Bad credit and quick loans are the oil and vinegar of consumer lending: They don’t mix unless you shake things up. In fact, the two can combine deliciously through online lending networks for personal loans.

We review the leading lender-matching services that arrange personal loans for subprime consumers. You can use these services to prequalify for a personal loan in seconds and receive multiple offers within minutes.

If you obtain final loan approval, you’ll have your money as soon as the next business day. That’s a quick cash loan, and unlike salad dressing, no shaking is necessary!

Quickest Personal Loans You Can Get Online

A remarkable aspect of these lending services is how quickly they can put money into your bank account. The secret sauce is their extensive lending networks, whose members compete for your business. If you apply on a Monday, you’ll likely collect your emergency loan proceeds on Tuesday. And it all happens online.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual is our top-rated lending network. Consumers can apply to it for a personal loan by submitting a short online form. MoneyMutual will connect you to a direct lender if it prequalifies your request. The lender will then request additional information and decide whether to offer you a loan.

If the lender approves your request, it will provide you with a loan agreement detailing the interest rate, fees, and repayment terms. After reviewing the contract, you can e-sign it and receive up to $5,000 in 24 hours or less.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group can connect you to bad credit loan lenders in minutes, even at 2 AM on a Sunday. All you have to do is fill out a loan request form to prequalify for a personal loan of up to $35,0000.

If you prequalify, 24/7 Lending Group will match you with up to four direct lenders. You can review each offer and apply for the one that best fits your needs. You may receive your money upon approval in as few as 24 hours.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com helps subprime borrowers find loans of up to $10,000, with a preapproval decision arriving within seconds. The online direct lender you choose can deposit your money into your checking account once it approves the loan.

To prequalify, you must collect at least $1,000 per month after taxes, have a checking account in your name, and provide valid work and home phone numbers, among other requirements.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Since 1998, CreditLoan.com has helped more than 750,000 consumers get quick online loans. The company’s lender-matching service is free, and you’re not obligated to accept a loan offer.

The website offers a personal loan calculator you can use to work out your monthly payments before you request a loan. The CreditLoan network welcomes consumers with bad, limited, or no credit.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

BadCreditLoans.com has made a name for itself in the online lending industry for helping borrowers with poor credit. Every direct lender it works with can provide subprime personal loans quickly — applicants don’t need good credit scores or collateral to get a loan.

But applicants must meet specific requirements, including having a reliable income source and an active bank account, to qualify for a loan offer.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com helps people obtain the money they need with quick loans of up to $5,000. Borrowers with any credit score can prequalify if they are US citizens or permanent residents, 18 or older, and have a steady income, active bank account, email address, and phone number.

Upon successfully prequalifying, you’ll receive links to one or more direct lenders at which you can complete the application. The proceeds from approved loans can arrive in your bank account as soon as one business day.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com can help borrowers get an emergency loan through its extensive lending network. Loans of up to $35,000 are available, although your credit score may limit the amount you can borrow. You can receive the loan proceeds within one business day of final approval and use the money for any purpose.

If PersonalLoans.com’s lending network cannot offer you a loan, it may share some of your contact information with debt relief, credit repair, credit monitoring, and other financial services that match your credit profile.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com can find fast cash loan offers of up to $20,000 from one or more direct lenders. You must receive a monthly income of at least $1,000 to prequalify for a personal installment loan.

You usually must wait one business day for your funds to reach your bank account. For example, if you receive approval on Friday, you may have to wait until Monday to collect your money. But some online lenders expedite processing for an additional fee.

Tips to Improve Your Approval Odds

Here are 10 terrific tips to help you land an online personal loan:

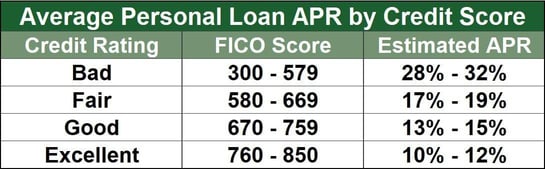

- Improve your credit score: Access to an affordable personal loan hinges mainly on your creditworthiness since it is not a secured loan and does not involve collateral. Building credit requires you to pay your bills on time, keep your debt levels relatively low, and refrain from too many credit applications.

- Understand the eligibility criteria: Ensuring you meet the lender’s requirements before applying for a loan saves time and energy. Those requirements will pertain to your income, employment, debt, housing costs, and credit status.

- Reduce your debt-to-income (DTI) ratio: Lenders may reject your loan application if you owe too much money relative to your income. Many loan providers require a DTI ratio below 36%. You can reduce your DTI ratio by paying down your existing debts and/or increasing your income.

- Submit accurate and complete information: When lenders check your credit reports, they want to confirm the information you provided in your loan application. Discrepancies will inevitably delay your loan request and may deep-six it entirely.

