How people use credit products and repay debt has a direct effect on their credit scores, such as those developed by FICO. All of that information will be listed on consumer credit reports created by TransUnion, Equifax, and Experian. As credit report data is updated with account usage, the credit scores will also adjust upward or downward.

Credit scores are dependent on a person’s unique borrowing behavior, but the amount of money people earn can affect their ability to pay off debt which can affect their credit scores as a whole. Studies show there is at least a moderate correlation between income and credit scores when examined in aggregate.1

Here is the latest data about credit scores by household income, and why there may be a differential.

Low to High Household Income Definitions

Income is not listed on a credit report so it is not factored in credit score calculations. Instead, the person would include it on their credit application. Along with the person’s credit profile, the lender assesses income to determine qualification and set terms.

The median household income in the US is currently $74,580.2The Consumer Finance Protection Bureau groups consumers into four income levels.3 These income levels are based on the ratio between the median family income in the consumer’s Census tract and the median family income of the Metropolitan Statistical Area for urban consumers or of the county for consumers residing outside of Metropolitan Statistical Areas.

The definitions are:

- Low income (relative income less than 50%)

- Moderate income (relative income 50% to less than 80%)

- Middle income (relative income 80% to less than 120%)

- Upper income (relative income of 120% or higher)

Low-Income Households Have the Lowest Average Credit Score: 658

It may come as no surprise to some that those who have the lowest average household incomes also have the lowest average credit scores:

| Annual Income | Median Credit Score |

|---|---|

| Low | 658 |

| Moderate | 692 |

| Middle | 735 |

| High | 774 |

A 658 credit score is within the fair credit range, though. This means that even when people have low incomes, many are still managing their credit accounts in positive ways.

With fair credit scores, consumers can qualify for certain credit cards and loans, but the terms will not be as attractive as if they had good or better credit scores.

High-Income Households Have the Highest Average Credit Score: 774

High-income households have the highest average credit scores at 774. This puts them firmly in the “very good” credit scoring range.

How did they get there? A combination of factors. They regularly pay the accounts listed on their credit reports by the due date and keep their revolving balances low or at zero. They do this for a number of years and with a variety of credit products. They avoid applying for back-to-back loans and credit cards within a short span of time, which will signal to lenders that something is amiss.

When a person has a high income, they also tend to have more opportunities to obtain credit because lenders perceive that the person can pay back loans and credit card balances. Hence, people with higher incomes are more apt to have higher credit scores.

How the Averages Differ Among Borrowers with Student Loans

Student loans are installment loans and payments made are reported to credit bureaus by the lender. When kept in good standing, student loans are an asset to a borrower’s credit report and credit score. They can be especially beneficial for younger consumers who are not working because federal loans are not granted based on a person’s credit history or current income.

During the COVID-19 pandemic, people with outstanding student loans saw their median credit scores rise.5 That’s because of the repayment moratorium that paused payment during those years. That resulted in these accounts being marked as current on borrowers’ credit reports.

Moreover, federal student loan delinquencies were temporarily lifted from people’s credit reports, which gave the credit scores of these borrowers a boost. This had a greater impact on delinquent borrowers in low- and middle-income areas where late payments and default rates have been higher in the pre-pandemic years.

The median credit scores of student loan borrowers in lower-income areas increased more sharply relative to median credit scores among borrowers in high-income areas. This is because, pre-pandemic, these borrowers were more likely to be behind on their student loan payments, and thus were more likely to benefit from the pause.

Reasons Credit Scores Vary Among Income Levels

Consistently making credit account payments on time can be difficult when a person is financially struggling because their income is low. When there isn’t enough money to cover all the bills, borrowers may fall behind and go delinquent, which will translate into late payments being listed on their credit report.

If a borrower continues to miss payments, the accounts may go into default and can go into collections.

Some people may even declare bankruptcy to escape the pressing creditors, which will further reduce their scores. Bankruptcy filings have historically been more prevalent among borrowers in lower-income areas.6

Additionally, people who earn low incomes may lean on expensive credit products to make ends meet. This can result in running the balance of credit cards they do have up, and not paying the balance in full. The high debt, when revolved month after month, has a strong negative impact on a person’s credit utilization ratio.

