In today’s mobile, tech-happy society, just about everything has gone digital, from bills and banking to movie tickets and boarding passes. For many people, the mailbox out front has become nothing more than a place to store junk mail — and financial notices.

Yes, the financial industry is one of the few left that still does much of its correspondence via good old snail mail. So, while other industries are emailing and downloading, some financial situations are still being dealt with by sending and receiving physical letters.

Debt validation letters and verification letters are two examples. Although these two letters have similar names and content, they do have some key differences. We’ve put together some facts to help you get the information you need to validate your debts.

1. Debt Validation Letters are Sent by Debt Collectors

Many of the legal protections from debt collectors granted to consumers come from the Fair Debt Collection Practices Act (FDCPA). The law lays out your rights and governs the parameters of debt collectors, including dictating when and how they can contact you and what data they are required to disclose.

Among the rules laid out by the FDCPA is one that stipulates that debt collectors must send you a debt validation letter within five days of first contact (if they don’t, request one the next time they contact you). The debt validation letter must include at least the following information:

- The amount of debt owed

- The name of the creditor to whom the debt is owed

- A statement of notice that the debt will be considered valid by the debt collector unless the consumer disputes it within 30 days of notice

- A statement of notice that if the consumer disputes the validity of the debt in writing within the 30-day period, the debt collector will obtain verification of the debt and mail it to the consumer

- A statement of notice that the debt collector will provide the name and address of the original creditor if requested in writing by the consumer within the 30-day period

While the last three points may sound like convoluted legalese, it all boils down pretty simply. Basically, the validation letter should say how much you owe, who you owe it to, and what to do if you don’t think the debt belongs to you.

In general, if you want to escalate the issue with the debt collector, you should do so within 30 days of receiving the validation letter. This includes disputing that you owe the debt, requesting additional verification of the debt, or requesting the name and address of the original creditor.

2. You Can Write to Request Verification of Your Debt

In the event that you believe you are not responsible for the debt in question, you can send a verification letter to the debt collection company asking for additional verification — read: proof — that the debt belongs to you.

Essentially, the law says that your debt collectors can’t force you to pay for a debt that you don’t legally owe. (Keep in mind that co-signed debts are your legal responsibility and can be collected by a debt collection agency.)

Collection agencies must be able to — at your request — demonstrate that a specific debt belongs to you to collect on that debt. If the debt collector can’t show that you legally owe the debt, it must stop trying to collect it from you immediately.

So long as you send your verification letter within 30 days of receiving your validation letter from the debt collection agency, the debt collector is required to send you written verification of the debt, such as a copy of a bill for the debt or a copy of a judgment.

It’s strongly recommended that you send your request for a verification letter through certified mail.

It’s strongly recommended that you send your request for verification letter through certified mail, and select the option for a return receipt and delivery confirmation. This will ensure you know when the letter has been received by the debt collection agency.

Additionally, always keep a copy of any correspondence you send to or receive from the debt collection agency. You never know when having documentation of your history with the agency will come in handy.

Although disputing a debt will not make it drop off your credit reports, it can stop the debt collection agency from harassing you in the meantime. As long as you dispute the debt within the 30-day window, the debt collector cannot legally contact you to try and collect the debt until verification of the debt has been provided.

Another right granted to consumers through the FDCPA is the ability to stop debt collectors from contacting you by phone altogether. If you’re being harassed by a debt collector, consider including a cease-contact request in your verification letter. Include a preferred mailing address for all communications.

3. You Can Use a Sample Template for Your Letter

When dealing with aggressive debt collection companies, you may be tempted to bring out the big guns by hiring a lawyer or legal expert to help you draft your verification letter.

If hiring a professional makes you more comfortable, that’s certainly an option, but you don’t need a JD — or any other type of graduate degree, for that matter — to write a verification letter that gets results.

In fact, you can find a variety of samples and templates online that should serve your purpose just fine. These templates range from legalese-laden letters that look like they’ve hopped off a lawyer’s desk, to more straightforward letters that simply state the requested data.

Our sample template includes a clear request for information, as well as a request for action should the debt collector be unable to verify the debt. It also includes a request to cease phone contact, both personal and work, while providing a preferred mailing address for written communication.

