Allow me to apologize for the article’s misleading title, “Prepaid Credit Cards For Bad Credit.” It badly conflates two distinctly different things — prepaid debit cards and secured credit cards. We named the article as is because it is a popular, if ill-conceived, reader query.

The two card types share some characteristics but are otherwise vastly dissimilar. You should know about both if you have bad credit because neither relies on your credit history for approval.

Keep reading as we untangle prepaid and secured cards and tell you about the best of both.

Prepaid Debit Cards For Bad Credit

The following three reloadable prepaid debit cards require you to load them with cash, checks, or other types of deposits. You can use them without a bank account to shop online, in stores, and in mobile apps.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A (Prepaid) | No | 9.5/10 |

The PayPal Prepaid Mastercard® is the best prepaid card for PayPal users, as it lets you transfer funds to and from your regular PayPal account. The card speeds access to direct deposits by up to two days.

The card’s optional cash back rewards appear as statement credits for select net purchases. Cardholders can obtain multiple virtual account numbers for greater security.

2. Brink’s Armored™ Account

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

The Brink’s Armored™ Account charges a plan fee that lets you choose between fixed monthly payments or pay-as-you-go transactional pricing. You can cut the regular plan charge by receiving a set amount in direct deposits each month.

This prepaid debit Mastercard offers cash back rewards and a small negative-balance purchase cushion to cover minor overdrafts. Cardholders can also open a high-interest savings account.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A (Prepaid) | No | 7.5/10 |

The NetSpend® Visa® Prepaid Card charges a flat monthly fee or you can pay for each separate purchase transaction. You can reduce the monthly fee by having a set amount in direct deposits during the month.

This Visa debit card welcomes authorized users and features Netspend Payback Rewards, mobile check load, and in-person cash reload at more than 130,000 Netspend locations.

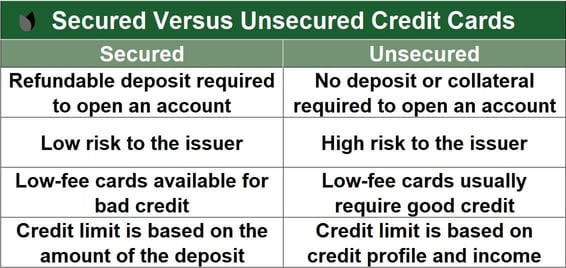

Secured Credit Cards For Bad Credit

Some folks consider secured credit cards to be prepaid only because they must deposit money before they can acquire and use them. Otherwise, they operate similar to any other credit card. Secured cards offer an excellent opportunity for subprime consumers to improve their credit.

4. Secured Sable ONE Credit Card

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

The Secured Sable ONE Credit Card is the best credit card in this group, offering one of the quickest ways to build your credit history. It provides milestones to help you graduate to an unsecured traditional credit card, such as spending a set amount per month.

Cardholders are required to maintain a minimum credit limit and make direct deposits in predetermined amounts for four consecutive months. This Mastercard does not charge a foreign transaction fee.

5. PREMIER Bankcard® Secured Credit Card

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

The PREMIER Bankcard® Secured Credit Card requires you to make a small minimum security deposit and charges a relatively low APR and a moderate annual fee. PREMIER Bankcard® may reward your responsible use of this secured Mastercard by graduating you to an unsecured credit card account.

Fees apply for cash advances, foreign transactions, and late payments (See Provider Website for full Terms & Conditions).

6. Surge® Platinum Secured Mastercard®

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

The Surge® Platinum Secured Mastercard® welcomes applicants with bad or thin credit. It allows you to build credit as you earn cash back rewards.

The card’s lack of setup and maintenance fees make it the best credit card in this review for thrifty consumers. Optional credit protection covers your minimum payments when you experience specified losses.

- Better than Prepaid…Go with a Secured Card! Load One Time – Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- 9.99% Low Fixed APR – Your Rate Won’t Go Up Even if You Are Late

- Activate Today with a $200 Minimum Deposit – Maximum $1,000.

- Increase Your Credit Limit up to $5,000 by Adding Additional Deposits Anytime

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 9.99% Fixed | Yes | 7.5/10 |

The Applied Bank® Secured Visa® Gold Preferred® Credit Card tells you immediately whether you qualify for the card. This secured Visa credit card offers automatic reporting to all three major credit bureaus.

The card does not provide an interest-free grace period on purchases, but the regular APR is low. You don’t have to contend with a penalty APR if you miss a payment due date.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

You can quickly apply for the OpenSky® Secured Visa® Credit Card in four short steps. Merchants that accept Visa welcome this card around the globe.

