Credit scores, such as those developed by the data analytics company FICO, do not rate you as a person, but rate your actions as a borrower. These companies dive into the financial and credit information that appears on your consumer credit reports, plug it all into an algorithm that weighs some information higher than others, and generate a number between 300 to 850. Higher scores are preferable to lenders because they indicate less credit risk.

So how does your current credit score compare with those of others in your state? Read on. But don’t worry if your score is lower than the scores of peers in your area.

The great news about credit scores is they change based on how you use credit products. If your credit scores are not to your liking now, you can improve them with some simple steps.

The Average Credit Score in All States is 714

Experian reports that the average credit score in the US was 714 in 2022.1 That puts numbers like these firmly in the “good” credit score range.

If your scores are similar to national average scores, you’re in the majority, too. Experian found that 67% of Americans had scores considered good or better.

Here’s the average credit score in each state as of September 2022:

| State | Average Credit Score | State | Average Credit Score |

|---|---|---|---|

| Alabama | 691 | Montana | 731 |

| Alaska | 723 | Nebraska | 731 |

| Arizona | 712 | Nevada | 702 |

| Arkansas | 694 | New Hampshire | 734 |

| California | 721 | New Jersey | 724 |

| Colorado | 730 | New Mexico | 699 |

| Connecticut | 725 | New York | 721 |

| Delaware | 714 | North Carolina | 707 |

| District of Columbia | 716 | North Dakota | 733 |

| Florida | 707 | Ohio | 715 |

| Georgia | 694 | Oklahoma | 693 |

| Hawaii | 732 | Oregon | 732 |

| Idaho | 727 | Pennsylvania | 723 |

| Illinois | 719 | Rhode Island | 723 |

| Indiana | 712 | South Carolina | 696 |

| Iowa | 729 | South Dakota | 734 |

| Kansas | 721 | Tennessee | 702 |

| Kentucky | 702 | Texas | 693 |

| Louisiana | 689 | Utah | 730 |

| Maine | 728 | Vermont | 736 |

| Maryland | 716 | Virginia | 721 |

| Massachusetts | 732 | Washington | 735 |

| Michigan | 718 | West Virginia | 700 |

| Minnesota | 742 | Wisconsin | 735 |

| Mississippi | 680 | Wyoming | 723 |

| Missouri | 712 |

With a credit score in the good range or higher, you should have access to a wide variety of attractive credit products, so aiming to hit and exceed the average is a common goal.

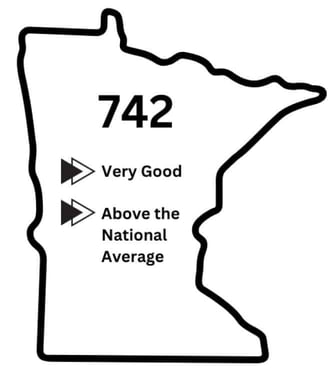

Minnesotans Have the Best Average Credit Score: 742

Minnesota residents earn the title for having the highest average credit scores among residents of all 50 states. Their average score of 742 pushes them into the “very good” scoring range.

Does this mean that Minnesotans are smarter with their money than people who live in the rest of the country? Not necessarily. There is a strong correlation between an area’s cost of living and the amount of debt a person carries over compared to their credit lines. The less you owe compared to the amount you can borrow from a credit line, the better.

When housing and other necessary expenses are affordable compared to relative incomes, a consumer will be less likely to borrow to make ends meet and use up too much of their credit lines.

While 11.6% of US residents live in poverty,2 only 9% of Minnesota residents are considered impoverished.3 And though the median household income in the US was $70,784 in 2021,4 the median household income in Minnesota was higher — at $77,706.5

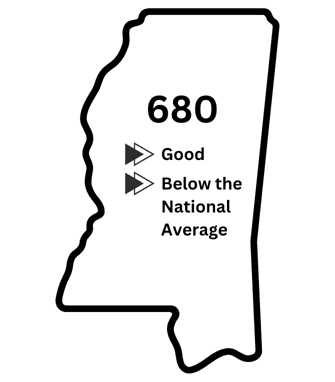

Mississippians Have the Worst Average Credit Score: 680

The average credit scores in Mississippi are the lowest in the nation at 680, but there’s still reason to celebrate. These numbers remain in the good range.

Why are Mississippians trailing the rest of the country when it comes to their credit scores? Unfortunately, a high poverty rate is likely to blame.

More than 18% of the population of Mississippi is considered impoverished, which is more than double the national average. The median income for an individual is the lowest in the country at $49,111.6 That’s $21,673 less than the national median.

It stands to reason, then, that a person who is struggling to afford necessities will be more apt to borrow the difference when times get tough. Even small revolving debt will negatively affect credit scores when the balances are at or close to their credit limits.

Understanding Credit Score Ratings

When you apply for and use loans and credit cards, the issuing financial institution will provide the credit bureaus with information on your activity each month. The major credit bureaus are TransUnion, Experian, and Equifax. All three bureaus collect the data and compile it into consumer credit reports that lenders can use to check your history and activity with credit products.

There are four basic sections of a credit report:

- Identifying information: Name, mailing address, date of birth, and Social Security number.

- Account history: Detailed overview of credit cards, loans, and collection accounts.

- Public records: Liens and bankruptcies.

- Inquiries: Soft and hard applications for credit.