Qualifying for loans and credit cards can be out of reach for people who don’t have a steady job, which affects how long a person has had and has used credit products. The fastest route to developing a measurable credit history is by using credit cards.

People with a positive history of paying their credit cards show lenders that they are spending according to their budget rather than borrowing what they cannot afford.

Only half of low-income households have access to a credit card, which is a barrier to credit development.7 Instead, some use credit products that do not show up on credit reports, such as payday loans. Not only do these products have high associated fees and interest rates, but even if they are managed responsibly, they do not help with credit development.

Finally, people who pursue credit products assertively when they need money to get by will appear desperate for cash, which throws up a red flag to lenders.

FICO Score Factors

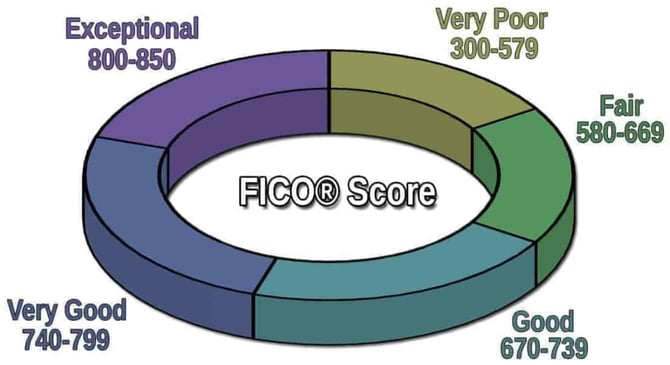

The most commonly used credit score in the US is the FICO Score. It ranges from 300 to 850 with higher numbers representing a borrower’s lower lending risk.

To develop a good or better credit score, a consumer would need to positively manage credit products over many years. The factors involved in creating a FICO Score are:

- 35% Payment history. This category includes how people make their monthly payments, specifically whether they pay their bills on time every month, have accounts in collections or accounts that have gone into default, or if they have filed for bankruptcy.

- 30% Credit utilization. This represents how much debt a person holds relative to the credit lines they have on revolving credit products, both per credit card and in total.

- 15% Length of credit history. The longer a person has had and used credit products, the better their score.

- 10% Types of credit in use. Having and using a variety of credit products, including different types of loans and credit cards, is beneficial to a score.

- 10% New credit. Too many applications for credit will negatively impact a score.

Key Takeaways

Certainly people who have high incomes can also mismanage their money and credit products, which will result in lower credit scores. But there is an embedded advantage to having a high income. It’s easier to qualify for loans and credit cards when the person can demonstrate that they have the funds to handle the payments and debt associated with the accounts.

Conversely, people who do not have high and steady incomes can struggle to obtain the same credit products, and then struggle to manage the accounts they do open in a way that results in high credit scores.

The good news is that although there is a statistical disparity in credit scores, income alone does not dictate credit score development. People of modest means can open and use credit products in a way that results in a high score.

The strategy is the same — always pay on time and in full, especially revolving debt. It’s a guaranteed path to a high credit score, no matter how much a person earns.

Further Reading:

- Average Credit Score by State

- Average Credit Score by Race

- Average Credit Score by Age

- Average Credit Score in America

Data Sources:

1 https://www.federalreserve.gov/econres/notes/feds-notes/are-income-and-credit-scores-highly-correlated-20180813.html

2 https://fred.stlouisfed.org/series/MEHOINUSA672N

3 https://www.consumerfinance.gov/data-research/consumer-credit-trends/mortgages/lending-neighborhood-income-level/

4 https://www.newyorkfed.org/medialibrary/media/press/the-state-of-low-income-america-credit-access-debt-payment

5 https://www.newyorkfed.org/medialibrary/media/press/the-state-of-low-income-america-credit-access-debt-payment-march-2022

6 https://www.newyorkfed.org/medialibrary/media/press/the-state-of-low-income-america-credit-access-debt-payment-march-2022

7 https://www.newyorkfed.org/medialibrary/media/press/the-state-of-low-income-america-credit-access-debt-payment-march-2022