Credit scores are three-digit numbers that are used by lenders to determine whether they’re going to approve your applications, and under what terms. Your many credit scores are determined solely from the information that resides on your credit reports at Equifax, Experian, and TransUnion.

And while the range of most general use credit scores is 300 to 850, the rarified air is anything above 800.

So exactly how can you earn and maintain 800 (or better) credit scores?

Here’s What Matters Most

To formulate a strategy to move your credit scores to and above 800, you have to understand what makes credit scores tick. Credit scores, which are formally called credit bureau-based scoring systems, only care about the information that is currently on your credit reports. Even with that, not everything on your credit reports is considered by credit scoring systems, and not everything that is considered it terribly important.

The information that is considered will fall neatly into five categories of metrics, which are a series of characteristics, variables, and weights, that will consider and score different aspects of your credit reports.

Those five categories are your:

- history of making payments on time (or not)

- amount and type of debt

- credit age

- credit mix

- record of “new credit” shopping activities

In the same order as listed above, these five categories account for 35%, 30%, 15%, 10%, and 10% of the points in your FICO credit scores, which are the most commonly used scores in the United States financial services environment.

Now that you have a basic understanding of what makes your FICO credit scores tick, let’s strategize about getting your score to 800 and above.

You Must Avoid Negative Information From Appearing on Your Credit Reports

To achieve credit scores of 800, you have to “bank” a large percentage of the available points. Remember, 800 is only 50 points off the perfect score, so you can’t afford to leave any points on the table. And, to bank a ton of points toward 800, you have to do well in the Payment History category.

While FICO doesn’t publicly disclose everything having to do with its scoring systems, you should assume the Payment History category, which is worth 35% of your credit score points, will make up about 190 points in your credit scores.

If you can make all of your payments on time every month, then you’ll bank every single one of them. And, you’ll be well on your way toward 800 or better. This would be a fantastic start!

This doesn’t mean making most of your payments on time. This means making all of your payments on time, which means by the due date defined by your lenders. When you make all of your payments on time, you will avoid the negative credit reporting of late payments.

And, because you’ll be making all of your payments on time, you’ll also avoid any third-party collection accounts, repossessions, and foreclosures from appearing on your credit reports. Basically, you’ll avoid all of the bad stuff.

You Must Maintain Lower Amounts of Credit Card Debt Across Fewer Credit Cards

This Debt Management category is almost as important as the afore-referenced payment history category. It’s worth 30% of the points in your FICO scores, which means it will make up in the neighborhood of 165 of your score points.

This category is trickier to manage than the payment history category because while nobody wants to miss payments, everybody who has a credit report has or has had debt. How you choose to manage that debt will determine how many points you bank in this category.

There are five debt-related metrics in this category, although it’s not uncommon for some to incorrectly suggest this category is made up exclusively by the credit card utilization ratio. In addition to the credit card utilization ratio, which is actually called revolving utilization, this category also considers:

- the number of accounts with balances

- the aggregate amount you owe

- your debt across different types of accounts

- how much of your installment debt you’ve paid relative to the original loan amounts

As I mentioned, this category is tricky because avoiding debt entirely isn’t the best strategy. It’s also unrealistic. Remember, credit scores reward you for proper credit management and credit avoidance is not proper credit management.

To perform well in this category, you have to focus on your credit card debt. Installment debt, like mortgages, student loans, and auto loans, are not terribly important to your scores as long as you’re making your payments on time. Installment debt defaults at a much lower rate than credit card debt, which means it’s a less risky extension of credit and, thus, doesn’t have much of a negative impact when you take on new loans.

In practical terms, because taking on new installment debt doesn’t have much of a negative impact on your scores, that means paying off installment debt will also not have much of a positive impact on your scores. Again, focus on the credit card debt.

In the perfect world, you would have many credit cards, but you’d use only a couple of those credit cards, and you’d pay them in full each month. That means no interest, never a late payment, and you’ll never revolve balances. But even that doesn’t necessarily mean you’ll have elite credit scores.

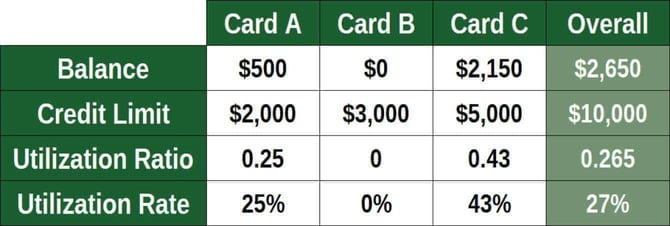

If you max out your cards each month, then your credit reports will constantly indicate that you’re heavily “utilized”, the metric that compares your balances to your credit limits.

