of the types of loans we recommend below come from lending networks. These networks don’t lend money, but rather help consumers in Pennsylvania and beyond get multiple loan offers after filling out a single loan application.

Bad Credit Cash Loans in Pennsylvania

Cash loans usually must be repaid quickly and are for smaller loan amounts. They can be used as an emergency loan to help pay unexpected costs or for basic needs such as groceries until you get your next paycheck.

You may be offered a payday loan that must be repaid with your next paycheck or a short-term loan that must be repaid within 90 days. Loan terms vary by lender. These companies are all lending networks that prequalify your single loan request with its partnered lenders. These lenders can wire funds to your bank account within one business day.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Quick cash loans should be used cautiously, as they can come with hefty interest charges and other fees that make these loans expensive. However, they can be a good option for those who need money fast when life doesn’t slow down.

Bad Credit Installment Loans in Pennsylvania

A bad credit installment loan has a larger loan amount and longer repayment term than the cash loans we recommend above. A personal loan is an unsecured loan that doesn’t require collateral. The loan is paid back in equal monthly payment amounts, which makes budgeting for them easier.

These loans are all viable options, but you’ll need to meet the direct lender’s requirements for approval. That generally means being at least 18 years old, a US citizen or permanent resident, meeting a minimum income threshold, such as $1,000 per month, and having a bank account to accept the deposit.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

5. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

Installment loans are generally easier to manage thanks to their drawn-out repayment periods and fixed monthly amounts. These loans also report payments to the credit bureaus to help you build credit when you consistently pay on time. But because the loan amounts are higher and the repayment term is longer (i.e., more time to charge you interest), the overall cost will be higher than short-term loans.

Bad Credit Auto Loans in Pennsylvania

A bad credit car loan can be the difference between getting to work so you can earn a living and being unemployed. A poor credit history can make it difficult to get a car loan, but the lending networks we recommend will connect you with a private lender or local car dealer that specializes in helping people with bad credit quickly find car loan options.

There’s no minimum credit score required to get a car loan, so most Pennsylvanians who can prove they have a reliable income to repay their loan should be able to obtain approval from one of the following nationwide companies:

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

8. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

Auto loans for bad credit may require a downpayment for approval, or for you to agree to repay the loan more often than once per month if you go through a Buy-Here-Pay-Here lot. The terms of your loan vary by lender and just how bad your credit is.

Bad Credit Home Loans in Pennsylvania

A home loan is another type of secured loan, though with a much higher value than that of a car. A poor credit history can make getting a home loan difficult, though not impossible.

A bad credit home loan will often include an origination fee charged by a lender as compensation for processing a loan application. A government-backed loan program, such as an FHA loan, can make it easier to buy a home if you have bad credit or don’t have much money for a down payment.

10. Rocket Mortgage

- America’s largest mortgage lender

- The entire process is completed online

- Options for new mortgages and refinancing existing mortgages

- Award-winning customer service and cutting-edge digital platforms

- More than 90% of clients would recommend us

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

11. Quicken Loans

- Best for cash-out refinance

- Utilize your home equity with America’s #1 lender

- eClosing allows customers to close electronically, greatly speeding the process

- A+ rating with the BBB

- Receive cash for home improvements, college tuition, or paying off debt

- 24/7 access to your loan through the Rocket Mortgage app

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

12. eMortgage

- Get today’s mortgage rates from the top mortgage lenders and banks

- Easily compare and choose mortgage lenders with no obligations or fees

- Review current mortgage rates side by side

- Pick mortgage lenders that meet your specific needs

- Compare rates from pre-qualified and approved mortgage lenders — 100% online, 100% free

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1979 | 4 minutes | 8.5/10 |

Mortgage rates are high, but we believe it’s never a bad time to secure a mortgage. You can always refinance when rates go down. And when rates go down, bidding wars begin, and it’ll be harder to get into a house you love.

What is a Bad Credit Loan?

A bad credit loan is a loan for someone with a low credit score who probably has made some mistakes throughout their credit history. It’s often a short-term loan used in emergencies, though the loan proceeds can also be used for bigger expenses, such as remodeling a home, and can take years to pay off.

