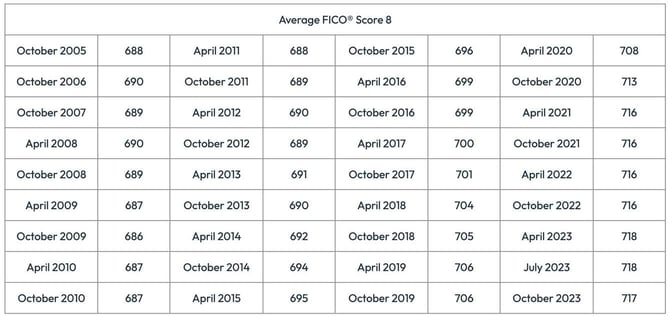

For at least the last 19 years, the company known as FICO, my former employer and the company that invented credit scores, has published reports on average credit scores. In 2005, the average FICO score was 688. Since then, the average FICO score has improved over time to a high of 718 in July of 2023.

Other than the years following the 2008 financial meltdown, that average FICO score has generally enjoyed an upward trajectory to the tune of about 30 points until October of 2023. In October 2023, FICO indicated that the average FICO score went down from 718 to 717.

A Drop in the Average Score is a Big Deal

While a drop of a single point may not seem like a big deal, when you start peeling back the onion, you can see the problems associated with what it takes for the average score to stop improving and start decreasing.

There are about 200 million consumers in the United States who have scorable credit reports under the FICO scoring system. That means they have at least one undisputed account that is over six months old and at least one undisputed account that is older than six months, or at least one account that meets both of those criteria.

That means it’s a big deal for the average score to move in any direction by even a single point on a sample size representing over 200 million consumer credit reports. I can think of several analogies to explain this in a way that personalizes the effort needed to move that average.

But the best is for those of you who went to college and couldn’t do anything to move your student grade point average during your last semester (or quarter) because you had so many classes (or hours) already under your belt over the prior four years or so.

Why Would the Average Score Drop?

For the average score to drop, it means changes to credit reports took place that are indicative of a higher level of credit risk. In fact, that’s the only reason any credit score would go down.

Without even digging into FICO’s analysis for the reason (or reasons) behind the decrease, the smart money guess would be on two things: an increase in credit report delinquencies and an increase in credit card debt. You would be correct on both counts.

1. According to FICO, delinquencies on credit reports were up 4% during the six-month period covering April 2023 to October 2023. This is even more problematic than you may think, given the built-in grace period on the credit reporting of late payments. The credit reporting industry guidelines do not permit the credit reporting of late payments until a consumer is at least 30 days past their due date.

That means any late payment appearing on a credit report has to represent someone being at least 30 days late, and not just a few days late because the dog ate the bill. There is no systematic method of reporting someone as being 1-29 days late. It doesn’t exist.

As in, late payments on a credit report mean a debtor blew way past their due date, probably were immediately notified by their creditors that they were late, and still didn’t make their payment until it was at least 30 days late.

2. According to FICO, the average credit card utilization as of October 2023 was 35%, which represents an increase of between 100 and 200 basis points over various points in time over the prior four years. Credit card utilization ratios (formally known as “revolving utilization”) can go up because of an increase in credit card balances, a reduction in credit card limits, or a combination of both. Regardless, an increase in revolving utilization can result in lower credit scores because, again, it is indicative of elevated credit risk.

When you combine an increase in the number of late payments with an increase in the credit card utilization ratio, credit scores are going to go down.

The Stability of the Average Credit Score Is Not Entirely Authentic

While the following is absolutely not a criticism of the credit bureaus, FICO, or any lender or debt collector, the upward trajectory (or the avoidance of a more pronounced decrease) of average credit scores over the last seven years has been influenced, to some extent, by the dilution of the negative information on consumer credit reports. As in, any increase and/or a less pronounced decrease has been, at least, partially artificial.

Starting in 2017, the three major consumer credit reporting companies began to remove negative information that had been on consumer credit reports for decades.