[Current Date]

[Your Name]

[Your Address][Debt Collector’s Name]

[Debt Collector’s Address]Re: Account Number [Your Account Number]

To Whom It May Concern,

This letter is in response to notice I, [Your Name], received on [Date of Contact] of a debt being claimed against me. In accordance with 15 U.S. Code § 1692g, I am requesting verification of the debt, including the age of the debt, an itemized statement of what is owed, the name and address of the original creditor, and evidence that I am legally responsible for the debt.

Please consider this debt to be under dispute. If it is found that there is no evidence of this debt under my name, then I request that all credit bureaus and appropriate financial institutions be made aware or a complaint will be filed to the respective local or federal agency.

Additionally, I request that you cease and desist any future telephone communication, whether through my residential or employment numbers. Please send all communication, by mail, to:

[Preferred Mailing Address]

I am aware of the request for payment by your company and any further telephone communication shall be considered harassment in violation of 15 U.S. Code § 1692d and shall be subject to State and Federal penalties.

Thank you for your cooperation, and I look forward to your response.

Sincerely,

[Your Signature]

Of course, you can change or adapt any of the language in a template to best fit your needs and situation. For example, if you want to be contacted by phone, you can instead provide a preferred phone number and list the hours during which you can be contacted.

4. Debt Validation Alone Will Not Repair Your Credit

A common misconception about disputing debt with a collection agency is that the debt will be removed from your credit reports if disputed. Unfortunately, that’s simply not the case. Simply disputing a debt after receiving a validation letter won’t make the debt disappear.

Furthermore, though you can request in your verification letter that disputed debts be removed from your reports if not found to belong to you, the debt collection agency may not be as quick to clear your credit as you would like.

If you’re left with debt accounts on your credit reports that are not verified as your debts, then you can dispute them directly with the credit bureaus to have them removed from your reports. You can dispute the accounts yourself, or hire an experienced credit repair professional, such as those below.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

You’ll need to file a separate dispute with each bureau for each erroneous account. Keep in mind that credit repair can’t remove debts that have been verified as yours, nor can it typically remove debts that are still being disputed with the debt collection agency.

5. You Have 30 Days to Dispute a Valid Debt

By law, debt collectors are required to send you a validation letter within five days of first contacting you. If they fail to send the letter, you can directly request one the next time you communicate with them.

However, debt collectors aren’t the only ones with time limits.

You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. If you fail to dispute the debt in that time, the debt collector is fully entitled to consider the debt valid.

6. Requesting Verification Could Result in Collection Calls

Although there’s little harm in disputing debts that are legitimately not your own, some consumers will dispute real debts in an effort to avoid the need to repay them. Of course, this causes problems and makes things all the more challenging for those who are fighting legitimate mistakes or fraud.

While this method can be effective when debts have changed hands many times and the original paperwork is hard to find, it can have the unfortunate side effect of a vigorous hail of collection notices and phone calls for the person dealing with the debt.

For example, if you’re in the process of trying to repair your credit, you may consider sending a debt verification letter for an old debt that has been in collections for some time. While it may turn out that the debt collector can’t verify the debt — getting you off the hook — it may also turn out that they can verify it.

Should the debt collector be able to properly verify the debt, you’ll likely not only receive a letter with that verification, but it will also probably include a request that you pay the debt, immediately.

You’ve now likely found yourself a prime spot at the top of the debt collector’s list. While you can still send a written request that the debt collector only contact you by mail at a specific address, your voicemail will likely fill up quickly before that letter arrives.

7. Some Debts May Be Too Old to Collect

One of the recommendations for what to include in your verification letter is a request to be provided with the age of the debt. While this piece of data may seem a bit trivial at a glance, the age of the debt may really be one of the most important pieces of information you receive from the debt collector.

That’s because most types of debt are subject to a statute of limitations, which is the legal time frame during which the debt collector must begin legal action. Once the statute of limitations has expired, the debt collector can no longer sue you to recover the debt (though they can still contact you to try and collect).

