If you’re reading this, you probably already appreciate the significance and benefits of a high personal credit score. A FICO® Score in the mid-700s or above signals to the financial world that you’ll protect their investment in you by using the credit they extend responsibly, not running up more debt than you can handle, and promptly paying back what you owe.

Even when your score is lower than you’d like, those are the strategies you must employ to improve. No matter where you start, improving your FICO score can increase your cash flow and give you more flexibility to buy the things you want and need while protecting you and those you love from the unexpected.

But what does an improving credit score say about a city? When a metropolitan area combines fast population growth and an improving credit picture, it signals something important about its vibrancy, economic resiliency, and promise of prosperity. You’re in a good place when you know your neighbors can contribute as significantly to your shared future as you do.

As Americans move beyond shutdowns and turbulence into what we all hope will be an extended period of opportunity, this list of the 20 fast-growing cities with the most improved credit scores from 2016 to 2022 points to places we should all pay attention to.

1. Greenville-Anderson-Mauldin, South Carolina

Greenville’s elegant downtown is one of the most browsable you’ll find, and the metro area contributes urban amenities to South Carolina’s picturesque upstate. Connect with history and culture among natural beauty in an economically vibrant region where families have room to live to their potential.

Greenville Stats:

- 2022 average credit score: 706, a 34-point improvement since 2016

- 2022 population: 959,000

- Median income: $57,432

- Median property value: $172,400

2. Phoenix-Mesa-Scottsdale, Arizona

Arizona’s capital is the most populous seat of state government in the US, but that doesn’t mean residents and visitors lose their sense of place. A location near spectacular desert preserves, not that far from Grand Canyon National Park, does that for a city.

Phoenix Stats:

- 2022 average credit score: 713, a 31-point improvement since 2016

- 2022 population: 5,016,000

- Median income: $67,068

- Median property value: $269,300

3. Myrtle Beach-Conway-North Myrtle Beach, Carolinas

Do you know whether you love beach music? Myrtle Beach is a touchstone for sounds and sights that draw on the rock, R&B, and pop music of the 1950s and 60s. It’s the beachy, entertainment-packed centerpiece of South Carolina’s vibrant northern coast.

Myrtle Beach Stats:

- 2022 average credit score: 712, a 31-point improvement since 2016

- 2022 population: 536,000

- Median income: $53,832

- Median property value: $195,700

4. Las Vegas-Henderson-Paradise, Nevada

What you don’t know about Las Vegas is more than what you do know. The strip is Nevada’s gambler’s paradise, of course. But the metro area is also home to millions who live and work in an area that intersects urban opportunity and natural beauty.

Las Vegas Stats:

- 2022 average credit score: 696, a 30-point improvement since 2016

- 2022 population: 2,323,000

- Median income: $61,048

- Median property value: $285,100

5. Lakeland-Winter Haven, Florida

Lakeland’s location between Orlando and Tampa makes it a nexus for opportunity and an ideal home base for visitors interested in sampling Florida’s many attractions. Folks of all ages streaming to live in the area attest to that.

Lakeland Stats:

- 2022 average credit score: 689, a 30-point improvement since 2016

- 2022 population: 787,000

- Median income: $51,535

- Median property value: $162,400

6. Nashville-Davidson-Murfreesboro-Franklin, Tennessee

Entertainment-focused Nashville is the home of the Grand Ole Opry, country music’s cultural center, and the Country Music Hall of Fame and Museum, its historic center. This dynamic metro region in Tennessee supports founders and families, and Vanderbilt University helps educate their children.

Nashville Stats:

- 2022 average credit score: 715, a 26-point improvement since 2016

- 2022 population: 2,047,000

- Median income: $68,406

- Median property value: $262,900

7. Stockton-Lodi, California

There’s an old song about being stuck in Lodi, but residents don’t think that way. Among California’s many diverse urban locales, Stockton-Lodi stands out for its proximity to San Francisco and San Jose amidst the beauty of wine country.

Stockton Stats:

- 2022 average credit score: 704, a 26-point improvement since 2016

- 2022 population: 793,000

- Median income: $68,628

- Median property value:$367,900

8. Seattle-Tacoma-Bellevue, Washington

When you think about Seattle, you may recall the Pike Place Market and the Space Needle, popular among visitors. Its beautiful environs in Washington State’s Pacific Northwest and a spirit of creativity keep residents engaged in this active metro area.

Seattle Stats:

- 2022 average credit score: 739, a 25-point improvement since 2016

- 2022 population: 4,034,000

- Median income: $90,790

- Median property value: $471,900

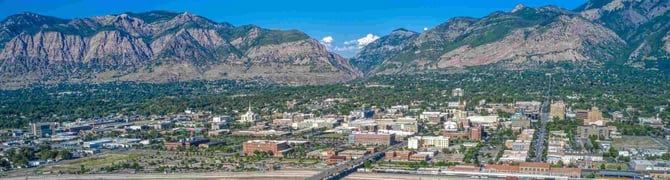

9. Provo-Orem, Utah

Provo sits east of Utah Lake, the Great Salt Lake’s smaller cousin. There’s still a small-town feel in this region where growth accommodates the beauty of the setting, and cultural and historical connections are always nearby.

Provo Stats:

- 2022 average credit score: 734, a 25-point improvement since 2016

- 2022 population: 715,000

- Median income: $76,864

- Median property value: $334,500

10. Cape Coral-Fort Myers, Florida

Cape Coral and Fort Myers straddle Florida’s Caloosahatchee River, where natural beauty and Gulf Coast attractions abound. What puts it on our list is the can-do dynamism of its diverse and growing resident population, which always finds time to welcome visitors.