The first to go were tax liens and civil judgments. They were removed from credit reports starting in 2017 as a result of the credit bureaus being sued by the attorneys general from over 30 states. It’s not as if the tax liens or judgments don’t exist, and it certainly doesn’t mean they were incorrectly reported. The credit bureaus just agreed to remove them, meaning they weren’t on credit reports any longer.

And, of course, if an item is not on a credit report, it cannot influence a credit score. Removing tax liens and judgments cannot result in lower scores as those public records have no redeeming value in a credit scoring model. This means the credit scores of consumers who had tax liens and/or judgments had to either remain the same or improve. Any improvement in their scores was artificial because the lien or judgment still existed.

Medical Collections Data No Longer a Hindrance for Many

Over the last few years, medical collections — collection accounts representing an attempt to collect defaulted medical debts — have also largely been removed from credit reports and/or excluded from consideration in credit scores.

First, there was a mandatory delay of six months before debt collectors could report medical collections to credit reporting companies, then it was changed to 12 months. Medical collections were also removed if they were paid by insurance; then a restriction went into place disallowing any reporting of medical collections if they were less than $500. Now there are efforts by the Consumer Financial Protection Bureau to restrict the credit reporting of medical debts entirely.

Again, it’s not as if the medical collection doesn’t exist. It just has a harder time making its way onto credit reports and is clearly now an endangered species of data. Similar to public records, if a medical collection is not on a credit report, it cannot influence a credit score.

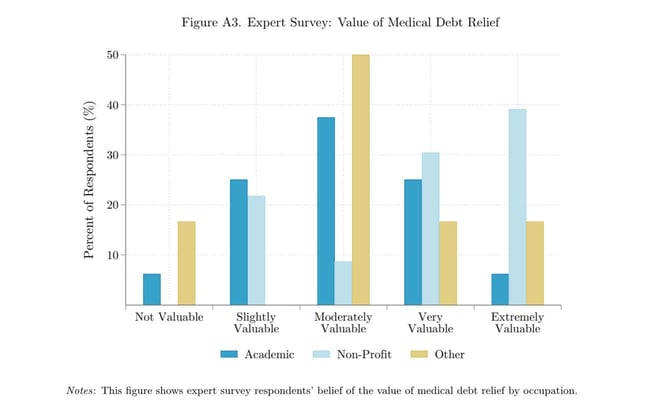

Removing collections cannot result in lower scores as collections have no redeeming value in a credit scoring model. That means the credit scores of consumers who had medical collections had to either remain the same or improve, although a study published in April 2024 by the National Bureau of Economic Research found that the elimination of medical debt did not improve debtors’ mental health or credit scores.

What this all means is any study regarding the average credit score conducted since 2017 has been influenced by the wide-scale removal of traditionally reported negative information (tax liens, civil judgments, medical collections).

None of the data that was removed could have caused a decline in a credit score, only an increase or no change at all. Unless this was controlled for by FICO in its last 14 studies, the number of averages published by FICO since October 2017, a change in the average score isn’t just about late payments or credit card debt.

Where Can I Find Out if My Credit Scores Are Above Average?

Generally speaking, a FICO score of 717 is considered to be a decent score, albeit not at all above average and certainly not good enough to get the best deals from lenders. If you want to put yourself in a position where you are likely to get the best deal from any lender for any financial services product, you really need to have FICO scores at or above 760 across all three of the credit bureaus.

The lowest published interest rates for mortgages are at FICO 760, and FICO 720 for auto loans.

While these FICO score averages are interesting, what’s really interesting is how high your FICO scores are right now. To the extent you don’t know your FICO scores, there’s no shortage of methods to check them. You can certainly purchase them at FICO’s website. You can also check your FICO 8 credit score at the Experian website at no cost. And if you have an account with one or more of the companies that participate in FICO’s Open Access program, you can check your FICO scores through them at no cost as well.

Checking your own credit scores will not leave a hard inquiry on your credit report. That means you can check your credit scores and credit reports as often as you like, without any potential negative impact to your scores.