Your credit reports and credit scores are always front and center for lenders and other service providers when they are considering whether to do business with you. And because most consumers start using credit in their early 20s and continue to do so for the next several decades, maintaining credit health is really no different than making a smart long-term investment in yourself.

Having said that, life happens. And situations either in our control or not can lead to negative and damaging information appearing on our credit reports, which means they will be in need of repair and rehabilitation.

It Could Take Months or Years, Depending On Your Situation

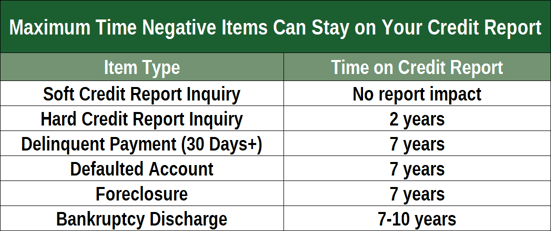

The credit repair process is not something you can knock out over a weekend. In fact, it may take you several years to fully rehabilitate your credit reports. The Fair Credit Reporting Act, a consumer protection statute, gives the credit reporting agencies wide latitude for how long they can legally maintain negative information on your credit reports.

Generally speaking, negative information can remain on your credit reports for between seven and 10 years, depending on the type of negative information. Bankruptcies will remain for between seven and 10 years, depending on the type of bankruptcy. All other negative information can remain on your credit reports for no longer than seven years.

Late payments, collections, settlements, discharged debts, repossessions, foreclosures, charge-offs/defaults, and similar negative entries are all legally allowed to remain on credit reports for up to seven years. But they are only allowed to remain on credit reports if they are accurate and can be verified.

If an entry is inaccurate or can no longer be verified, it must be removed or corrected, even if the seven-year period has not expired.

This certainly doesn’t mean it’s going to take seven to 10 years to repair your credit reports. You may be able to remove negative information much sooner, especially if it is not verifiable. And, credit repair isn’t synonymous with “removing bad stuff.” On the contrary, you can begin repairing your credit by adding rather than simply removing bad information.

Credit scoring systems, those built by FICO and VantageScore, love to see recent positive information and a lack of recent negative information. As such, even if you have poor credit reports, you can accelerate the repair process by beginning to establish new credit even before the poor credit has been purged.

Generally speaking, credit scoring systems will weigh the more recent information more heavily, so if you can put some time between yourself and the bad stuff, your scores will begin to improve.

How Does Poor Credit Happen?

The path to poor credit reports and scores is different for all of us. Some consumers lose their jobs and cannot continue to make their minimum monthly payments. Some consumers get sick and cannot pay their bills because their funds are being spent on medical treatment for themselves or their loved ones.

Some consumers just cannot handle the responsibility of credit and find out the hard way that the industry can be very punishing. There are countless backstories to poor credit.

Because there are many paths to poor credit, there are equally as many paths to repairing your credit. The point being, there is no universal advice other than don’t ever miss payments. But solid credit repair advice should be a little more strategic than that.

What Does It Mean to Repair Credit?

It’s not uncommon for consumers to associate the term credit repair with credit repair companies or, formally, credit repair organizations. These are the companies that, for a fee, will help you challenge information on your credit reports with which you disagree.

If these efforts are successful, the credit reporting agencies will remove or modify the offensive information.

Credit repair, which is a legal process despite what some would have you believe, can be very effective. Lexington Law boasts that it has removed 70 million items from its clients’ credit reports over the last 17 years.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

Credit repair services, however, do have a cost. The cost varies depending on the credit repair company, the level of service you chose, and how long you remain a client. If your credit repair company is successful repairing your credit in a few months, then your costs will be minimal.

If, however, your credit report is more stubborn than others, it can take much longer and at a higher long-term cost.

Ultimately, the definition of credit repair is pretty generic. It generally means to improve the quality of the information that appears on your credit reports and, as a result, improve your credit scores. This can mean removing information from your credit reports or adding information to your credit reports.

Either, or a combination of the two, can yield better credit reports and credit scores.

Finally, you can also choose to repair your own credit instead of hiring a company to facilitate the process. It’s up to you whether to repair your own credit or hire a company to do it for you.

Many people hire service companies to perform tasks that they don’t have the time, energy, or desire to perform. Think about lawn care services, tax prep services, mechanics, and cosmetology services as a small example of companies that perform services you likely can perform on your own, either for free or for a much lower cost.

Why Is It a Good Idea to Repair Your Credit?

If you have good credit reports, you’re going to also have good credit scores. It’s that simple. And, if you have good credit scores, then you’re going to have a better experience with lenders and other service providers that rely on credit risk assessment when considering whether to do business with you and on what terms.

For example, consumers who have FICO or VantageScore credit scores in the high 700s or higher may be able to buy a new car with a zero-interest loan. Zero interest means free money. There is no better benefit to having good credit than free money.

The same consumers will also qualify for mortgage loans with rates that are at or near historic lows. And, high-scoring consumers are going to have their pick of the best credit card offers from the best card issuers.

Other, less recognized benefits of repairing your credit include less expensive insurance premiums and waived deposit requirements by both utility providers and property management companies. When you start stacking up the benefits of repairing your credit, you can begin to understand just how financially beneficial doing so will be.

Three Bureaus Maintain Your Credit Reports

Before you embark on your credit repair journey, it’s important to understand the landscape a bit. When you hear terms like credit repair, it really means to repair all of your credit reports, not just one of them.

Repairing one of your three credit reports is a little like fixing one of the three leaks in your roof. It’s simply not going to be good enough.

If you have a poor credit report with Equifax, you likely have poor credit reports with Experian and TransUnion. That means credit repair is a tri-bureau process. But it may not mean triple the work, triple the time, or even triple the cost.

Correcting errors on credit reports follow a certain pattern. If you file a dispute with one of the credit bureaus and it corrects information in its credit file system, those corrections are likely going to make their way to the other two credit bureaus as well.

This process, informally referred to as carbon copy, eliminates the need for you to go through the same repair process times three. And if you choose to skip filing disputes with the credit bureaus and file disputes directly with the furnishing party, normally a financial services company or a debt collector, then the news is even better.

If the furnisher acknowledges a mistake, it must correct its error everywhere, not just with one of the credit bureaus. As in, if XYX Bank determines what they sent to Equifax, Experian, and TransUnion was incorrect, it has to correct it with Equifax, Experian, and TransUnion.

Still, even though that’s the way it’s supposed to work, it’s not a bad idea to trust but verify. You can do this by pulling your credit reports from all three credit bureaus after you believe you have completed the repair process. You can do this for free at www.annualcreditreport.com.

In Sum

If you are about to embark on a credit repair journey, you’re going to need two things: patience and realistic expectations. If you have credit reports with page after page of accurate and verifiable negative information, credit repair will take years.

If, however, your credit reports only contain a few older negative marks, it may only take you a few weeks to repair your credit.

Regardless of how long it takes, you should do it. Good credit is so financially beneficial that it is no different from choosing the right stock or mutual fund because you’ll end up with more money in your pockets.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.