BadCredit.org survey reveals that many younger consumers, predominantly Gen Z and millennial males, trust AI tools to help them improve their credit.

In today’s digital age, AI isn’t just for sci-fi — it’s shaping how we manage our finances. According to a recent BadCredit.org survey, some consumers are turning to AI tools like ChatGPT for credit advice, with Gen Z and millennial males leading the charge. Trust in AI isn’t universal, though, with only 16% of those surveyed fully on board.

But it’s not just about trust — it’s about action. While 25% of respondents believe AI can help them boost their credit, only 15% have taken the plunge. Still, there’s optimism, especially among younger generations.

In a world where technology meets finance, this survey offers a snapshot of how millennials and Gen Z are reshaping the credit game, one algorithm at a time.

24% of Americans Have Asked AI Where to Check Their Scores

The average FICO® Score, as of April 2023, stands at 718, which is two points higher than the average FICO Score a year ago. Could GenAI be contributing to this improvement?

According to the survey, nearly one-quarter (24%) of Americans surveyed say they have used ChatGPT (or another AI bot) to suggest a source for checking their credit score. That number represents 29% of male respondents compared with 20% of females.

Younger consumers are showing even more excitement around using AI tools to source credit score monitoring. Survey results show that 30% of millennial respondents and 29% of Gen Z respondents say they have used ChatGPT (or another AI bot) to suggest a source for checking their credit score.

The counter to using AI tools for checking credit scores is that fewer consumers say they trust AI, as the survey reports only 16% of respondents say they trust ChatGPT or another AI bot to suggest a source for checking their credit scores. Of those who say they trust AI to recommend a credit score source:

- 22% are male

- 11% are female

- 37% are millennials

- 35% are Gen Z

Millennial Males Trust Technology to Shape Credit Scores

The survey also revealed that 25% of Americans surveyed say they trust AI to help them improve their credit, and that number increases to 31% of males versus 19% of females. Younger consumers were more likely to say they trust AI can help them improve their credit scores, with 39% of millennials and 37% of Gen Z surveyed buying in.

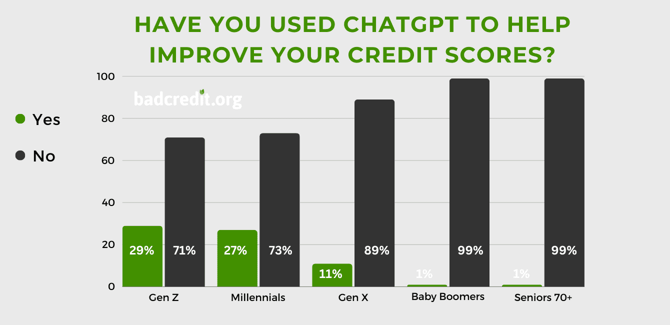

That said, the survey found that only 15% overall have actually used ChatGPT or another AI bot’s advice to help improve their credit scores. That breaks down to 20% of male respondents, 10% of female respondents, 29% of Gen Z respondents, and 28% of millennial respondents.

Quick Tips to Improve Your Credit

“The key to achieving the average FICO score of 718 or higher is to lower your credit card debt and consistently repay your debts on time,” said Ashley Fricker, Senior Editor with BadCredit.org. “Younger generations are more likely to use ChatGPT already, and many have leveraged it to help them with school assignments, job applications, and other written applications. So entrusting it to help them answer questions about their credit scores and heed its actional advice isn’t too surprising. But users should nevertheless verify the advice they’re given and double-check its validity.”

Here are a few tried and true ways to help improve your credit scores:

- Pay all your bills on time. Your payment history is the largest credit scoring factor, and missing even a single payment by 30 or more days can wreak havoc on your credit. But if you can catch up and make your account current again, you should see a significant bump in your score the next time it’s calculated, which is typically monthly.

- Pay down your debts. How much outstanding debt you have is the second-largest credit scoring factor, so paying down your debts can greatly help your credit. It is more advantageous to pay off revolving accounts, such as credit cards, than installment loans, such as personal or student loans.

- Request a credit limit increase. If you’ve had a credit card account open and in good standing for more than six months, contact the card issuer to see if you qualify for a credit limit increase. This is particularly beneficial if you carry credit card debt, as it will help lower your credit utilization ratio, which is among the metrics considered in the “amounts owed” category discussed in tip #2 above.

- Dispute any inaccuracies on your credit reports. If you’re not checking your credit reports, you should be. You can access your reports from each bureau for free once per week on AnnualCreditReport.com. Reviewing the details and ensuring everything is correct is important because inaccuracies could be unfairly lowering your credit scores. If you do spot something amiss, you can contact each of the bureaus to dispute the information and have your reports corrected.

Methodology

A national online survey of 1,015 U.S. consumers, ages 18 and older, was conducted by Propeller Insights on behalf of BadCredit.org in February of 2024. Survey responses were nationally representative of the U.S. population for age, gender, region, and ethnicity. The maximum margin of sampling error was +/- 3 percentage points with a 95% level of confidence.