CreditNinja is an online lender that allows subprime borrowers to take out unsecured personal loans of up to $5,000. With more than 12 million Americans taking out payday loans every year, the need for finding loans with solid rates and terms has never been greater amid rising inflation.

Those who need help getting approved for traditional loans can benefit from CreditNinja’s easy application process that can facilitate a direct deposit of loan funds to your bank account, sometimes even on the same day.

In this CreditNinja review, we’ll go over the service in-depth and review alternative loan referral services that are equally comparable with their loan offerings.

Best Online Loans Like CreditNinja

Although CreditNinja is a legitimate lender, it is not available in all states, presenting a need for an alternative if you live in one of the states it doesn’t service. The following lending networks offer access to a broader pool of direct lenders, each with competitive rates and terms.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual is a top-rated lending network that allows you to compare multiple loan offers after filling out a quick prequalifying form. It connects bad credit borrowers with direct lenders offering short-term loans of up to $5,000, available in as little as 24 hours.

One of our favorite things about MoneyMutual is its long-standing track record. Boasting over 2 million customers to date, this lending network is also a member of the Online Lenders Alliance (OLA) and Community Financial Education Foundation, two trade organizations that advocate for online financial education programs and fair lending practices.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

In business since 2001, 24/7 Lending Group has helped people of all credit types find accessible loans through a quick and straightforward prequalification form. Like most lending networks, money can be deposited to your bank account by the next business day.

To qualify for a loan, applicants must be at least 18 years old with a full or part-time job, although most government benefit recipients (e.g., SSI and disability) are welcome to apply. This loan matching service also has stellar ratings, averaging 4.7 out of 5 Trustpilot scores across 2,220+ reviews.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com is one of our favorite cash loan referral services, facilitating online installment loans to subprime borrowers. Its large pool of direct lenders promises a lower interest rate than traditional payday loans.

The loan terms you’re offered depend on the lender. Prequalifying on the website is free, and its online form uses industry-standard encryption to keep your personal information safe. Another benefit to using CashUSA.com is its extensive education resources, featuring helpful articles on common topics such as how credit monitoring services work and the best methods for paying off your debt.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com is a top-rated service that matches subprime borrowers with direct lenders specializing in bad credit loans of up to $20,000. You can receive a loan approval decision in as little as two minutes and receive money in your bank account within one to two business days.

The interest rate and repayment terms you qualify for depend on the direct lender making the offer. To qualify for a SmartAdvances loan, you must have a full-time or part-time job or collect government benefits, such as disability or SSI. SmartAdvances.com is also a member of the Online Lenders Alliance (OLA).

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

In business since 1998, BadCreditLoans.com has a stellar track record of connecting subprime borrowers with short-term emergency cash loans.

BadCreditLoans.com’s network of direct lenders can offer loans from $500 to $10,000. To qualify, you must have a bank account, a source of income, and be age 18 or older. There is no cost to use the service, and it is accessible 24 hours a day, seven days a week.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

With more than 75,000 customers since 1998, CreditLoan.com is a highly recommended lending network specializing in short-term emergency loans with fast approval times and easy lending criteria for subprime borrowers.

Direct lenders on the network offer $250 to $5,000 with cash deposited to your account as early as the next business day. You only need to submit a loan request form to potentially receive multiple loan offers. This service is free, and there’s no obligation to put pen to paper.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com features an extensive network of lenders offering bad credit borrowers payday and installment loans of up to $5,000. You can use this network’s loans for virtually any purpose, including unforeseen medical expenses and debt consolidation.

The site offers a secure prequalification form where you can provide your employment, financial, and contact details, and receive a real-time lending decision from direct lenders with competing offers. Submitting the form will not trigger a hard credit check or affect your credit score.

What is CreditNinja?

Founded in 2018, Chicago-based CreditNinja is an online lender that offers unsecured personal loans of up to $5,000.

One of CreditNinja’s biggest draws is its quick application process. It takes up to five minutes to prequalify. If your application is approved before 10:30 AM CT, you can receive loan proceeds in your bank account on the same business day.