The longer the loan terms, the lower the loan payment. Minimum loan amounts are $100 from some lenders, but most start at $500.

Payday lenders are sometimes the lenders for a short-term loan, but lending networks also help match borrowers with Pennsylvania installment loan providers. Some lenders specialize in personal loans or loans to buy a home or car.

A bad credit loan will likely charge a higher interest rate than someone with good credit history would be offered. Other bad credit financing fees, such as an origination fee, may also be charged to make up for the risk of lending to someone with a low credit score.

A bad credit loan may require a credit check and your signature, or promise to pay, as a credit card does. A secured loan, such as a title loan or home loan, or a secured credit card, uses collateral as a way to make sure the loan is paid. The lender will repossess your car or keep the security deposit you paid on the secured credit card if you don’t repay the loan.

What Credit Score Do I Need?

You may not need to have a minimum credit score to be approved for a bad credit loan, though each lender has its own rules for approval.

The lending networks we recommend expect applicants with low credit scores, so you shouldn’t let that deter you from applying. Each network works with many lenders, so you may receive multiple loan offers, even if you have a bad credit score with one or more credit bureaus. Each participating lender will offer you a unique interest rate and loan term, so be sure to compare offers carefully.

However, a home loan may be more difficult to qualify for with bad credit and may require a higher credit score. The minimum credit score needed to buy a home is generally 580. A home costs more than what is considered a typical personal loan, so there’s obviously more risk for the lender. Buying a home costs a lot more than, say, paying back a student loan.

Home loan rates will be lower if you have good credit and lower still if you have a good-sized down payment. Improving your credit score before applying for a home loan is a good way to get a better interest rate.

A conventional loan is typically harder to qualify for, but there are also government programs to help people buy homes, including the FHA loan meant for first-time homebuyers. FHA loans are federal loans with low down payments and closing costs.

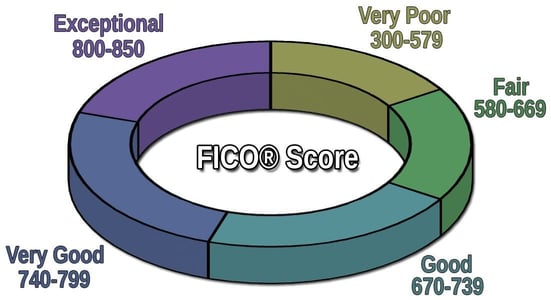

A FICO credit score ranges from 300 to 850. A score of 579 or lower is considered bad credit. Lending networks that often accept loan applications from people with bad credit may prefer a minimum credit score of around 500.

A borrower can still qualify with a score lower than 500 but may need to meet other criteria. These can include having a steady income or other revenue, having a steady job and residential history, and being able to afford the loan after paying major bills, including rent and any credit card debt.

What Interest Rate Will I Pay?

Interest rates on a bad credit loan depend on many factors, starting with the type of loan you’re getting.

Until you apply for a loan and get a loan offer, lenders aren’t too forthcoming with information about the interest rates they charge or how they decide the rate they’ll offer you. Each lender has its own rules.

In general, you should expect interest rates of 6%-36% on the personal loans we reviewed. These loans have terms that can last from three months to six years. Interest rates from payday lenders can range from 200%-2,290% and repayment is due in seven to 31 days.

Auto loan interest rates vary, but some lenders charge 4%-30% for loans with repayment terms that can last six years or so.

Home loan interest rates also vary, though a borrower with bad credit should expect a higher rate than someone with good credit. Home loans can be repaid over 30 years.

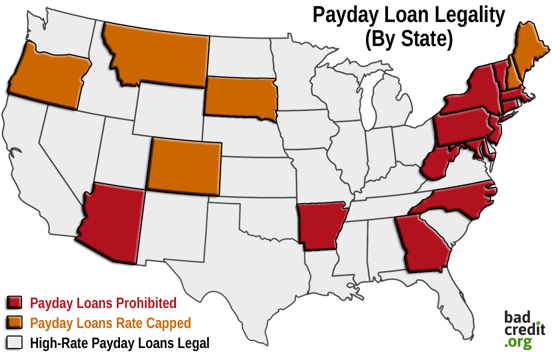

Are Payday Loans Legal in Pennsylvania?