The card features fraud protection and email alerts. Its APR and fees are relatively low.

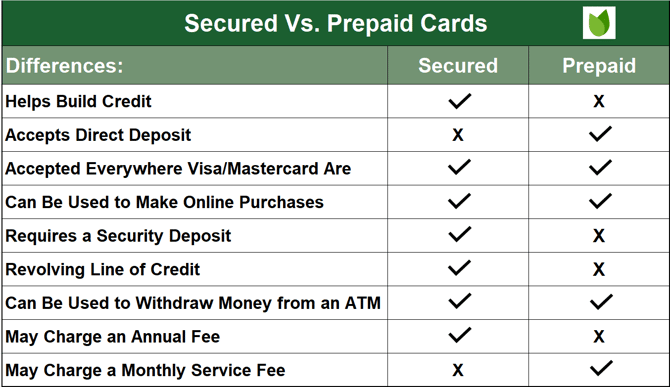

What Is the Difference Between a Prepaid Debit Card and Secured Credit Card?

Both types of cards let you avoid using cash when you pay for the items in your shopping cart. Despite their similar functionality, the cards operate in distinctly different ways.

Getting a Card

You can quickly obtain a prepaid debit card by filling out a short form with your name and Social Security number. The issuer will not pull your credit reports or check your FICO scores when you apply for a prepaid debit card. You must fund the card when you open the account online or in person.

Applying for a prepaid card online is usually free, but an initial fee almost always applies when you buy a card in person or over the phone. You receive a temporary card when you buy it in person.

However you purchase it, it takes up to 10 days for your permanent card to arrive. You must activate your new card online by entering the card’s account number, security code, and expiration date.

You cannot buy a secured credit card in a store, but you can apply for one online for free. The application requires information about your identity, including your name, address, phone number, email address, and Social Security number. You may have to answer additional questions about your income, employment, and debts.

You also need to specify the amount you wish to deposit, although some secured cards for poor credit set a fixed initial deposit, usually $200 to $300. You must deposit your security collateral before the issuer sends you the card. Most secured credit cards pull your credit when you apply.

Funding and Purchase Limits

The cash you load onto your debit card pays for purchases and fees. Your card balance is your purchase limit, although a few cards offer a complimentary $10 purchase cushion for small overdrafts.

The card balance increases when you reload the card via cash, transfers, and direct deposits. Purchases and fees reduce your balance. You can load a prepaid debit card in several ways, including:

- Cash or checks at a designated reload location

- Checks you upload on your mobile phone

- Transfers from another account

- Direct deposits

Reloadable credit cards limit the amount of cash you can deposit daily and cap your maximum overall balance (as high as $15,000 or $20,000 for some cards). Prepaid debit cards also impose daily limits on spending and ATM withdrawals.

The initial deposit to a secured credit card doesn’t fund your spending. Instead, it is a security deposit held by the card issuer.

Normally, the deposit sits in an escrow account under the issuer’s control. The issuer may tap into your deposit and reduce your spending limit if you fail to pay at least the minimum amount due on time.

In almost all cases, your secured card’s spending limit equals the size of your security deposit. The issuer will decline any transactions that push your balance above the credit limit. It can also impose a penalty on overdrafts.

You may be able to increase your credit limit, with the issuer’s approval, by adding more cash to your security deposit. Secured cards usually limit the maximum deposit amount to less than $10,000.

The money you spend on purchases comes from a secured card’s revolving credit line. In other words, it’s borrowed money. You repay the debt according to your own timing, but you must repay at least the minimum amount due each billing cycle.

The card’s grace period is between the last day of the cycle (the statement date) and the payment due date. If you repay your entire balance by the due date, you don’t pay interest on your purchases.

Almost all credit cards offer a grace period (which by law must be at least 21 days), but those that don’t charge interest immediately on all purchases. Grace periods don’t apply to cash advances or balance transfers.

If your payments are repeatedly late, the card issuer may close your account and refund any remaining deposit.

Fees

Prepaid debit cards (a.k.a. reloadable credit cards) generally charge several fees that cover various events and circumstances. These include:

- Purchase fees

- Plan fees (monthly or pay as you go for each transaction)

- Cash deposit fees

- Withdrawal fees

- Foreign transaction fees

- Transfer fees

- Inactivity fees

- Charges for custom or replacement cards

- Card delivery fees

- Other miscellaneous fees

You can save money by comparing fee schedules. All prepaid card issuers must publish their fees in a standard format that facilitates comparison shopping.