- Select the right lender: Some lenders are more willing to work with subprime borrowers. We recommend you start with the reviewed lending networks. Each one is devoted to serving the needs of bad-credit borrowers.

- Demonstrate stable income: Be prepared to furnish bank statements, pay stubs, and tax returns to prove how much you earn. By law, lenders must be reasonably sure you can afford to repay any loan they offer.

- Recruit a cosigner: Nothing instills more relief into a lender’s heart than a second signature on a loan agreement. Using a cosigner reduces the lender’s exposure to default, making loan approval much easier.

- Only borrow what you can repay: Try to minimize the amount of your loan request. Doing so will increase your prospects for approval and make it easier for you to repay the loan.

- Burnish your credit history: You can help your financial image by maintaining one or more long-term, trouble-free relationships with banks, credit unions, and other institutions. Lenders look more kindly upon applicants who demonstrate financial responsibility.

- Minimize credit applications: Creditors make a hard inquiry each time you apply for a loan or credit card. Too many hard inquiries bunched together may hurt your credit score and convince creditors that you are in financial distress.

We suggest you check your credit reports before applying for a loan. Get free copies from AnnualCreditReport.com and dispute any derogatory items that are inaccurate, obsolete, or unverifiable. You can undertake the task yourself or hire a credit repair company to do the heavy lifting for you.

How Can I Get an Online Loan Quickly?

You can get a personal installment loan quickly using an online lender-matching network. It’s as easy as 1, 2, 3:

- Submit the short loan request form, which will include questions about your address, income, citizenship status, bank account, email address, phone number, and the amount you want to borrow.

- If you successfully prequalify, click the link to a direct lender on the loan network and complete the application process by providing additional information, if necessary.

- Receive loan approval and collect the proceeds in your bank account as soon as the next business day.

You can use the borrowed money as you see fit. The lender will provide you with a repayment schedule, which typically consists of three to 60 monthly installments.

The lender will withdraw your payment from your bank account each month on the due date. You will face late and overdraft fees if your account balance is too low to cover the loan payment.

Will My Credit Score Be Checked?

Yes, a direct lender will check your credit when you apply for a personal loan. But the lender-matching services do not pull your credit when they attempt to prequalify your loan request.

Because they don’t check your credit report, you can apply to one of these lending networks without immediately impacting your credit score. Only when you are preapproved for a loan and apply to a direct lender will you undergo a credit check.

A credit check shouldn’t discourage you from applying to any of the reviewed lending networks because the participating direct lenders serve borrowers with poor credit. These lenders typically don’t impose stringent credit score requirements on their applicants.

In any event, your credit score is just one factor in a lender’s decision to offer you a loan. For example, the lender will want to see if you have a history of missing monthly payments. Multiple late payments are a red flag that tells the lender you are a high-risk borrower.

In this case, the lender will likely charge a high interest rate on the loan, reduce the loan amount, or simply decline your application.

In the long run, you will want to improve your access to loans by building credit. One effective strategy is to take a credit builder loan from a credit union or online provider.

A credit builder loan is a secured loan product in which a lender funnels your loan proceeds into an escrow account. You then make monthly payments just as you would for a conventional loan. The lender will report your payments to all three major credit bureaus, which should raise your credit score over time. The lender will return the escrowed money to you when you finish repaying the loan.

If you’re unable to make the payments on your credit builder loan, the lender will close the account and refund your money without any credit score damage. These loans can only help your credit — never hurt it.

Can I Get a Quick Online Loan From a Credit Union?

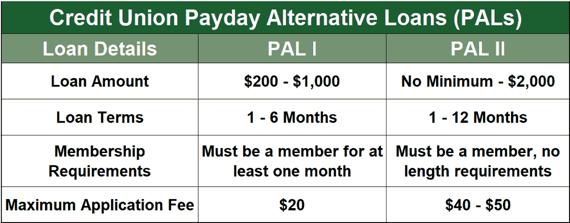

Federal credit unions offer Payday Alternative Loans (PALs) that let you borrow up to $2,000 and take a year to repay. You can quickly get a PAL online if you meet the loan requirements.

The National Credit Union Administration (NCUA) designed the PAL program in 2010 to give members a low-cost alternative to a predatory payday loan.

A low credit score shouldn’t disqualify you from getting a PAL because a credit union will likely look beyond your credit history and consider your standing as a credit union member.

Get an Online Loan Without Delay

The reviewed lender-matching networks offer consumers a streamlined strategy for getting an online loan as soon as the next business day. The networks serve subprime lenders who do not have access to bank loans.

When you need a fast cash loan, contact a network lender and submit a loan request. If you use one of the reviewed companies, we think the results will please you.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.