Upon finding this review of The Credit Pros, you’re probably wondering whether this credit repair company is legitimate and trustworthy. We’ll cut right to the chase by agreeing with that description.

To bolster its reputation, The Credit Pros provides a 90-day money-back guarantee:

“We understand that you have placed your trust in us, and we take that responsibility seriously. If we fail to get any of your questionable items deleted or updated on your credit report within 90 days of enrollment, you are entitled to a full refund of any sums paid to us.”

We think all credit repair companies should adopt a similar policy.

Founded in 2009, New Jersey-based The Credit Pros provides credit monitoring and repair services throughout the United States. The Inc. 5000 List has included this credit repair service six times. It charges an upfront assessment and a monthly fee for its services.

Services Offered

The Credit Pros’ primary service is to identify and dispute questionable items on your credit reports. You have three reports and scores, one each from Experian, Equifax, and TransUnion, the big three credit bureaus.

Your credit score suffers when a credit report contains derogatory information that is inaccurate, unverifiable, or unfair. Under the Fair Credit Reporting Act, you have the right to challenge incorrect information reported by the credit bureaus.

The company also provides credit monitoring and education tools to promote financial literacy. Its services aim to reinforce your rights as an American consumer while providing you with a bit of credit knowledge.

How the Credit Repair Process Works

You can contact The Credit Pros and request a free consultation with a Certified FICO Professional (your personal credit pro), who will explain what the credit repair agency does and how you may benefit.

At its core, The Credit Pros credit repair service uses its expertise to challenge items on your credit reports. You can subscribe to one of its two packages to help you repair your credit. There’s also a less expensive package available to monitor credit, a helpful service if you prefer to dispute items on your reports independently.

You’ll pay an initial work fee if you decide to buy a subscription. This charge covers the cost of obtaining and reviewing your credit reports. You’ll then work with your credit counselor to help identify and dispute questionable information on your three credit reports, as is your right under the Fair Credit Reporting Act.

The dispute letter is central to a subscription’s primary credit repair process. Your counselor will create and send dispute letters challenging negative items on your credit reports.

Because of its experience and expertise, the company’s counselors know how to craft these letters for maximum effectiveness. They also understand the timing requirements and regulate the workflow to generate successful outcomes.

The Credit Pros International Corporation performs additional services beyond credit bureau challenges. The services available to you depend on which plan you choose. Services include:

- Creditor interventions: The credit repair agency will correspond with your creditors and with collection agencies. For example, The Credit Pros credit repair service may send a letter asking a creditor or collection agency to remove a negative or derogatory mark on your credit report. Another common intervention is requesting written evidence of a debt that you consider invalid after you receive a debt validation letter from a debt collector. Debt collectors are required to send you a debt validation letter within five days of first contacting you, and it should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt.

- Cease and desist letters: Under the Fair Debt Collection Practices Act, you can demand debt collectors stop contacting you. The Credit Pros will write cease and desist letters to enforce your demand. Upon receipt, creditors must end all further contact unless the law permits. Cease and desist letters must observe specific protocols to ensure their effectiveness, a crucial reason to leave the job to experts. For example, the letters should always refer to debts as alleged and exclude information that the creditor doesn’t already have.

Other services include access to credit bureau reports and scores, dark web monitoring, bill reminders, and a budgeting system.

TheCreditPros.com Online Privacy Policy

Even the best credit repair company is likely to sell your personal information. The Credit Pros International Corporation may sell, trade, or otherwise transfer personal information to outside parties, service providers, and regulators. This information may include your name, address, city, town, any form or online contact identifier email, and phone number.

Subject to certain exceptions, you can opt out of the sale or disclosure of your personal information. You can also request the company delete any of your personal data it collected, once again subject to exceptions.

To protect your personal information, The Credit Pros maintains physical, electronic, and procedural safeguards in keeping with industry standards and practices. It reviews and adjusts these safeguards regularly in response to technological advances.

The company uses SSL encryption on all web pages to protect your confidentiality and restricts personal information access to essential employees. It also places cookies and web beacons on client devices to collect information about how consumers use the company’s website and mobile applications.

Why Use The Credit Pros?

You can hire The Credit Pros when you want to collect (and possibly fix) information on your credit reports. It offers several positive features that recommend its use, including:

- Free initial consultation: A certified FICO professional will speak with you for free to explore which services you may need and how the company can help you achieve your objectives.

- Bonus services: The company’s service packages offer extra features, including financial planning tools, identity theft monitoring, land loan and credit card debt management, among other services.

- Mobile app: You can stay in constant contact with The Credit Pros via its mobile app, downloadable on Android and iOS devices.

- Unlimited disputes: The company does not limit the number of credit disputes it will send on your behalf each month. It monitors each challenge and reports its progress to you.

- Bilingual service: You can receive assistance in English or Spanish.

- One-on-one client support: You work with a single designated credit counselor for the life of your subscription. This arrangement ensures the continuity of your relationship.

- Satisfaction guarantee: You can get a full refund if the company can’t get any of your questionable items updated or deleted within 90 days.

- Cancellations: You can cancel your service at any time.

- Blogs: The company’s senior principals publish informative blogs each month. These articles address credit repair, borrowing money, and managing credit.

Of course, no credit repair company is perfect. We’d like to see the company lower its initial work fee, and its consumer education resources aren’t as extensive as those of its competitors. But this company is no credit repair scam and is worth your consideration.