Unlike your average payday loan, this service offers loans with flexible repayment schedules and interest rates, and is accessible to most borrowers, including subprime borrowers who often have difficulty qualifying for traditional loans.

However, CreditNinja doesn’t service all 50 US states. At the time of this review, its loan service is only available in:

Alabama

California

Delaware

Florida

Idaho

Louisiana

Mississippi

Missouri

New Mexico

North Dakota

South Carolina

Texas

Utah

Wisconsin

That leaves 36 states the lender doesn’t operate in, and a whole lot of people left needing to find an alternative, which is why we created this guide to loans like CreditNinja.

CreditNinja has solid Trustpilot reviews. As of this writing, it has achieved an average 4.4 out of 5 rating based on nearly 8,000 reviews, with 81% of reviewers giving it a 5-star rating.

Meanwhile, 7% of reviewers gave the company a 1-star rating, including this one:

“Went through the process. Was told that I was approved for $2,500 but the bank verification won’t go through. Logged back in the next day and the bank verification finally went through but changed the approval amount to $800. Then got a bank alert that this company was sharing my bank data and the bank blocked my card for fraud!”

— Del

That aside, the majority of reviews are positive, and we have no reason to believe CreditNinja isn’t a legitimate service.

Is CreditNinja a Reputable Company?

Yes, we believe CreditNinja is a reputable company for the following reasons:

- Background: CreditNinja has facilitated more than 475,000 loans to 275,000+ customers since its founding in 2018.

- Transparency: CreditNinja is committed to transparency. Its website disclaimers call out many factors, for example, this one, that states, “Not all loan requests are approved and high-cost disclosures that site higher than average interest rates and loan origination fees.” It offers representative loan examples, providing the total cost of borrowing for different loan amounts and scenarios, e.g., 25% APR, $15,000 personal loan with a 2-year repayment term.

- Resources: One of the best things about CreditNinja is its extensive article database covering helpful financial literacy topics, from understanding your credit score to budgeting with an irregular income. It also includes various financial calculators that help you estimate any loan’s total cost of borrowing by entering in your loan amount, interest rate, and repayment length.

The loan you qualify for, including the amount, interest rate, and repayment term, will vary based on your state of residence and its lending laws.

What Kind of Loans Does CreditNinja Provide?

CreditNinja states on its website:

“Generally, we offer unsecured loans [of] up to $5,000. However, we encourage you to apply because your resident state will affect both the minimum and maximum loan amounts we offer and whether we make a loan directly or arrange a loan made by an FDIC-insured bank or other non-affiliated lender.”

That means that, depending on where you reside, CreditNinja may not be your lender, and it will instead refer you to an eligible third-party lender. This is similar to how our recommended lending networks above operate.

What is the Easiest Loan to Get Approved For?

The easiest type of loan to get approved for is typically a payday loan or a secured loan such as a pawnshop loan, neither of which typically requires a credit check.

Another easy way to obtain a loan, despite a limited or bad credit history, is to use a lending network such as MoneyMutual and 24/7 Lending Group. Lending networks are not direct lenders, but third parties connecting borrowers with loan offers using one easy-to-use platform.

They offer many benefits, including but not limited to the following:

- They Offer Several Types of Loans: Loan referral networks specialize in all types of loans, including payday, installment, and debt consolidation loans. You can even use a lending network to find auto and home loans. Personal loan amounts start as little as $100 with repayment terms anywhere from two weeks to several years. Most personal installment loan interest rates top out at 35.99% APR, but short-term cash loans, such as payday loans, can charge much more.

- Qualification is Quick: To request a loan using an online lending network, complete a prequalification form through its website. It will ask for your personal information, including contact and financial details. Once you submit your loan request, you may receive multiple loan offers from direct lenders. Compare each offer’s interest rates, repayment terms, and fees to estimate the total cost of borrowing before agreeing to the loan.

- Prequalifying Doesn’t Affect Your Credit: Submitting a free prequalification form through a loan referral service will not ding your credit history. Only when you submit an application will a hard inquiry be performed on your credit file, though some payday lenders don’t require hard credit checks and instead base approval on your income.