Cape Coral Stats:

- 2022 average credit score: 720, a 25-point improvement since 2016

- 2022 population: 822,000

- Median income: $59,608

- Median property value: $235,300

11. Indianapolis-Carmel-Anderson, Indiana

As the home of the Indy 500, Indianapolis welcomes hundreds of thousands each year to witness the Great American Race. Indiana’s capital and most populous city also hosts plenty of historical and cultural energy, entrepreneurial spirit, and family-focused attractions.

Indianapolis Stats:

- 2022 average credit score: 712, a 25-point improvement since 2016

- 2022 population: 2,142,000

- Median income: $63,545

- Median property value: $172,300

12. Tampa-St. Petersburg-Clearwater, Florida

Tampa-St. Pete (and its sister city, Clearwater, to the north on the Pinellas Peninsula) is one of the bigger metro areas on our list and home sweet home to millions. Of course, millions of beach-loving vacationers make the area their temporary home, too.

Tampa Stats:

- 2022 average credit score: 708, a 25-point improvement since 2016

- 2022 population: 3,291,000

- Median income: $57,097

- Median property value: $210,900

13. Sacramento-Roseville-Arden-Arcade, California

California is a state where geography is always a factor, and its capital city, Sacramento, sits in the center of a massive valley truly like no other in the US. The metro area still connects to California’s Gold Rush era as residents build a different kind of wealth.

Sacramento Stats:

- 2022 average credit score: 726, a 24-point improvement since 2016

- 2022 population: 2,417,000

- Median income: $75,533

- Median property value: $412,400

14. Salt Lake City, Utah

Utah combines snowy mountains and arid deserts and provides opportunity to millions looking for the best life can offer. Salt Lake City, its capital and largest metro area, is an amalgam of the state’s different qualities and aspirations and a scenic wonderland.

Salt Lake City Stats:

- 2022 average credit score: 726, a 24-point improvement since 2016

- 2022 population: 1,266,000

- Median income: $77,102

- Median property value: $329,200

15. San Antonio-New Braunfels, Texas

Home to The Alamo and its rich history, San Antonio straddles a river by the same name that enlivens the city with its Riverwalk. The metro area also sits in a region of Texas that makes it an ideal jumping-off point for almost anything.

San Antonio Stats:

- 2022 average credit score: 692, a 24-point improvement since 2016

- 2022 population: 2,656,000

- Median income: $61,437

- Median property value: $183,000

16. North Port-Sarasota-Bradenton, Florida

Thousands of new residents flock to Florida yearly, and many have Sarasota in their sights. Of course, it’s a destination for retirees, but there’s more than enough going on for everyone, including some spectacular Gulf Coast natural beauty.

Sarasota Stats:

- 2022 average credit score: 733, a 23-point improvement since 2016

- 2022 population: 891,000

- Median income: $62,438

- Median property value: $261,100

17. Austin-Round Rock, Texas

Residents proudly call for keeping Austin weird, and this burgeoning metro area in Texas, home to a great university, manages to do that while nurturing a tech-focused entrepreneurial influx. Austin also rivals Nashville as a center of American music.

Austin Stats:

- 2022 average credit score: 718, a 23-point improvement since 2016

- 2022 population: 2,421,000

- Median income: $80,852

- Median property value: $303,300

18. Deltona-Daytona Beach-Ormond Beach, Florida

Daytona Beach, home to the Daytona 500, is the center of Florida’s Atlantic Coast experience. North and south along the famous state road A1A, there’s always something to see and do as residents build (and keep building) while maintaining an essential connection to the ocean.

Daytona Beach Stats:

- 2022 average credit score: 710, a 23-point improvement since 2016

- 2022 population: 706,000

- Median income: $53,339

- Median property value: $203,000

19. Jacksonville, Florida

Jacksonville is a large and growing city in every way: geographically, culturally, and economically. It’s near some of the southern Atlantic’s most beautiful coastal regions yet immersed in urban creativity. Evidence is that the city is constantly changing yet always welcoming.

Jacksonville Stats:

- 2022 average credit score: 702, a 23-point improvement since 2016

- 2022 population: 1,676,000

- Median income: $63,064

- Median property value: $220,000

20. Ogden-Clearfield, Utah

Utah’s Great Salt Lake gives energy to Ogden, the state’s home base to the ski industry and the spectacular natural beauty that inspires it. That, in turn, animates opportunities for thousands of new residents who find something essential and lasting in the area’s community focus.

Ogden Stats:

- 2022 average credit score: 733, a 22-point improvement since 2016

- 2022 population: 714,000

- Median income: $78,680

- Median property value: $284,500

Census data on urban population growth serves as a counterweight to the claim that mortgage rates, home and rental prices, and inflation are leading fewer Americans to relocate than before the pandemic. And travel has definitely rebounded from COVID quarantines and shutdowns.

What Americans seem to want more than anything is a sense that they’re in the right place at the right time. This list of high-growth cities with excellent and improving credit scores will point you in the right direction as you plan your future.

Methodology

We used U.S. Census data to compile a list of metro areas of at least 500,000 in population that had added 50,000 or more people and had grown by 5% or more between 2016 and 2022. Anonymized data from the consumer credit database of the US credit bureau Experian helped us obtain average credit scores for those places. DataUSA provided 2020 data on median income and property values, and TripAdvisor served as our source for popular attractions in each of the cities on our list.