How Much Does The Credit Pros Cost?

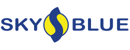

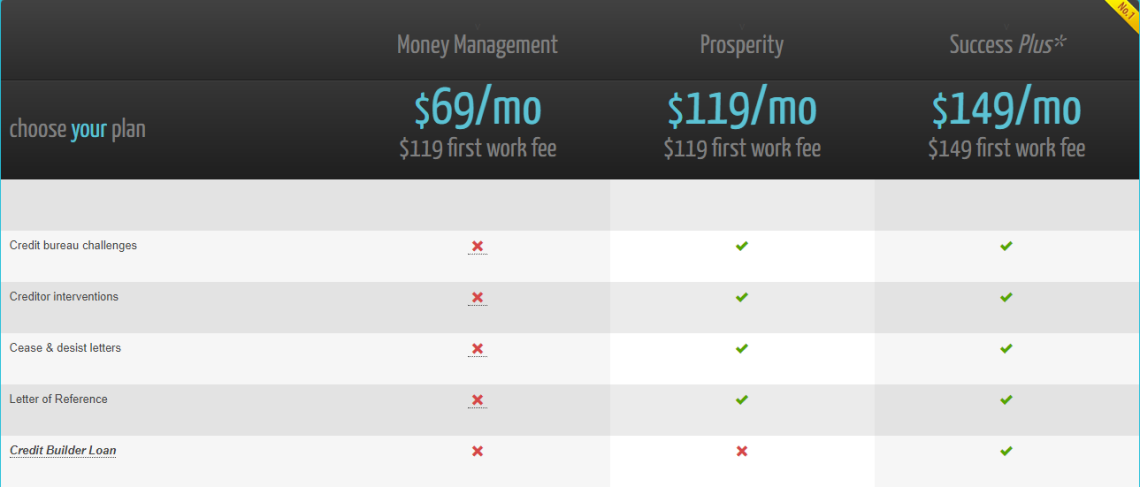

The Credit Pros offers three unique service packages: Money Management, Prosperity, and Success Plus.

The Credit Pros offers three plans to choose from, but only two offer credit repair services.

Money Management Package

This basic package monitors your credit rather than fixes it. It charges $69 per month and a one-time work fee of $119. The package supports consumers who want to stay on top of their credit status and handle disputes personally.

This package includes credit reports and scores from one credit bureau, dark web monitoring, TransUnion credit report alerts, real-time account sync, bill reminders, and a budgeting system.

Prosperity Package

This is the less-expensive choice for consumers who want The Credit Pros to dispute negative items on their credit reports. Its setup cost is $119, as is its monthly fee.

In addition to all Money Management services, you get credit bureau challenges, creditor interventions, cease and desist letters, and a letter of reference. This package makes sense when you need to dispute multiple items on your reports.

Success Plus Package

The Success Package is an upgrade to the Prosperity Package. It charges a $149 first-work fee and $149 per month to subscribe.

The Success Package includes all of the above plus a credit builder loan option that reports timely payments to all three credit bureaus. In a credit builder loan, you deposit money into the lender’s escrow account via monthly installments. When the loan amount is paid, the lender refunds your money.

The loan allows you to repair your bad credit history and boost your credit score by reporting your on-time payments to the credit bureaus.

Access to a credit builder loan is an unusual feature for a credit repair company to offer. This package also provides reports and scores from all three credit bureaus.

Is The Credit Pros a Legit Company?

We believe The Credit Pros is a legitimate credit repair company with a primarily positive customer review scorecard. Credit Pros reviews often praise the company’s customer service. But some Credit Pros reviews criticize the high monthly cost.

The Consumer Financial Protection Bureau has filed no official complaints against the company. Although it lacks Better Business Bureau accreditation, it has a BBB rating of A- and an average customer rating of 3.32 out of 5.

Trustpilot gives The Credit Pros an excellent customer review rating of 4.7 out of 5. It received an honorable mention six times from Inc Magazine.

The company boasts accreditation from the National Association of Credit Services Organizations, a group dedicated to responsible credit repair. To receive NASCO certification, a company must adhere to governing agency guidelines, refrain from deceptive advertising and false claims, and not have any adverse relevant legal or government action pending. You can’t be a credit repair scam while remaining in NASCO’s good graces.

The Credit Pros’ statement of core values further supports its trustworthiness:

“We respect our clients.

We work hard and play hard together.

We do the right thing even when no one is watching.

We respect and hold each other accountable.

We strive to be better tomorrow than we are today.

We are passionate about what we do.”

Finally, Jason Kaplan, the founder and president of The Credit Pros, was the subject of a 2016 BadCredit.org article. It quotes Jason as follows:

“It’s very important to me, with my law background, to be an advocate for someone who is unable to get something accomplished, and especially being an advocate for someone who is being wronged in an obvious way with incorrect, outdated, or erroneous information on a credit report.”

The Credit Pros Review: You Don’t Have to Fix Your Credit on Your Own

By now you should understand how the company can repair your credit reports and provide additional credit services. Although you can write a dispute letter for each credit report error yourself, hiring a credit repair company saves you time and energy while providing the expertise necessary to get results.

BadCredit.org regularly reviews the best credit repair companies. The Credit Pros ranks in our top four, with an overall rating of 4.5 out of 5. We suggest you compare your alternatives and select the best credit repair company that meets your needs, fits your budget, and offers good customer service.