Many prepaid card fees are avoidable. For example, you needn’t worry about foreign transaction fees if you don’t make purchases abroad. Prepaid cards don’t charge interest because they don’t provide credit.

As a rule, secured credit cards have fewer fees than do prepaid cards (and unsecured cards for bad credit). The charges you’re most likely to encounter on a secured card are:

- An annual fee

- Cash advance fees

- Balance transfer fees

- Late payment fees

- Overdraft fees

- Returned payment fees

Secured credit cards also charge interest on the unpaid balances you carry across billing cycles. Some cards charge the same APR to all cardholders, while others offer interest rates that depend on your creditworthiness.

Secured cards may charge a different APR for cash advances. Some may charge you a penalty APR if you miss a payment. Credit card APRs top out at 36%, but secured cards tend to have lower interest rates than those for unsecured credit cards for bad credit.

Credit Building

You cannot build credit with prepaid debit cards because they don’t issue credit. A secured credit card is an appropriate option for building or rebuilding credit if your goal is to establish a credit history or boost your credit score.

If you own a small company, a secured business credit card can help those who are rebuilding credit.

It’s up to you to use credit cards responsibly. Not paying on time, maintaining too much debt, or frequently applying for new credit can harm your credit score.

Graduation to Unsecured Credit Cards

Secured cards require refundable security deposits. The issuer will refund your money if it decides you are creditworthy enough to warrant an unsecured personal or business credit card.

Most secured credit cards promise to review your credit history at set intervals to see whether you’ve made your payments on time. If you satisfy the issuer’s requirements, you’ll graduate to an unsecured regular credit card. The issuer may also increase your credit limit.

There is no graduation path from a prepaid debit card to a regular credit card.

Can I Get a Prepaid Credit Card With Bad Credit?

You don’t need any credit to get a prepaid debit card. In fact, folks with bad credit often turn to prepaid debit cards for this very reason.

Issuers of secured credit cards cater to consumers with bad credit — if you had good credit, you wouldn’t need to post collateral. Some secured cards have a minimum credit score requirement, but it is seldom published and varies from one card to the next.

Credit scores are essential to issuers of unsecured credit cards (as well as personal loan providers) since they must face default risk without the benefit of collateral deposits.

Nonetheless, many subprime unsecured cards aim for consumers with bad credit who are willing to pay hefty fees. By collecting upfront application and annual fees and offering puny credit limits, the issuers of these cards reduce their losses from credit card defaults.

Do Prepaid Cards Show Up on Credit Reports?

Your prepaid debit card will never appear on your credit report. These reports reflect credit activity, whereas prepaid cards generate only debit transactions.

Typically, a creditor that pulls a credit report also conveys credit activity to a credit bureau. Secured card issuers do both, whereas prepaid card issuers do neither.

Credit card issuers check applicants by pulling their credit reports and scores from one or more of the three major credit bureaus (Experian, Equifax, and TransUnion). These reports contain details of an applicant’s credit history.

Each credit bureau collects consumer credit data and feeds it into credit score algorithms (FICO is the primary consumer scoring system used in lending decisions). Bureaus issue scores that reflect the probability of an applicant defaulting on their debt in the next two years.

The scores range from 300 (worst credit) to 850 (perfect credit). Your responsible use of credit will help raise your credit score.

Do I Need a Credit Check For a Prepaid Card?

Prepaid debit cards never require a credit check, making them suitable for consumers with bad, limited, or no credit. Virtually anyone 18 or older with a Social Security number can get a prepaid card with few questions asked.

The debit-only nature of prepaid cards has both positive and negative consequences. On the plus side, prepaid cards are easy to get, never create debt, never charge interest, and can’t harm your credit score. But neither can prepaid cards help you build credit, and you can’t use them to finance purchases over time.

Most secured credit cards pull an applicant’s credit report. The Secured Sable ONE Credit Card and the OpenSky® Secured Visa® Credit Card are two exceptions. These cards are compelling alternatives to prepaid debit cards for consumers with very poor credit who want to avoid a credit check. They are easy to get and cost less than prepaid cards.

Secured Sable ONE Credit Card

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

Additionally, a secured card is a credit builder option that allows you to stretch out payments across multiple months. If you pay your entire balance each month, you avoid accumulating debt and interest.

