Credit scores, those three-digit numbers based on your credit reports, are used well over 20 billion times each year by lenders and others to make decisions about you. Almost every single time you apply for credit, one or more of your credit scores are going to be calculated and delivered to your prospective lenders.

You would think, reasonably, that people have a decent understanding of what their credit scores are. Unfortunately, you’d be mistaken.

According to a June 2023 survey commissioned by BadCredit.org, 30.6% of Americans surveyed indicated they did not know what their credit scores were. These results, while troubling, are fairly consistent with previously commissioned studies on the same or very similar topics.

It seems that about a third of consumers don’t know very much about their personal credit at various points in time.

More Troubling Statistics

Among the people surveyed, BadCredit.org also found that:

- 22.6% don’t know which factors contribute to their credit scores, and another 38.1% said they only “somewhat” know.

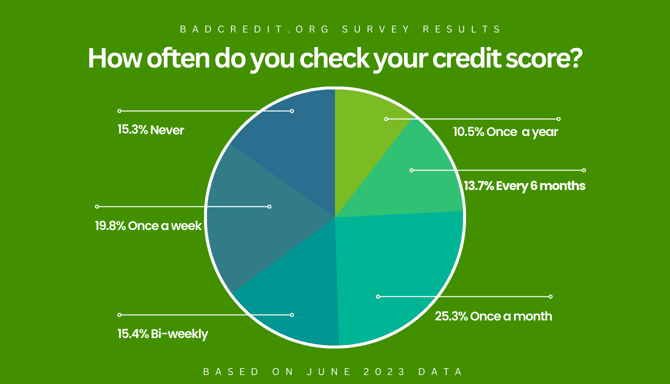

- 15.3% never check their credit score, while another 10.5% only check it once per year.

- 25.6% said they believe checking their credit hurts their credit scores.

Why is This Troubling?

The findings are troubling for a variety of reasons. The primary reason is that, when you apply for credit, your credit score is essentially your résumé. Your credit scores are going to act as the tipping point to determine the outcome of most of your credit applications. As in, if your scores are higher than X, you’re likely going to be approved. If your scores are lower than X, you’re likely going to be denied.

Don’t you want to know what X equals?

The second reason has to do with the price of credit. Lenders in the United States use a practice called risk-based pricing or “RBP.” What RBP means is the less risk you pose, the less money the lender has to charge you to subsidize the risk of doing business with you.

It also means the more risk you pose, the more the lender has to charge you to subsidize the risk of doing business with you. This is why applicants who have better credit scores get better deals than those who have lower scores.

If you don’t know what your scores are, then you aren’t going to know whether the quote you’re getting from a lender or the APR on your new credit card is in line with your credit risk.

For example, if I know I have FICO scores above 750, I know any offer I get from a lender or card issuer had better be extremely competitive. If not, I know I’m not getting a fair offer, and I’m going to walk and take my business elsewhere. If I don’t know what my scores are, I won’t know if I’m getting a fair offer.

How to Check Your Credit Scores

It has become so easy to check your credit scores for free that you don’t have to remain in the 31% of consumers who don’t know their scores.

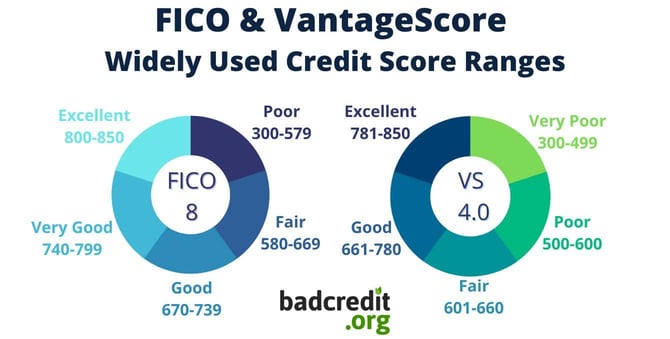

Credit scores are given away to attract new customers, as an incentive to become a registered user of various websites, or to direct credit card customers away from paper statements and toward web-based account access. There is no shortage of outlets that will give you access to FICO-branded scores and VantageScore-branded scores.

And because those two score brands, collectively, make up about 100% of the credit score market in the United States, that’s certainly good enough.

Hundreds of lenders that use FICO scores will happily give you your FICO score at no cost via their app or if you log in to your account on their website. These companies participate in FICO’s Open Access program, which allows users of their credit scores to repurpose the scores for display to the lender’s customers. Hundreds of lenders participate in the program, so one of your credit cards may already allow you access to your FICO score.

You can also estimate your FICO score using FICO’s Score Estimator tool. When used properly, the tool yields an extremely accurate score.

The challenge with the tool is that consumers who don’t know very much about credit reporting nomenclature may not answer the various questions accurately. Still, it’s free and doesn’t involve you giving up any of your personal or payment information.

How to Check Your Credit Reports

Your credit scores are based entirely and exclusively on the information in your consumer credit reports. You can check your credit reports, but not your credit scores, for free at www.annualcreditreport.com. You can check your reports once per week at no cost from all three of the credit reporting agencies.

That is a smart move considering your reports are likely going to be different, which means they’d yield different credit scores.

While not a perfect proxy for your credit scores, certain attributes from your credit reports may give you an idea as to where your scores would likely fall in a broad range of bad, average, good, and excellent.

If your credit reports are old, void of anything negative, and you have modest credit card balances, your scores are likely going to be good or better. If you have negative information on your credit reports, or you have large credit card balances, your scores are likely going to be average, at best.

Survey Methodology

A national online survey of 1,055 U.S. consumers, ages 18 and older, was conducted by Propeller Insights on behalf of BadCredit.org in June of 2023. Survey responses were nationally representative of the US population for age, gender, region, and ethnicity. The maximum margin of sampling error was +/- 3 percentage points with a 95% level of confidence.