The data in each of these sections, except what is listed in the identifying information and the soft credit inquiries, will be used to calculate your credit score. Soft credit inquiries are when companies check your credit to see if you may be a good fit for their products.

FICO Scores are divided into five different rating categories:

- 300 to 579 is considered poor

- 580 to 669 is considered fair

- 670 to 739 is considered good (the average credit score of 714 falls here)

- 740 to 799 is considered very good

- 800 to 850 is considered exceptional or excellent

Although lenders want to be confident you have sufficient income to make your loan or credit card payments, most depend on credit scores to determine eligibility and to set terms. A high credit score is an indication that you have managed your credit accounts responsibly over a long period of time. A high credit score is also a predictor that you will do so in the future.

Bear in mind that credit scores are a snapshot of what you have done in the past. When you change the way you handle credit products, your scores will either go up or down.

Tips For Improving Your Credit Score

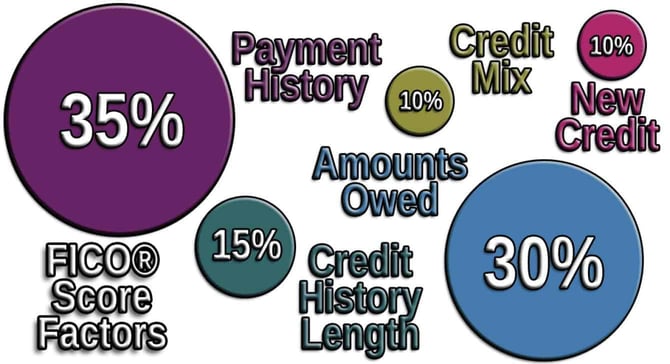

No matter where you live and how much you earn, it is possible to bring a low credit score up. FICO Scores are based on five different factors:

To improve your credit scores, focus on the areas that are most impactful and follow the tips for adding more points to your scores.

- Get and use credit. If you don’t have a credit card and your scores are low, apply for a credit card designed for your credit rating. There are plenty of cards designed specifically for people with poor credit. Many are secured with a cash deposit. Whichever type you get, use it regularly and only charge the amount you can afford to repay by the time the bill comes in.

- Pay on time. If you have missed payments in the past, be sure to start paying by your due dates from now on. Each timely payment will be noted on your credit file. What you have done recently is more important than what you have done in the past. When you have at least a year of on-time payments noted on your credit report, you should see a significant difference in your scores. To make it easier on yourself, enroll in automatic bill pay with your bank.

- Expand your credit utilization. A good rule of thumb is to keep your credit card balance under 30% of the credit limit. So if you have a card with a $1,000 limit, you should roll over no more than $300. No debt is best, though. If you’re carrying over high balances, rework your budget so you can make large monthly payments until you’ve repaid your bills. Another option is to ask your credit issuers if they will increase your limit. You will have the same amount of debt but have an expanded credit line. Or consider consolidating your credit card debt into a loan, since loans are not revolving credit products and aren’t factored into your credit utilization ratio.

- When ready, mix up your credit. Showing that you can effectively use a variety of credit cards and loans will help your credit rating rise over time.

- Apply for credit prudently. Only seek the credit products that you qualify for and that you will use beneficially. New credit accounts will lower your average credit history, but over time, it will bounce back. Submitting applications for several credit cards over a short period will have a temporary negative impact on your credit scores, especially when your scores are low.

- Add in positive information. Using a credit card regularly and paying the balance in full and on time is the easiest and fastest way toward credit rehabilitation. But you can also add the activity from non-credit accounts to your file, which will be included in your scores. Experian offers its Boost program, which enables you to add your utilities and cellphone bills to your Experian credit report. When you pay those regular bills on time, they can help your scores rise. You can also add rent payments to your file. Check out Piñata, a free service for renters that reports to TransUnion. Others, like Rental Kharma and RentReporters, are fee-based.

- Clear up errors. It is a good idea to access your credit reports at least once a quarter. You can get them for free from AnnualCreditReport.com. Read each section carefully, and if you spot mistakes, contact the credit bureau and file a dispute. A 2021 Consumer Reports investigation found that more than a third of consumers found errors in their reports.7 While most were in the personal information section which doesn’t affect scores, 11% discovered account information mistakes that can have an impact.

You can read more tips for improving your credit here.

Key Takeaways

There is no reason to panic if you do find that your credit scores fall below your state’s average or are simply not where you want them to be. You can begin to take action as soon as today.

Remember, credit scores are not static. They will fluctuate as information is reported to your credit file. You can take control of the situation by ensuring the data that is being reported is the kind that creates high credit scores.

Further Reading:

- Average Credit Score by Age

- Average Credit Score by Race

- Average Credit Score by Income

- Average Credit Score in America

Data Sources:

1 https://www.experian.com/blogs/ask-experian/what-is-the-average-credit-score-in-the-u-s/

2 https://www.census.gov/newsroom/stories/poverty-awareness-month.html

3 https://data.web.health.state.mn.us/poverty_basic

4 https://www.census.gov/library/publications/2022/demo/p60-276.html

5 https://www.census.gov/quickfacts/fact/table/MN/INC110221

6 https://www.census.gov/quickfacts/fact/table/MS/INC110221

7 https://www.consumerreports.org/media-room/press-releases/2021/06/consumer-reports-investigation-finds-more-than-one-third-of-consumers-found-errors-in-their-credit-reports/