One other factor to consider: Most secured credit cards require you to have a checking account. Prepaid cards have no such requirement yet provide many of the conveniences of a checking account. If you don’t like banks, prepaid debit cards can fit your lifestyle without compromising your beliefs.

Are There Any Free or No-Fee Prepaid Cards?

Every prepaid debit card has fees, but a free or no-fee card waives monthly and pay-as-you-go plan fees. One example of this rare breed is the Bluebird American Express Prepaid Debit Account, which avoids plan fees and other charges. The card also offers free in-network ATM withdrawals, free cash reloading at Walmart, free debit card transfers, and free early direct deposit.

Many other debit cards advertise low fees, but you have to dive into the fine print to see what’s free and what’s not. For instance, chances are a prepaid card that advertises no monthly fee charges for each purchase transaction.

Almost all prepaid cards offer free direct deposits and mobile check loads, and several do not charge for in-network ATM withdrawals. You can access fee information for the prepaid cards we review by clicking on the “See application, terms and details” links in the review boxes.

Can You Run a Prepaid Card as Credit?

Remember earlier how we lamented the use of the term “prepaid credit card,” the unicorn of the personal finance industry?

Prepaid cards are debit cards; secured cards are credit cards. So it may surprise you to learn that, yes, you can run a prepaid debit card as a credit. The catch is how we use “credit” in this context.

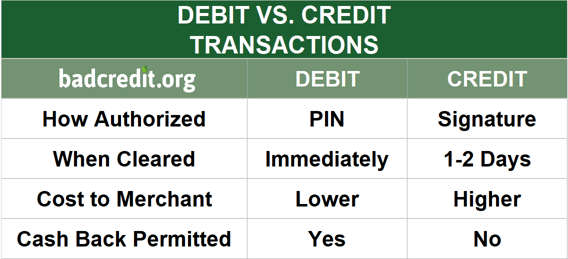

You can run a debit card at the checkout counter as a debit or credit. Both are actually debit transactions but differ in several ways:

When you tap, swipe, or insert your card, the reader will recognize it as a debit card and ask whether you want a debit or credit transaction.

If you answer debit, the device will ask you to enter your secret PIN, which it immediately verifies. If it’s a valid card with sufficient funds, the issuer approves the transaction and instantly adjusts the balance.

You and the merchant should prefer debit transactions since they are more secure (you must supply the correct PIN), and the merchant pays a lower fee. Moreover, the store may allow cash back, in which you enter a debit amount larger than the purchase total and receive the difference in cash.

You can alternatively request a credit transaction for your debit card. You must sign the device’s screen (typically using your finger or a stylus), presumably triggering an attempt to validate your signature electronically.

Unfortunately, it’s much harder to verify a signature than a PIN, and the transaction costs the merchant a higher fee. Card thieves prefer credit transactions because they are less secure.

If the credit transaction receives the OK, the issuer puts the purchase amount on hold until it clears the transaction in the next day or two. As a security precaution, you cannot get cash back from a credit transaction.

How Fast Can I Build Credit With a Secured Card?

It usually takes six to 12 months for your credit score to rise due to your use of a secured credit card. That’s generally how long it takes for the credit bureaus to recognize a consistent pattern of timely payments.

FICO designates 35% of your credit score to your payment history, the most significant score factor. The amount you owe, i.e., your card balance, is worth another 30% of your FICO Score.

Making timely payments and keeping your card balance below 30% of your available limit will help you maintain a good credit score.

Do Prepaid Cards Offer Rewards?

Several prepaid debit cards offer cash back rewards when you use them to purchase items at select merchants. For example, the PayPal Prepaid Mastercard® provides an optional Payback Rewards program in which your shopping habits influence the rewards you’ll get. The Brink’s Armored™ Account and NetSpend® Visa® Prepaid Card feature similar reward programs.

Several secured credit cards offer rewards for the money you spend on net purchases, including the Secured Sable ONE Credit Card and Surge® Platinum Secured Mastercard®.

Choose the Prepaid Card For Bad Credit That Meets Your Needs

Now that you’ve read about prepaid credit cards for bad credit, you’re wise to the differences between prepaid debit cards and secured credit cards. Both serve subprime consumers, albeit in distinct ways. We’ve given you a starting point for choosing the right card for your lifestyle.

Keep in mind that nothing prevents you from holding both types of cards and benefitting from the strengths of each. You’ll do well to seek out the cards with the lowest fees and best perks. Read the Schumer Box and the fine print for each card offer — that’s the most direct way to compare your options and choose the cards that best fit your lifestyle.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.