The secret here is to keep using a small number of your credit cards because credit cards are uber convenient and safe, but keep your balances lower relative to your credit limits. This can be accomplished by charging less, by asking for larger credit limits, or by a combination of both. The easiest way to do this is to open several credit cards and just use a couple of them.

If you have tens of thousands of dollars of credit limits, then your normal monthly card usage will represent a lower ratio of that amount. Because we’re shooting for 800 credit scores, or better, you need that ratio to be less than 10%. That means if your average monthly credit card balance total is $5,000, then you have to have at least $50,000 of credit limits across your cards.

We’re quickly approaching a day when that ratio is going to be joined by another series of ratios, those that consider your balances over the last 24 months. This is called “trended” or “time series” data. Only two scoring models consider that information, but those models are about to become the two models used for mortgage lending.

These newer scoring models, specifically FICO 10T and VantageScore 4.0, consider your historical balances over the past 24 months. None of the other credit scores, besides those two, consider historical balances. This means your historical credit card ratios are going to become important.

If you can maintain lower balances and ratios month after month, instead of just the month before you apply for credit, you’ll do better across all scoring models, even the newer, more sophisticated scoring systems.

Have an Older Credit Report and Different Types of Accounts

Because these next two categories, credit age, and credit mix, are influenced by your age, I’m going to combine them. These two categories are collectively worth 25% of the points in your scores, or about 137 points.

These two categories are also less actionable than the first two categories. Anyone can choose to make their payments on time, and anyone can choose to stay out of excessive amounts of credit card debt. But, you can’t choose to be older, and you can’t snap your fingers and suddenly have a record of different types of accounts on your credit reports.

But this is what your credit reports need to reflect if you want 800 credit scores.

To be clear, when I’m referring to being older or having older credit reports, this doesn’t mean your personal age is considered by credit scoring models. Rather, this refers to the age of your credit reports.

There are two important metrics here; the age of the oldest account on your credit reports and the average age of your accounts. To bank max points here, you’re going to need a credit report that indicates decades of credit experience.

This category is the primary hurdle for younger consumers who want to earn perfect, or near-perfect, credit scores. If you’ve only had credit experience for a few years, you’re not going to max out this category. It’s that simple. But as your credit reports age, your scores will improve for no other reason than they’re getting older.

Additionally, credit scoring models will reward you when you’ve achieved a record of managing different types of accounts, including different types of credit cards and loans. This takes time, and you’ll organically improve your performance in this category as you go through your credit journey.

Nobody has mortgages, auto loans, and different credit cards on their credit reports on day one. It may take many years to check all of these boxes. But when you do, you’ll perform well in the “credit mix” category.

Only Apply for Credit When You Actually Need It

The final category on your path to 800 has many names. Some people call it the “Inquiry” category. Some call it the “Pursuit of Credit” category. FICO calls it the “New Credit” category. Whatever you’ve heard it called, it’s worth 10% of the points in your score, or about 55 points.

While many people think this category is only about hard credit inquiries, that’s not correct. There are actually more non-inquiry related metrics in this category than there are inquiry-related metrics. Specifically, this New Credit category considers the number of recently opened accounts, the time since your most recently opened account, and possibly your hard inquiries.

I intentionally used the word “possibly” when referring to the influence of hard inquiries on your credit scores. Hard inquiries, those that are generally caused when you apply for credit, may or may not have an effect on your credit scores. It is absolutely incorrect to suggest or infer that all hard inquiries lower scores.

So how can you perform well in this New Credit category? It’s actually quite simple. Apply for credit sparingly.

That doesn’t mean avoiding credit for fear of what it will do to your credit scores. It means you should be cognizant that when you apply for and open new accounts your scores may go down. That’s the intended byproduct of opening new accounts. If you limit this activity to only when you actually need and want credit, you’ll be fine.

In Sum, My Math, and the Extremes

I recognize that the advice I’ve given you is extreme. Don’t ever miss payments, don’t get into too much credit card debt, have fewer accounts with balances, pay your credit cards in full each month, don’t apply for credit very often, have different types of accounts, and be older!

You certainly have to do many, if not most, of these things if you want to earn 800 credit scores. But you don’t have to do all of them if you want to earn, for example, 700 credit scores.

And if you’ve been following along with a calculator, you probably noticed that, according to my math, you can only earn about 550 points during the scoring process. It was actually 547 points in the body of the article, but that’s due to rounding. If this is confusing to you, here’s the explanation.

Remember, everyone starts out at 300 because the scaling of FICO scores is 300 to 850. So, you’d add whatever points you’ve earned during the scoring process to 300, hence the 550 available points. 300 plus 550 is 850, and 850 is the perfect score.

To earn at least 500 of those 550 points, you have to perform exceedingly well in each of the five credit-scoring categories. That means making payments on time, controlling credit card debt, limiting your credit applications, and staying patient as your credit reports get older and more voluminous.