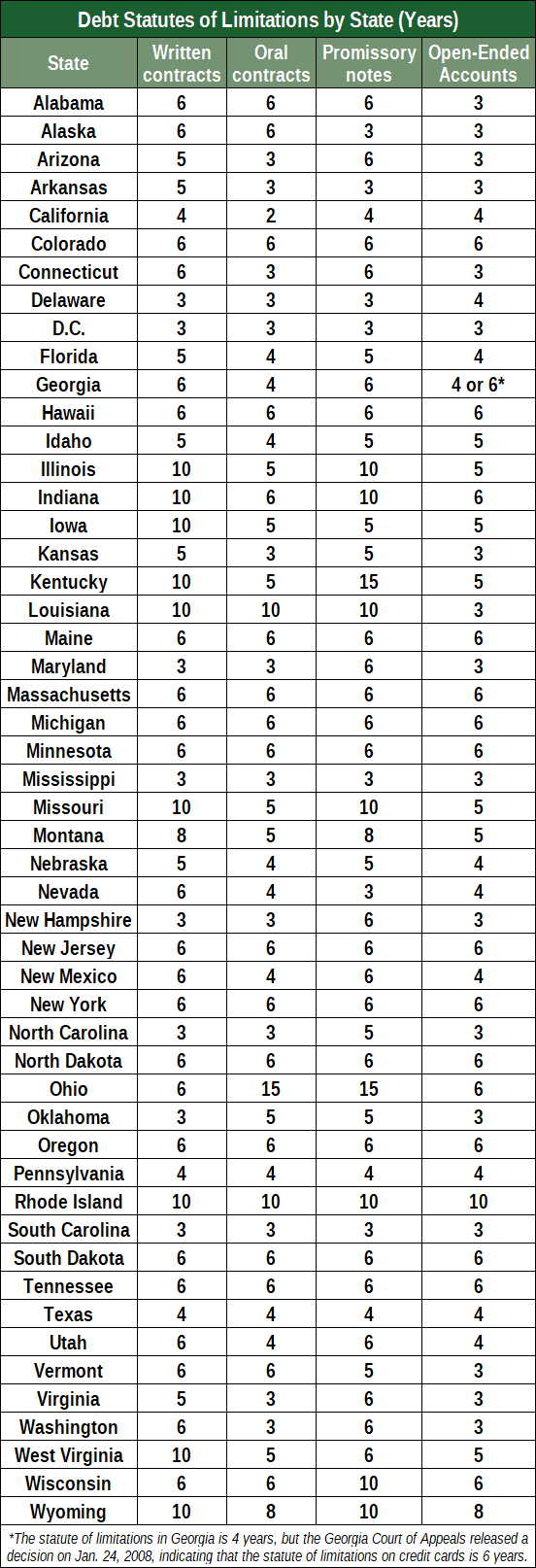

The actual statute of limitations for a given debt will vary based on both the type of debt and the state in which you reside. In general, debts are broken down into four types: written contracts, oral contracts, promissory notes, and open-ended accounts.

While it can vary by state, the statute of limitations countdown generally begins when the account becomes delinquent, which is typically when it reaches 30 days past due. In some cases, such as when no payments have been made, the clock may start when you take on the debt.

You can ask the debt collector if the debt in question is time-barred, and, by law, debt collectors must respond truthfully if they respond (they aren’t required to answer). You can also check the validation letter that should have been sent within five days of first contact, which should include the date of last payment.

If you think a given debt may be approaching the statute of limitations, you should be careful about the type of contact you make with the debt collector.

Avoid saying anything that could potentially indicate an acknowledgment of the debt, as this may revive, extend, or waive the statute of limitations. This includes making any payments on the debt or even entering into a payment agreement.

Only Pay the Debt for Which You Are Legally Responsible

When most of the letters we receive hit our inboxes rather than out mailboxes, it can be a rare delight to find a bit of old-school correspondence when you check the mail.

But that delight quickly fades when you realize it’s not a letter from a friend — it’s a validation letter for a debt you didn’t even know existed.

Knowing when and where to use debt validation and verification letters can make all the difference when dealing with persistent debt collectors. With the right knowledge, you can protect yourself from aggressive tactics designed to scare you into paying a debt that may not even belong to you.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.