Although credit scores are neutral algorithms based on a person’s reported credit activity, there are indisputable variations between various demographics. Studies indicate that there are significant differences in credit scores across the racial divide.

Here are the average credit scores from people of different stated races, and potential reasons for these numerical differences.

White Americans Have the Highest Average Credit Scores: 727

According to the Urban Institute’s most recent data, people who identified as white have the highest average credit scores at 727.1

Urban Institute used the following racial groups as a comparison regarding credit scores in 2022:

| Race | Median Credit Score |

|---|---|

| White | 727 |

| Hispanic | 667 |

| Black Non-Hispanic | 627 |

| Native American | 612 |

Credit scores, such as FICO Scores and VantageScores, are developed from the credit and debt information that appears on credit reports from the major consumer credit bureaus: TransUnion, Experian, and Equifax. That data is inputted into mathematical models, producing a risk-based score that other lenders can use to grant credit and set terms.

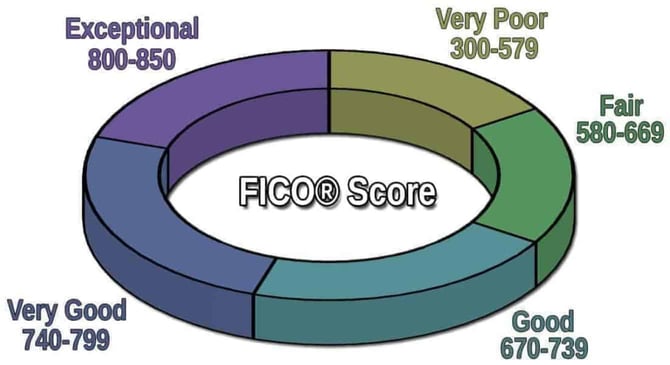

Credit scores start at 300 and go up to 850, with higher numbers representing greater creditworthiness because they indicate less lending risk.

According to FICO, the distribution of credit scores by what is considered poor to exceptional is as follows2:

- Poor:

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Exceptional: 800>

So with a 727 score, a person would have a number that fits within the good range. This would make good credit products more available than they would be to people who have lower credit scores.

High credit scores are a result of maintaining a record of long-term positive borrowing and repayment activity. That means having and using a variety of credit products, such as loans and credit cards, responsibly for many years.

A person with a good credit score pays their bills on time and keeps their revolving credit debt levels low relative to the amount they can borrow with the credit line. They also have no negative mistakes or fraud appearing on their credit file that would bring their scores down.

Native Americans Have the Lowest Average Credit Scores: 612

According to the Urban Institute’s data, Native Americans have the lowest average credit scores in the United States, at 612. These scores are in the fair range. Securing credit products is possible with such scores, but the interest rates are unlikely to be as low, and the perks and rewards will not be as attractive as they would be for someone with higher scores.

Someone with no accounts listed on their credit reports will have no credit scores at all. They will have what’s known as “thin credit,” indicating the person has no or too little credit history to calculate a credit score.

Although people from all racial backgrounds can have thin credit (especially when they are young and just starting out), the National Community Reinvestment Coalition reported that Native Americans tend to have limited access to banks and other financial institutions, making it difficult to establish credit and build a positive credit history.3

A person’s credit scores will be lower if there is negative information on their credit reports, such as a history of late payments, accounts in collections, defaults, bankruptcies, and high debt relative to revolving credit limits (credit cards, usually). Applying for many new credit products in a short period will also cause scores to be lower, especially when a person has a thin credit file or already has scores at the lower end of the scale.

It also takes time to create a good credit score, as well as time (and money if people want to pay professionals) to rectify problems that bring scores down.

Reasons Credit Scores Vary Among Races

The purpose of credit scores is to have an objective system where borrowers are not judged based on irrelevant factors such as race, sex, marital status, religion, or any other discriminatory considerations. In fact, credit scores do not include income in the calculations either (though lenders will ask for that information on the application).

Credit scores are strictly based on a borrower’s history of behavior: how a person takes out credit products and then uses them.

So why do credit scores vary according to race? There are a few main drivers:

- Income. It stands to reason that the more a person earns, the greater likelihood they will have higher credit scores. Consumers in upper-income brackets use loans to buy homes and vehicles and open credit cards to purchase the things they need and can afford to repay. Income is correlated to credit scores, but there are striking differences in incomes between different racial groups. According to the U.S. Census Bureau, the average incomes by race are4:

- Asian – $94,903

- White – $74,912

- Hispanic – $55,321

- Black – $45,870

- Access to conventional financial products. Many alternative lenders do not report credit activity to the credit bureaus, so even if the person handles these accounts responsibly, they will not result in a positive impact on their credit scores. For example, payday loans are disproportionately used by Black and Hispanic people.5 Not only are these products absent from credit reports, but they are expensive relative to conventional loans and credit lines.

- Trust in banks. Participating in the banking system with deposit accounts is a key part of becoming an active borrower, but USA Facts reported that Black Americans have the highest underbanked rate — at 27% — of any demographic group.6

- Wealth gap. The wealth gap related to income is the amount of money a person keeps, which creates stability. In the event of a financial emergency, such as job loss or a large unexpected expense, a person who has substantial savings and investments won’t have to rely on credit products and loans and then fall behind on payments, causing credit scores to decline. The St. Louis Federal Reserve reported that, on average, Black families owned about 24 cents for every $1 of white family wealth, while Hispanic families owned about 23 cents for every $1 of white family wealth.7

Key Takeaways

To create a good or better credit score, a consumer would need to use credit products the right way. Additionally, if problems arise, they would need to address them swiftly. That requires catching and remedying issues such as mistakes and fraud by paying attention to credit reports and filing disputes.

This process can take considerable time out of one’s day, which can be a hardship for people who are financially struggling. A wealthy person can even pay a third-party service to monitor reports and hire a professional to deal with issues should they occur.

So while it is possible for everyone to develop high credit scores, racial disadvantages and discrepancies remain.

Further Reading:

- Average Credit Score by Age

- Average Credit Score by State

- Average Credit Score by Income

- Average Credit Score in America

Data Sources:

1. https://apps.urban.org/features/credit-health-during-pandemic/

2. https://www.myfico.com/credit-education/what-is-a-fico-score

3. https://ncrc.org/native-americans-struggle-to-obtain-credit-a-close-analysis-of-native-american-mortgage-lending-from-2018-2021/

4. https://www.census.gov/content/dam/Census/library/visualizations/2021/demo/p60-273/figure2.pdf

5. https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

6. https://usafacts.org/articles/who-is-the-least-likely-to-have-a-bank-account-in-the-us/

7. https://www.stlouisfed.org/institute-for-economic-equity/the-state-of-us-wealth-inequality