- You Can Easily Compare Loans: Using a loan referral service allows you to compare multiple loan offers, saving you time contacting bad credit personal loan providers separately.

Be sure to closely read the fine print of any loan offer you receive to ensure you choose the best offer for your situation. Look for trigger terms like “prepayment penalty” and “compounding interest” so you can avoid predatory loan offers.

How Can I Get Instant Money for an Emergency?

You can try taking out a loan through CreditNinja or any alternative lending network. You can visit a local payday lender or pawnshop if you need immediate cash. But this is only a good idea if the situation is dire and you know you can repay the loan as agreed, due to their highest interest rates and fees.

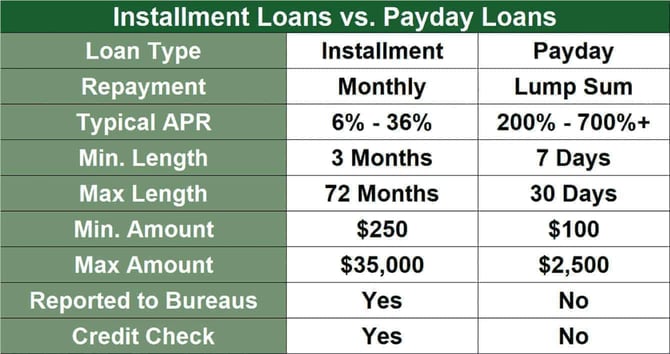

Payday loans require lump sum repayment with much higher APRs in the 200% to 700%+ range. Repayment windows are much shorter (seven to 30 days), and loan amounts typically cap out around $2,500. Most payday lenders do not report activity to any of the credit bureaus unless you fail to repay the loan.

Installment loans have greater flexibility than payday loans, requiring monthly payments with lower APRs (5.99% to 35.99%) and longer repayment terms from three months to 72 months. Borrowing minimums typically start at $250 and go up to $35,000. But installment loans may be harder to qualify for if you have really poor credit.

We recommend observing the pros and cons of taking out payday or installment loans before financing your next emergency.

To be eligible for a payday or personal loan through any of the recommended loan services, you must:

- be 18 years of age or older

- be a US citizen or permanent resident

- have a minimum monthly income of $800

- meet the lender’s debt-to-income (DTI) ratio requirements

- not be an active military member (per the Military Lending Act)

- have a valid checking account

One important thing to know about CreditNinja and our alternative lending networks is that approval is not guaranteed. Every direct lender has its underwriting requirements, so every borrower will receive different terms. However, each has an extensive network of direct lenders competing for your business, so you may find one or two loan offers you like.

What is a Hardship Loan?

A hardship loan helps cover borrowers who face unexpected expenses, such as home repairs, auto repairs, and past-due rent. These loans typically provide funding from $1,500 to $5,000.

Three sources for hardship loans include the government, banks, and credit unions. Each lender has its own application process, and different government hardship loans focus on other needs. For example, the Low-Income Housing Home Emergency Assistance program assists families with energy costs, with proceeds going to eligible low-income households.

Another popular hardship loan is the Supplemental Nutrition Assistance Program and Temporary Assistance for Needy Families (TANF). These two programs offer food stamps and monthly cash payments for the unemployed or underemployed.

Banks and credit unions have their versions of hardship loans. For example, select credit unions offer payday alternative loans, which are short-term cash loans of up to $2,000 repaid in one to twelve months.

To qualify, you must generally pay the application fee and be a member of the credit union. Some credit unions impose a minimum membership duration, such as one month, depending on the type of payday alternative loan offered.

In short, hardship loans are an excellent source of emergency cash to address many of life’s financial roadblocks.

Finding a CreditNinja Alternative is Easy

Lending networks such as MoneyMutual and CashUSA.com do an exceptional job of connecting borrowers with personal loans for any purpose. Each one has hundreds of direct lenders ready to “make a deal.”

Whether you have bad credit or no credit, you can prequalify today by submitting an online personal loan application through one of our recommended CreditNinja alternatives, particularly if you don’t live in one of the states CreditNinja currently services.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.