No, payday loans are illegal in Pennsylvania. The state banned payday lending in 1998 and imposed a 6% APR cap on loans of less than $50,000.

In 2019, the Attorney General in Pennsylvania settled with a payday lender that the Attorney General said had effective interest rates as high as 448%. All remaining loan balances were voided, and borrowers who paid more than 6% in interest and the loan principal were allowed to share in a multimillion-dollar restitution fund.

The state government alleged that the company, which offered a loan product called ThinkCash from the First Bank of Delaware, attempted to shield itself from state and federal laws by operating under the guise of Native American Tribes.

If a lender offers a loan with repayment due in a week to 31 days, chances are it’s a payday loan with an interest rate that’s much higher than any other type of personal loan.

Some lenders team up with a federally chartered bank headquartered in a state with a higher interest rate cap to try to get around laws in Pennsylvania and other states that ban or limit payday lenders. Some Senate Democrats are trying to change this rule.

Some payday lenders try to work around the law that bans their services in Pennsylvania by offering loans online and having consumers apply through the Internet. But online payday lenders are subject to the same laws when they offer their services to Pennsylvania residents and are legally required to tell consumers about their rights and the legality of the agreement on the payday loan.

The Pennsylvania Department of Banking and Securities warns consumers against accepting illegal loans. Some of the alternatives it recommends to a Pennsylvania payday loan include:

- Borrowing from a credit union.

- Payroll advance from your employer.

- Negotiate with your creditor to raise your credit limit or to provide more time to pay.

- Pay the late fee, which will likely be less than the interest on a payday loan.

Any of these options is a viable alternative to traditional payday loans.

Your Best Options for the Best Bad Credit Loans in Pennsylvania

There are many options for the best bad credit loans in Pennsylvania. We’ve outlined 12 of them, including small cash loans and larger personal loans that can be paid back from a week to a few years later. We’ve also recommended auto and home loan options if you have bad credit, which are secured loans that use your car or home as collateral.

The lending networks we reviewed all work with a variety of lenders that specialize in working with people with bad credit. The lending networks can help you prequalify for a loan with a simple online form that can be filled out within minutes.

Loan offers can come back to you within minutes too, and the cash you need can be in your bank account within 24 hours. Getting a loan when you really need it may end up being a lot faster than you ever thought possible.

In-Person Options for Bad Credit Loans in Pennsylvania

In-person bad credit loan options are also a great choice, especially when you have lots of questions or there are details about your financial situation that an online application may not capture. Here are some in-person options for bad credit loans in Pennsylvania:

OneMain Financial

330 Oregon Ave Ste F

Philadelphia, PA 19148

Lendmark Financial Services LLC

6538 Steubenville Pike

Pittsburgh, PA 15205

Mariner Finance

1380 Hanover Ave

Allentown, PA 18109

OneMain Financial

2173 W 12th St Ste B-6

Erie, PA 16505

OneMain Financial

4300 Perkiomen Ave

Reading, PA 19606

Lendmark Financial Services LLC

1500 Garrett Rd Suite F

Upper Darby, PA 19082

Lendmark Financial Services LLC

1753 N Keyser Ave

Scranton, PA 18508

Mariner Finance

3859 Nazareth Pike # 106

Bethlehem, PA 18020

OneMain Financial

1 Kennedy St

Lancaster, PA 17602

Mariner Finance

45 W Main St

Uniontown, PA 15401

OneMain Financial

1647 N Atherton St

State College, PA 16803

Mariner Finance

2742 Plank Rd

Altoona, PA 16601

OneMain Financial

156 Eagles Glen Plz S101

East Stroudsburg, PA 18301

OneMain Financial

3843 Union Deposit Rd

Harrisburg, PA 17109

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.